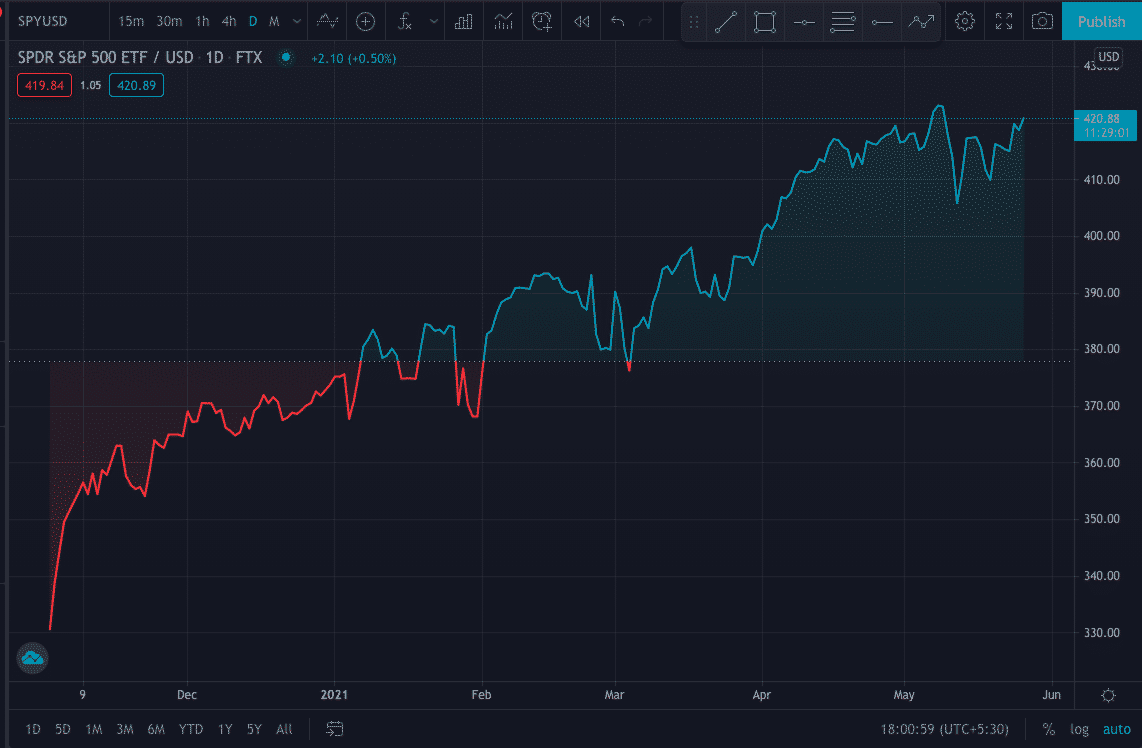

According to IHS Markit Ltd. data with the US standard, equality is trading at an all-time high by increasing the short-term interest rate of the S&P 500 too from $357 to the highest this year.

IHS Markit Ltd. data suggest a rise in the short interest rate by stating the value 4.8% of the fund’s shares are now out on loan. This data shows the value of 4.8% is more than 2% two months ago and 1.7% at the start of the year, showing the rise in the short interest rate.

Chart of SPDR S&P 500 showing at an all-time high in 2021

What happened?

The famous fund that tracks the 500 large and mid-range US stocks, the SPDR S&P 500 ETF, also known as SPY in the trading world, was seen to have a substantial short position by the market sharks.

Investing in S&P 500 ETF means you are buying all the 500 large and mid-range US stocks that S&P 500 tracks. The significant holdings of the S&P 500 involve giant firms like Microsoft, Amazon, Apple, and Facebook.

The current zone was not seen back in 2020 by the investors, where the short-term interest rates spike higher than 7% in a row in 2020, keeping the quantify well below the two-year high zone.

“The surging short interest in the S&P 500 is in part due to skepticism that the rally can continue or at least that we are due for a pullback,” said Chris Zaccarelli, chief investment officer at Independent Advisor Alliance. “We don’t think the bull market is in any danger of ending prematurely. But with a 10% or greater pullback happening on average once every two years (at least since 1980), we do believe a pullback of that magnitude is likely this year.”

Rising inflation and the probability of higher interest rates have hit the investors. The events of high market volatility leading to fear in investors.

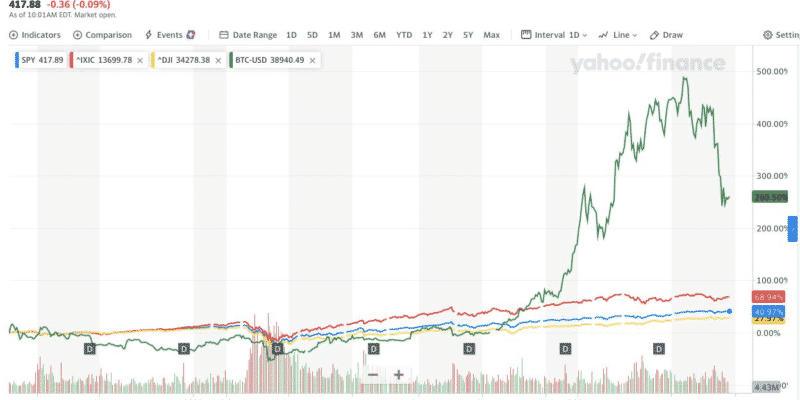

Trending markets like cryptocurrency also played out a significant role in overall market scenarios. All major cryptos were trading at an all-time high, with too many investors participating in the bull run.

Before the meeting minutes of the previous week, Nasdaq went in red with a 0.7% loss, whereas the S&P 500 saw 0.9%. Bitcoin was seen falling from $64,000 all-time high in mid-April to almost $30,000 range the previous week. China’s statement to the financial institution for not conducting crypto-related business might be one reason for this fall.

Not just BTC but almost all the crypto coins such as DOGE, ETH, CAKE saw a massive price cut with 45%, 40%, and 38% downfall. However, after the fall, the market has been seen having bullish sentiments giving some signal of bulls entering the market.

What to expect?

The actual dividend yield and real earning yield for the S&P 500 have both recently turned negative, as noticed by Chris Murphy, co-head of derivatives strategy at Susquehanna International Group, on Tuesday. However, they also noted that short interest in US stocks remains low by historical standards.

The market being in a panic state might take some time to be stable. Meanwhile, the rally in crypto has begun again. Investors and traders who missed the entry are not taking the dip in the crypto-world.

Comments