According to Brock Jeffrey Pierce, the effect of blockchain technology on the globe will be more radical than the effect of the internet. Why make such a statement, given the internet’s impact on every facet of our lives?

Simply because blockchain technology is a solution to a problem as old as the universe, how to efficiently exchange assets in a cost-friendly and safe way.

What are blockchain ETFs?

By definition, blockchain technology refers to complex blocks of decentralized digital information: a digital ledger that records all transactions in real-time. These transactions are secure and unalterable, and stored in a decentralized network for all participants to access.

Blockchain might be the technology powering cryptocurrencies, but the two are not synonyms. This technology allows for the more secure transmission of data making it applicable in various industries. The blockchain industry composition includes some of the leading global blue-chip companies: IBM, General Electric, Visa Inc., Oracle, JPMorgan and Chase, Baidu, to name a few.

Blockchain ETFs, therefore, comprise organizations that either employ blockchain technology in their operations or those benefiting.

What are the benefits of blockchain ETFs?

- Access to the fast-paced world of this technology

- Ease in trading and available on almost all the broker platforms

- Access to an emerging market but one driven by already established blue-chip organizations

- A cost-effective yet low-risk investment method in an emerging market

How to be part of the blockchain ETF market?

An investor can be part of the blockchain technology market in two ways:

- Investing in the blockchain ETF

- Speculating on blockchain ETF prices through trading CFDs, contract for differences

In both cases, one needs the services of a broker. Brokers are either the traditional call brokerage firms or online brokerage firms.

Getting into the blockchain ETF market is a simple three-step process

| Step 1 | Step 2 | Step 3 |

| Find a broker providing blockchain ETFs as part of the investment instruments | Screen the blockchain ETF to ensure portfolio risk and return requirements align | Buy the ETF of choice |

Top 3 blockchain ETFs worth buying in Q3 2021

The blockchain industry is made up of both established blue-chip companies and more recent entrants. To be a part of this emerging market strategically poised to take the world by storm, if its cryptocurrency subset is anything to go by, the following three ETFs are worth considering given their returns and assets under management.

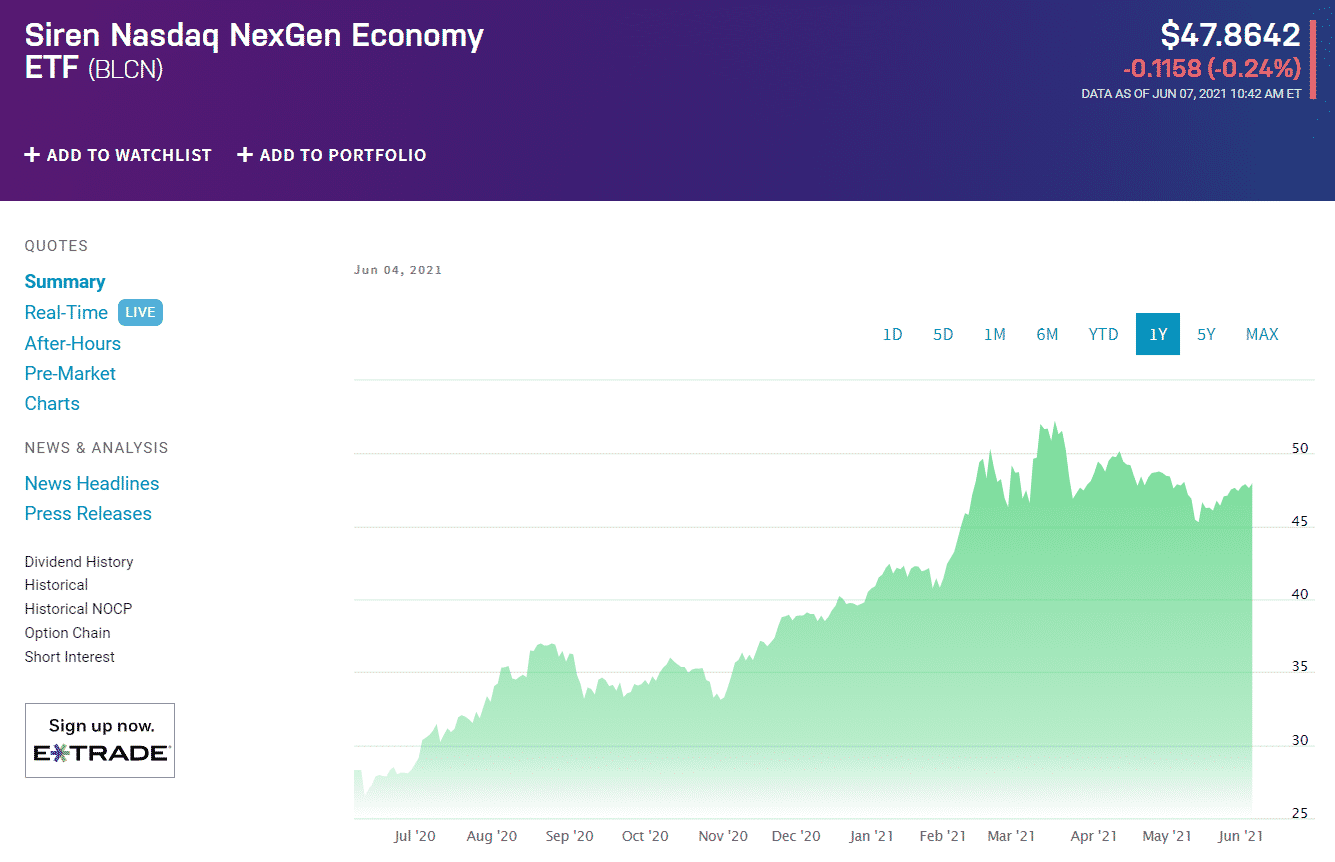

№ 1. Siren Shares Nasdaq NexGen Economy ETF (BLCN)

Price: $47.86

Expense ratio: 0.68%

This blockchain exchange-traded fund seeks to track the performance of the Siren NASDAQ Blockchain Economy Index. The index it tracks comprises organizations that research, develop, innovate, utilize and support blockchain technology use primarily or as a support service.

BLCN ETF, therefore, invests +80% in the underlying companies making up the Siren NASDAQ Blockchain Economy Index. It is a non-diversified ETF. It provides its investor exposure, currently, to 70 companies dealing with blockchain technology.

To cushion its investors against the challenges of emerging markets, the 70 companies making up this fund are a mix of established blue-chip companies and smaller organizations in the industry.

Holdings

Its top three holdings are: Overstock.com Inc. with a weighting of 2.09%, International Business Machines Corporations with a weighting of 1.86%, and SAP SE Sponsored ADR with1.80%.

Despite having some tech big boys on board, the top 10 holdings only account for 17.6% of the total fund weighting. In its arsenal, it boasts $317.92 million in assets under management. The current dividend payout is at $0.04, quarterly.

It is no surprise that this ETF managed 1-year returns of 75%, increasing from the average 3-year returns of 27.11%.

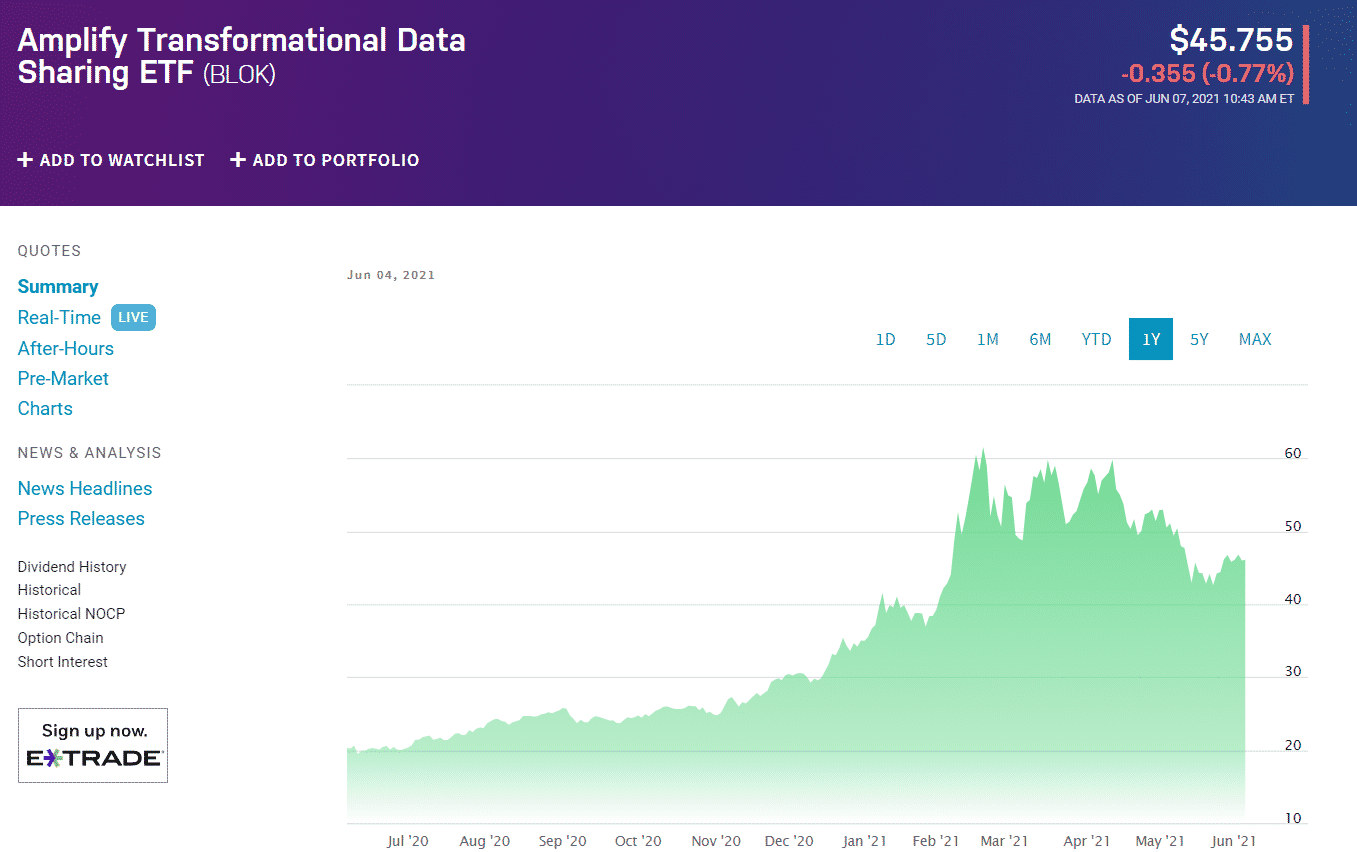

№ 2. Amplify Transformational Data Sharing ETF (BLOK)

Price: $45.75

Expense ratio: 0.71%

BLOK is a non-diversified exchange-traded fund made up of companies that develop and utilize transformational data sharing technology. Given the rarity of such organizations, it is an actively managed fund seeking total returns. Thus, it invests not less than 80% of its funds in its underlying holdings, both in the US and abroad, including depository receipts.

Screening of the underlying holdings is in two categories:

- 70% are companies that develop or profit by deploying data sharing technology

- 30% are companies in a partnership or have staked investment with the first category organizations

Holdings

Despite not having recognizable blue-chip companies forming most of its top 10 holdings, it is the most prominent blockchain ETF in terms of assets under management, $1.01 billion.

The top 3 holdings are: PayPal Holdings ltd with a weighting of 4.96%, MicroStrategy Incorporated Class A with a weighting of 4.7%, and Square, Inc. Class A with a weighting of 4.6%.

In addition, it led the other blockchain ETFs last year in earnings, 140.24%. Its 3-year earnings stand at 34.24%, with an annualized dividend yield of 1.3%.

№ 3. First Trust Indxx Innovative Transaction and Process ETF (LEGR)

Price: $42.95

Expense ratio: 0.65%

The LEGR, First Trust Indxx Innovative Transaction, and Process ETF tracks the Indxx Blockchain Index and seeks to replicate its performance before expenses and fees. The fund screens its underlying holdings and categorizes them.

Active explorers-companies are researching blockchain technology for utilization, and active enablers-companies are developing blockchain technology for their use or sale. Being an emerging market, this fund is rebalanced and reconstituted semi-annually.

Holdings

The top three holdings are: Equity Other, a weighting of 2.2%, Nvidia Corporation with a weighting of 1.63%, and A.P. Moller-Maersk A/S Class B with 1.6%.

Compared to the other blockchain ETFs it had relatively lower 1-year earnings, 48.42%. However, it is among the pioneer blockchain ETF and exposes investors to the global blockchain market. Its average 3-year earnings stand at 14.63%. It boasts $109 million in assets under management.

Comments