Israel is the second-best economy in the Middle East and North Africa region and among the most advanced countries globally in the development front; life expectancy, per capita income, and education. Its economy is driven by technology, diamond cutting, and pharmaceuticals.

In addition, the country is a religious hotspot resulting in severe inflows for the tourism sector, primarily since it also features some breathtaking beaches and the most liberal and modern city in the region-Tel Aviv.

What is the composition of an Israel ETF?

In this article, Israeli ETFs featured have significant exposure to the Israeli equity market, and those with Israeli equities form the top ten weightings in their composition.

The 7 best Israel ETFs

Due to its regional positioning, Israel features two ingredients crucial for churning out returns: the immense growth potential of emerging markets coupled with the stability of developed markets. The seven ETFs below expose investors to this hidden investment gem in the Middle East.

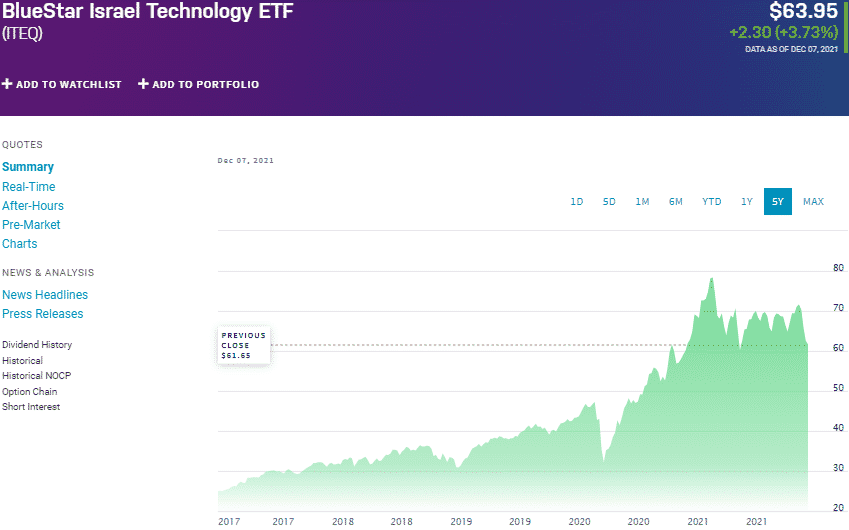

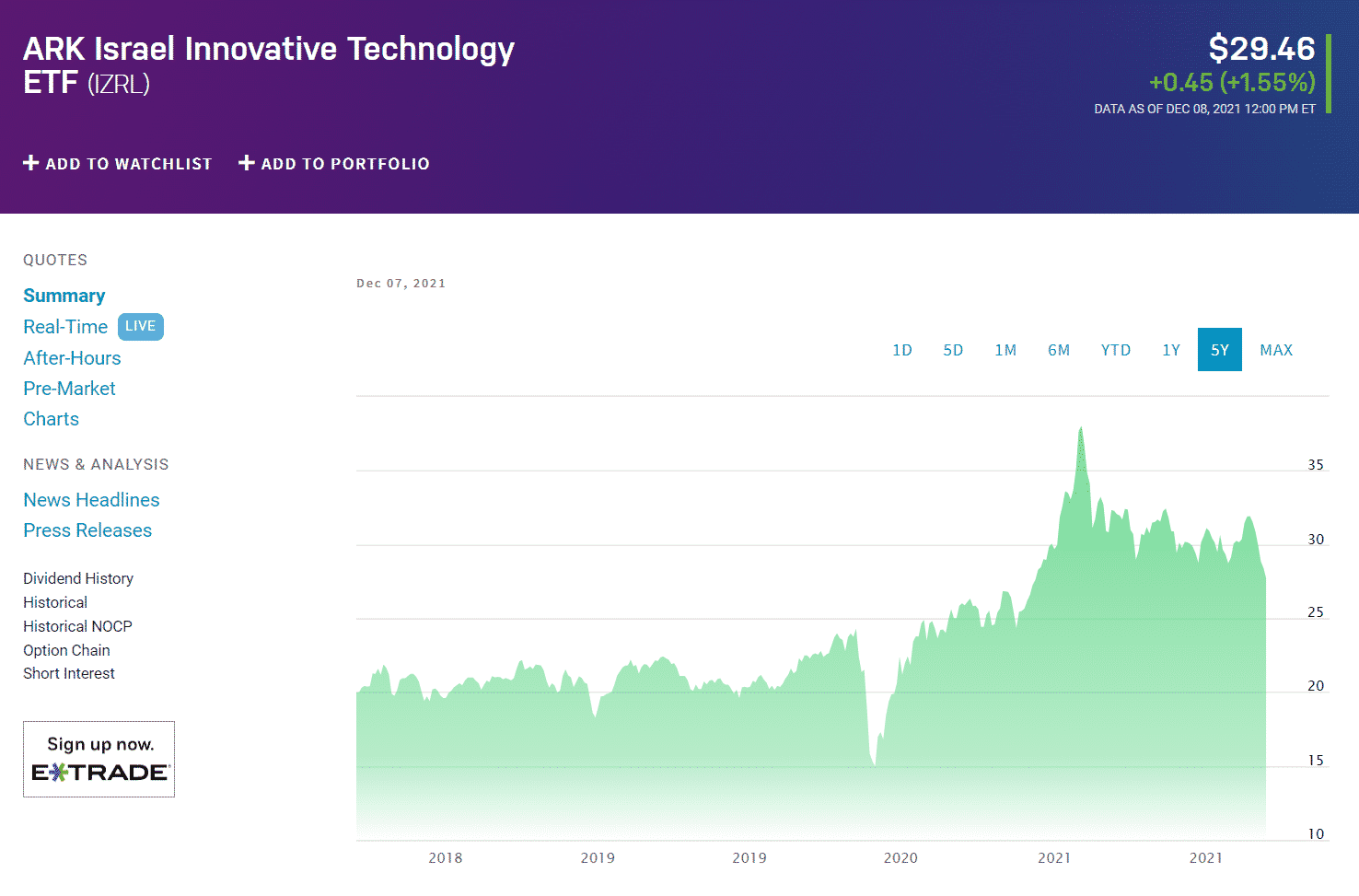

BlueStar Israel Technology ETF (ITEQ)

Price: $63.95

Expense ratio: 0.75%

Annual dividend yield: 2.10%

ITEQ chart

BlueStar Israel Technology ETF is the pioneer pureplay Israeli ETF. It tracks the BlueStar Israel Global Technology Index, investing at least 80% of its total assets in the holdings of the tracked index and their ADRs. It exposes investors to the technological sector of the Israeli economy; information technology, defense technology, biotechnology, clean energy, and clean water technology.

ITEQ has $167.8 million in assets under management, with an expense ratio of 0.75%. In addition, historically, it has demonstrated a knack for minting money; 5-year returns of 151.96% and 3-year returns of 86.84%. With technology running the world and Israel being a tech innovation giant, this Israel ETF is worth a second look.

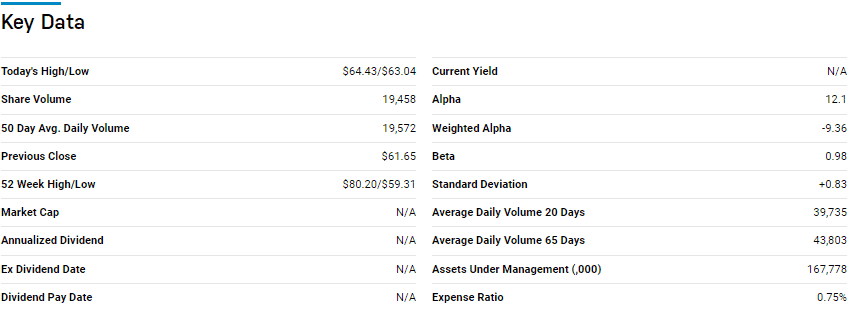

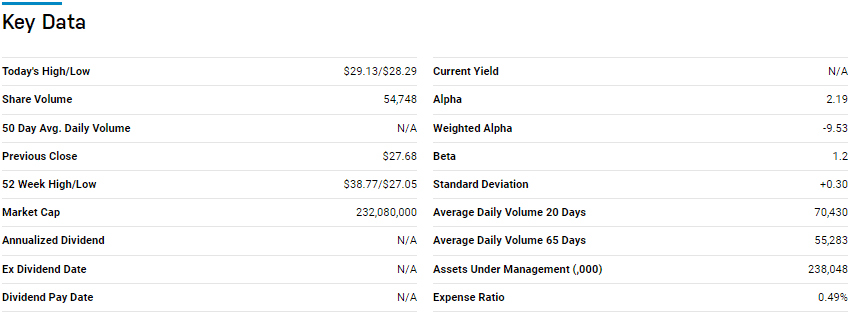

Ark Israel Innovative Technology ETF (IZRL)

Price: $29.46

Expense ratio: 0.49%

Annual dividend yield: N/A

IZRL chart

The ARK Israel Innovative Technology ETF tracks the performance of the ARK Israeli Innovation Index, investing at least 80% of its total assets in the underlying holdings of the composite index and their ADRs.

It exposes investors to approximately 40 Israeli companies causing disruptive advancements in health care, manufacturing, genomics, biotechnology, and the industrial sector. Despite coming from an issuer known for actively managed ETFs, the IZRL is a passively managed fund.

The IZRL ETF has $225.4 million in assets under management, with an expense ratio of 0.49%. With Cathy Wood as part of the advisory team, known for beating the market consistently, the negative returns of this fund in the pandemic year and year to date point at an undervalued ETF with room for growth.

After contracting upwards of 4% in the pandemic year, the Israel economy has started its resurgence, and the IZRL ETF provides targeted exposure to this country’s innovators.

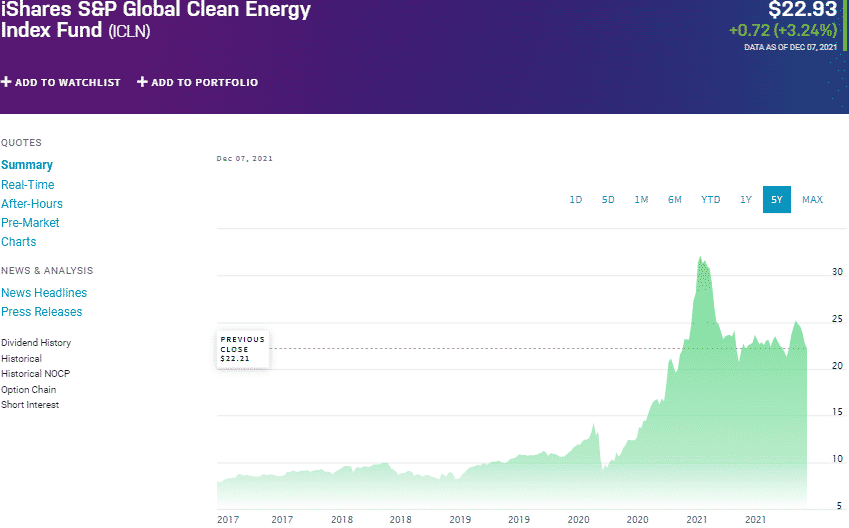

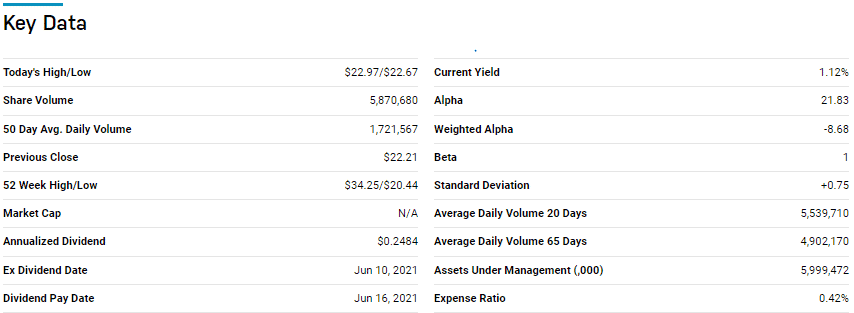

iShares Global Clean Energy ETF (ICLN)

Price: $22.93

Expense ratio:0.42%

Annual dividend yield: 0.67%

ICLN chart

The ICLN ETF tracks the performance of the S&P Global Clean Energy IndexTM, investing at least 80% of its assets in the underlying holdings of the composite index and any other security of like economic characteristics. Investors in this ETF get exposure to the top 100 global clean energy equities.

An evaluation of 48 various sectors’ ETFs by US News has the ICLN at rank № 8 for long-term investment.

This ETF has $6.2 billion in assets under management, with an expense ratio of 0.42%. Israel is one of the major players in the clean energy sector, and ICLN is another diversified play into this Middle East economy. The global appetite for clean energy is on the rise. All major players have agreed to strive for zero greenhouse gas emissions setting the stage for this ETF to continue its tradition of posting positive returns; 5-year returns of 205.23% and 3-year returns of 157.33%.

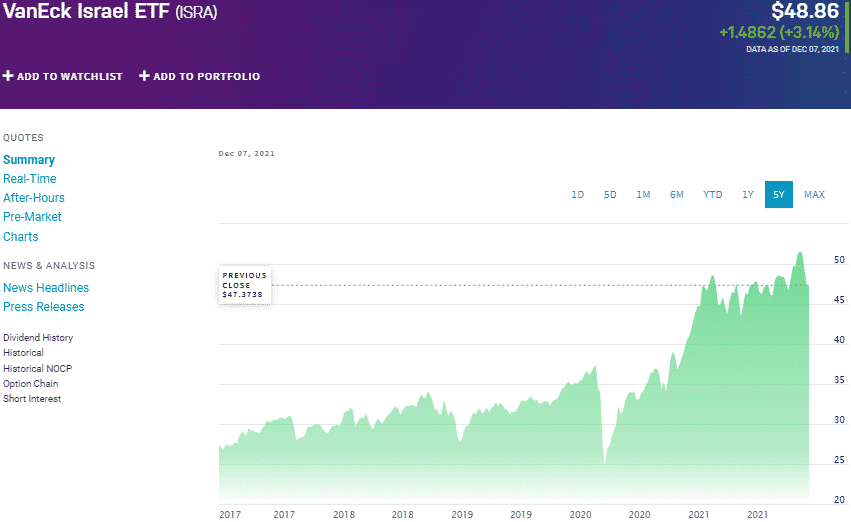

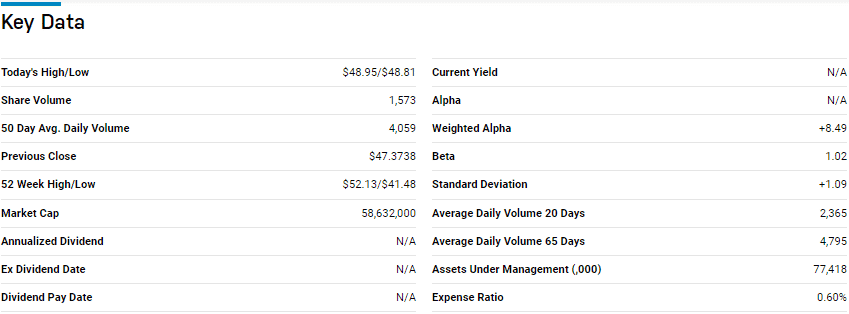

VanEck Israel ETF (ISRA)

Price: $48.86

Expense ratio:0.60%

Annual dividend yield: 0.15%

ISRA chart

The VanEck Israel ETF tracks the BlueStar Israel Global Index, investing at least 80% of its assets in the holdings of the composite index and their depository receipts. It exposes its investors to the Israeli economy equity market by only investing in firms categorized as publicly-traded Israeli companies by the MV Index Solutions GmbH.

ISRA ETF has $77.4 million in assets under management, with an expense ratio of 0.60%. Unlike some of the ETFs on this list that has posted negative returns since the start of the pandemic, ISRA has consistently made money for its investors; 5-year returns of 81.92%, 3-year returns of 54.89%, and pandemic year returns of 14.95%. In addition to this remarkable resilience, including all caps equities no matter where they have listed results in a well-balanced fund worth having in any portfolio.

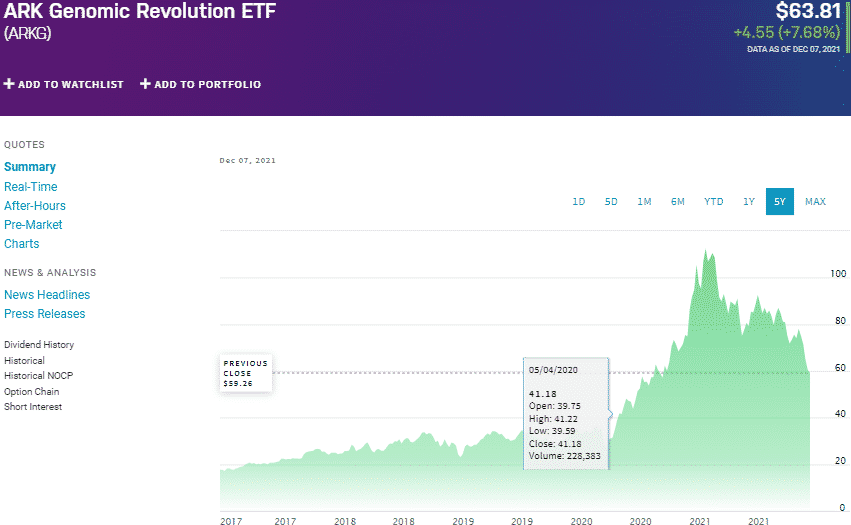

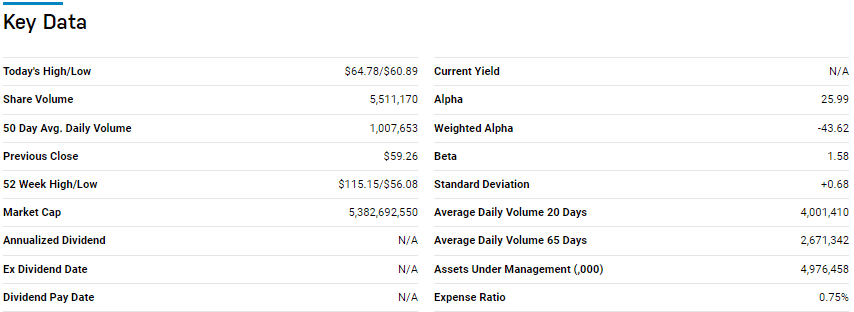

ARK Genomic Revolution ETF (ARKG)

Price: $63.81

Expense ratio: 0.75%

Annual dividend yield: 1.07%

ARKG chart

The ARK Genomic Revolution ETF is an actively managed fund that invests at least 80% of its total assets in global firms involved in; energy sector, consumer discretionary sector, healthcare sector, and information technology.

ARKG chart

ARKG has $5.32 billion in assets under management, with an expense ratio of 0.75%. Except for the pandemic year, this ETF has a habit of outperforming its category average; 5-year returns of 259.63% and 3-year returns of 121.02%. Israel is a global genomic powerhouse and investing in ARKG ETF is a diversified way of playing the Israel economy since it has global exposure. Active management of this ETF allows it to be flexible enough to take advantage of global opportunities from the genomic space.

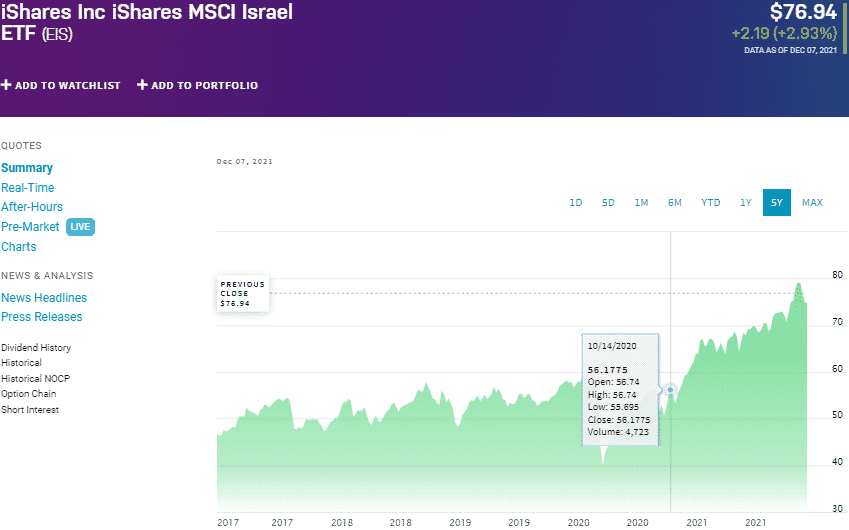

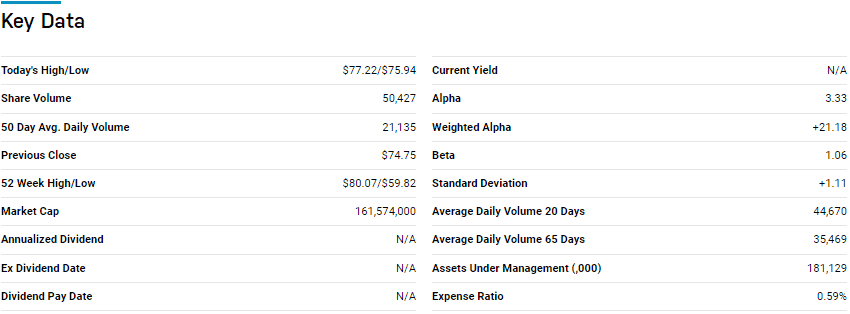

iShares MSCI Israel ETF (EIS)

Price: $76.94

Expense ratio: 0.59%

Annual dividend yield: 0.15%

EIS chart

The iShares MSCI Israel ETF tracks the performance of the MSCI Israel Capped Investable Market Index, investing at least 80% of its assets in the underlying holdings of the composite index and any other security of like economic characteristics. The underlying index is a free float-adjusted market-cap index with exposure to the entire publicly traded Israeli equity market.

An evaluation of 48 various region sector ETFs by US News has the EIS at rank № 5 for long-term investment.

The EIS ETF has $181.11 million in assets under management, with an expense ratio of 0.59%. In the last five years, investors have enjoyed positive returns even though the pandemic; 5-year returns of 69.20%, 3-year returns of 43.89%, pandemic year returns of 25.31%, and current year to date returns of 16.79%.

Analysis of these returns shows an ETF that outperforms the category and segment averages, reason enough to have this ETF if considering geographical diversification.

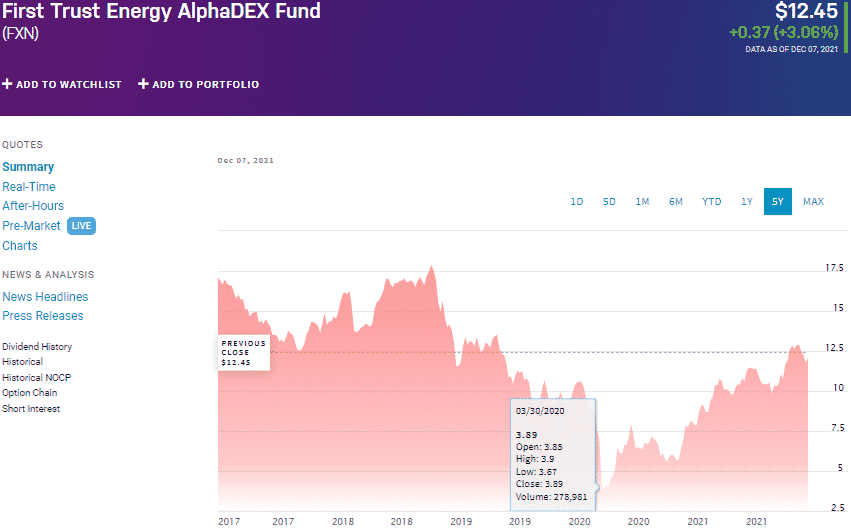

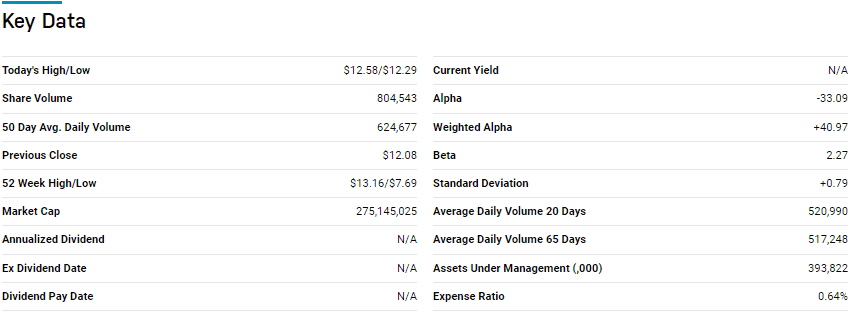

First Trust Energy AlphaDex Fund (FXN)

Price: $12.45

Expense ratio: 0.64%

Annual dividend yield: 0.83%

FXN Chart

The First Trust Energy AlphaDex ETF seeks to replicate the performance of the StrataQuant Energy Index, net of expenses and fees. FXN invests at least 90% of its total assets in the underlying holdings of its composite index and ADRs of the underlying holdings. It exposes its investors to equities chosen via the AlphaDex methodology, ensuring energy stocks from the Russel 1000 index generate positive alpha.

An evaluation of 24 equity energy funds by US News has the FXN at rank № 11 for long-term investment.

The FXN ETF has $394 million in assets under management, with an expense ratio of 0.64%. The last five years have not been the best for this ETF, but since the pandemic, it seems to be thriving; 5-year returns of -19.84%, 3-year returns of -4.13%, pandemic year returns of 50.31%, and current year to date returns of 52.96%.

With the AlphaDex methodology all about identifying stocks that might outperform the broader sector, this ETF gives an alternative to investing in the Israeli energy sector and enjoying phenomenal returns.

Final thoughts

Despite being politically unstable, Israel exhibits strong fundamentals and fiscal policies resulting in a vibrant investment market. The ETFs above provide an avenue to invest in this economy which also features a young and growing population, an essential feature for an equity growth market.

Comments