Despite the pullout by Britain for the European Union and the concentration of many investors on the developed economies, it is a vast continent with opportunities that rival Wall Street if played right. To name but a few, it is a continent that domiciles some of the leading global brand names across the industries; Volkswagen, Nestle SA, Royal Dutch Shell, SAP SE, Gazprom, Total, BP, Exor Group, and Daimler.

The different coronavirus variants show that it is not yet done with disrupting economic activities and other facets of our lives. However, the havoc caused by this virus across the Eurozone has resulted in widespread vaccinations setting the stage for quick economic resurgence.

With the Eurozone having experienced its worst economic contraction on record during the coronavirus, it is time to buy the dip. These three exchange-traded funds are in pole position to make the most of the current situation.

What is the composition of a Euro ETF?

At present, there are upwards of forty European ETFs trading in the United States available to investors to gain exposure to this economic block powerhouse. These exchange-traded funds comprise a basket of investment assets that track indices domiciled in the European region, investing at least 75% of their total assets in investment vehicles domiciled in the Eurozone. As such, most of these ETFs expose investors to a combination of the developed Eurozone markets and the emerging markets in this region.

Top 3 European ETF to make money in 2022

Exchange-traded funds headquartered in the US might traditionally outperform their Euro counterparts, but Covid-19 has shifted this narrative like it has other facets of our lives. In the last 12 months, European equities have outperformed their US counterparts preparing the ground for increased demand for Euro ETFs, and the three below are the best of this lot.

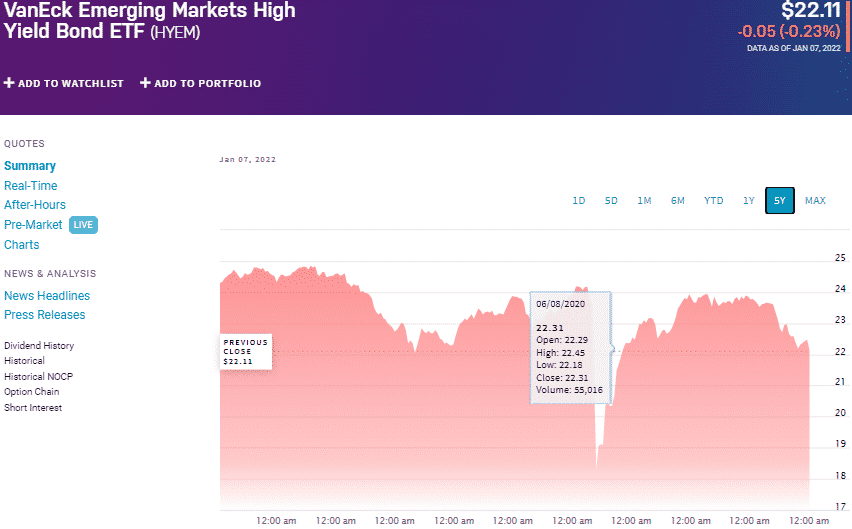

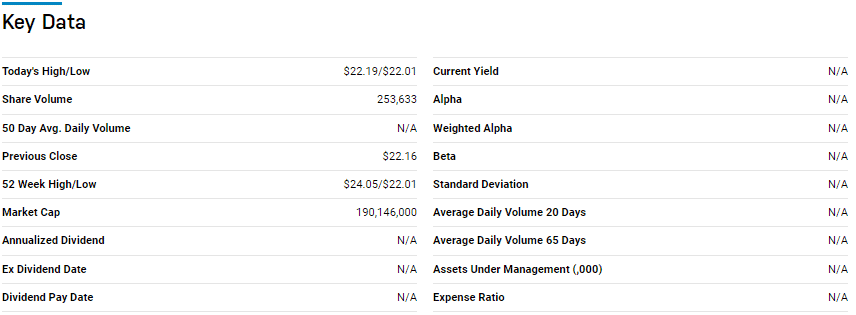

№ 1. VanEck EM High Yield Bond ETF (HYEM)

Price: $22.11

Expense ratio: 0.40%

Dividend yield: 5.88%

HYEM chart

The HYEM ETF tracks the ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index, investing at least 80% in its underlying index. This ETF is for the high-risk, high-return investors since it exposes them to the emerging European “junk” bond market.

This ETF is ranked №1 by US News analysts among emerging markets bond ETFs.

The top three holdings of this non-diversified ETF are:

- Industrial and Commercial Bank of China Limited 3.2% PERP – 1.06%

- Teva Pharmaceutical Finance Netherlands III BV 3.15% 01-OCT-2026 – 0.78%

- Ecopetrol SA 6.875% 29-APR-2030 – 0.60%

HYEM ETF has $1.26 billion in assets under management, with an expense ratio of 0.40%. With a dividend yield of 5.88%, this fund provides diversification and consistent incomes. This ETF has recorded returns of 16.99% and 3-year returns of 21.50% in the last five years.

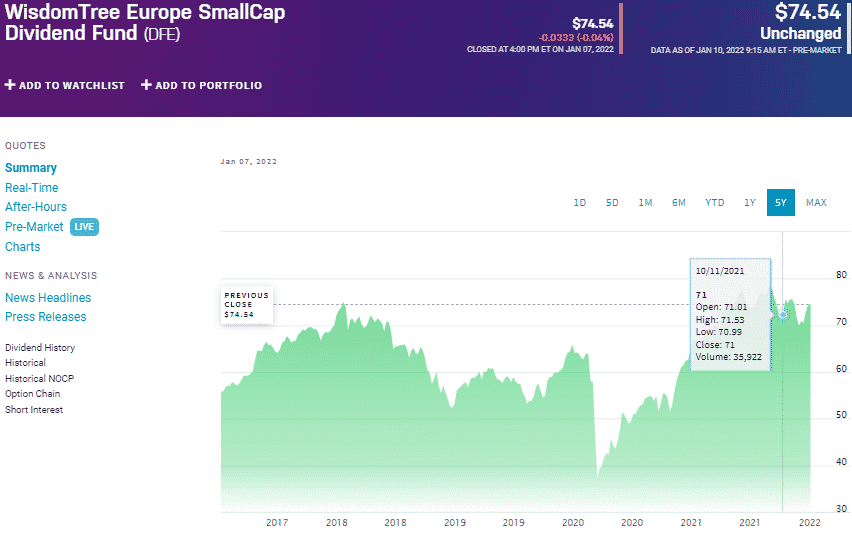

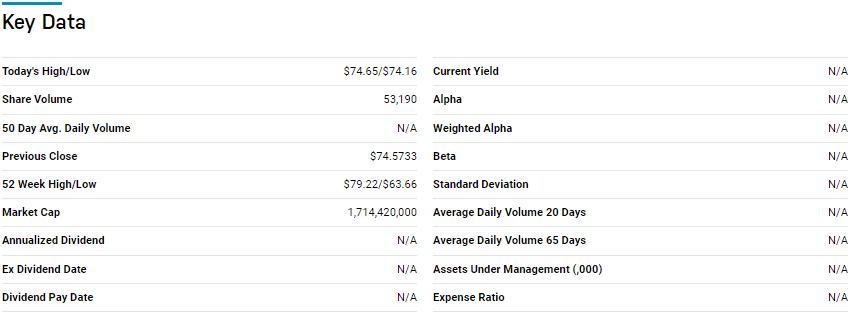

№ 2. WisdomTree Europe SmallCap Dividend Fund (DFE)

Price: $74.54

Expense ratio: 0.58%

Dividend yield: 2.69%

DFE chart

WisdomTree Europe SmallCap Dividend ETF tracks the WisdomTree Europe SmallCap Dividend Index, investing at least 95% of its total assets in the underlying holdings of the composite index, and other assets of economic characteristics. Most Euro funds concentrate on large-cap equities making the DFE a unique play on the European economic block.

The top three holdings of this non-diversified ETF are:

- PostNL NV – 3.32%

- Ferrexpo plc – 2.25%

- BFF Bank SpA – 1.63%

The DFE ETF has $324.7 million in assets under management, with an expense ratio of 0.58%. Small-cap ETFs have a tendency to outperform large-cap equities immediately after economic strife. The post-pandemic environment is pipped to provide an environment for small-caps’ to thrive and when it comes to the Eurozone, the DFE has a track record of returns for its investors; -year returns of 58.36%, 3-year returns of 50.98%, and 1-year returns of 14.22%.

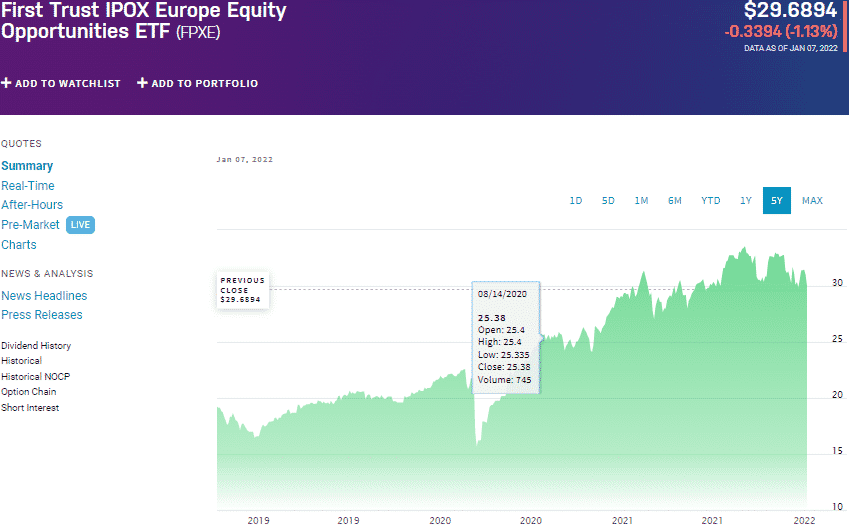

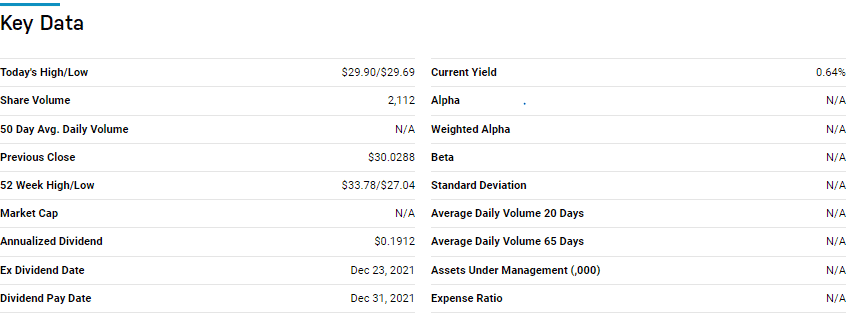

№ 3. First Trust IPOX Europe Equity Opportunities Fund (FPXE)

Price: $29.68

Expense ratio: 0.70%

Dividend yield: 1.02%

FPXE chart

The First Trust IPOX Europe Equity Opportunities ETF tracks the IPOX 100 Europe Index, investing at least 90% of its total assets in holdings that make up its composite index and depository receipts. Investors in the FPXE gained exposure to the best 100 firms running IPOs in Europe-purchased on the 6th day of trading after initial IPO and sold on the 1000th day.

The top three holdings of this unique ETF are:

- Siemens Healthineers AG – 8.29%

- Adyen NV – 7.19%

- Prosus N.V. Class N – 4.50%

FPXE ETF has $10.5 million in assets under management, with investors’ parting with $70 annually for every $10000 invested. 2022 will be characterized by many monetary policies to spur fast economic resurgence to pre-pandemic levels availing a host of opportunities.

This fund provides investors with a way to gain exposure to firms weighed above $50 million, with the best liquidity and other desirable trading metrics, raising IPOs to take advantage of the said opportunities. Quarterly rebalancing and reconstitution, among other quantitative methods of picking the underlying holdings, have ensured investors enjoy more than average returns; 3-year returns of 81.90% and 1-year returns of 1.51%.

Final thoughts

The current economic uncertainty and volatile markets call for investors to have portfolio diversification to weather the storms. The Eurozone is a more excellent starting point for Wall Street diversification, and the three ETFs above are a great option.

Comments