ETF full name: Horizons Psychedelic Stock Index ETF

Segment: Developed Markets Healthcare

ETF provider: Mirae Asset

| PSYK key details | ||

| Issuer | Mirae Asset | |

| Inception date | January 31, 2022 | |

| Expense ratio | 0.75% | |

| Average daily $ Volume | $43K | |

| Investment objective | Replication Strategy | |

| Investment geography | Health and Biotech Equities | |

| Benchmark | Enhanced Consciousness Index | |

| Net assets under management | $26.96 million | |

About the PSYK ETF

While the global appetite for green technology is dominating the energy space, the health space is undergoing its revolution in utilizing psychedelics as a modern-day treatment option. The use of psychedelics for treatment purposes is not new, having been around for millenniums.

However, this is the first age of humanity to have the benefits of psychedelic treatment researched extensively, with the results so far being a gem for psychiatry. The investment world has noted these developments and provided an ETF comprising equities involved in research and development, production, and psychedelics as a pharmacological solution, the Horizons Psychedelic Stock Index ETF. It was among the first exchange-traded funds to launch in January of 2022, with this year expected to be one of the record ETF launches.

PSYK fact-set analytics insight

This fund tracks the performance of the Enhanced Consciousness Index, net of expenses, and fees. It invests all of its assets in the holdings of its composite index in the exact weighting, exposing investors to global companies involved in the research, development, production, and utilization of psychedelics as a legal pharmacological option.

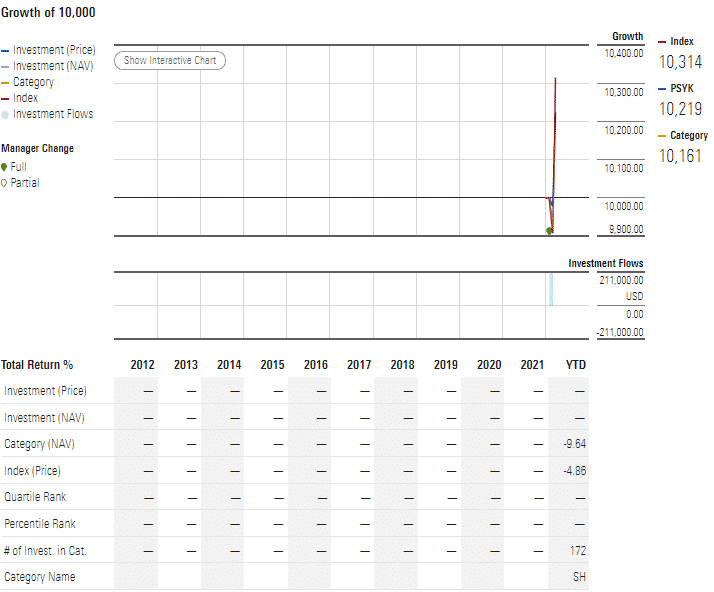

PSYK annual performance analysis

PSYK annual performance analysis

This fund is already in the money with just three months of operation. An investment of $10000 would now be worth $10219, a 2.2% increase. This performance, if maintained, will put the PSYK ETF in an elite group of ETFs that post positive returns in their launch year.

PSYK key holdings

The ETF comprises equities involved in legal psychedelic treatments and neurology biopharmaceuticals. It utilizes a natural language processing algorithm to ensure that it picks companies that only fit the psychedelic space definition. The companies are then ranked based on frequency, context, and relevance. Where the hit results in less than 25 holdings, neurology pharmaceutical equities come into consideration.

The top ten holdings of this fund are.

| Ticker | Holding | % assets |

| JAZZ | Jazz Pharmaceuticals Public Limited Company | 7.94% |

| ITCI | Intra-Cellular Therapies, Inc. | 7.56% |

| MYGN | Myriad Genetics, Inc. | 6.79% |

| SAGE | SAGE Therapeutics, Inc. | 6.74% |

| BHVN | Biohaven Pharmaceutical Holding Company Ltd. | 5.90% |

| ATAI | ATAI Life Sciences N.V. | 5.76% |

| RLMD | Relmada Therapeutics Inc | 4.82% |

| UCB | UCB S.A. | 4.76% |

| NBIX | Neurocrine Biosciences, Inc. | 4.52% |

| CMPS | COMPASS Pathways Plc Sponsored ADR | 4.34% |

PSYK fund is reconstituted annually and rebalanced quarterly.

Industry outlook

Since the legalization of medicinal marijuana, research has accelerated to unearth the other psychedelics that have therapeutic potential. The result has been the growth of a corner of the health sector, legal psychedelics, with the ability to disrupt and revolutionize this industry. This ETF is bound to grow given its exposure to the psychiatry niche value chain and its ability to sort the global mental health issues, estimated to be one billion of the global populace.

The rise of the psychedelics space is also due to their ability to heal neurological conditions that have otherwise proven incurable with traditional medicines. Couple all these with a global regulatory greenlight on psychedelics, and what you have is a niche on the cusp of an unprecedented bullish run. The PSYK ETF offers pureplay exposure to the resulting returns.

Comments