ETF full name: iShares 1-3 Year International TrsBd ETF (ISHG)

Segment: Global Bond Market

ETF provider: Blackrock Management

| ISHG key details | ||

| Manager | Radell and Mauro | |

| Dividend | N/A | |

| Inception date | 1st January 2009 | |

| Expense ratio | 0.35% | |

| Average Daily $ Volume | $414.29K | |

| Investment objective | Replication Strategy | |

| Investment geography | Global Developed Economies Bond Market | |

| Benchmark | FTSE World Government Bond Index – Developed Markets 1-3 Years Capped Select Index | |

| Weighted Average Market Cap | $165.21B | |

| Net Assets under Management | $74.7 Million | |

| Number of holdings | 396 | |

| Weighting methodology | Market сapitalization | |

About the ISHG ETF

The global community is yet to break from the clutches of the coronavirus resulting in central banks trying to find a balance between policies that spur economic resurgence and those that accommodate the reduced capacities.

For this reason, most governments are talking about easing government spending depending on the inflation levels and allowing for an interest rate hike. With the US government debt over the ceiling and analysts fearing a default, investors are looking for alternative economies to provide them with a dollar hedge, a haven in economic uncertainty, and consistent income generation. Investors have the ISHG to do precisely this by offering exposure to non-US developed economies’ government debts.

ISHG Fact-set analytics insight

The fund tracks the FTSE World Government Bond Index – Developed Markets 1-3 Years Capped Select Index intending to replicate its performance as closely as possible, net of expenses and fees. It invests at least 90% of its total assets in the securities of the composite index and the remaining 10% in financial instruments with similar economic characteristics; future contracts, cash equivalents, swap contacts, cash, and options. In the years preceding September 2020, this fund tracked the S&P International Sovereign Ex-U. 1-3 Year Bond Index.

This non-diversified fund’s performance results from currencies, fixed rates, investment grades, and sovereign bonds from the developed global economies.

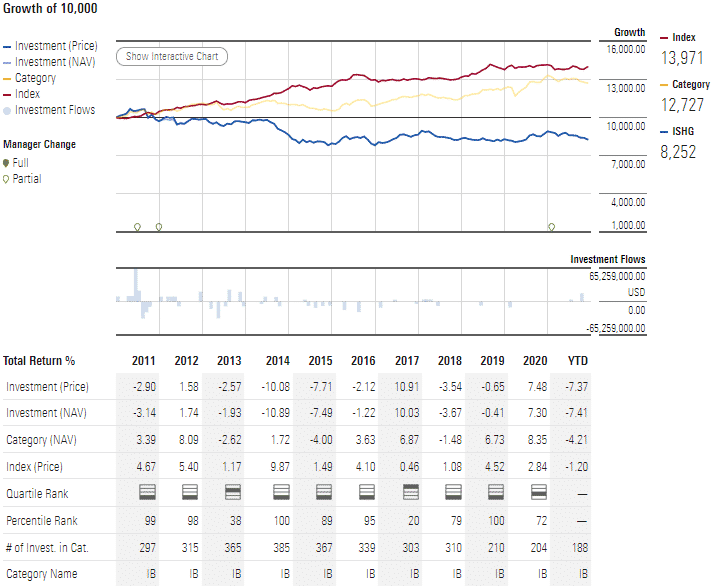

ISHG performance analysis

Bond funds are fixed-income debt instruments issued to raise funds by organizations or government agencies. As such, investors look to them for their consistent income generation rather than returns due to price changes. A look at the historical performance of the ISHG shows that its 5-year returns were positive at 2.28% before falling on hard times and posting negative returns since.

ISHG performance analysis

Despite its negative returns, this bond ETF has consistently yielded to its investors more than average income to the tune of $1.43 dividend to the share, monthly.

ISHG ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A- | N/A | N/A | * | N/A |

| IPO ESG Rating | 6.34 out of 10 | 6.34 out of 10 | 5th Quantile | 13.56 out of 50 | N/A |

ISHG key holdings

The ISHG holding base comprises high-quality short-term government bonds from developed economies. The result is a bond fund that is well balanced and free of concentration risk. It also rebalances every month to ensure it doesn’t deviate from its objective.

The ISHG seeks to dampen weighting on overly indebted countries by putting a cap on country weightings. As such, the top ten holdings account for only 17.87% of the ISHG fund weighting and areas below.

| Holding | % assets |

| Sweden 1.5% 13-NOV-2023 | 2.19% |

| TREASURY ISSUES (LONG-TERM) | 1.97% |

| Government of Ireland 3.4% 18-MAR-2024 | 1.92% |

| Japan 0.1% 20-DEC-2022 | 1.90% |

| Australia 0.25% 21-NOV-2024 | 1.81% |

| Norway 2.0% 24-MAY-2023 | 1.74% |

| Australia 5.5% 21-APR-2023 | 1.68% |

| Government of Ireland 3.9% 20-MAR-2023 | 1.56% |

| Japan 0.1% 20-MAR-2023 | 1.55% |

| Denmark 1.5% 15-NOV-2023 | 1.55% |

Industry outlook

Having a bond fund with international exposure provides geographical diversification and enhanced portfolio returns. In an interest-rising global economic environment, the ISHG ETF is a great investment option due to its concentration on short-term debt.

However, investors must contend with the local currency fundamentals since all under holdings are in their respective local currencies. Given the volatile equity markets and uncertainty surrounding the post-pandemic world, it is prudent to have some eggs nestled in the bond market, and the ISHG is a solid global option.

Comments