The world is looking for ways to reclaim the environment and reverse climate change. As a result, afforestation and reforestation are on the lips of many. However, there is still a sizeable market for lumber and timber globally.

A survey in early 2020 had estimated that the lumber market would be worth $51.4 billion, but as the year closes, the market is estimated at a whopping $135.4 billion, with a CAGR of upwards of 4.7%.

Lumber ETFs: how do they work?

Commodities offer the best hedge in an uncertain environment full of rate hikes and rising inflation. However, most investors look to precious metals for a hedge and other popular commodities. In a small corner of the commodity market, we have lumber.

Lumber stocks are heavily coupled to the timber industry, and most may use the two terms interchangeably, but that is not the case. Timber is a general term covering unprocessed wood, while lumber refers to already processed wood, usually used as a building material. As such, lumber ETFs comprise organizations involved in forested leasing land, timber harvesting, and lumber processing, distribution, and sale.

The best three lumber ETFs for 2022 to take advantage of soaring prices

In the last +40 years, timber has been one of the best complimentary commodity investments to stocks. Lumber is a direct and indirect play on the timber and housing industries, giving investors the best of both worlds for two haven investments. With the world recovering from coronavirus, lumber will be an excellent indicator for the health of the housing and manufacturing sectors. The ETFs below stand to be a source of growth for any portfolio.

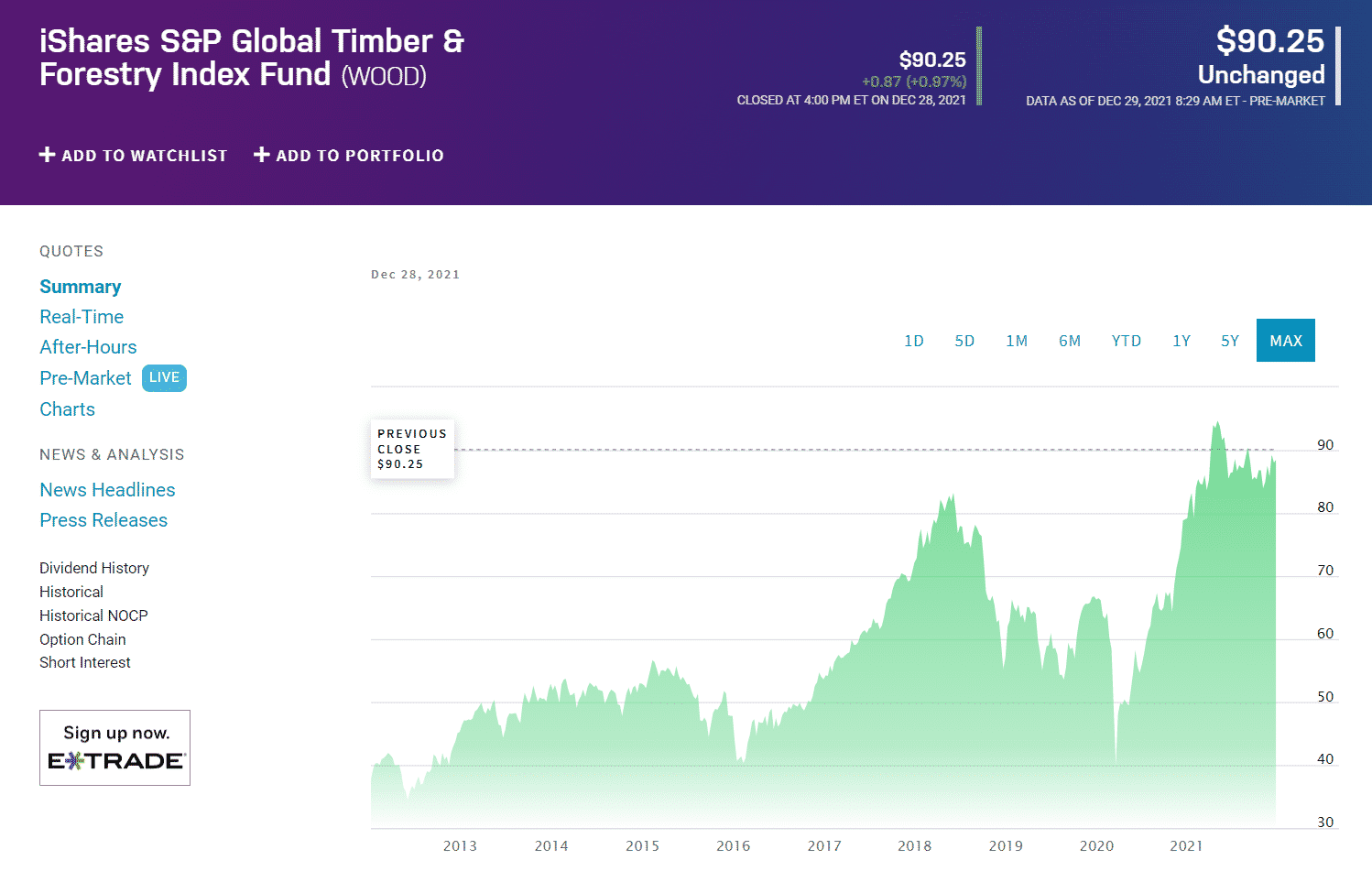

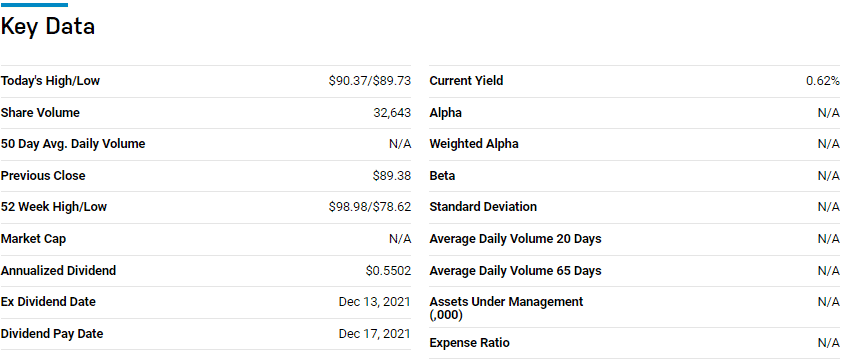

№ 1. iShares Global Timber and Forestry Fund (WOOD)

Price: $90.25

Expense ratio: 0.43%

Annual dividend yield: 1.36%

WOOD chart

iShares Global Timber and Forestry Fund tracks the performance S&P Global Timber & Forestry Index, investing at least 80% of its total assets in the securities of its underlying holdings. The remaining 20% is invested in assets with similar economic characteristics to the composite index, including futures, swap contracts, cash, options, and cash equivalents.

WOOD ETF is ranked № 15 by US News analysts among 38 of the best natural resources ETFs for long-term investing.

The top three holdings of this ETF are:

- West Fraser Timber Co. Ltd. – 9.18%

- Weyerhaeuser Company – 8.69%

- Svenska Cellulosa AB Class B – 8.56%

WOOD ETF has $307.8 million in assets under management, with an expense ratio of 0.43%. Exposure to the global timber industry makes WOOD ETF an indirect play of the global lumber industry from the source. In addition to more than average returns, this ETF is an effective hedge against rising prices as experienced; 5-year returns of 81.76%, 3-year returns of 64.38%, pandemic year returns of 14.39%, and current year to date returns of 13.70%.

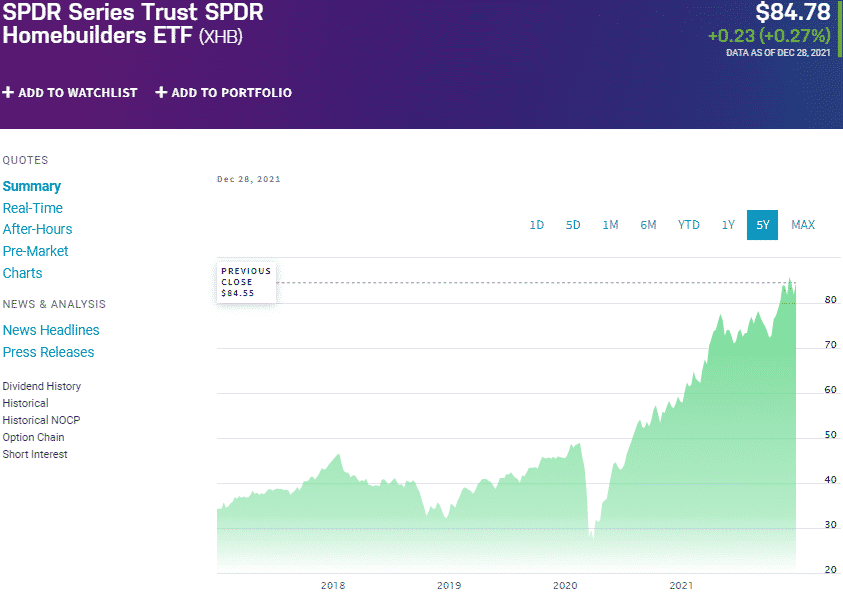

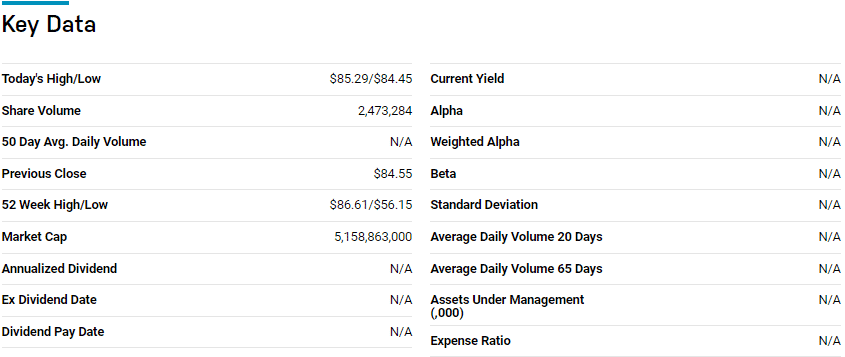

№ 2. SPDR S&P Homebuilders Fund (XHB)

Price: $84.78

Expense ratio: 0.35%

Annual dividend yield: 0.52%

XHB chart

SPDR S&P Homebuilders ETF tracks the performance of the S&P Homebuilders Select Industry Index, investing at least 80% of its total assets in the securities of its underlying holdings via a sampling strategy.

XHB ETF is ranked № 5 by US News analysts among 35 of the best consumer cyclical ETFs for long-term investing.

The top three holdings of this ETF are:

- Builders FirstSource, Inc. – 4.13%

- Masco Corp. – 3.96%

- Whirlpool Corp. – 3.95%

XHB ETF has $2.475 billion in assets under management, with an expense ratio of 0.35%. A well-balanced weighting ensures no concentration risk while a straddle between the cyclical and general homebuilding sectors provides diversification and consistent returns; 5-year returns of -157.89%, 3-year returns of 169.44%, pandemic year returns of 43.24%, and year to date returns of 47.54%. This ETF is an indirect play into the lumber market but with enough diversification to weather any volatilities in the market.

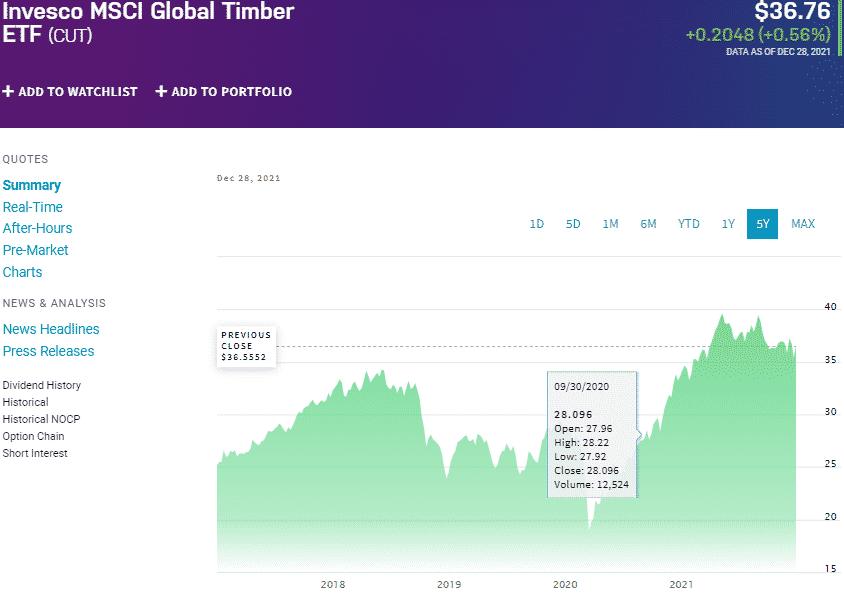

№ 3. Invesco MSCI Global Timber ETF (CUT)

Price: $36.76

Expense ratio: 0.69%

Dividend yield: 1.49%

CUT chart

Invesco MSCI Global Timber ETF tracks the performance of MSCI ACWI IMI Timber Select Capped Index, investing at least 90% of its total assets in the securities of its underlying holdings, together with their ADRs and GDRs. Therefore, it exposes investors to equities of organizations that own and operate forests and timberyards and those that produce timber-based end products.

CUT ETF has $89.9 million in assets under management, with investors having to part with $69 annually for every $10000 investment. CUT is a better option for investors seeking more diversification in the timber industry than the other ETFs on this list, has a holding base of more than 200 organizations. This diversification has resulted in consistent returns over the last half a decade, making a solid case for having this fund if considering lumber investing; 5-year returns of 64.13%, 3-year returns of 62.19%, pandemic year returns of 11.24%, and year to date returns of 10.65%.

Final thoughts

The post-pandemic environment has proven to be full of inflationary pressure creating an excellent environment for lumber and timber, which are excellent hedge assets against rising inflation. In addition, they have historically proven to be less volatile than REITs, stocks, farmland investments, and private equities, making them excellent complimentary investment options. Combine this with rising timber prices, and you can cut a path to portfolio profitability via the lumber ETFs above.

Comments