ETF full name: Invesco CurrencyShares British Pound Sterling Trust

Segment: currency

ETF provider: Invesco

|

FXB key details |

||

| Issuer | Invesco | |

| Inception date | 21st June 2006 | |

| Expense ratio | 0.4% | |

| Average Daily $ Volume | $1.61 million | |

| Investment objective | Hedge | |

| Investment geography | Currency | |

| Benchmark | GBP/USD Spot Exchange | |

| Net Assets under Management | $157.3 million | |

About the FXB ETF

21st June 2006 saw the launch of the Invesco CurrencyShares British Pound Sterling Trust Fund, FXB. Finally, investors had an investment vehicle for betting against the green-buck using the currency of one of the last remaining world monarchs, the British Pound.

The FXB is a non-diversified ETF comprising a single currency, the British Pound. Tracking one of the most widely traded and stable spot exchange currencies, it comes as no surprise that this exchange-traded fund has a 60-day average spread of 0.02%.

FXB fact-set analytics insight

The Invesco CurrencyShares British Pound Sterling Trust’s primary objectives are to try and match the performance of the British Pound, after expenses, as much as possible. Therefore, investors get exposure to the British Pound and its coupled interest rates.

This forex ETF holds a physical British Pound with JPMorgan via a deposit account to realize its objectives. The result is closer tracking of the GBP/USD spot exchange.

However, the FXB deposit account has the following limitations:

- Increased default risk of JPMorgan since the funds are not insured.

- Increased holding cost due to taxation at nominal income rates for FXB distributions and share sales, regardless of the holding period

- Unlike its benchmark spot exchange, GBP/USD, this currency ETF does not offer overnight lending rates.

FXB ETF has a negative correlation to the USD. It increases in value when the green-buck value declines and vice versa.

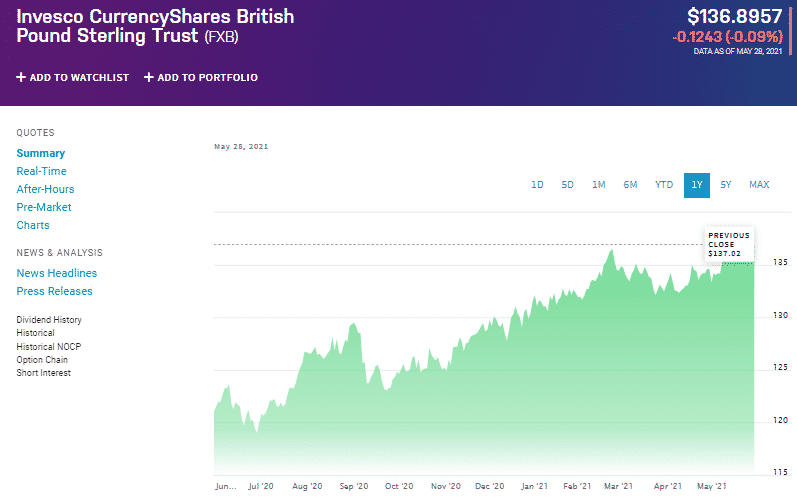

FXB annual performance analysis

With the entire global community grappling with Covid19, the British economy had an extra challenge on its doorstep, exit from the eurozone, commonly named Brexit. Despite all these, the FXB managed to be bullish for most of the year and reward investors with 14.62% returns.

The massive coronavirus vaccination drive in the United States and Britain and the resumption of economic activities show that the British economy is still in a more favorable position. As a result, the FXB is still on a bullish run, continuing last year, with investors enjoying a year-to-date return of 3.56%.

The FXB ETF has $157.3 million in assets under management.

FXB ETF RATING |

|||||

|

Resource |

ETF DATABASE | ETF.com | MarketWatch | Morningstar.com |

Money.usnews.com |

|

IPO Rating |

A- | B | 1 | N/A |

N/A |

|

IPO ESG Rating |

N/A | N/A | N/A | N/A |

N/A |

FXB key holdings

Invesco CurrencyShares British Pound Sterling Trust Fund is a single forex spot exchange ETF. Instead of constituent assets like other ETFs, it holds the British Pound in a deposit account. The deposit account undergoes rebalancing quarterly.

The JPMorgan deposit account provides for performance tracking of the GBP/USD forex pair more accurately. It provides a cost-efficient avenue, relatively low-risk, of taking part in the treacherous forex market. In addition, the fund manager utilizes the account for futures contracts trading, options trading, and index swaps.

Industry outlook

Vlieghe of Bank of England, BoE, says that the earliest interest rate change to the upside is early next year. The expectation is for the British Pound to continue its upward trajectory for as long as the US economic resurgence doesn’t overtake the UK economic activities driven by the federal stimulus packages.

However, investors and traders should know that the GBP/USD is currently flirting with a multi-year resistance level, 1.421 — 1.424 range. The spread of the Covid19 new variants and overheating of the US economy will determine whether this resistance level will maintain its integrity or be overrun.

Comments