The most significant reason for investing in equities is income provision through share dividends. Dividends represent the percentage of profits that organizations distribute to shareholders to have a stake in the organizations. It is no surprise that between 1930 and 2020, 41% of the investment market returns were dividend payouts.

What are dividends?

In the words of Kevin O’Leary, “The secret to investment success and financial freedom is investing in dividend-paying investment assets.” This strategy resulted in O’Leary’s mutual fund company and investment empire.

Income investing through dividend investing does not mean investors have only equities as an option, nor should they forego returns. There are exchange-traded funds available to investors that are structured to ensure enhanced dividend payouts. By investing in dividend ETFs, investors mitigate against the inherent risk inequities by spreading it and tapping into the returns pool associated with ETFs. Therefore, for wealth creation, accumulation, and consistent income in the uncertain post-pandemic economic environment of 2022.

What are dividend ETFs?

Exchange-traded fund structure pools together different investment assets with similar economic characteristics. Therefore, dividend ETFs are exchange-traded funds comprising dividend-paying investment securities, providing a consistent income stream to their investors. As such, their underholding’s are equities with a proven track record of paying dividends consistently, usually more than five years. The result is funds heavily skewed towards dividend-paying blue-chip equities.

The highest paying dividend funds for 2022

One of the fastest portfolio growth strategies is dividend reinvesting. Therefore, whether in the market for dividend ETFs for accelerated portfolio growth or to take care of recurrent expenditure, the ETF market has evolved to ensure there are funds to cater to your specific need. With 2021 in the rearview mirror, the learnings have been the market will experience significant volatilities before full economic resurgence, post-pandemic. This environment then calls for investment strategies that ensure portfolio stability and additional gains. The three ETFs below are the highest dividend-paying ETFs with the potential to provide those mentioned earlier.

№ 1. iShares Select Dividend ETF (DVY)

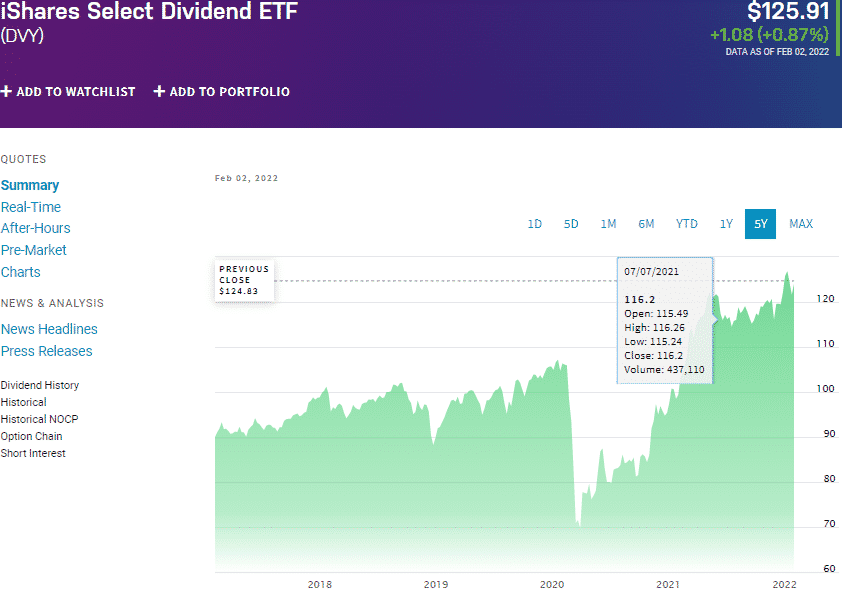

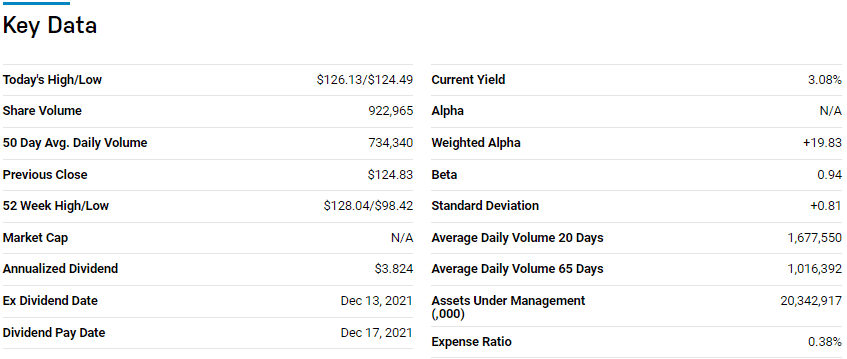

Price: $125.91

Expense ratio: 0.38%

Annual dividend yield: 3.16%

DVY chart

iShares Select Dividend ETF tracks the iShares Select Dividend ETF performance, exposing investors to the highest dividend-paying US equities. It invests at least 80% of its total assets in the tracked index underlying holdings and other investment instruments of like economic characteristics.

In a list of 118 large value exchange-traded funds, DVY ETF is ranked № 49 for long-term investing.

The top three holdings of this non-diversified ETF are:

- ONEOK, Inc. – 2.56%

- Altria Group Inc – 2.31%

- Exxon Mobil Corporation – 2.18%

DVY ETF boasts $20.04 billion in assets under management, at a relatively low expense ratio of 0.39%. It also pays yearly dividends at the rate of $3.82 to the share, with investors expecting annual dividend yields at 3.16%. With a $10000 investment, an investor at the current prices would have approximately 80 shares and enjoy $303 dividends annually. This ETF might have just 100 holdings, but their even distribution ensures a fund capable of weathering market volatility to provide income and returns; 5-year returns of 65.88%, 3-year returns of 46.39%, and 1-year returns of 31.85%.

№ 2. Global X Super Dividend ETF (SDIV)

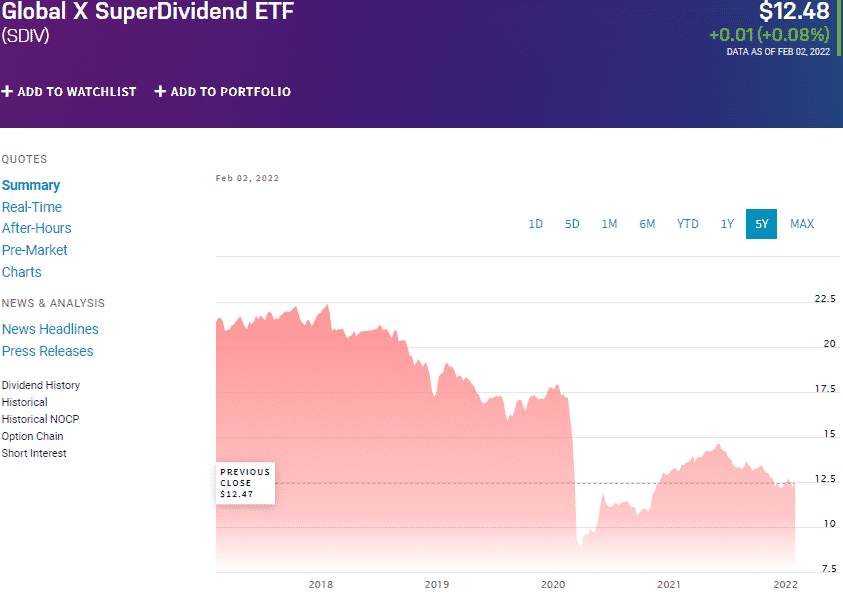

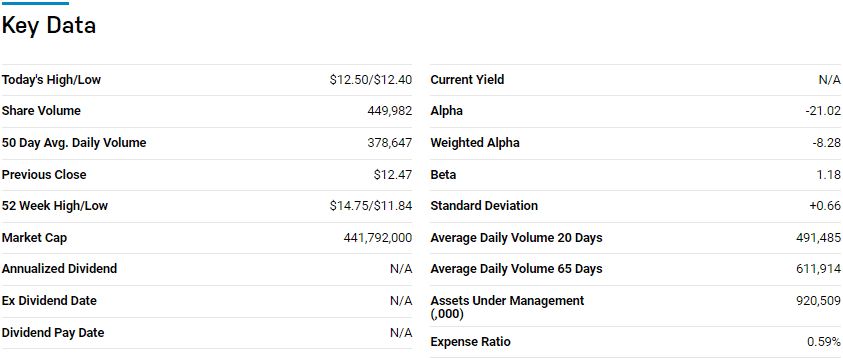

Price: $12.48

Expense ratio: 0.59%

Annual dividend yield: 7.76%

SDIV chart

The coronavirus was a global pandemic that transcended borders. Geographical portfolio diversification is one of the ways to ensure portfolio growth and value even in times of market volatility and uncertainty. The same holds when it comes to dividend investing.

The Global X Super Dividend ETF tracks the performance of the Solactive Global Super Dividend Index, investing at least 80% of its total assets in the tracked index underlying holdings, including GDRs and ADRs of the underholding’s. It exposes investors to the top 100 dividend-paying equities globally, including emerging market equities.

In a list of nine global small and mid-stock exchange-traded funds, SDIV ETF is ranked №2 for long-term investing.

The top three holdings of this global dividend fund are:

- Transmissora Alianca De Energia Eletrica SA Unit – 1.55%

- NOS SGPS SA – 1.53%

- Williams Companies, Inc.– 1.52%

The SDIV ETF has $920.8 million in assets under management, with an expense ratio of 0.59%. It pays yearly dividends at the rate of $1.02 to the share, with investors expecting annual dividend yields at 7.76%. With a $10000 investment, an investor at the current prices would have approximately 801 shares and, as a result, enjoy $817 dividends annually. Global diversification and tapping into emerging markets provide value and growth attributes to this fund.

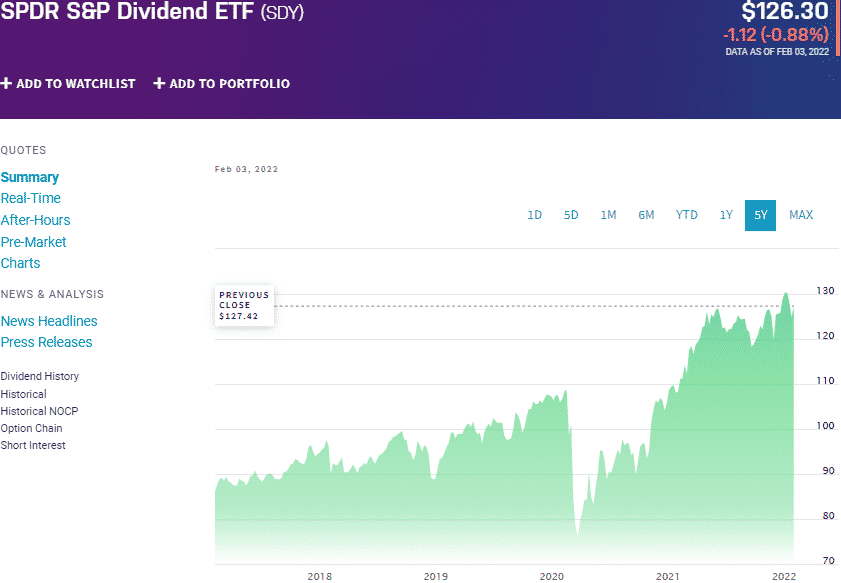

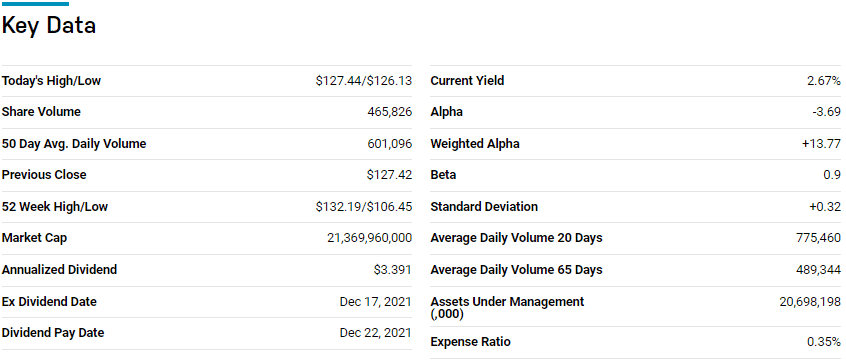

№ 3. SPDR S&P Dividend ETF (SDY)

Price: $126.30

Expense ratio: 0.35%

Annual dividend yield: 2.70%

SDY chart

SPDR S&P Dividend ETF tracks the performance of the S&P High Yield Dividend Aristocrats Index, investing at least 80% of its net assets in the tracked index underlying holdings. It exposes investors to the best dividend-paying equities in the S&P 1500 composite index, with a 20-year history of increasing dividend yields.

In a list of 118 large value exchange-traded funds, SDY ETF is ranked №24 for long-term investing.

The top three holdings of this global dividend fund are:

- Transmissora Alianca De Energia Eletrica SA Unit – 1.55%

- NOS SGPS SA – 1.53%

- Williams Companies, Inc.– 1.52%

The SDY ETF has $20.16 billion in assets under management, with an expense ratio of 0.35%. This large value ETF % pays yearly dividends at the rate of $3.41 to the share, with investors expecting annual dividend yields at a rate of 2.70%.

With a $10000 investment, an investor at the current prices would have approximately 79 shares and, as a result, enjoy $270 dividends annually. Largely made up of large-cap value equities, provide rock-solid stability to a portfolio, consistent incomes, and returns; 5-year returns of 70.41%, 3-year returns of 45.78%, and 1-year returns of 22.42%.

Final thoughts

Since the advent of the stock markets, dividends have proven to be the sure way of gauging corporate profitability. Dividend ETFs provide inflows to investors just like dividend stocks but with reduced risk compared to equities due to their diversification. Interest rates still have a ways to go before reaching pre-pandemic times.

Despite the expectations of rate hikes later in the year, inflation levels might call for a controlled rise in rates, necessitating the need for extra income. The dividend ETFs above provide investors the income to continue growing their portfolio in the current high-inflation, low-interest environment.

Comments