What is an ETF?

An exchange-traded fund is a ready-made investment portfolio, which, like a stock, is traded on the stock exchange. The fund includes the necessary set of securities or other assets.

The ETF is diversified, balanced, and protected from price risks. That is, everything that was needed has already been done for you. You just buy this fund on the stock exchange, like a share, and wait for its value to rise. The share price on some ETFs begins from $15-20, so you can create a diversified portfolio with low costs.

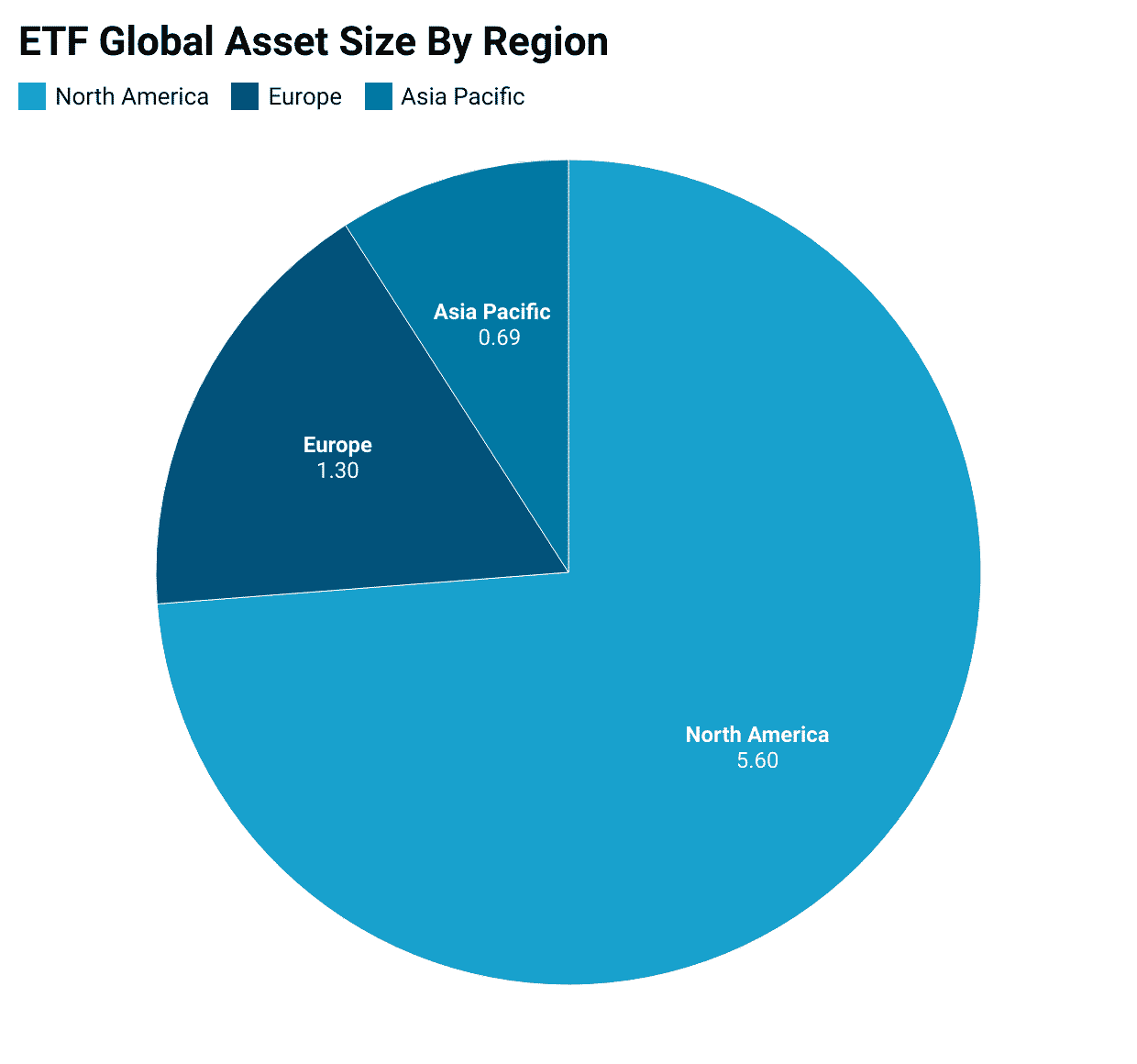

Global ETF market

As one of the fastest-growing investment funds, the global ETF market comprises an asset size of $7.59 trillion, with North America alone managing a staggering $5.6 trillion. According to Statista, this market share constitutes nearly 75% of the global asset base, as shown in the chart below.

What to look at while choosing an ETF?

- Managing company. For beginners, it is better to choose companies with world names and successful work history — for example, State Street Global Advisors, Vanguard, Invesco, and others.

- Amount of commissions or expense ratio that the investor pays to the management company annually. A lower commission means higher income for the investor. The acceptable commission rate should be below 0.5% per annum.

- Market capitalization. Preference should be given to funds with capitalization above $500 million.

- Historical performance. On how the fund was during periods of downturns in the stock markets. Of course, there is no guarantee that the historical performance will be repeated in the future. However, this will give an understanding of the behavior of the asset in comparison with others.

- Paying dividends — the yield on distribution, and what is their size.

How to buy an ETF?

To do this, you need to take a few simple steps.

Step 1. Open a brokerage account

You can open an account with a brokerage company or bank licensed as a professional participant in the securities market. We advise you to choose a large broker or a bank with a solid history of working in the stock market, then compare rates and commissions.

Step 2. Fund your brokerage account

After signing an agreement with a broker or a bank, an account will be opened for you. Using a brokerage account, you can trade securities: both using a standard trading program and “by voice,” giving appropriate instructions to the broker over the phone.

Step 3. Form the portfolio structure

It is essential to select assets in your portfolio primarily based on your individual investment goal.

Step 4. Buy assets

Based on the ETF purchase application, the broker buys the required assets for you.

ETF trading strategies for beginners

ETF is a blend of diversification benefits from mutual funds and liquidity of the stock, and economists regard it as a friendly investment option for beginners. Even though this industry is very profitable, many people fear investing their money and time because of the thought of failure. That said, you must have a plan to realize profits in the ETF trade, and here are strategies you can apply to help you out.

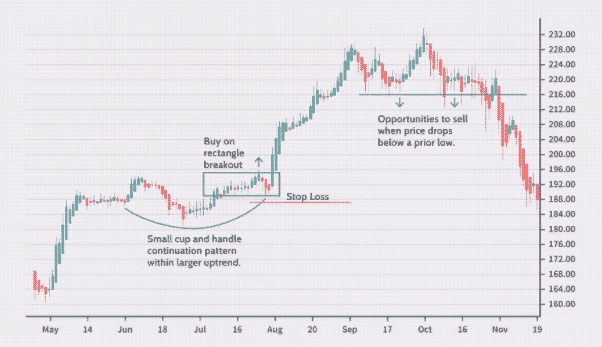

Try swing trading

Swing trading involves taking advantage of the sizable swings in stocks or any other instrument of trade. Working out the swing trade margins can take time, say a week or more, and require patience. ETFs are very diverse and permanently have sealed bids, making them perfect for swing trading.

As a beginner, diversification is critical since it cushions you against capital erosion before becoming established in the industry. You can trade ETFs in a wide range of sectors, but as a beginner, trading ETFs on one sector or asset class basis is wiser because it requires little expertise.

For instance, if you buy Nifty 100 ETF trading for $1.06 each and buy 200 units in 4 sessions, you should watch the market value. If you sell the units after the value of 1 unit appreciating by $0.13, you will make a $26.53 profit from the 100 units sold.

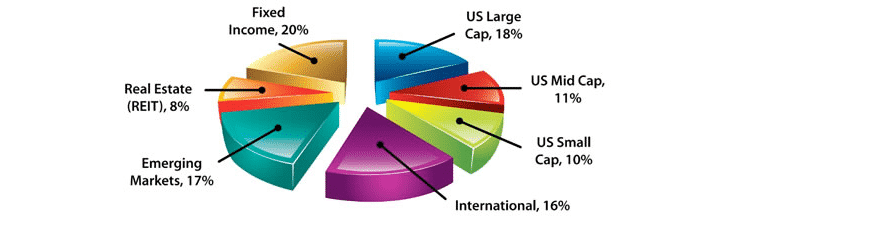

Use an asset allocation

Asset allocation is a “do not put all your eggs in one basket” strategy that helps cushion beginners from massive losses. It involves spreading your investments to different asset categories like stocks, bonds, real estate, and commodities to have a diversified trade.

Any beginner can implement this strategy since it has a shallow investment threshold. The asset allocation investment thresholds are dependent on risk factors and investment time horizons.

For instance, young investors often put money into equity ETFs because they have an increased time horizon and risk tolerance. When they get experienced, this changes and begins to develop a more robust investment strategy, comprising, for example, 55% equities and 45% bond ETFs.

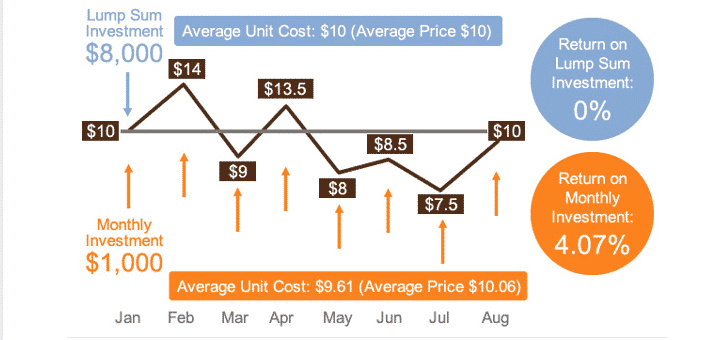

Try dollar-cost averaging strategy

This strategy involves buying a fixed dollar amount of any asset without looking at its fluctuation value. It is a perfect strategy for beginners who are employed and can make some regular savings.

Instead of a fixed deposit account, you can choose ETFs’ investing since it has higher interests than ordinary banks offer. Moreover, with dollar-cost averaging, your unit’s value increases when ETF prices fall and decrease when prices rise, cushioning you from losses.

Build an ETF core for free

One of the obstacles that traders would like to join the ETF trading industry is raising the starting capital. It is almost impossible to avoid the cost, but you can reduce your expense price by preventing the brokerage fee upon starting ETF trading.

Currently, each broker is trying to win over customers, and thanks to this healthy competition, a trader can buy ETFs without incurring any extra costs paying for commissions. Most brokers make it easier and cheaper for traders to deal on their online platforms by treating them to different offers. Access to a comprehensive line of ETFs on different investment lines, for example.

This makes it easy for beginners to an asset allocation strategy due to the favorable business terms.

Focus on your best ideas

Every beginner has an idea of the type of business to invest in but settling on the stock to trade in becomes a challenge. To avoid falling into this trap, which pulls down many beginners, you should understand what ETF trading entails and find the best idea to pursue.

For instance, many stocks pay attractive dividends in the tech field and appear very profitable. You can buy two or more positions if their pricing is within your budget. Pricing is not the only consideration you should make when investing in an ETF. Therefore, you should consider the ETFs’ demand by studying the relationship between players and profit prospects.

Choose a good style of investing

Traders often look at the best sectors to invest in without considering the best possible strategy to spur their growth in the ETF trading industry. It doesn’t sound significant, but it is vital to every beginner’s success.

There are various styles that you can use when trading. The most commonly used techniques are growth and value systems. The growth investing style is best for ETFs that have sporadic growth, like ETFs from big companies. On the other hand, value style involves buying cheaper ETFs from smaller companies. This requires patience because it might take some time to realize profits.

Conclusion

ETFs have several features which make them more accessible for beginners to understand easily. With proper strategy, trading ETFs is a very profitable venture. You must conduct adequate research on the dos and don’ts in ETF trading and formulate the best plan for how best you will implement the strategies.

For beginners, the best strategies should be easy to understand and practice. Some of the most viable ones include swing trading, asset allocation, dollar-cost averaging, and building an ETF code.

Simultaneously, focusing on your ideas and choosing an excellent investing style will undoubtedly give you an edge in your investment.

Comments