The allure of Wall Streets has many duped investment potential across the US borders. In addition to the investment in fellow developed economies, investors can have a stake in emerging markets. The first and most popular emerging market index, the MSCI EAFE index, can be traced to 1988, initial exposure to ten countries.

It has now evolved to expose investors to 26 countries. With total assets under management of over $344.7 billion attributable to emerging-market ETFs, it is time that investors sought not only geographical exposure with these funds but also value and growth.

Emerging market ETFs for value: how do they work?

To most, emerging markets elicit the images of China, India, and countries with similar economic characteristics. In actuality, funds comprise a mix of companies domiciled in countries with quasi development and those exhibiting better human development indicators but are assumed to be still emerging.

Investors get exposure to equities operating in economies such as Brazil, Chile, South Korea, Italy, China, and Taiwan, among others. In addition, most emerging market ETFs are made up of large-cap and middle-cap organizations that can cushion against political risk, currency exchange risk, regional risk, and stock exchange risk.

The best emerging market value ETFs for 2022

Despite exhibiting higher inherent risks than wall street and developed economies ETFs, emerging market ETFs have great potential for phenomenal returns. In the post covid pandemic environment, all economies are recovering from the clutches of the coronavirus, amplifying the potential for returns.

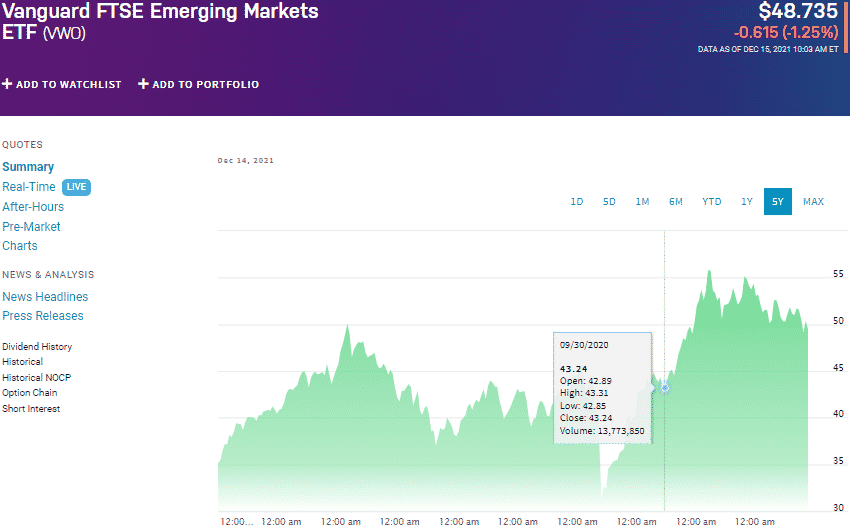

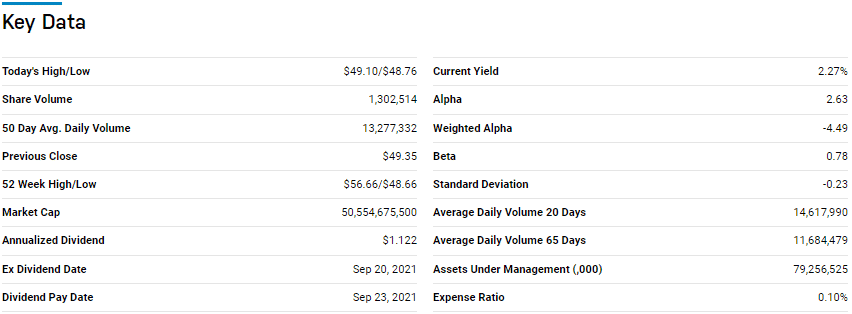

№ 1. Vanguard FTSE Emerging Markets (VWO)

Price: $48.735

Expense ratio:0.10%

Annual dividend yield: 2.17%

VWO chart

The Vanguard FTSE, Emerging Markets Index Fund, tracks the FTSE Emerging Markets All Cap China A Inclusion Index. This diversified emerging market fund utilizes representative sampling in investing in the holdings of the composite index to replicate its performance.

VWO ETF is ranked № 13 by US News analysts among 78 of the best diversified emerging markets ETFs for long-term investing.

The top three holdings of this ETF are:

- Taiwan Semiconductor Manufacturing Co., Ltd. — 4.84%

- Tencent Holdings Ltd — 4.45%

- Alibaba Group Holding Ltd. — 3.57%

VWO ETF is one of the most significant funds globally, with $79.3 billion in assets under management, with one of the lowest expense ratios for emerging markets of 0.10%. This fund’s broad country and regional exposure allow it to post positive returns year in year out even when certain under holdings are performing poorly; 5-year returns of 52.47%, 3-year returns of 36.16%, and pandemic year returns of 2.82%. The year-to-date returns of 0.04% show that this ETF is in the deep, and it’s time to consider buying into it.

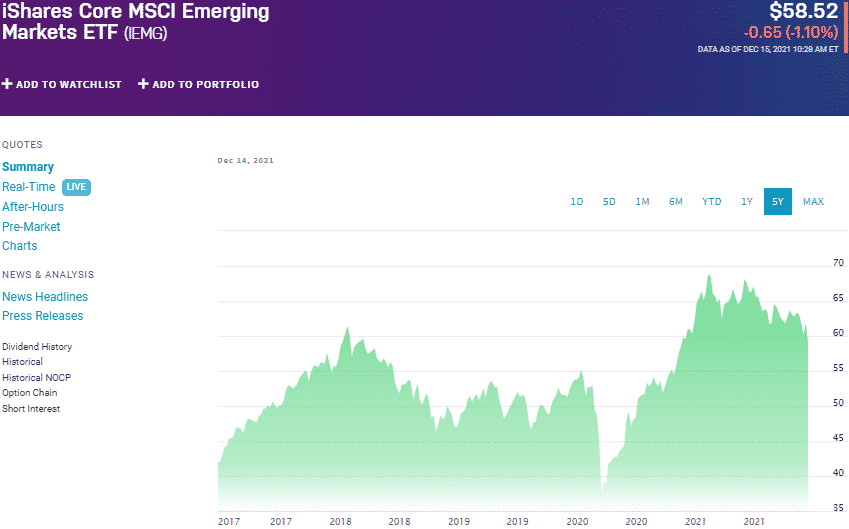

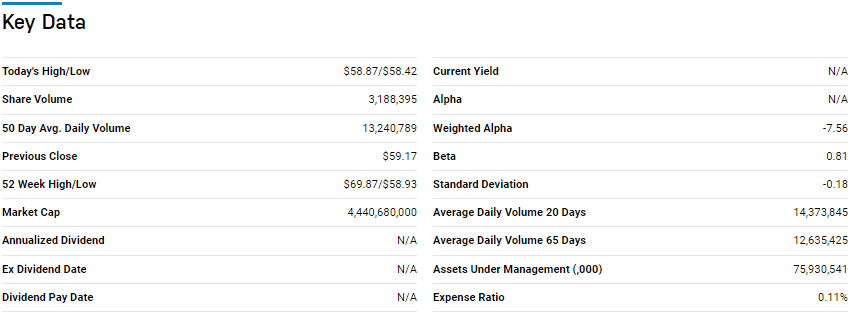

№ 2. iShares Core MSCI Emerging Markets ETF (IEMG)

Price: $58.52

Expense ratio: 0.11%

Dividend yield: 1.88%

IEMG chart

The iShares Core MSCI Emerging Markets ETF tracks the MSCI Emerging Markets Investable Market Index investing at least 80% of its total assets in the component securities of the underholding. Investors in this ETF get exposure to organizations in the Asian region, ex-Japan.

IEMG ETF is ranked № 12 by US News analysts among 78 of the best diversified emerging markets ETFs for long-term investing.

The top three holdings of this ETF are:

- Taiwan Semiconductor Manufacturing Co., Ltd. — 5.89%

- Tencent Holdings Ltd. — 3.79%

- Samsung Electronics co., Ltd. — 3.44%

IEMG ETF has $75.9 billion in assets under management, with investors’ parting with $11 annually for every $10000 invested. Like the VWO, this ETF’s past performance calls for it to be considered as the world recovers from coronavirus and Asian markets make strides towards their next economic evolution; 5-year returns of 52.47%, 3-year returns of 36.16%, and pandemic year returns of 2.82%.

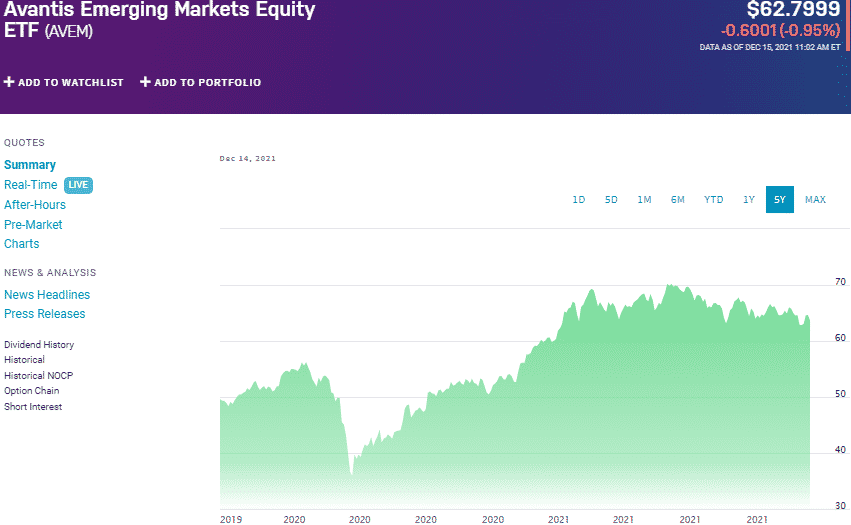

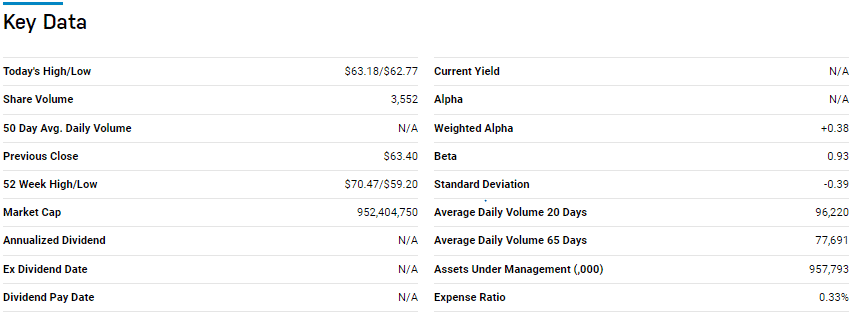

№ 3. Avantis Emerging Markets Equity ETF (AVEM)

Price: $62.7999

Expense ratio: 0.33%

Dividend yield: 1.66%

AVEM chart

Avantis Emerging Markets Equity fund is an actively managed exchange-traded fund seeking capital appreciation by investing at least 80% of its total assets to organizations with significant affiliation to emerging markets. Therefore, it exposes investors to global emerging markets multi-cap organizations providing both value and growth.

The top three holdings of this ETF are:

- Taiwan Semiconductor Manufacturing Co., Ltd. — 3.33%

- Tencent Holdings Ltd — 2.87%

- Samsung Electronics co., Ltd — 2.81%

AVEM ETF has $960.9 million in assets under management, and for a fund that debuted in late 2019, this is commendable. Investors part with $33 annually for every $10000 investment. Despite launching and then the coronavirus striking, this ETF still has positive results, placing it in an elite group. Active management gives this ETF the agility to take advantage of emerging opportunities in the emerging markets and the flexibility to avoid the related pitfalls.

Final thoughts

Emerging markets are characterized by young working demographics and a growing middle-class population hence a budding consumer market ready to produce a total capacity. Starting at a lower level of development, equities come in cheap and higher yields, setting the stage for both value and growth.

However, emerging markets tend to be volatile, calling for careful consideration. Always ensure the funds chosen have enough diversification to mitigate against volatility, with the three ETFs above giving you a head start.

Comments