The purpose of investing is to get a return on investment for wealth creation and accumulation. Thus, investing in equities results in dividend payouts, a share of an organization’s profits.

According to Kevin O’Leary, the secret to his success was owning investment vehicles that paid dividends, enabling him to launch one of the most successful mutual fund companies globally.

To put this into perspective, in the pandemic year, the top three dividends’ ETFs outperformed the S&P 500, and yet it had a record return year, 35.5%. Therefore, dividend ETFs might answer investors interested in wealth creation and accumulation, and regular income.

What are dividend growth funds?

According to Warren Buffett, you should never invest in a business you do not understand. You don’t have to understand every company with dividend ETFs, just that the organization pays dividends regularly. As such, dividend growth ETFs are exchange-traded funds comprising investment vehicles that pay dividends periodically and demonstrate dividend yield growth-sufficient payment period to qualify is five years.

Thus, the majority of the dividend growth ETFs focus on established blue-chip companies. Such companies have more than five years of dividend payment and growth history. Some invest in small-cap holdings that pay higher dividends hoping that this is sustainable in the long run.

With dividend growth investing, ETFs look in addition to the dividends, holdings that have room for growth.

The best index funds in the 2021 investor jittery market

The ETF market has provided every investor with an investment asset to fit their investment strategy and objectives. The same is true for dividend growth ETFs. Depending on the diversification and holding classification, each investor chooses the dividend growth ETFs that match their risk levels and the allowable costs.

The following three dividend growth ETFs provide portfolio diversification coupled with regular income in a hassle freeway. They also have a history of outperforming the S&P 500.

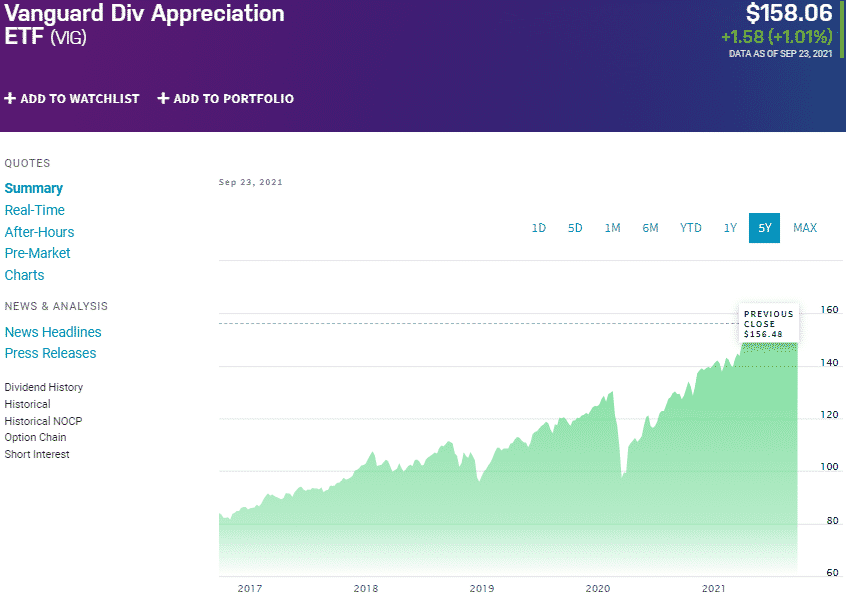

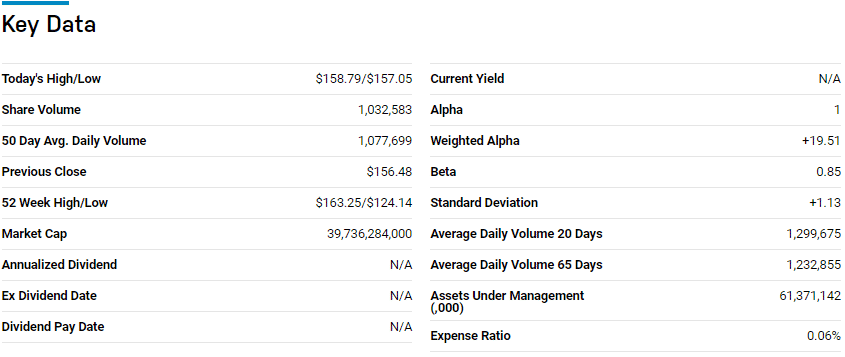

№ 1. Vanguard Div Appreciation ETF (VIG)

Price: $158.06

Expense Ratio: 0.06%

Annual dividend yield: 1.64%

Vanguard Div Appreciation ETF (VIG)

The Vanguard Dividend Appreciation ETF tracks the performance of the S&P US Dividend Growers Index, exposing investors to US companies with a history of year-on-year dividend increases. It invests at least 90% of its total assets in the tracked index underlying holdings.

In a list of 227 large blend exchange-traded funds, VIG is ranked № 64 for long-term investing.

In its arsenal of holdings, the top three organizations are:

- Microsoft Corporation — 4.45%

- JPMorgan Chase & Co — 3.72%

- Johnson and Johnson — 3.67%

Being the flagship income fund for Vanguard, the VIG boasts $61.78 billion in assets under management, at a relatively low expense ratio of 0.06%. It also pays quarterly dividends of $0.7 to the share, with investors expecting annual dividend yields at a rate of 1.64%.

Investors in this fund can expect continued dividend growth if the historical performances are anything to go by.

The 5-year returns of 105.23%, 3-year returns of 47.77%, and pandemic year returns of 25.40%. With interests in 247 of the largest top dividends paying US equities, VIG is a low-risk income investment vehicle with investors’ relatively modest dividend yield.

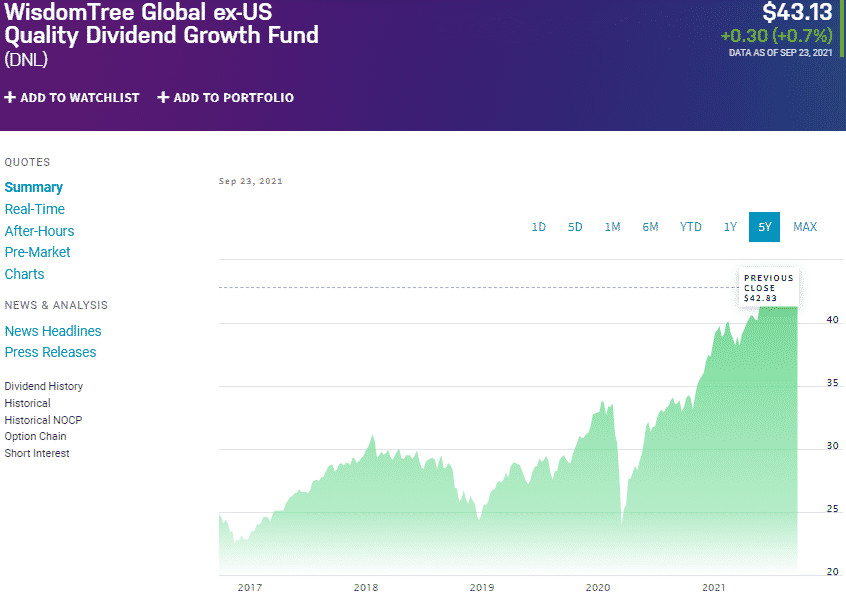

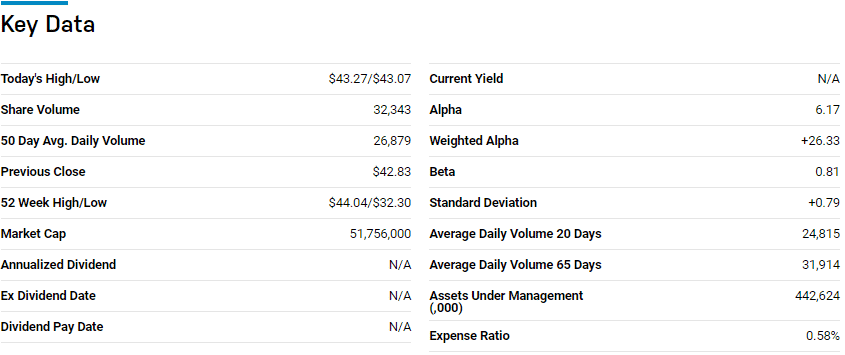

№ 2. WisdomTree Global ex-US Quality Dividend Growth Fund (DNL)

Price: $43.13

Expense ratio: 0.58%

Annual dividend yield: 2.71%

WisdomTree Global ex-US Quality Dividend Growth Fund (DNL)

Who said you have to invest in domestic equities only for income generation? The DNL tracks the performance of the WisdomTree Global ex-US Quality Dividend Growth Index exposes investors to global companies with a year-on-year dividend increase and payout history. It invests at least 95% of its total assets in the tracked index underlying holdings.

In a list of 19 foreign-cased large growth exchange-traded funds, DNL ETF is ranked №6 for long-term investing.

In its arsenal of holdings, the top three organizations are:

- ASML Holdings NV — 5.10%

- Taiwan Semiconductor Manufacturing Co. Ltd. — 4.58%

- Norvo Nordisk A/S Class B — 4.55%

The DNL has modest assets under management compared to the VIG, $446.41 million, at a 0.58% expense ratio. It also has modest quarterly dividends of $0.20 to the share but beats the VIG when it comes to the annual dividend yields, 2.71%.

If holding domestic equities or even a combination of domestic and international equities, why not add 277 holdings in this ETF and earn regular income? A look at the historical performance also reveals more than average returns.

The 5-year returns of 91.28%, 3-year returns of 57.36%, and pandemic year returns of 32.72%.

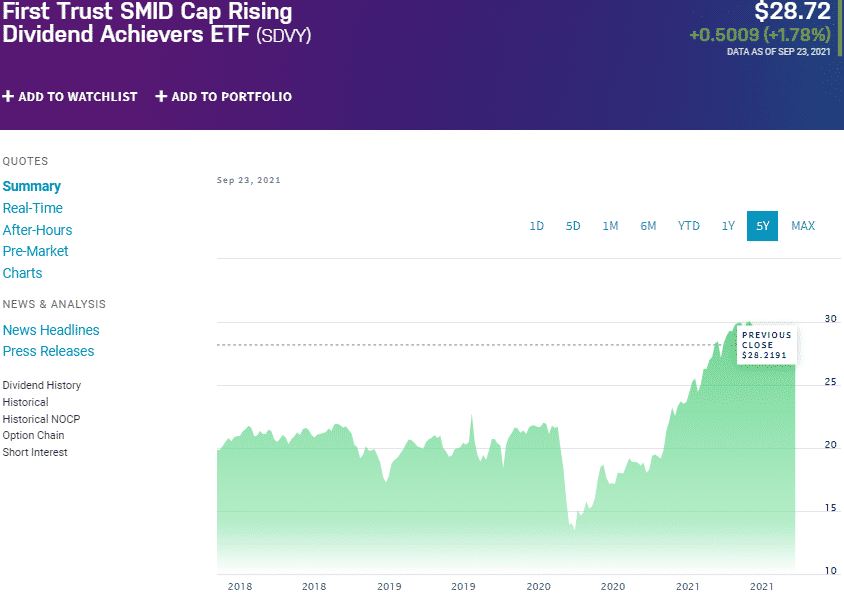

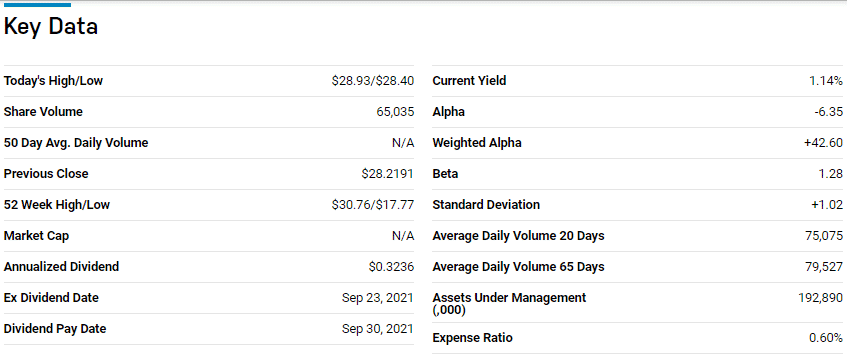

№ 3. First Trust SMID Cap Rising Dividend Achievers ETF (SDVY)

Price: $28.72

Expense ratio: 0.60%

Annual dividend yield: 1.11%

First Trust SMID Cap Rising Dividend Achievers ETF (SDVY)

SDVY tracks the performance of the Nasdaq US Small-Mid Cap Rising Dividend Achievers Index, investing at least 90% of its net assets in the tracked index underlying holdings.

The top three holdings of this ETF are:

- Global Industrial Company — 1.09%

- Williams-Sonoma Inc. — 1.04%

- Radian Group Inc. — 1.03%

The SDVY has $199.43 million in assets under management, with an expense ratio of 0.60%. It pays quarterly dividends of $0.08 to the share, coupled with an annual dividend yield of 1.11%.

Despite these modest numbers, SDVY exposes investors to 100 of the best dividend-paying small and mid-cap organizations with a proven track record of consistency. The combination of midcap and small-cap equities results in an ETF with a lot of legroom for growth, with reduced volatility, as the historical returns show; 3-year returns of 38.16% and pandemic year returns of 63.37%.

Final thoughts

Dividend growth ETFs present the best of both worlds, returns and income generation. The exchange-traded funds above present an opportunity to take income investing to the next level by providing regular income at a low cost and with the diversification to weather short-term market volatility.

Comments