ETF full name: WisdomTree Chinese Yuan Strategy Fund

Segment: currencies

ETF provider: WisdomTree

| CYB key details | |

| Issuer | WisdomTree |

| Dividend | $0.11 |

| Inception date | May 14, 2008 |

| Expense ratio | 0.45% |

| Management company | WisdomTree |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 10.37% |

| Investment objective | Non-fundamental investment policy |

| Investment geography | currencies |

| Benchmark | Active-no index |

| Leveraged | N/A |

| Median market capitalization | $52.58 million (assets under management) |

| ESG rating | MSCI 6.1/10 |

| Number of holdings | 1 |

| Weighting methodology | Weighted Market capitalization |

About the CYB ETF

The WisdomTree Chinese Yuan Strategy Fund was initiated in May 2008 and looked to provide exposure to the Chinese yuan concerning the United States dollar. Its market capitalization stands at $52.58 million in assets under management, with an average yearly return of 10.37%.

CYB Fact-set analytics insight

The CYB consists of only one holding, with that one unit being China renminbi, as traded in the Special Administrative Region of Hong Kong and as traded in mainland China.

The CYB ETF uses weighted market capitalization for its methodology.

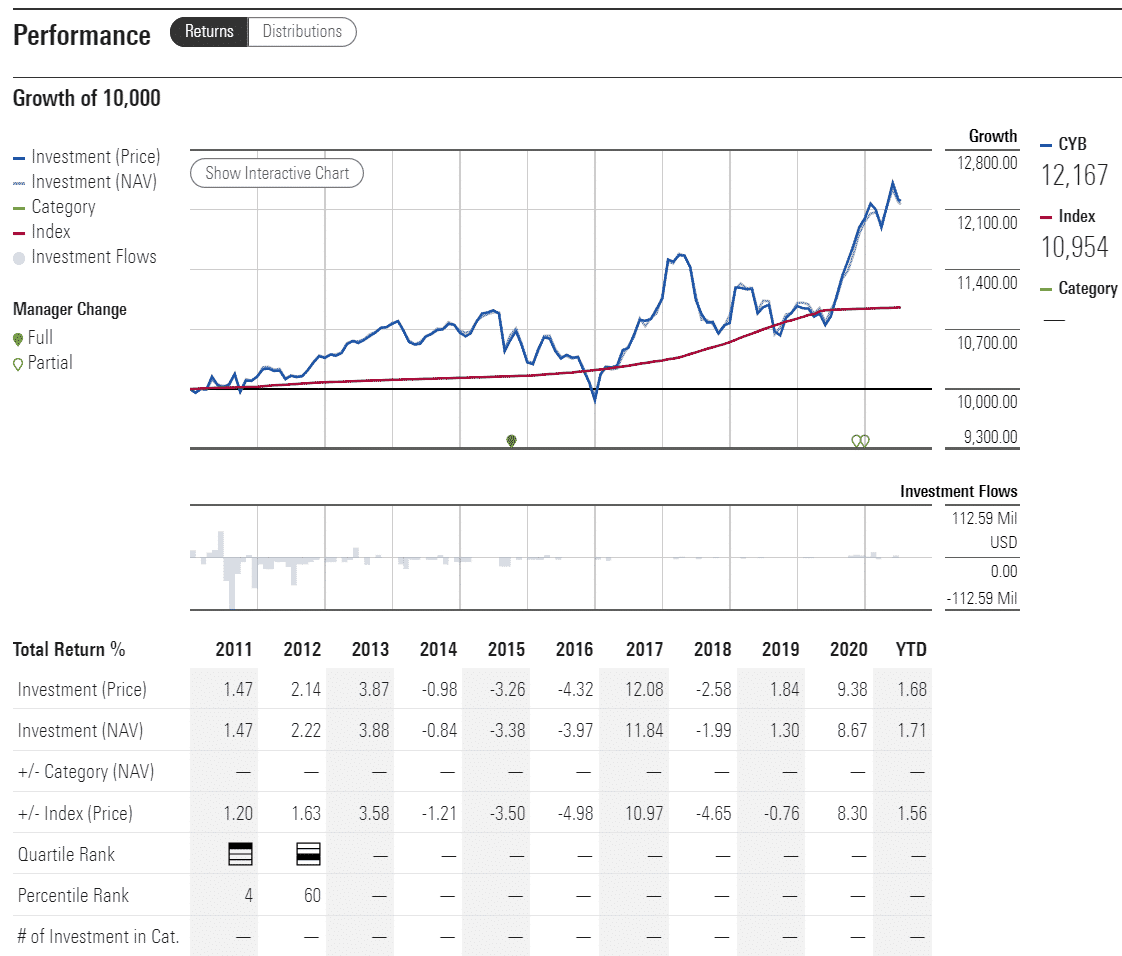

CYB performance analysis

The CYB ETF looks to express a view on Chinese currency appreciation tactically. What that means is that the fund does better every time that the Chinese currency outperforms the greenback.

That usually occurs if China, in general, gains the upper hand in a business endeavor or outpaces the US in some of the key economic factors, such as trade balance, inflation rate, GDP growth, and employment rate.

As can be seen in the graph, the fund has been doing reasonably well since recovering from the initial shock after the Covid-19 pandemic came to be.

The CYB ETF pays dividends quarterly. The last disclosed dividend came in at $0.11 on the share at an expense ratio of 0.45%.

On the MSCI ESG scale, CEW ETF has a 6.1/10 A rating. The fund was declared to be of higher-than-average resilience in environmental, governmental, and social changes.

CYB ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| CYB Rating | A | A | N/A | N/A | N/A |

| CYB ESG Rating | 6.1/10 | A | N/A | N/A | N/A |

CYB key holdings

The only holding on the ETF is the China renminbi. This means that the fund is of a non-diversified kind. However, the fund itself can be a diversification method for your portfolio, especially if the assets you primarily invest in correlate with the performance of the US economy in general.

That would be the case with any asset that correlates to many economic sectors taken together, like investment banks or dollar-heavy funds, for example.

Industry outlook

One of the main appeals of the CYB fund is the low volatility followed by a reasonable interest rate in China. That’s why the yuan is one of the most attractive currencies nowadays, especially from an interest rate/volatility perspective.

The outlook will primarily depend on the performance of the yuan in comparison to the dollar. To better anticipate the fund’s movements, it would be advantageous to follow the statements of the US officials regarding China and Beijing-backed companies.

You can also get valuable insight by keeping an eye on the daily press conferences by China’s Foreign Ministry and periodical statements issued by China’s Central Bank (PBoC) and the Ministry of Commerce (MOFCOM).

While the yuan doesn’t usually work as a safe-haven asset, like the Swiss franc or the Japanese yen, it can be a valuable hedge against the US dollar volatility.

As a bonus note, be sure to monitor the latest developments on the Didi Chuxing front, as it might prove to be a litmus test of how Washington intends to counter the growing popularity of Chinese stocks among domestic investors.

Comments