If the crypto space has proven any similarity to the conventional investment world, it is volatile, and some assets are experiencing sell-offs; others experience inflows. For this reason, nuanced market participants build a crypto portfolio fund comprising different assets, ensuring the market downturn of one does not lead to financial ruin and hence achieving higher risk-adjusted returns.

However, this diversification comes with its challenge, how do you gain real-time visibility across all assets for timely-informed decision making?

What are desktop crypto portfolio trackers?

They are web-based applications that either utilize blockchain technology or other API technology to integrate with crypto wallets to facilitate the real-time tracking of multiple crypto assets. Therefore, desktop crypto portfolio trackers read the data in all users’ crypto wallets. An integrated interface displays the data in a dashboard for the investor to make real-time investment decisions, including charts, historical data, real-time market data, and advanced value prediction tools.

The top 5 crypto trackers to include in your crypto fund

Using a crypto portfolio tracker makes tracking a piece of cake and helps you make better investment decisions, as most come with a P&L feature not found in most wallets. As is common in the crypto space, there are numerous desktop crypto portfolio trackers making finding the best fit quite the ordeal.

This is where we come in by analyzing for you what is available in the market and coming up with the top five desktop crypto portfolio trackers to include in your crypto fund. To arrive at the following portfolio trackers, we considered:

Safety & security

Blockchain anonymity and decentralization, coupled with the irreversible nature of crypto transactions, not to mention the difficulty in tracing transactions, call for prudence. Therefore, always go for trackers that provide an extra layer of security, two-factor authentication, or multi-layer encryption, mitigating against data leaks and hacking vulnerabilities.

Layout

The investment world, especially the crypto space, calls for real-time decision-making. The tracker chosen should provide assets visibility simplistically and understandably while facilitating hassle-free operability.

Diversification

The sole objective of a desktop crypto portfolio tracker is to facilitate the tracking of a pool of crypto assets. Therefore, go for a tracker that supports all the wallets and blockchain cryptos that you own.

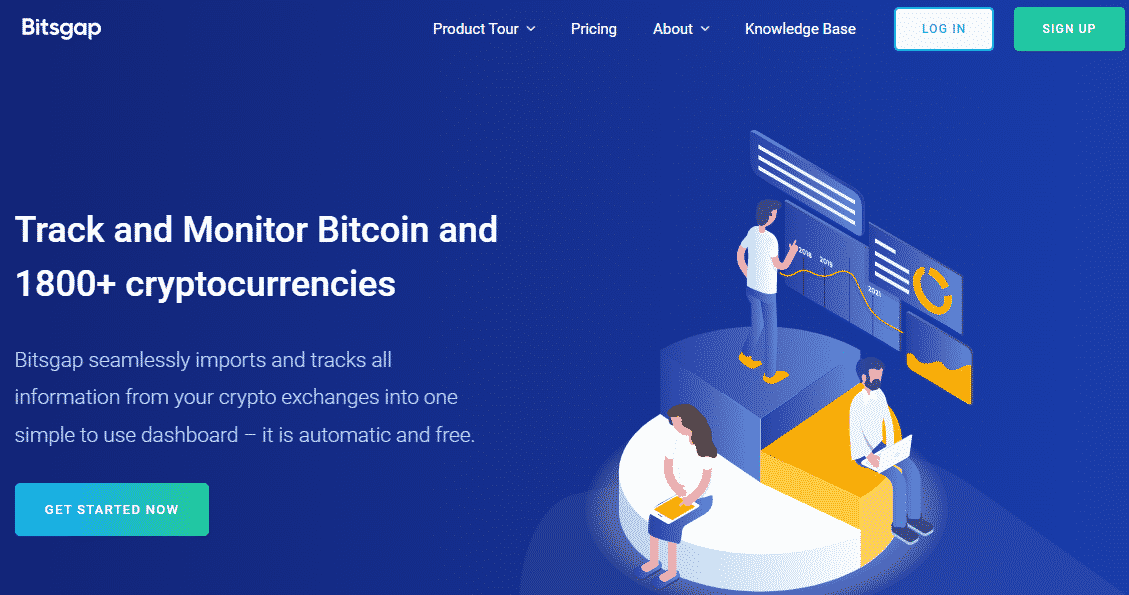

Bitsgap

Bitsgap is a unified crypto trading interface that facilitates the integration of all cryptos available and the majority of the leading crypto exchanges into an all-in-one platform; Coinbase Pro, Kraken, Binance, Poloniex, Bitfinex, etc. The available services remain the same for all of the exchanges it supports:

- Trading

Avails top-notch trading tools to all the supported exchanges, shadow orders, smart trades, and stop-limits.

- Automated bots

It has paid subscriptions, with the basic one starting at $29 monthly, which expose investors to tested trading bots for use in speculative intraday trading, enabling investors to take advantage of price fluctuations. Rather than wait for the rocket to launch, their mantra is your crypto funds rocket. It provides a demo account to test and fine-tune bot training before utilizing it in real-crypto asset trading.

- Portfolio tracking

An easy-to-operate dashboard on the backdrop of calming blue-hued background facilitates crypto portfolio tracking in real-time through their live generated portfolio. In addition to all of the above, this crypto portfolio tracker allows for custom modifications to some of its trading BOTs while enhancing security and confidentiality by utilizing only API key integration.

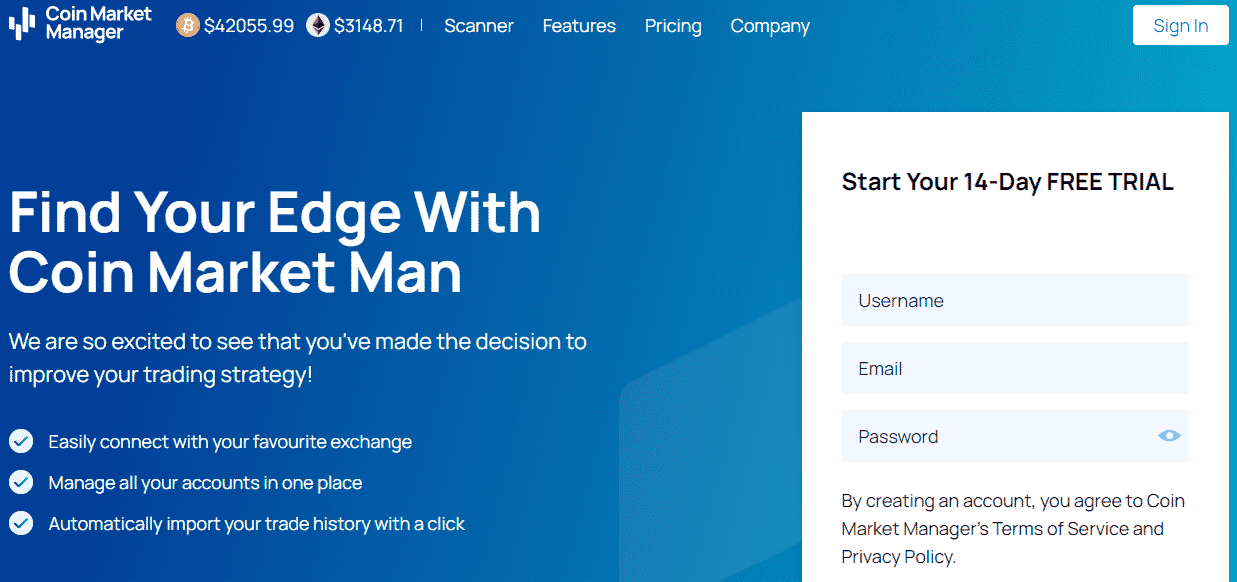

Coin Market Manager

Features endearing investors to this platform include:

- Automated journaling

This platform records trades automatically and keeps a journal that can be used to identify market patterns.

- Trading tools

Features a host of tools that come in handy in facilitating trading.

- Tracking and analytic features

It has several choice tracking and analytical tools that help make informed trades.

- Security

It features a personal verification page coupled with a custom URL. Unlike Bitsgap, which is unrestricted, choosing Coin Market Manager means a limited trial period of 14 days and then a paid subscription with the minimum plan being $49.99 monthly.

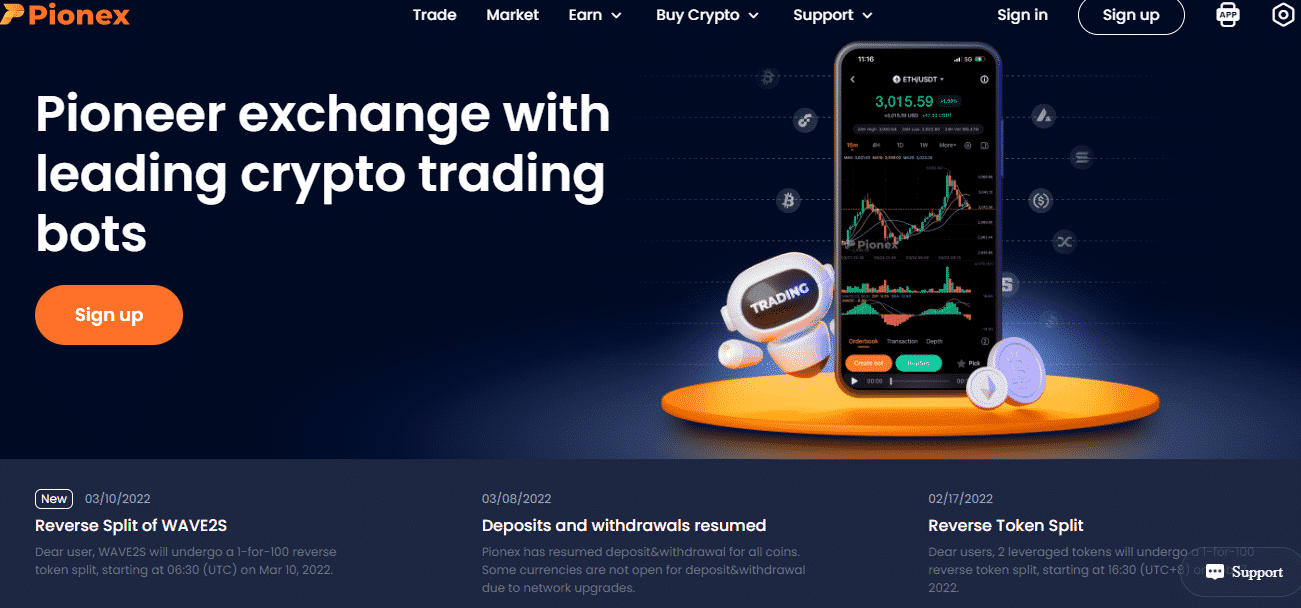

Pionex

- Trading BOTs

It has 18 free trading BOTs for use by investors.

- Leveraged trading

Utilizing leveraged grid BOT unlocks X5 trading leverage.

- Bank

It allows for direct trading from the bank account.

- Passive income

Utilization of spot-futures arbitrage BOTs can result in passive income of 15%-50% APR. What do investors have to part with for all these goodies? No initial fee is needed to be a part of this ecosystem, but traders pay a 0.05% commission, accruable to both the maker and taker.

Coinsmart

In addition, it features a hosted wallet that allows for direct crypto deposits, facilitating a one-stop-shop for deposits, withdrawals, crypto to fiat exchange, and trades and portfolio tracking.

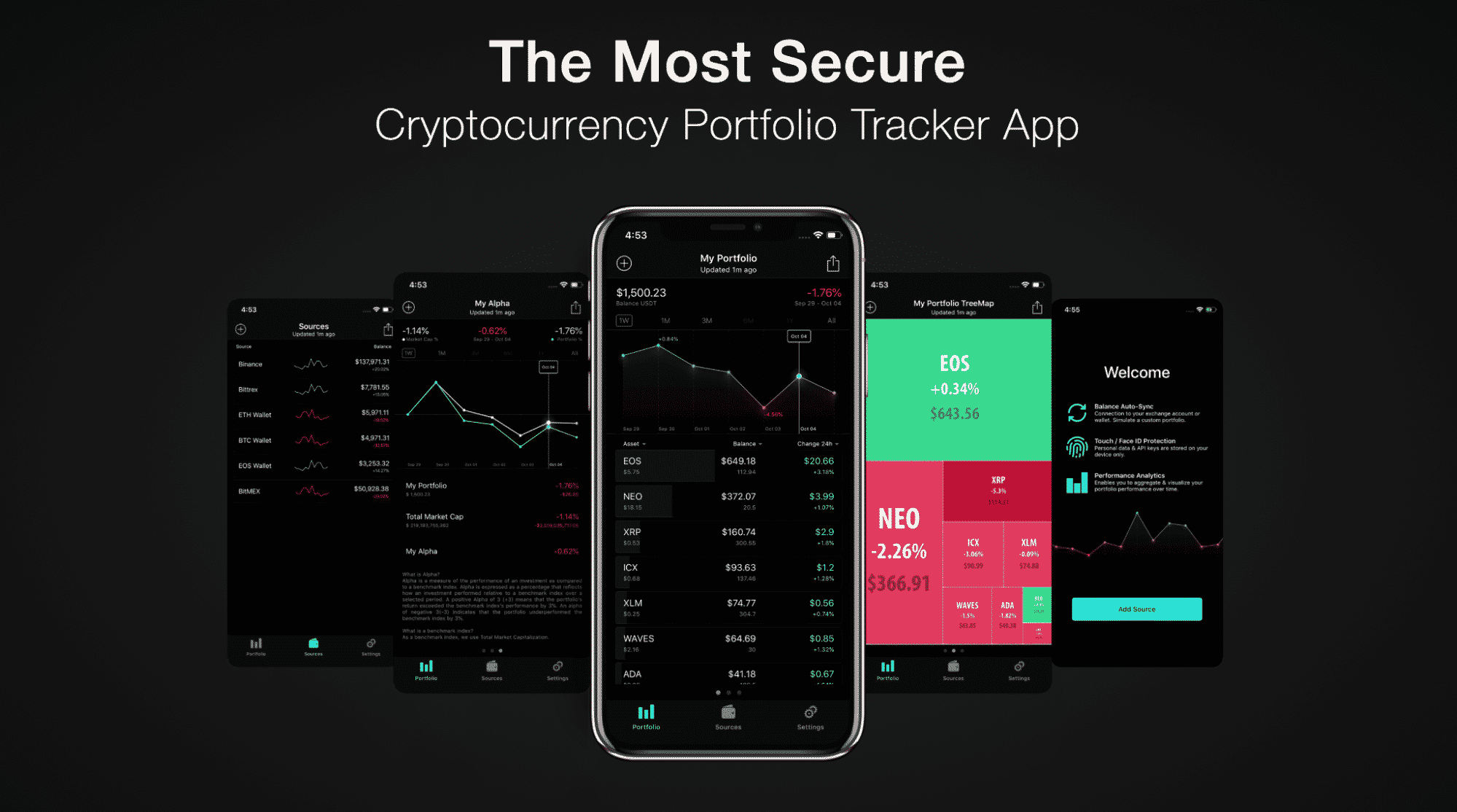

CoinStat

This premium crypto tracking desktop web application and mobile application provides participants with crypto portfolio tracking and management tools, analytics, and real-time crypto news. Similar to the others on this list, it supports multiple wallets, exchanges, and all the available crypto assets.

Portfolio tracking comes with customizable charts showing either specific assets and how they are fairing or the whole portfolio fund. It also features a heat map that shows assets in the money and those in the market downturn.

The top 5 crypto trackers comparison

Based on the above indicators, the top five portfolio trackers to include in your crypto fund are as below.

| Name | Best for | Fiat or other assets portfolio included | Pricing | Our rating

0/10 |

| Bitsgap | All in one portfolio tracking and trading automation program for all crypto assets | A wide variety of exchanges & all crypto assets supported | Free except for the paid subscription starting at $29 per month | 10/10 |

| Coin Market Manager | Active traders with advanced crypto portfolio tracking capabilities | A wide variety of exchanges & assets is supported | Free plan & the price starts at $49.99 per month | 8/10 |

| Pionex | Top-notch free automated crypto trading bot. | Crypto | Start for free. 18 free in-built trading bots | 9/10 |

| Coinsmart | Instant same-day crypto withdrawals in fiat through the bank. | Only crypto | Free | 5/10 |

| CoinStats | Premium all in one crypto tracker | Only crypto | Premium with starting subscription being at $3.49 monthly | 7/10 |

Final thoughts

It is no longer a matter of if but when cryptocurrencies will receive global recognition as part of the financial segment. As the globe grows into this reality, there is still a lot of volatility in this segment, necessitating close monitoring of crypto funds.

The crypto portfolio trackers in this list a great starting point to ensure close monitoring of these funds in real-time and via a single app, providing informed and timely decision-making for profitability.

Which is our favorite among the top five listed above? Bitsgap because it does not only support all the available crypto-assets at present, but it does so a no extra fee for sign-up and 0 commission charge for trading.

Comments