ETF full name: ProShares Short Euro

Segment: Currencies

ETF provider: ProShares

| CGW key details | |

| Issuer | ProShares |

| Dividend | N/A |

| Inception date | June 26, 2012 |

| Expense ratio | 0.97% |

| Management company | ProShares |

| Average 3-5 EPS | N/A |

| Average Annualized Return | -3.12% |

| Investment objective | Replication |

| Investment geography | Currencies |

| Benchmark | Euro (-100%) |

| Leveraged | N/A |

| Median market capitalization | $2.16 million (assets under management) |

| ESG rating | N/A |

| Number of holdings | 1 |

| Weighting methodology | Weighted Market capitalization |

About the EUFX ETF

ProShares Short Euro ETF came to be in June 2012 and tracks the euro’s performance on an inverse basis. It has $2.16 million in assets under management.

EUFX Fact-set analytics insight

The EUFX consists of a single holding, which is the euro price, as measured in the United States dollars. The fund uses weighted market capitalization for its methodology.

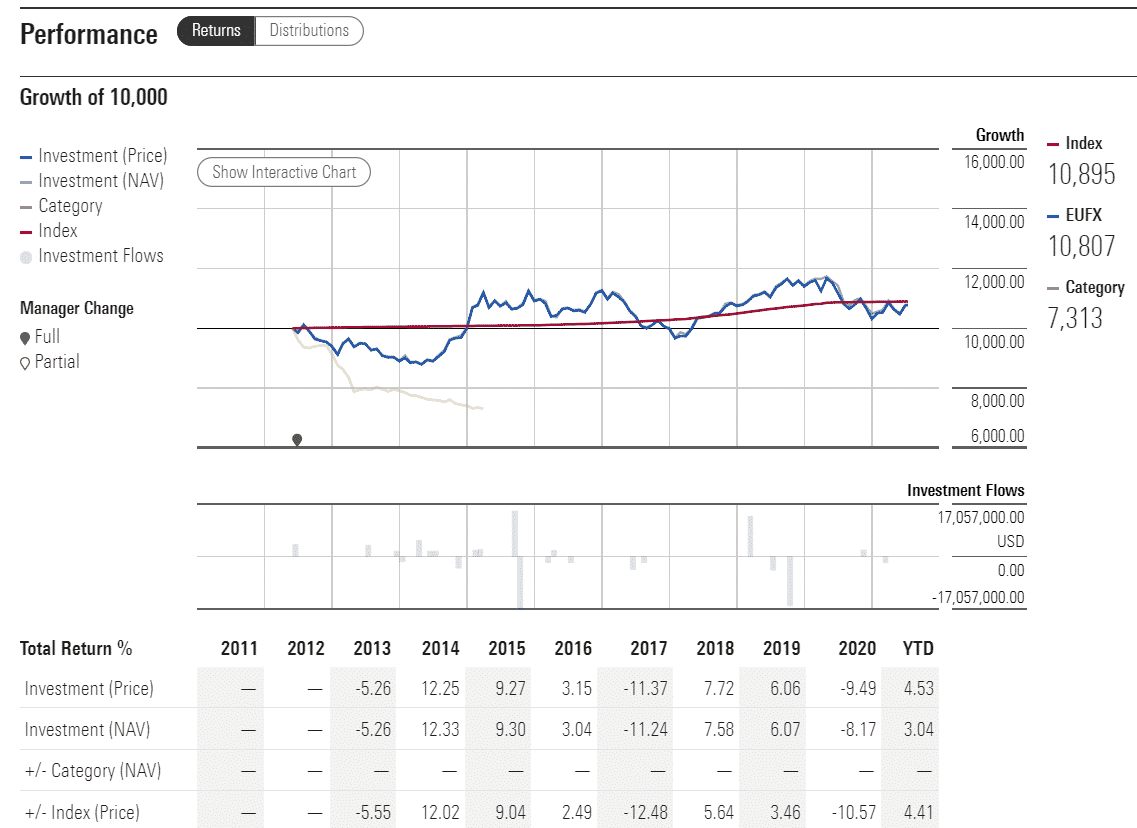

EUFX performance analysis

The EUFX exchange-traded fund offers inverse exposure to the euro in comparison to the US dollar. That means that the chart you see marks the opposite trend of the EUR/USD pair.

The worse that the euro performed in time, the better the fund has fared, and vice versa. The initial drop that the graph shows is the initial shock of the Covid-19 crisis and the lockdowns that the crisis brought. As the most commonly traded foreign currency globally, the dollar took a harder hit than the euro, explaining the drop.

EUFX ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| EUFX Rating | N/A | N/A | 2 | N/A | N/A |

| EUFX ESG Rating | N/A | N/A | 33rd percentile | N/A | N/A |

EUFX key holdings

The fund offers inverse exposure to the euro, which means that it looks to meet the needs of investors who feel confident that the US dollar will do better than the European currency. But this fund isn’t only for those who are bearish on the euro. That would be an understatement.

Due to its inverse nature, the fund rebalances its exposure to the negative 100% every day. That makes it a less-than-ideal option for investors looking to make long-term returns, even if their stance on the dollar versus the euro is bullish. Due to the inversion, compounding becomes difficult to predict, even if compared to the EUR/USD pair.

An additional caveat is that the fund references the Bloomberg 4 pm ET EUR/USD cross rate, which can be slightly different from other rates used for reference.

Industry outlook

In its essence, the idea behind EUFX is simple, to allow investors to bet against the euro, and the usual rules still do apply. If the European economic outlook looks more optimistic than that of the US, the euro will probably rise compared to the greenback. The opposite will happen if the tides turn and the US comes out on top.

But following the European Central Bank’s statements on the monetary policy and Fed’s hints on when the tapering might come will not be enough to expect the EUFX to work for you as it should.

The investors need to be aware that the inversion included in the fund means a constant need to assess and rebalance. If you decide to do it, prepare to carve out some time at least once a day to see how the fund is doing that day, and readjust if needed.

To sum it up, the EUFX ETF is a solid option for investors looking to put their money against the euro’s performance. It also needs to be said that more experienced, knowledgeable, and dedicated investors are likely to get more bang for their buck than those looking for a buy-and-hold solution and long-term steady gains.

Comments