ETF full name: Invesco CurrencyShares Swiss Franc Trust

Segment: currency

ETF provider: Invesco

|

FXF key details |

||

| Issuer | Invesco | |

| Inception date | June26, 2006 | |

| Expense ratio | 0.4% | |

| Average Daily $ Volume | 3.03 million | |

| Investment objective | Hedge | |

| Investment geography | Currency | |

| Benchmark | USD/CHF Spot Exchange | |

| Leveraged | N/A | |

| Net Assets under Management | $262.56 million | |

About the FXF ETF

June 2006 saw the launch of the Invesco CurrencyShares Swiss Franc Trust, FXF, to investors. It gave them an avenue to hedge against currency exposure and a way to bet against the green buck. It is a non-diversified fund comprising a single currency, the Swiss franc-national currency of Switzerland.

Since its inception, this currency ETF has averaged 60-day spreads of 0.02%.

FXF fact-set analytics insight

The Invesco CurrencyShares Swiss Franc Trust objective the price of the Swiss franc after expenses. Therefore, it seeks a reflection of the Swiss franc value. To effectively realize its goal, the FXF directly holds Swiss francs in a deposit account.

Despite the deposit account allowing for closer tracking of the CHF/USD spot exchange, it does not:

- Have insurance on its deposit, effectively increasing the account’s deposit risk.

- Regardless of the holding period, distributions and share sales of the FXF attract taxation at nominal income rates.

The fund has a negative correlation to the green-buck value. So if the dollar value decreases, its value increases, and suppose the dollar value increases, its value decreases.

FXF annual performance analysis

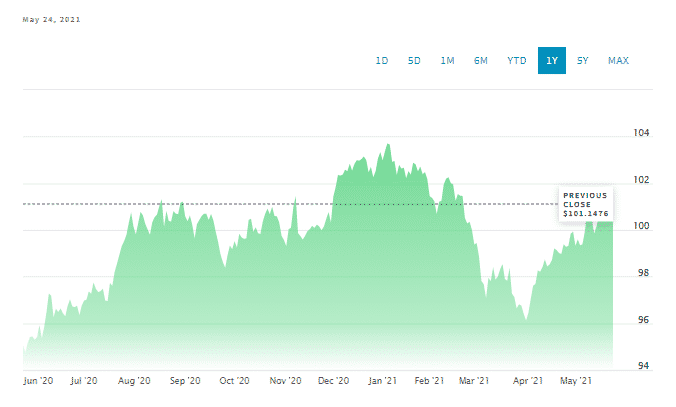

Switzerland is one of the few countries to experiment with herd immunization coupled with early border restriction. The 12-month returns of the FXM of 6.82% show that while the United States took quite the hit from the coronavirus, the Swiss economic activities didn’t slow as much.

However, the FXF has been on the back foot for the better part of the year. This decline is attributable to the resurgence of the US economy on the back of widespread vaccination and the resumption of some economic normalcy.

The FXF ETF boasts $262.56 million in assets under management.

FXF ETF RATING |

|||||

|

Resource |

|||||

|

IPO Rating |

A- |

B |

5 |

N/A |

N/A |

|

IPO ESG Rating |

N/A |

N/A |

N/A |

N/A |

N/A |

FXF key holdings

The Invesco CurrencyShares Swiss Franc Trust Fund is a single currency exchange-traded fund. As such, it has no holdings but has a deposit account of Swiss francs with the sole objective of tracking the CHF/USD spot exchange. The ETF sponsor’s only objective is to provide a cost-efficient and relatively lower risk of investing in the brutal forex market. In addition to its deposit accounts, this fund has interests in options, futures contracts, and index swaps.

Industry outlook

While still in the red year-to-date returns, a look at the chart shows a market re-correction of the Invesco CurrencyShares Swiss Franc Trust Fund. The global community is not yet over the Coronavirus pandemic making the Swiss franc quite desirable. In addition, many investors consider the Swiss franc a safe-haven outside of treasuries, gold, and the dollar. The safe-haven status might result from the Swiss nation and economy being around since the 11th century and one of the most stable economies in the globe.

According to Thomas Jordan, Chairman of the Swiss National Bank, the swiss inflation rate of slightly above zero coupled with less than 100% productive capacity utilization discourages monetary policy tightening. As a result, the franc is still highly valued as a safe-haven currency, and the short-term outlook for the FXF fund is bullish.

Comments