Last week saw the SPY close in the green and set yet another record since February 2021 of the highest weekly positive change, +3.8%.

Would the SPY hold on to the newfound bullish momentum, or would its wings be clipped?

Monday’s opening gap up of 0.3% to have the SPY start its trading at $468.26 was a sign of continuing bullish run to many, given the previous week’s phenomenal run. The bulls, however, could not muster the necessary momentum needed to break the November resistance point of $471.87, resulting in a downward slide that would dominate the better part of the trading week.

The sideways market resulted from the jitters surrounding the FED meeting on Wednesday. The expectations were for the committee to announce speedier tapering rates that would feed into earlier rate hikes. The Wednesday meeting rewarded those bullish on the economy and the SPY, revealing that dovish committee members had turned hawkish.

Powell also acknowledged that inflation is way past the transition point, and strategy is in place despite scanty information on this. However, the bullish reaction was only momentary as investors grappled with the fact that interest rate hikes would have to be highly regulated not to slow down economic recovery and invert the yield curve. A combination of the out-of-control inflations and continued supply bottlenecks is an ever-worsening price environment.

Meanwhile, the Omicron variant of the coronavirus is sweeping across global cities, accelerating discussions about how best to ensure and enforce mandatory vaccination in the private sector. All these factors saw the musical chairs between the individual sectors continue.

Top gainers of the current week

Health Care sector

The Health Care sector was the biggest gainer of the week, with news of some boaster shorts being adequate against the Omicron variant to finish the week at +3.15%.

Consumer Staples Sector

Continued jitters as we come to the close of the year, and the earlier slide in the week had investors seeking out defensive sectors with consumer staples benefiting the most to end the week at +2.90%.

Utilities Sector

Another sector is seen as a defensive option; the utility sector also capitalized on the rising investor jitters to close the week at +2.77%.

Losers of the current week

Sectors that dragged the SPY behind were;

Energy sector at — 2.91%

Information Technology sector at — 3.42%

Consumer Discretionary sector at — 3.83%

The eurozone block of the G20 cannot seem to agree on energy and the way forward regarding carbon price. It has also become apparent that there will be no sustainable green energy without utilizing nuclear power resulting in further jitters and the slide of this sector to close the week at -2.91%.

The information technology sector and the consumer discretionary sector took the brunt of rising prices and spreading Omicron Covid-19 variant to close at -3.42% and -3.83%, respectively.

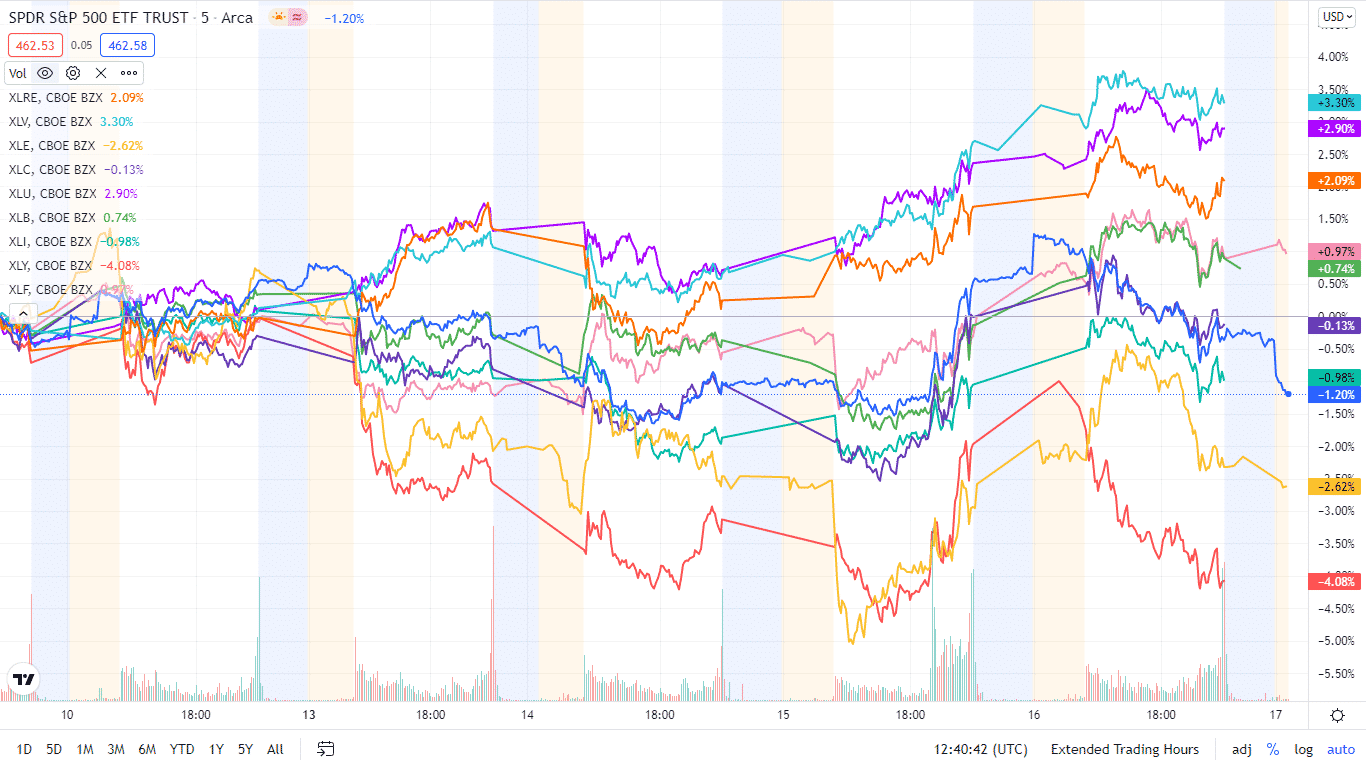

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs, with some sectors finishing in the green and others in the red.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Healthcare | XLV | +3.15% with the accompanying healthcare select sector ETF |

| 2. | Consumer Staples | XLP | +2.90% with the accompanying consumer staples select sector ETF |

| 3. | Utilities | XLU | +2.77% with the accompanying utilities select sector ETF |

| 4. | Real Estate | XLRE | +1.91% with the accompanying real estate select sector ETF |

| 5. | Financial Services | XLF | +0.99% with the accompanying financial select sector ETF |

| 6. | Materials | XLB | +0.52% with the accompanying materials select sector ETF |

| 7. | Communication Services | XLC | -0.57% with the accompanying communication services select sector ETF |

| 8. | Industrial | XLI | -1.08% with the accompanying industrial select sector ETF |

| 9. | Energy | XLE | -2.91% with the accompanying energy select sector ETF |

| 10. | Information Technology | XLK | -3.42% with the accompanying information technology select sector ETF |

| 11. | Consumer Discretionary | XLY | -3.83% with the accompanying consumer discretionary select sector ETF |

Comments