ETF full name: Invesco CurrencyShares Japanese Yen Trust Fund

Segment: currency

ETF provider: Invesco

|

FXY key details |

||

| Issuer | Invesco | |

| Inception date | December 2, 2007 | |

| Expense ratio | 0.4% | |

| Average Daily $ Volume | $4.26 million | |

| Investment objective | Hedge | |

| Investment geography | Currency | |

| Benchmark | USD/JPY Spot Exchange | |

| Net Assets under Management | $163.09 million | |

About the FXY ETF

The Christmas mood of 2007 was atypically special to investors with interest in the Japanese economy. 2nd December 2007 saw the launch of Invesco CurrencyShares Japanese Yen Trust Fund, FXY. It was an avenue for investors to hedge their overseas positions in the Japanese economy and provide them with an asset to facilitate bets against the green-buck using the Japanese Yen.

The FXY is a non-diversified exchange-traded fund comprising a single currency, the Japanese yen. Despite the volatility of the spot exchange currency it tracks, this ETF has one of the lowest 60-day average spreads, 0.02%.

FXY fact-set analytics insight

The Invesco CurrencyShares Japanese Yen Trust Fund objective is to try and match the performance of the Japanese yen, as much as possible, after expenses. It, therefore, provides investors exposure to the Japanese Yen and its coupled interest rates.

To realize the vision of its sponsor and expectations of the investors, this forex ETF holds the Japanese yen in a JPMorgan deposit account. The account provides for closer tracking of the USD/JPY spot exchange.

However, the FXY deposit account has the following limitations:

- Non-insured JPMorgan deposit account hence increased depository credit risk.

- Increased holding cost due to taxation at nominal income rates for FXY distributions and share sales, regardless of the holding period.

- Unlike its benchmark spot exchange, USD/JPY, this currency ETF does not offer overnight lending rates. However, the Japanese lending rate is slightly above 0%; hence overnight lending has marginal effects on the markets.

FXY ETF has a negative correlation to the USD. It is bullish when the green-buck is bearish and vice versa.

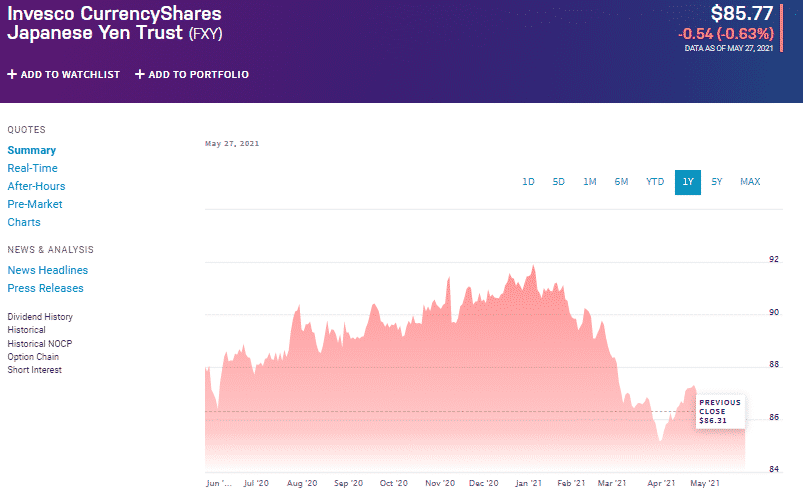

FXY annual performance analysis

In the whole world, the Pacific Islands was the best-prepared region in disaster management, at least the pandemic way, if the Coronavirus revealed anything. Australia is one of the countries in the Pacific’s endured a relatively more specific pandemic period compared to many in the globe.

The graph above shows that this currency ETF bullish trend presence is in the last 12 months. Investors holding the Aussie with American investment got an opportunity to hedge against the Covid19 effects and enjoy returns of $15.9% with the FXY.

Come the resurgence of the American economy on the back of Covid19 vaccination, and the value of the Australian dollar so far defies by remaining in the green, 0.15%.

The FXY exchange-traded fund boasts $138.6 million in assets under management.

FXY ETF RATING |

|||||

|

Resource |

ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

|

IPO Rating |

A- | B | 2 | N/A |

N/A |

|

IPO ESG Rating |

N/A | N/A | N/A | N/A |

N/A |

FXY key holdings

Invesco CurrencyShares Australian Dollar Trust Fund is a single forex spot exchange ETF. Therefore, rather than having underlying assets like other ETFs, it holds the Australian dollar in a deposit account.

Through the deposit account, the FXY can track the performance of the AUD/USD pair more accurately and provide a cost-efficient and relatively lower risk way of investing in the forex market. The fund manager also engages the deposit account in index swaps, options trading, and futures contracts trading.

Industry outlook

The Reserve Bank of Australia, RBA, according to Reuter’s economic panelists, is not yet ready to change its quantitative easing strategy. Expectations are for the RBA to maintain the OCR, Official Cash Rate, at its current record low of 0.1%. These measures are an attempt to spur post-pandemic economic recovery as fast as possible.

However, the AUD/USD has been in a ranging market, and the current closure of Victoria state, the 2nd most populous Australian state, might prove to be the spark that tanks the Aussie dollar below the 0.7725 support.

The FXY currently mimics its spot exchange pair patterns, and the only hope is the holding of the current support level and no widespread infection of the populace with the new Covid19 variant.

Comments