ETF full name: VanEck Vectors Gold Miners ETF

Segment: Precious metals mining equities

ETF provider: Van Eck Associates

| GDX key details | |

| Issuer | VanEck Vectors ETF Trust |

| Dividend | 0.55% |

| Inception date | May 16, 2006 |

| Expense ratio | 0.52% |

| Management company | Van Eck Associates |

| Investment objective | Track the investment results of the NYSE Arca Gold Miners Index |

| Investment geography | Worldwide |

| Benchmark | NYSE Arca Gold Miners Index |

| Leveraged | No |

| Weighted average market cap | $14.3 billion |

| MSCI ESG rating | 6.19 out of 10 |

| Number of holdings | 53 |

| Weighting methodology | Market-cap-weighted |

About the ETF

VanEck Vectors Gold Miners ETF invests in publicly-listed gold mining firms from around the world. Launched in 2006, GDX gives investors and traders exposure to gold, silver, and precious metals mining sectors. Its expense ratio is just 0.52%.

GDX tracks the NYSE ARCA Gold Miners Index. It is a market capitalization-weighted index composed of gold and silver mining companies. VanEck Vectors Gold Miners ETF is the most liquid ETF available for precious metals investors.

GDX FactSet analytics insight

The ETF gives investors exposure to some of the world’s largest gold mining companies. Since the earnings of gold miners depend heavily on gold prices, buying the ETF allows investors to benefit from the upward movement in gold prices indirectly. Only in rare circumstances do gold prices and gold mining stocks move in opposite directions.

GDX has 53 stocks in its portfolio. The top ten stocks account for 63.11% of the assets. Only companies that generate at least 50% of their revenue from gold mining are added to the index.

Country-wise, Canada has the highest weightage — 43%, followed by the US — 20.25%, Australia — 13%, Brazil — 7.14%, and South Africa — 4.30%.

Many investors prefer to buy gold ETFs over physical gold due to tax advantages and risks associated with owning bullion. Investing in gold ETFs like GDX allows investors to hedge their portfolios against inflation and economic uncertainties.

GDX annual performance analysis

Gold prices have rallied dramatically over the last year due to the economic impacts of the COVID-19 pandemic. The Federal Reserve’s decision to print trillions of dollars to provide financial support to American individuals and businesses has weakened the US dollar. It encouraged investors to rush to gold and other assets that act as a hedge against inflation.

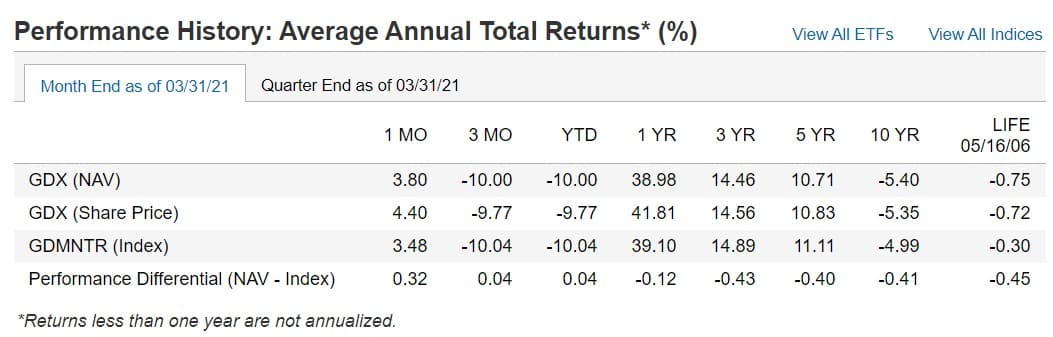

The ETF’s performance has closely followed the movement in gold prices. It has delivered an impressive 38.98% return over the last year. Over the last three years, the ETF has returned 14.46%. The five-year performance is also impressive at 10.71%. However, the robust economic recovery has negatively affected gold prices in the past few months. Subsequently, the ETF has declined 10% this year so far.

GDX is a risky ETF particularly suited for sophisticated investors who understand the yellow metal and the mining industry and are comfortable with a certain degree of risk.

| VanEck Vectors Gold Miners ETF (GDX) | ||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com |

| GDX | A+ | B 83 | 2 | 3 |

| MSCI ESG Rating | – | 6.19/10 | – | – |

GDX key holdings

VanEck Vectors Gold Miners ETF’s holdings include some of the world’s leading gold mining giants. Since it tracks a market-cap-weighted index, larger companies have a more excellent representation. Newmont Corp. — 15.29% and Barrick Gold Corp. — 11.59% are two of its most significant holdings. Franco-Nevada Corp., the third-largest constituent, represents 7.84% of the ETF. Wheaton Precious Metals — 5.60% and Newcrest Mining — 5.33% are the fourth and fifth-biggest holdings.

These are the ten most significant holdings of the VanEck Vectors Gold Miners ETF.

| Ticker | Holding name | % of assets |

| NEM | Newmont Corporation | 15.29% |

| GOLD | Barrick Gold | 11.59% |

| FNV | Franco-Nevada Corporation | 7.84% |

| WPM | Wheaton Precious Metals Corporation | 5.60% |

| NCM | Newcrest Mining Ltd. | 5.33% |

| AEM | Agnico Eagle Mines Ltd. | 4.43% |

| NST | Northern Star Resources Ltd. | 3.43% |

| KL | Kirkland Lake Gold Ltd. | 3.27% |

| KGC | Kinross Gold Corporation | 3.06% |

| AU | Anglogold Ashanti Ltd. | 3% |

Industry outlook

Equity markets are roaring, and gold has dipped this year so far. But given the Federal Reserve’s loose monetary policy and widening budget deficit, investors and economists are concerned about the US dollar’s weakening.

According to FXEmpire, the US Treasury yields are topping out, which indicates that gold could rally in the coming months.

Comments