After a disappointing week that had seen the S&P 500 close the week at -0.02%, Monday morning market opening aligned to significant weekly support, the opening price of $414.73 against the weekly support of $414.48.

According to Yahoo finance analysts, the year-long run of the S&P 500 needs to take a rest. This sentiment echoes central banks who believe that the S&P 500 is long overdue for a pause.

Like previous weeks, the S&P 500 flirted with the weekly support and was buoyed to trade around the $417-$419 range. So far this week, it has defied all sentiments to trade at +1.02% compared to last week’s closing price.

The week in week improvement takes the year-to-date returns for the S&P 500 to 12.47%. It is up from 11.33% as at the close of the market last week. The individual sectors have had mixed performance even though only three sectors closed in the red.

The health sector took a –2.65% tumble from its +1.68% high of last week. Fortunately, the consumer discretionary offset this short selling by +3.27%, gaining from last week -0.81%. The other major gainer was the industrial sector, +3.21% gain from -1.19% last week.

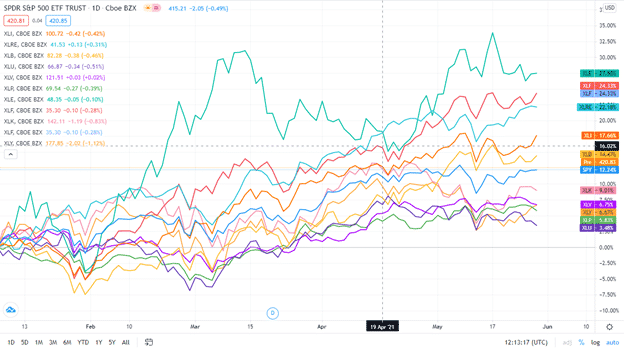

Find below the full summary of the S&P 500 underlying sectors and their performance over the week-May 24th to May 28th, and their corresponding sector ETF performances.

Here is a chart of the ten sectors’ year-to-date performance and how they have fared against the S&P 500.

S&P 500 industry sector weekly performance breakdown |

|||

| 1. | Communication Services | XLC | +2.79 with the accompanying utilities select sector ETF |

| 2. | Consumer Discretionary | XLY | +2.46% with the accompanying consumer discretionary select sector ETF |

| 3. | Industrial | XLI | +2.02% with the accompanying industrial select sector ETF |

| 4. | Real Estate | XLRE | +1.43% with the accompanying real estate select sector ETF |

| 5. | Information Technology | XLK | +1.27% with the accompanying information technology select sector ETF |

| 6. | Financial Services | XLF | 1.01% with the accompanying financial services select sector ETF |

| 7. | Materials | XLB | 0.75% with the accompanying materials select sector ETF |

| 8. | Energy | XLE | -0.09% with the accompanying energy select sector ETF |

| 9. | Consumer Staples | XLP | -0.39% with the accompanying consumer staples select sector ETF |

| 10. | Healthcare | XLV | -0.97% with the accompanying health care select sector ETF |

Comments