Barely a decade ago, the ETF market commanded a meager $1.77 trillion in assets under management. At the end of 2021, the ETF market value was upwards of $7.8 trillion in assets under management, a 340.68% growth.

2022 is promising to be another big year for ETFs if the 44 new launches, at the mid-Feb, compared to last year’s same period launch of 37 ETFs. Short of a crystal ball, the only way to know which of these new ETFs will be a success is to look at the megatrends that will drive the markets in 2022. In essence, exchange-traded funds are currently the most exchanged product globally and account for approximately a third of the market trades at any given time.

Cryptocurrency

The market capitalization for cryptocurrencies’ value at present is upwards of $1 trillion. Global governments are looking into a central bank digital currency, which shows that it is the next currency frontier and worth your investment.

ESG investing

There is no corner of the globe where the impact of adverse weather conditions is not a pain point. As a result, green technology is on the lips of the global populace bringing in focus ESG investing, with the acceleration expected in 2022.

Small-caps

Small-cap stocks tend to outperform the general market after economic turmoil, and with rising interest rates, investors need both value and growth.

Top 3 most promising new ETFs for 2022

The worst of the coronavirus pandemic is in the rear-view mirror, reducing interruptions to business operations. Therefore, 2021 experienced record-breaking ETF launches, but if the start of the year is anything to go by, 2022 will be another record-breaking year of new product launches in the ETF market. Sifting between which of these ETFs will thrive is quite the hassle, but you have a great starting point with the three below.

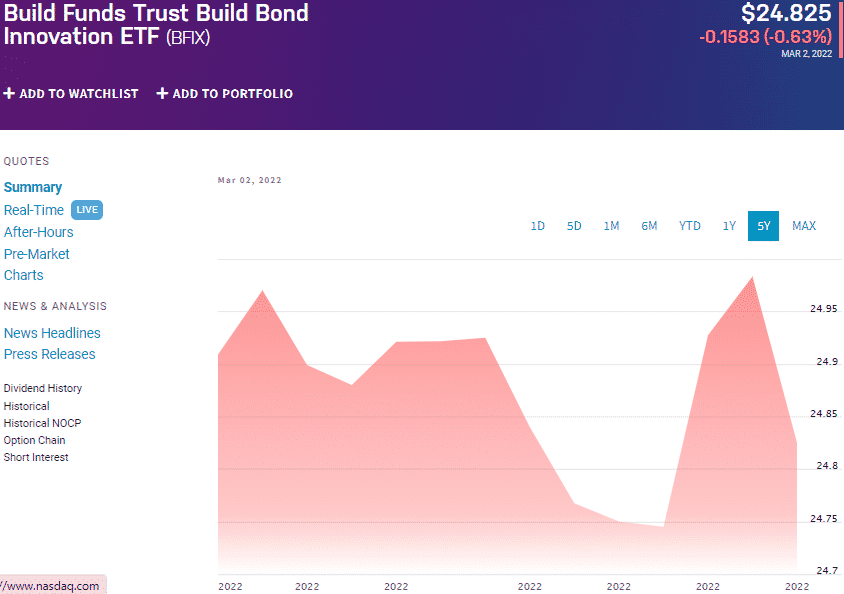

№ 1. Build Funds Trust Build Bond Innovation ETF (BFIX)

Price: $24.82

Expense ratio: 0.50%

BFIX chart

In times of uncertainty, bonds have been the go-to investment asset. With the unprecedented market sell-offs of 2021, rising interest rates, and rising inflation, it comes as no wonder that we have the launch of bond ETFs with a twist.

The Build Funds Trust Build Bond Innovation ETF is an actively managed fund that seeks capital appreciation by investing at least 90% of its total assets in investment-grade fixed-income investments. The remaining 10% invested in actively managed call options coupled to large-cap equities forming part of the SPY ETF.

The top three holdings of this bond fund are:

- Vanguard Short-Term Corporate Bond ETF – 45.04%

- Vanguard Short-Term Treasury ETF – 31.12%

- Vanguard Intermediate-Term Corporate Bond ETF – 13.02%

BFIX ETF has accumulated $27.4 million in assets under management, with an expense ratio of 0.50%. The unique combination of investment-grade fixed income and equities results in a fund that lowers downside risk while maintaining upside potential due to its low correlation to the conventional equity market. Being actively managed leaves it agile enough to play with its holdings to reduce volatility by allocating high yield bonds.

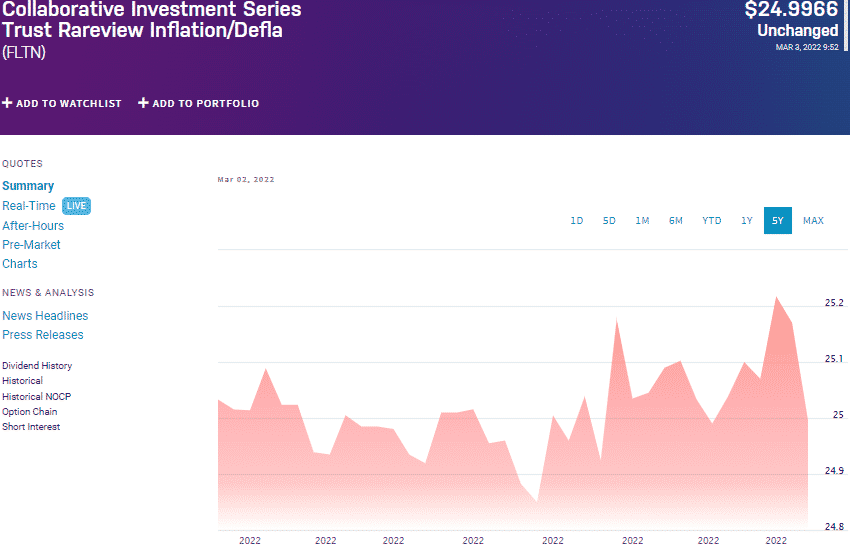

№ 2. Rareview Inflation/Deflation ETF (FLTN)

Price: $24.99

Expense ratio: 0.92%

FLTN chart

The is out; the ETF market is the gift horse that keeps giving. Investors now have an asset that hedges them against inflation and deflation and right when in high demand. The Rareview Inflation/Deflation ETF is an actively managed bond fund that invests in investment-grade and inflation-protected TIPs and treasury securities, hence hedging against both inflation and deflation. As a result, it is a fund that seeks an amplified rate of return to the prevailing inflation rates.

The only holdings of this unique fund are:

- U.S. Dollar – 54.10%

- Schwab US TIPS ETF – 45.90%

The FLTN ETF has $8.2 million in assets under management so far, with investors’ parting with $92 annually for every $10000 invested. The holding of cash and cash equivalents and derivatives, in addition to the inflation-protected US Treasury Securities, ensure the agility to take advantage of changing interest rates, potentially increasing returns.

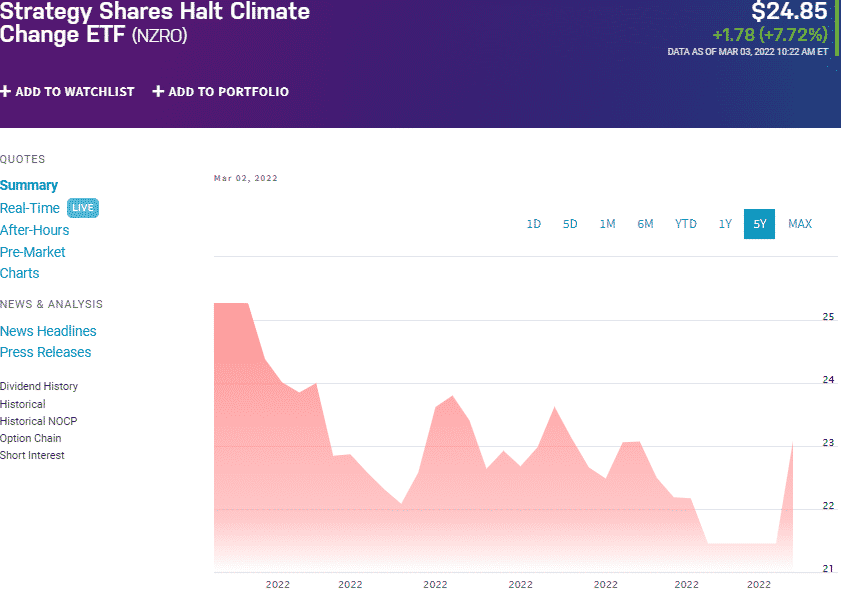

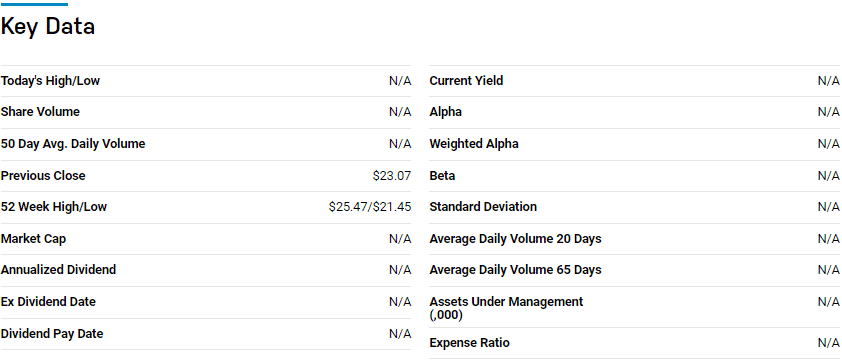

№ 3. Strategy Shares Halt Climate Change ETF (NZRO)

Price: $24.85

Expense ratio: 0.95%

NZRO chart

The globe is up in arms regarding adverse climate change reversal, and efforts to go green while reclaiming the environment are intensifying. There are already several ETFs playing this field, but now investors have a chance to invest in a new player in the green investing space via the Strategy Shares Halt Climate Change ETF. This conscious fund seeks capital appreciation by exposing investors to global companies at the forefront of carbon emission reduction.

The top three holdings of this non-diversified ETF are:

- Apple Inc. – 2.60%

- Microsoft Corporation – 2.58%

- U.S. Dollar – 2.50%

The NZRO ETF has $1.2 million in assets under management, with an expense ratio of 0.95%. A pretty even weighting and concentration on global companies that derive at least 50% of their revenues from advancements towards a low carbon, combating climate change, and equities facilitating the transition from fossil fuels ensures this fund cuts across almost all existing ESG activities. Active management also provides that this fund is agile enough to develop technologies and emerging opportunities in the green technology space.

Final thoughts

With rising inflation and interest rates, the expectation is for large-cap equities to take a break from earning season, necessitating investors’ need to look elsewhere for income and returns. Among other strategies, it will include looking into new ETF launches to buy at relatively low cost but with the ability to take advantage of mega-market trends to provide portfolio value and growth.

2022 ETF market will exceed the 2021 launch of 480 new funds if the current launch pace holds, and the three new ETFs above are a great starting point to get a head start.

Comments