All investment products carry a certain level of risk or uncertainty due to numerous economic and other factors. However, some stocks and ETFs are more volatile and sensitive to the economic climate. The financial downturn of the Covid-19 pandemic harshly impacted the cyclical stocks, but the recovery phase has already begun.

Most cyclical stocks have regained their valuation with the vaccination drive and subsiding fears. According to Gunzberg, cyclical stocks can outperform the defensives with rising interest rates and GDP growth, showing an average of 7.4% year-to-year increase compared to the 5.2% increase of defensive stocks.

So, are you interested in learning about the cyclical ETFs that provide diversified exposure to cyclical stocks?

Go through this article to know the best cyclical ETFs that can allow you to ride the economic recovery wave.

Cyclical ETFs: how do they work?

Cyclical ETFs are a collection of stocks that directly relate and react to the present economic conditions. Such cyclical investments can provide commendable gains in economic growth and recovery periods but dispense lower than average returns during the recession phase.

Such ETFs consist of companies that supply optional and discretionary services. Some of the most prominent cyclical sectors are airlines, hotels and restaurants, auto-parts manufacturing, and luxury textile goods.

When people stop spending on non-essential items during challenging times, the sales and revenue of cyclical businesses tend to fall. In contrast, these industries outperform the defensive sector when the economy is stable or thriving.

What to check before choosing cyclical ETFs?

Cyclical ETFs allow investors to take advantage of the market-beating growth of the cyclical industries. With the termination of corona devastation, cyclical sectors have begun prospering by re-establishing their financial standing.

It is necessary to determine some factors before investing in the cyclical zone. The most crucial step is to specify the cyclical companies that have the potential for revival. Moreover, it would help to detect the opportunities timely for extracting maximum profits.

After choosing your preferred sectors and ETF, analyze the fund’s level of assets and average trading volume. Liquidity indicates the potential of the securities and provides tight bid-ask spreads.

In addition, study the fund’s holdings, percentages, and tracking error level. Invest in a fund that provides correct exposure to the underlying index with minimal tracking difference.

However, cyclical ETFs have a relatively volatile nature; hence the decision to invest in this sector should be based on personal goals and risk tolerance.

Best cyclical ETFs to buy in 2022

Cyclical ETFs are seeing a booming period with the recovering of the global economy. People are once again dining out, traveling, and engaging in leisure activities, boosting the cyclical companies’ sales. We have listed the best cyclical or consumer discretionary ETFs for buying in 2022.

1. Vanguard Consumer Discretionary ETF (VCR)

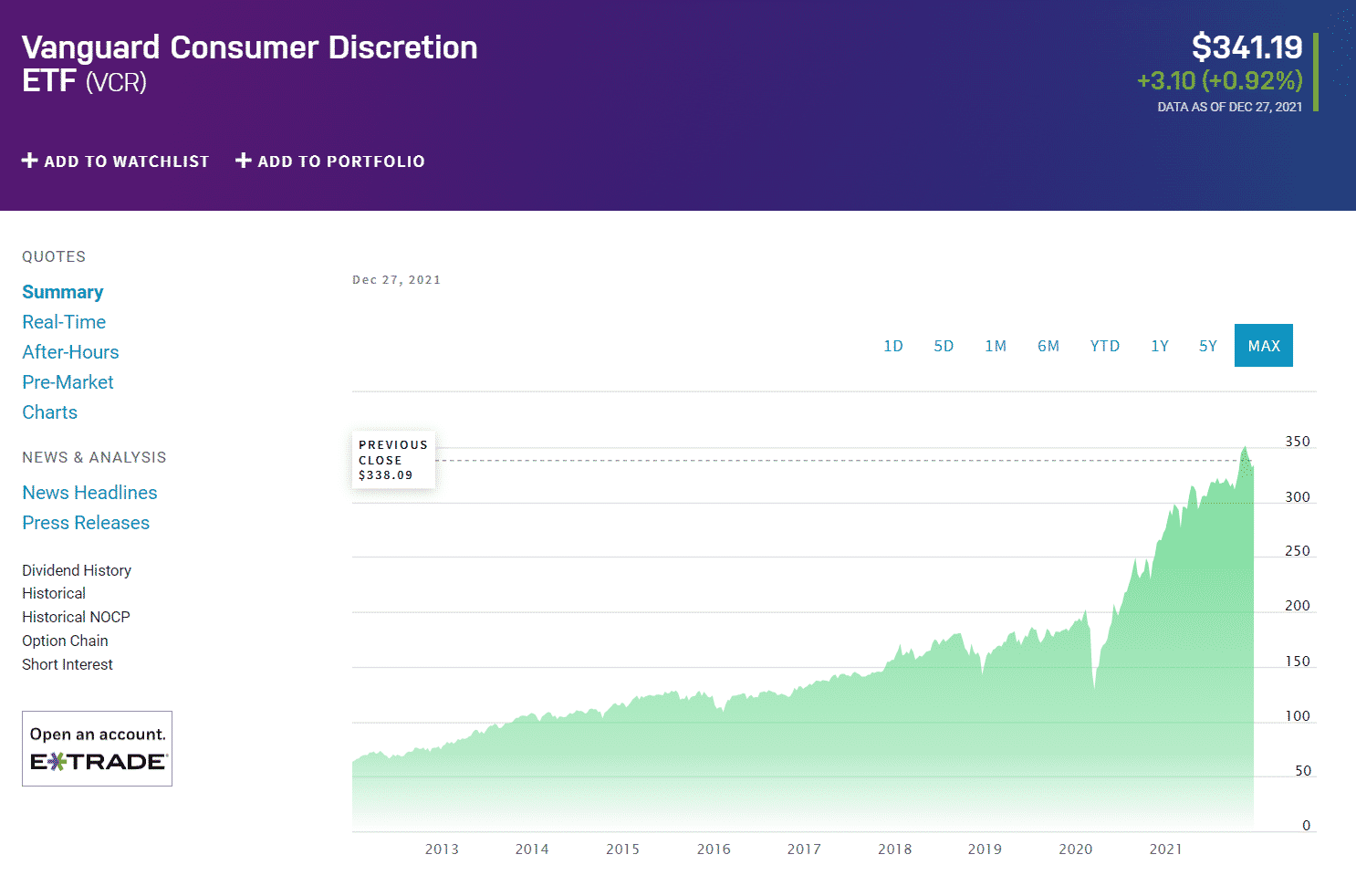

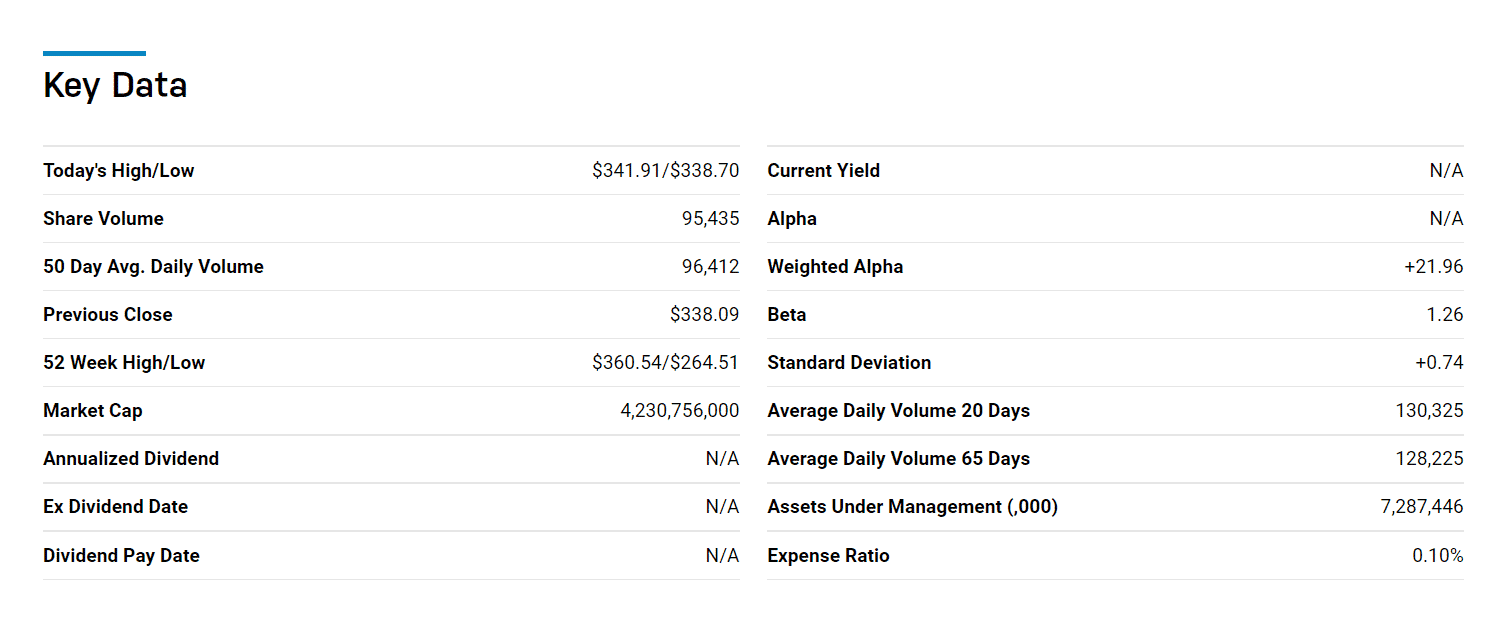

Price: $341.19

Expense ratio: 0.10%

Vanguard Consumer Discretionary ETF tracks the performance of MSCI US IMI Consumer Discretionary 25/50 Index, which consists of US small to large-cap consumer discretionary companies. Specifically, the index includes cyclical companies related to home building and improvements, hotels and resorts, automobiles, restaurants, and direct marketing sectors.

Vanguard Consumer Discretionary ETF is an extensively diversified fund with total net assets of $7.2 billion. The fund’s latest monthly report (average annual return) showed an exceptional one-year NAV growth of 31.39%. In addition, its earnings growth rate stands at 35.7%, with a price-to-earnings ratio of 28.5x.

VCR price chart

As of December 2021, VCR has 304 holdings, out of which the top three stocks are:

- Amazon.com Inc.

- Tesla Inc.

- Home Depot Inc.

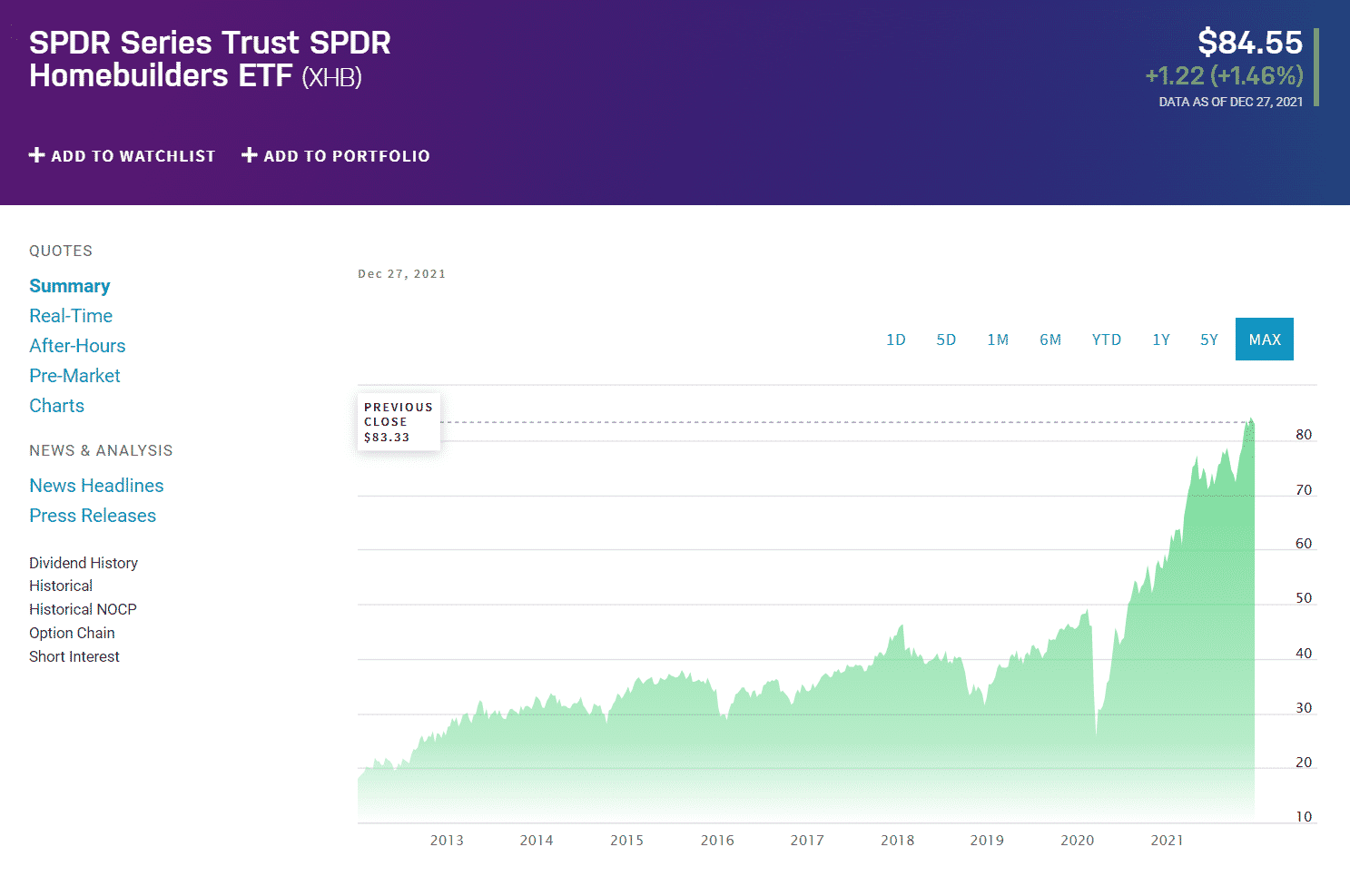

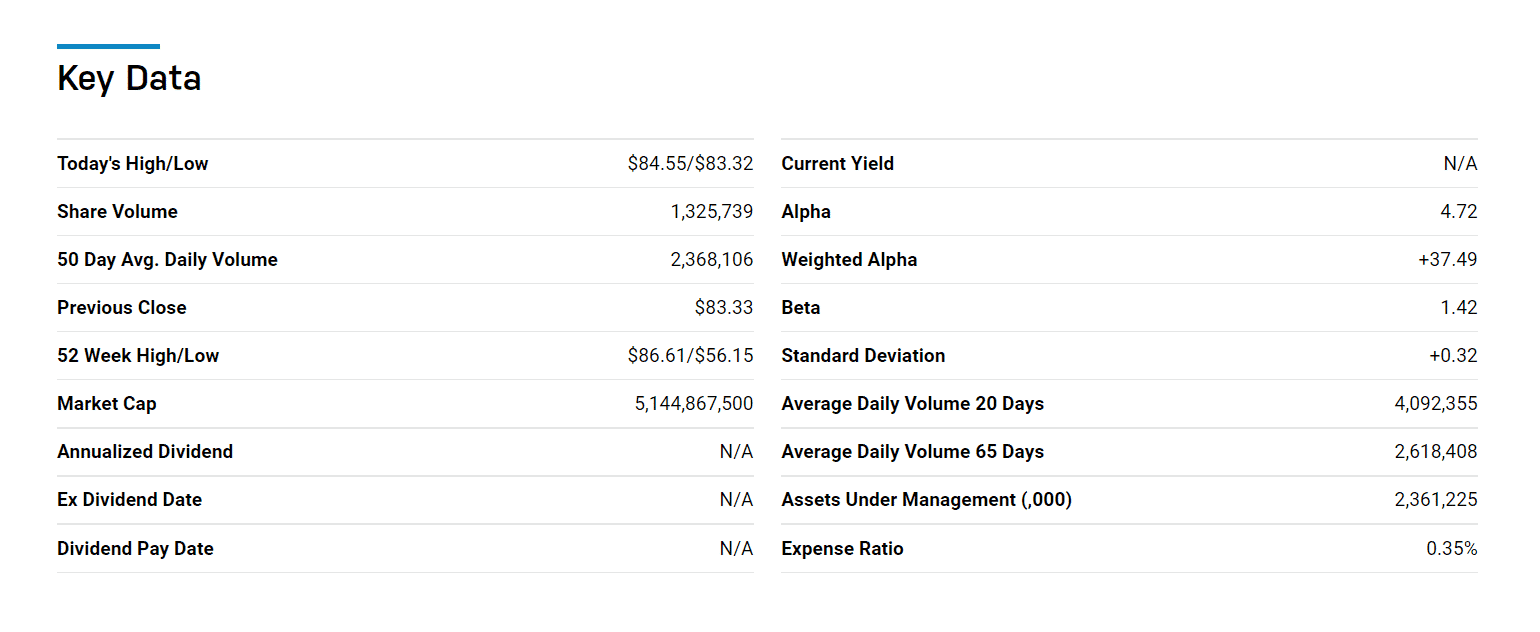

2. SPDR S&P Homebuilders ETF (XHB)

Price: $84.55

Expense ratio: 0.35%

XHB seeks the investment results of S&P® Homebuilders Select IndustryTM Index. This modified equal-weighted index comes under the homebuilder’s sector of the S&P Total Market Index and includes companies associated with the home improvement, home furnishing, and home appliances sections.

SPDR S&P Homebuilders ETF has around $2.3 billion assets under management with 27.8 million shares outstanding. According to the fund’s quarter-end report, its 1-year and 5-years NAV growth stand at 34.04% and 17.19%, respectively. Moreover, its weighted market cap is approximately $42 billion with a P/E ratio of 13.30.

XHB price chart

As of December 2021, XHB’s total number of holdings is 35, and the top three spots are occupied by:

- Builders FirstSource Inc. — 5.00%

- Lowe’s Companies Inc. — 4.31%

- Home Depot Inc. — 4.22%

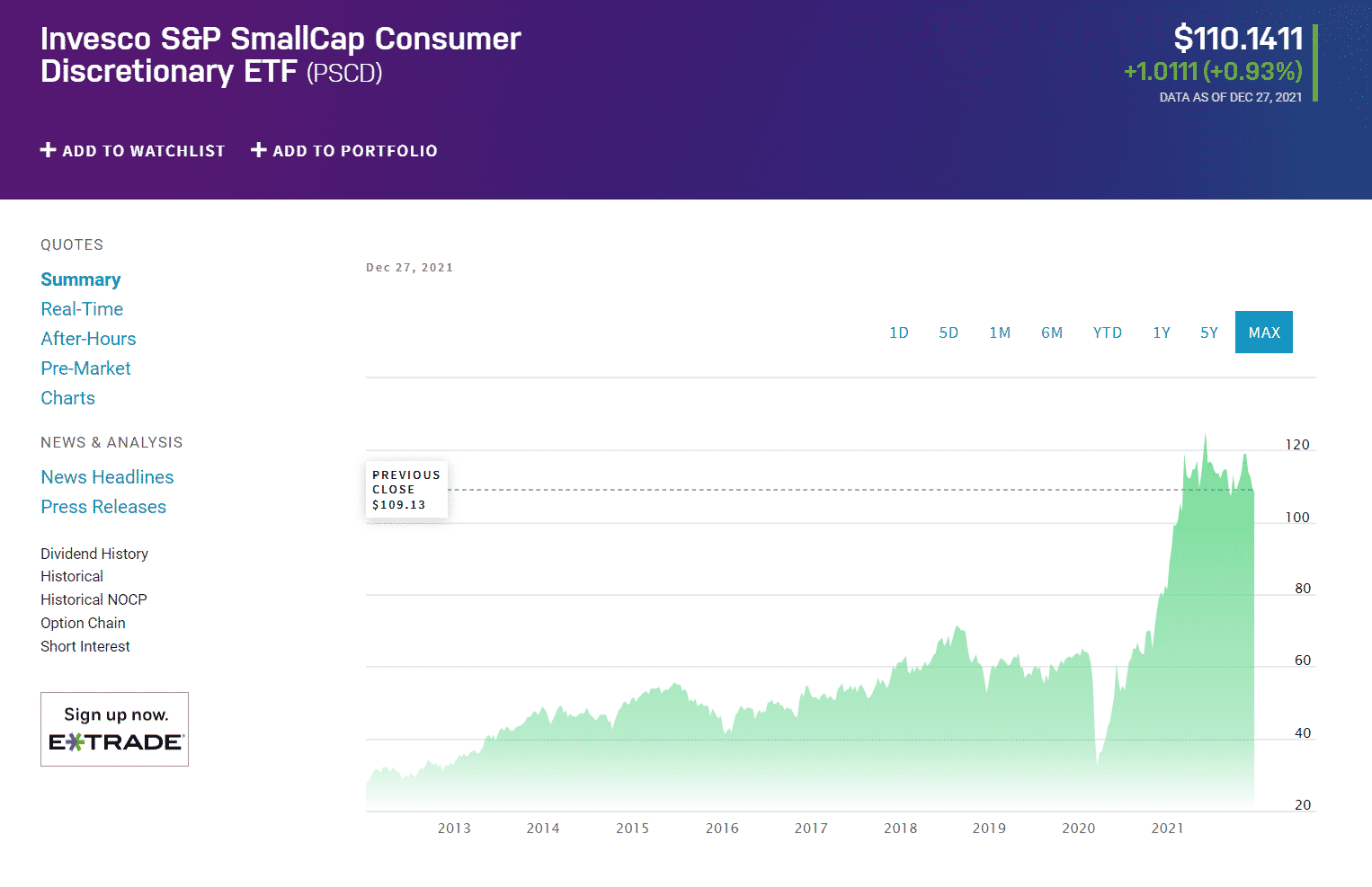

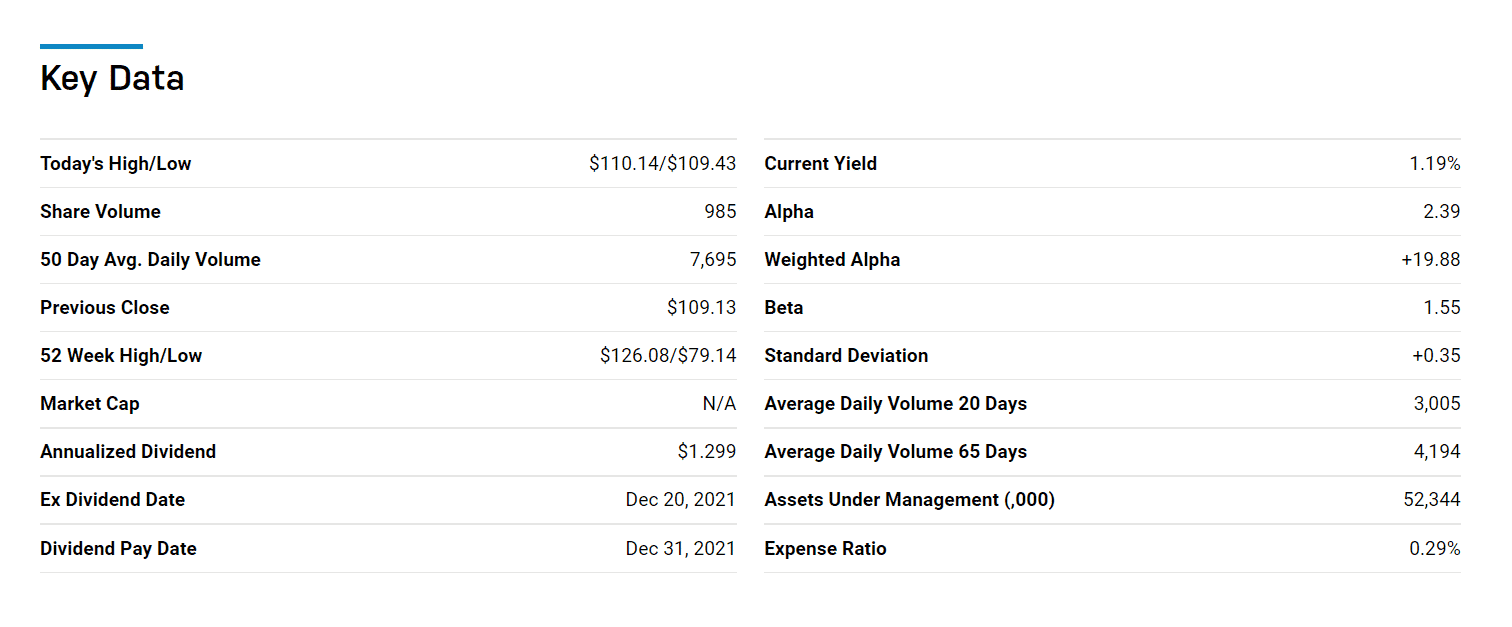

3. Invesco S&P SmallCap Consumer Discretionary ETF (PSCD)

Price: $110.14

Expense ratio: 0.29%

Invesco S&P SmallCap Consumer Discretionary ETF imitates the performance of S&P SmallCap 600® Capped Consumer Discretionary Index. This market-cap weighted index includes US automotive, leisure, real estate, and retail companies providing services or products related to the cyclical industry.

This fund has a market value of $52.8 million, with 48 million shares outstanding at the time of writing. Like all cyclical ETFs, the fund’s price faced a major dip with the corona turmoil; however, the recovery phase broke the previous all-time highs. The fund’s quarterly data has reported an exceptional one-year and YTD NAV growth of 71.72% and 32.64%, respectively.

PSCD price chart

The top three holdings of this fund are as follows:

- Macy’s Inc. — 5.92%

- Signet Jewelers Ltd. — 3.22%

- Meritage Homes Corp. — 3.19%

Pros and cons

These are some pros and cons of a cyclical ETF that you must know before starting your investment in them.

| Pros | Cons |

|

|

|

|

|

|

Final thoughts

Cyclical investments are an excellent way to gain exposure to economic growth and recovery cycles. Moreover, these investment products are the most beneficial when investors time their entries, similar to the methodology of value stocks.

In addition, professionals recommend making cyclical industry investments through exchange-traded funds to gain diversification to various consumer discretionary sectors. However, these funds’ volatile and sensitive nature calls for their holding with other defensive stocks to minimize the risk factor.

Comments