The popularity of private equity derives from minimal regulation and tax considerations that facilitate an agile and lean financing option. Riding on such factors, the private equity market size is currently estimated at upwards of $280 billion and is expected to grow at a CAGR of 16% by 2026.

This growth might double, driven by the funding requirements in a post-pandemic world. The problem has enough financial muscle to be part of this market directly. However, private equity exchange-traded funds expose investors to this market, and here we explore the best three to buy in 2022.

What is the composition of private equity ETFs?

To understand the composition of private equity ETFs, we need first to define private equity firms. Private equity firms cater to the capital of high-net-worth entities in exchange for equity and management and financial knowledge to run them to profitability. Therefore, private equity ETFs comprise publicly-listed private equity firms, financial management institutions, business development firms, and firms whose core business is lending equity to privately held organizations. Since the early 2000s, activities by private equity firms started gaining traction, and by the time the 2008 recession hit, it provided the launch pad that this corner of the investment market needed to realize global recognition.

Top private equity ETFs for 2022

If 2021 is anything to go by, the investment market in 2022 will experience unprecedented market movements on the tailwind of monetary policies and other factors put in place to spur fast economic resurgence. Investors need diversification and stability to weather these market storms, and with the three private equity firms below, it is possible to achieve both.

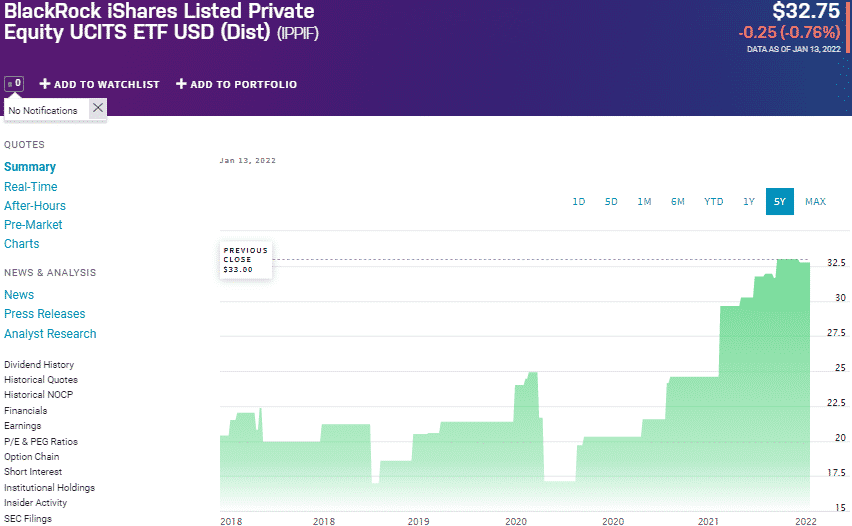

iShares Listed Private Equity UCITS ETF (IPRV)

Price: $28.54

Expense ratio: 0.75%

Dividend yield: N/A

IPRV chart

The iShares Listed Private Equity UCITs ETF tracks the S&P Listed Private Equity Index, investing at least 80% of its assets in the holdings of its composite index, in combination with other investment assets that have economic characteristics those of the tracked-index holdings. The remaining 20% is invested in Master Limited Partnerships, MLPs, achieved via contracts for differences, CFDs. IPRV gets exposure to global private equity companies in North America, Eurozone, and Asia.

The top three holdings of this fund are:

- KKR and Co INC – 7.72%

- Brookfield Asset Management INC – 7.68%

- Blackstone INC. – 7.05%

IPRV is the largest private equity ETF boasting $1.2 billion in assets under management, with an expense ratio of 0.75%. In the last half a decade, this ETF has outperformed not only its benchmark index but both its category and segment averages; 5-year returns of 18.22%, 3-year returns of 29.32%, and 1-year returns of 41.86%. The geographical diversification of this fund globally ensures exposure to the different financial-economic blocks hence a hedge against market volatility.

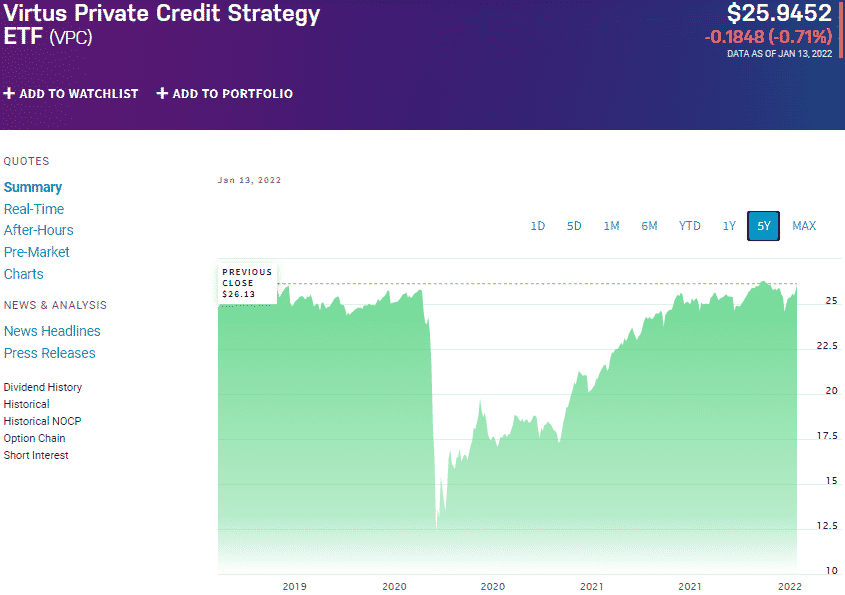

Virtus Private Credit Strategy ETF (VPC)

Price: $25.94

Expense ratio: 5.53%

Dividend yield: 6.51%

VPC chart

The Virtus Private Credit Strategy ETF tracks the Indxx Private Credit Index, investing at least 80% of its assets in the holdings of its composite index. This non-diversified fund exposes investors to the US-listed closed-end investment organizations operating as business development companies according to the investment company act of 1940 and close-end financial firms not under the BDC umbrella.

The top three holdings of this fund are:

- Oxford Lane Capital Corp. – 3.87%

- Nuveen Credit Strategies Income Fund – 3.40%

- FS KKR Capital Corp. – 3.02%

VPC ETF is a new entrant to the private equity ETF market, having launched in early 2019 hence has only managed to accumulate $29.8 million in assets under management, with investors having to also part with $553 for every $10000 investment annually. Despite launching and operating its formative years in a very volatile market, the VPC joins an elite group of ETFs that have posted positive returns since their launch, 1-year returns of 33.06%. In addition to returns, the screening method that shuns large premiums and discounts on credit facilities is a strategy to ensure consistent incomes via a dividend yield of 6.51%. With all the financing and loans expected to bail out firms to ensure full capacity in 2022, and rising interest rates, the VPC is worth monitoring.

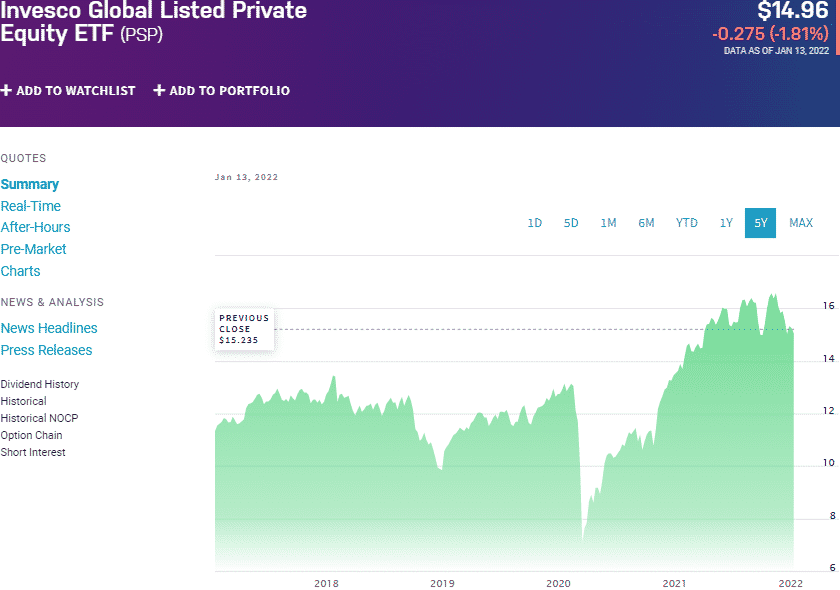

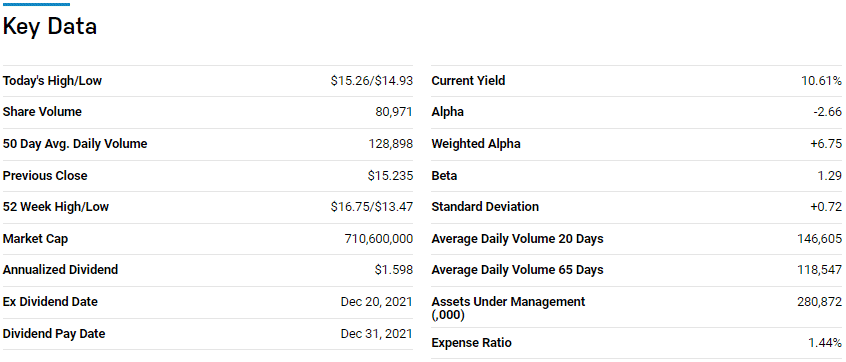

Invesco Global Listed Private Equity ETF (PSP)

Price: $14.96

Expense ratio: 1.44%

Dividend yield: 7.56%

PSP chart

The Invesco Global Listed Private Equity ETF tracks the Red Rocks Global Listed Private Equity Index, investing at least 90% of its total assets in the underlying holdings of the composite index, including their ADRs and GDRs. The PSP exposes investors to global companies listed in nationally recognized exchanges that offer private firms, private equity organizations, business development firms, and master limited partnerships.

The PSP ETF is ranked №3 by US News analysts among 9 of the best world small/mid stock funds for long-term investing.

The top three holdings of this non-diversified ETF are:

- Prosus N.V. Class N – 5.32%

- Melrose Industries PLC – 4.94%

- Carlyle Group Inc – 4.41%

PSP ETF has $276.4 million in assets under management, with an expense ratio of 1.44%. Concentration on private firms that show significant upside potential has ensured a consistent flow of returns to this fund’s investors; 5-year returns of 96.72%, 3-year returns of 80.09%, and 1-year returns of 23.58%. In addition to being a low-risk investment asset, the PSP has shown to be a consistent income generator, dividend yield of 7.56%, hence worth a look in 2022.

Final thoughts

Over time, the investment world has shown that some of the best opportunities are found outside the public markets, especially in uncertain economic times. Private equity ETFs give investors exposure to these other markets and take advantage of the numerous opportunities therein to not only make a profit but diversify their portfolios. As the private market continues to experience growth in 2022, the ETFs above are a great starting point for exposure.

Comments