The post-pandemic environment has provided many opportunities for micro-cap and small-cap stocks to thrive and grow. Historically, small-cap and micro-cap equities outperform the large and mid-cap stocks in post-economic strife environments. However, the problem is that micro-cap stocks are more volatile than even small-cap stocks.

What is the composition of micro-cap ETFs?

Micro-cap ETF comprises publicly traded equities listed with major stock exchanges with a market capitalization of $50 million and $300 million. Unlike small-cap ETFs, the jury is not out on how to define micro-cap ETFs. However, for this list, we define micro-cap stocks as those equities with a market capitalization of below $300 million, commonly referred to as penny stocks.

The best micro-cap ETF portfolio growth in 2022

The problem with investing in micro-cap ETFs is that most of these equities trade in the OTC markets, and without their listing in major stock exchanges, they don’t qualify to be part of exchange-traded funds. Therefore, most micro-cap ETFs couple the few listed micro-cap equities with small-cap equities to make a fund that provides value and growth attributes while mitigating against the inherently high volatility associated with such stocks. On the backdrop of this, the following three micro-cap ETFs are in pole position to benefit from the current global economic expansion.

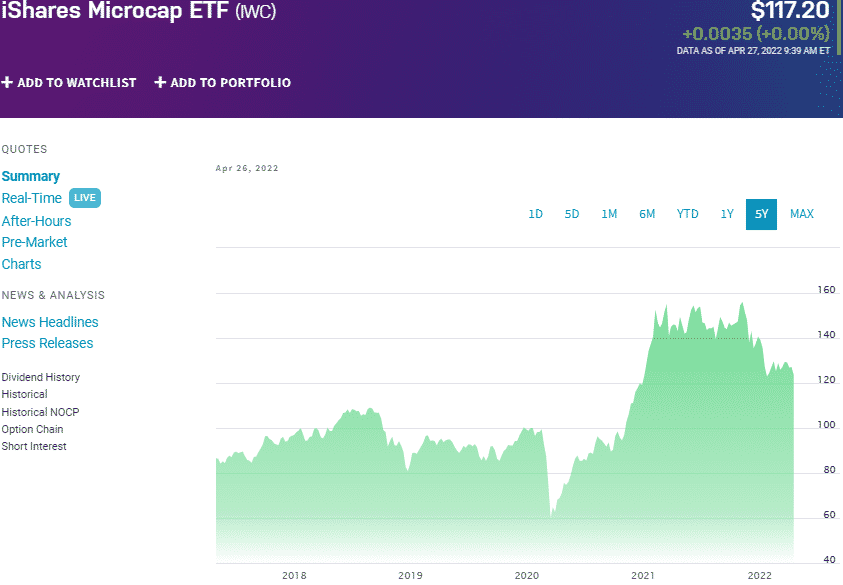

№ 1. iShares Microcap ETF (IWC)

Price: $117.20

Expense ratio: 0.60%

Annual dividend yield: 0.59%

IWC chart

You cannot talk about micro-cap ETFs and fail to mention the iShares Micro-cap ETF. It is the most popular and liquid exchange-traded fund plying its trade in the micro-cap segment. It tracks the Russell Microcap Index, a sub-index of the Russel 2000 index. It invests at least 80% of its total assets in the securities comprising the index and other investment assets exhibiting similar economic characteristics. The remaining 20% is invested in other financial instruments that can help track the composite index; future contracts, options, cash and cash equivalents, and swap contracts.

In a list of 61 small blend funds, the IWC ETF is ranked № 27 for long-term investing.

The top three holdings of this balanced ETF are:

- Lantheus Holdings Inc – 0.90%

- Civitas Resources, Inc. – 0.60%

- Alpha Metallurgical Resources, Inc. – 0.50%

The IWC ETF is one of the largest funds operating in the micro-cap space with $1.02 billion in assets under management, with investors parting with $60 annually for a $10000 investment. Pretty even distribution and relative spread across different sectors mitigate against the inherent volatility of microcap stocks and a resilient fund to grow a portfolio value exponentially; 5-year returns of 41.79%, 3-year returns of 28.88%, 1-year returns of -20.55%.

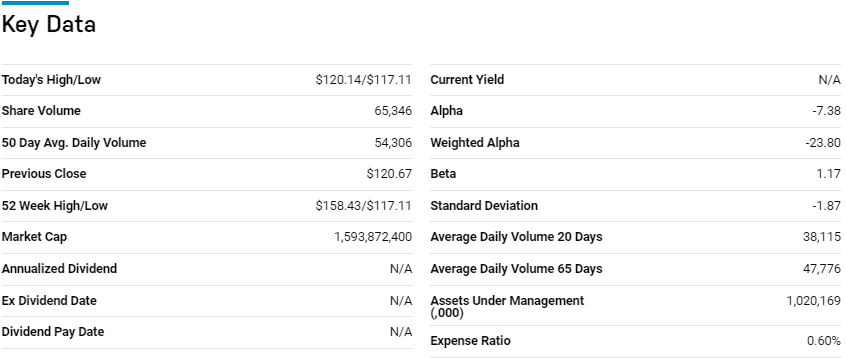

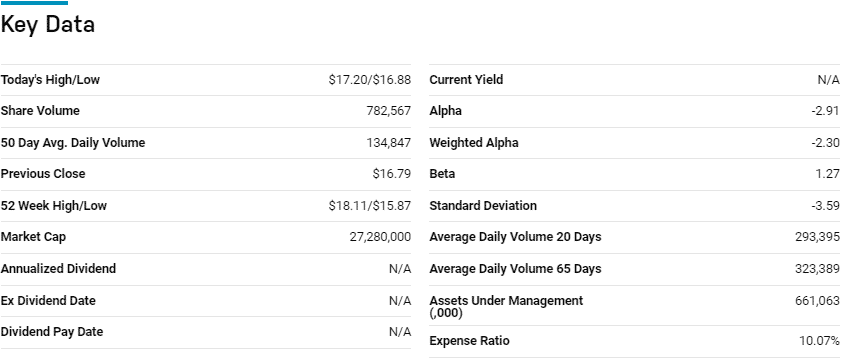

№ 2. VanEck BDC Income ETF (BIZD)

Price: $17.05

Expense ratio: 10.07%

Annual dividend yield: 7.73%

BIZD chart

The VanEck BDC Income ETF tracks the yield and price performance of the MVIS® US Business Development Companies Index, net of expenses and fees. It invests at least 80% of its total assets in the securities of the tracked index, exposing investors to BDC companies that invest or provide funds to micro-cap equity organizations.

In a list of 22 financial funds, the BIZD ETF is ranked № 22 for long-term investing.

The top three holdings of this global large-cap ETF are:

- Ares Capital Corporation – 14.27%

- FS KKR Capital Corp. – 8.60%

- Owl Rock Capital Corporation – 6.56%

The BIZD ETF has $662.6 million in assets under management, with investors paying dearly for the high returns, an expense ratio of 10.07%. Concentration on private equity firms that provide capital to the most liquid and largest business development companies creates value for not only this ETF but also exponential growth possibilities; 5-year returns of 42.36%, 3-year returns of 38.24%, 1-year returns of 8.80%, and a mouthwatering dividend yield of 7.73%.

This is an indirect play on the micro-cap segment by investing in the firms that do the analysis and provide funds to the equities with the best chance of being the next Tesla.

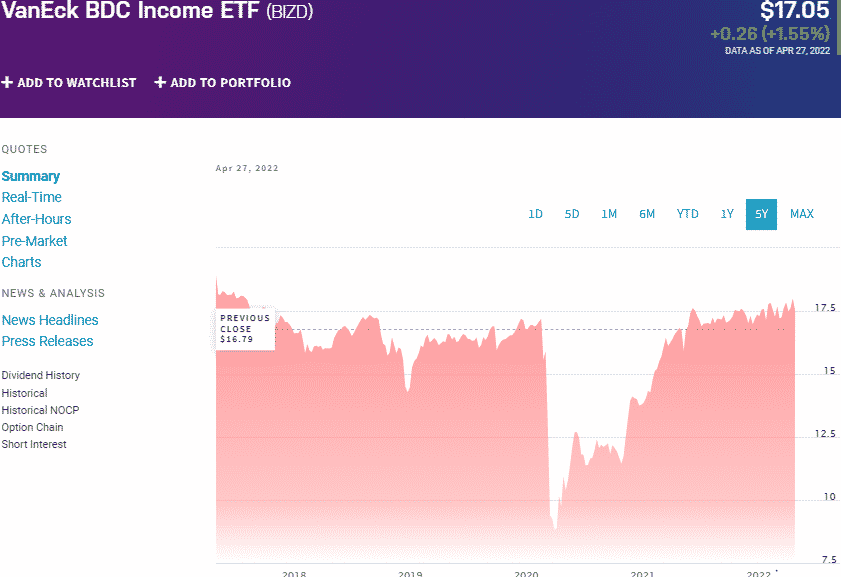

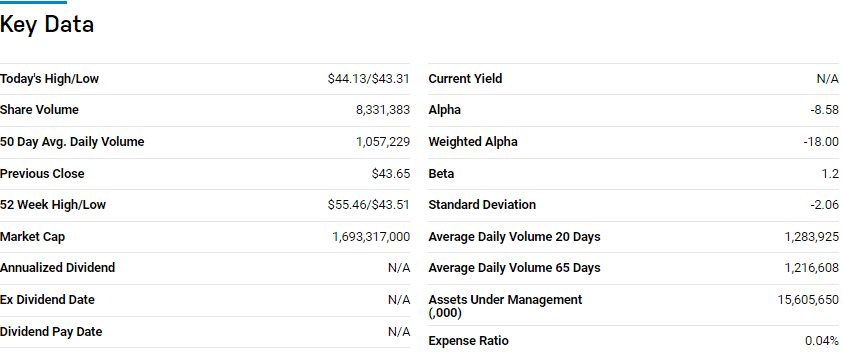

№ 3. Schwab US Small-Cap ETF (SCHA)

Price: $43.53

Expense ratio: 0.04%

Annual dividend yield: 0.95%

SCHA chart

The Schwab US Small-Cap ETF tracks as closely as possible the total returns performance of the Dow Jones US Small-Cap Total Stock Market Index, investing at least 90% of its net assets in the securities of its composite index. The tracked index is a float-adjusted market capitalization-weighted index and exposes investors to micro-cap and small-cap equities with a market valuation range of $37 million to $22 billion.

In a list of 61 small blend equity funds, the SCHA ETF is ranked № 7 for long-term investing.

The top three holdings of this small blend equity fund are:

- LPL Financial Holdings Inc. – 0.42%

- ZoomInfo Technologies Inc – 0.40%

- Rexford Industrial Realty, Inc. – 0.35%

The SCHA ETF is the largest fund operating in the micro-cap segment on this list, boasting $15.6 billion in assets under management while also being the cheapest option, with investors parting with just $4 for a $10000 investment annually. An even weighting provides mitigation against the extreme volatility of the micro-cap stocks, while a focus on both value and growth attributes results in a resilient fund capable of more than decent returns; 5-year returns of 45.51%, 3-year returns of 26.54%, and 1-year returns of -14.85%.

Final thoughts

There are no pure-play micro-cap ETFs due to the extreme volatility of these equities. However, the funds on this list have a significant weight assigned to this sector and provide a diversified way to play this segment and outperform the broader markets.

Comments