If zero greenhouse emissions are achievable, the energy sector’s battery technology niche has to grow. At present, the most efficient battery technology available is lithium-ion, powering everything from electric vehicles to smartwatches.

The estimated global market size of the battery market in 2021 was $105.6 billion, with an expected CAGR growth of 10.3%. Driven by the electric vehicle market, an expected CAGR growth of 28.1% to 2028, this energy industry niche provides investors with many investment opportunities.

However, there are those of the school of thought that the existing battery technologies are inefficient, with ongoing research on several alternative battery technologies. Therefore, rather than invest in individual battery technologies that might prove obsolete in a few years, or even months, why not bet on the entire industry’s growth with these three-battery exchange-traded funds.

Battery ETFs for gains in 2022: how do they work?

Way before the global appetite for clean energy accelerated the need for electric vehicles and other technologies utilizing high-capacity batteries for renewable energy, the battery market was on the lookout for high-capacity batteries at minimal cost, without the susceptibility to volatility due to raw material prices. This need necessitated exchange-traded funds in the battery market for investors wishing to mitigate against these volatilities. Battery ETFs comprise organizations developing battery technology, producers of battery raw materials, organizations dependent on battery technology to operate, and all ancillary service equities to this industry.

The best battery ETFs for portfolio gains in 2022

High-capacity and performance batteries are at the forefront of renewable energies and the fight for green energy technologies. Most smart devices are only in use today due to advancements in battery technologies, not to mention electric vehicles. Global leading economies are driving green energy and technology, making demand for batteries at present insatiable.

The reduced supply of raw materials due to the escalated Ukraine-Russia conflict, with Russia as a primary supplier of the base metals for battery technologies, and investing in this industry can only lead to gains. The three battery ETFs below are in pole position to benefit from the imbalance between rising battery demand and constrained supply.

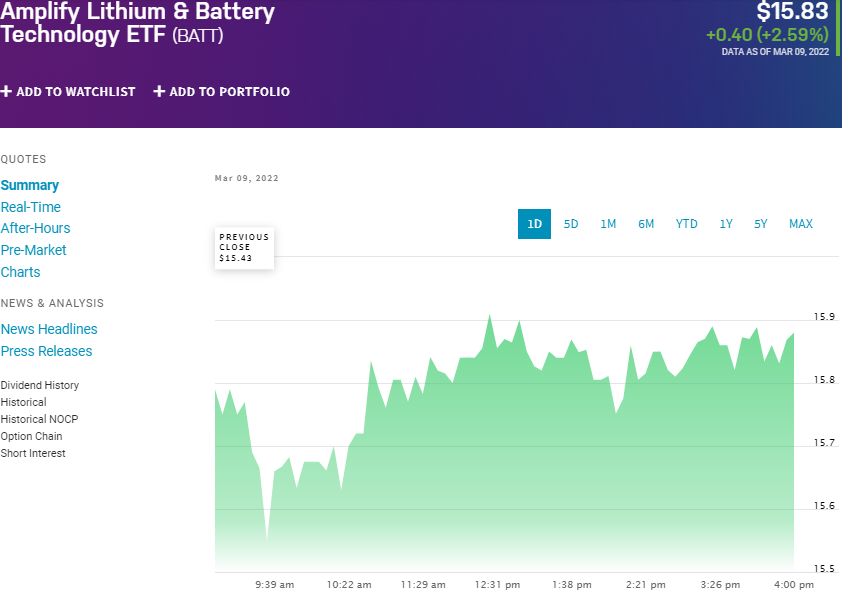

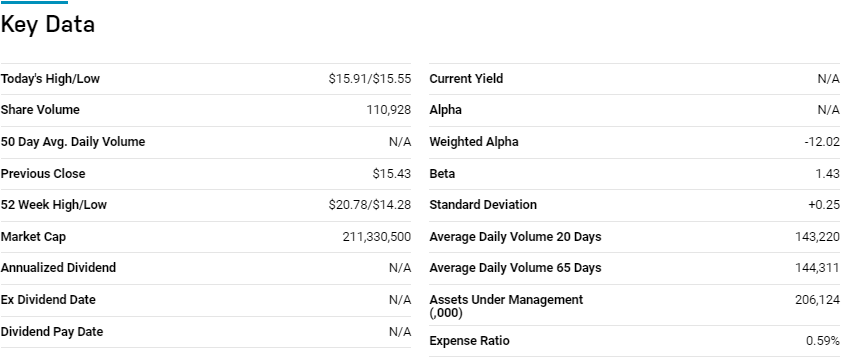

№ 1. Amplify Lithium and Battery Technology ETF (BATT)

Price: $15.83

Expense ratio: 0.59%

Dividend yield: 0.17%

Battery ETFs

Amplify Lithium & Battery Technology ETF tracks the performance of the EQM Lithium & Battery Technology Index, net of expenses and fees. It invests at least 80% of its total assets in the underlying holdings of the tracked index, offering diversified global exposure to equities deriving significant revenues from the development, production, and utilization of the leading battery technology currently, Lithium-ion.

The top three holdings of this non-diversified ETF are:

- BHP Group Limited Sponsored ADR – 8.23%

- Tesla Inc. – 6.27%

- Contemporary Amperex Technology Co., Ltd. Class A – 5.78%

The BATT ETF has $206.1 million in assets under management, with an expense ratio of 0.59%. This ETF differentiates itself from other battery ETFs by assigning more weight to mining companies exploring and converting EV battery inputs with only 20% allotted for EV automakers. Including both metal miners and equities utilizing battery technology results in a very resilient fund able to ride market volatility and result in significant gains; 3-year returns of 27.74% and 1-year returns of 5.69%.

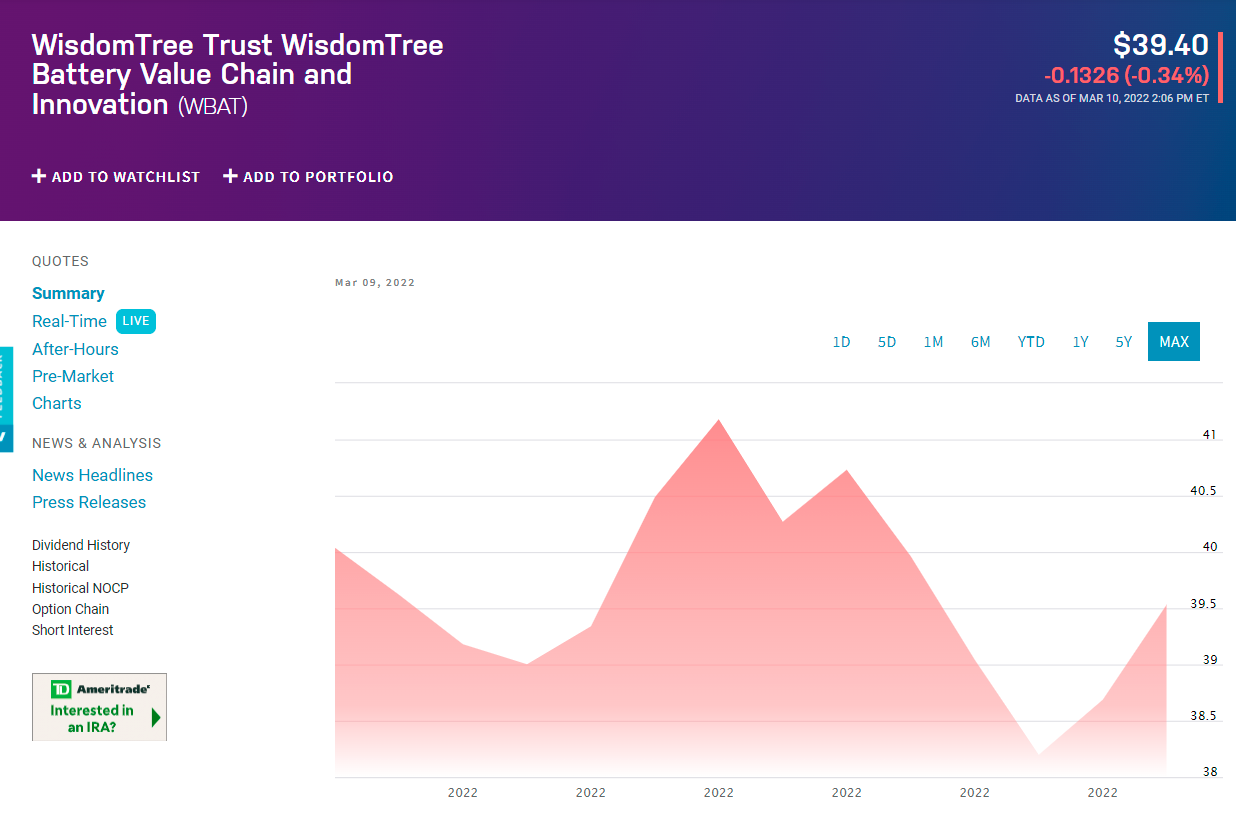

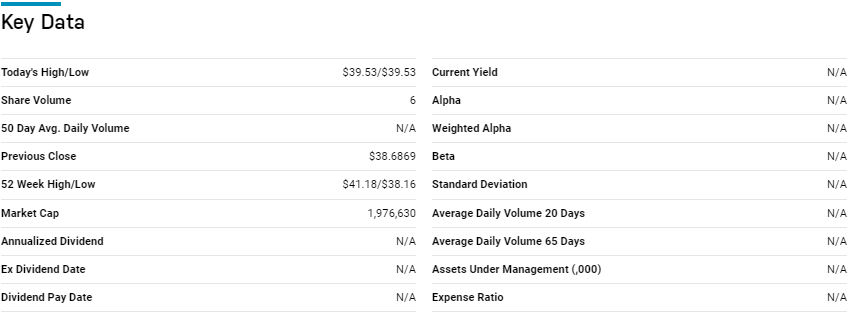

№ 2. WisdomTree Battery Value Chain and Innovation ETF (WBAT)

Price: $39.53

Expense ratio: 0.45%

Dividend yield: N/A

WBAT chart

The WisdomTree Battery Value Chain and Innovation ETF tracks the performance of the WisdomTree Battery Value Chain and Innovation Index. It invests all assets in its composite index in the same weight distribution. This ETF exposes investors to global equities involved in the battery and energy storage value chain and related solutions.

The top three holdings of this non-diversified ETF are:

- Mineral Resources Limited – 4.48%

- Simplo Technology Co. Ltd. – 3.96%

- TDK Corporation – 3.86%

WBAT ETF has $1.9 million in assets under management, with investors’ parting with $45 annually for every $10000 invested, a relatively cheaper option to some of the existing battery ETFs despite launching in 2022. The use of multifactor investment indicators to select and weigh holdings, coupled with exposure to the four segments making up the battery value chain; enablers, raw materials, emerging technologies, and manufacturing, ensures a fund that gives you exposure to all opportunities arising in the battery value chain.

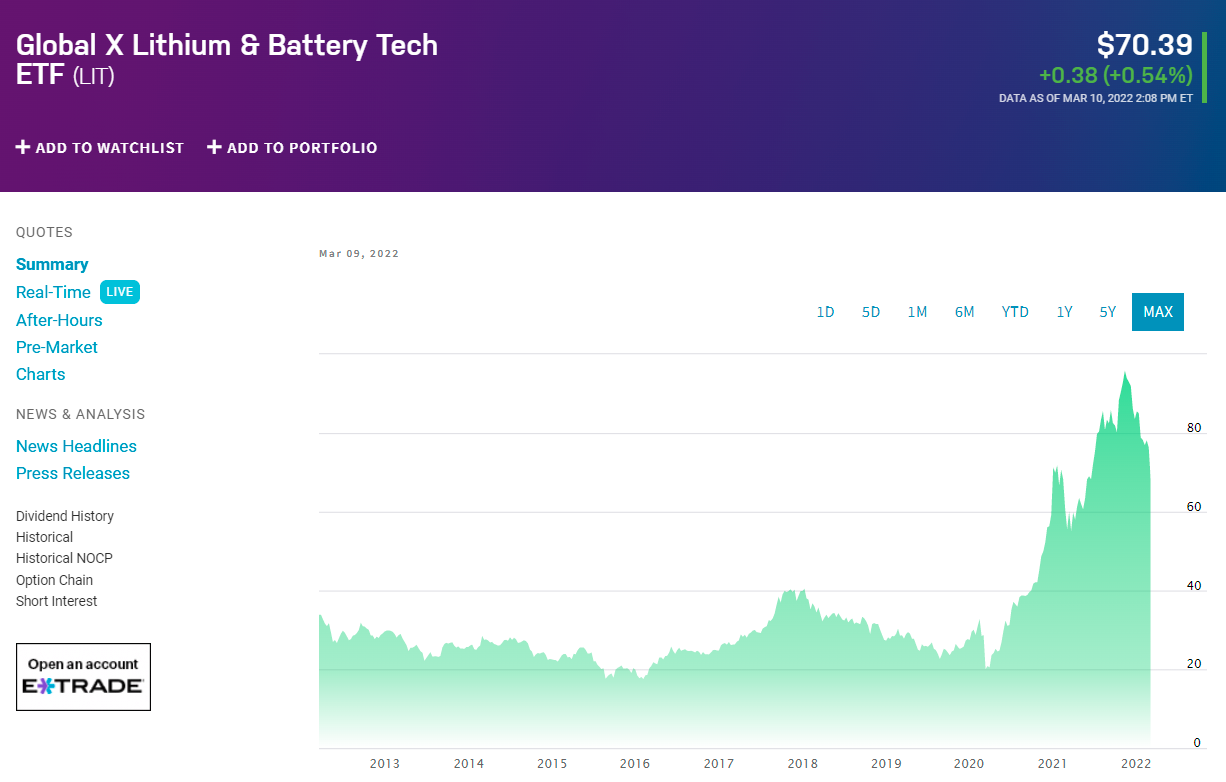

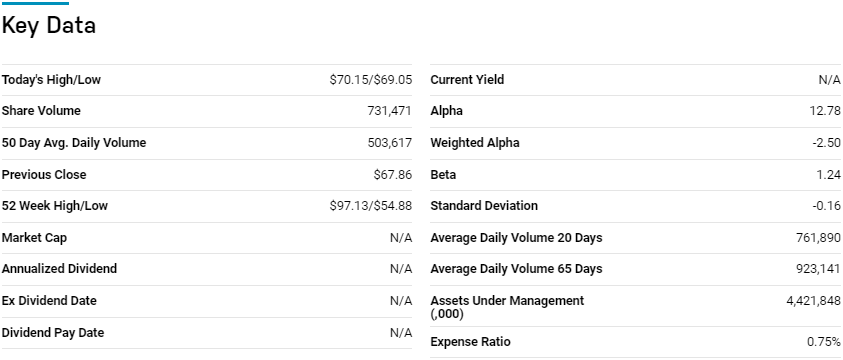

№ 3. Global X Lithium and Battery Technology ETF (LIT)

Price: $70.39

Expense ratio: 0.75%

Dividend yield: 0.13

LIT chart

The Global X Lithium and Battery Technology ETF tracks the performance of the Solactive Global Lithium Index, net of fees, and expenses. It invests at least 80% of its total assets in the holdings of its composite index, including the associated ADRs and GDRs.

Among 40 natural resource ETFs, the LIT is ranked № 23 by USNews.

The top three holdings of this non-diversified ETF are:

- Albemarle Corporation — 9.74%

- TDK Corporation — 6.24%

- Tesla Inc — 5.59%

The LIT ETF is the largest fund on this list with $4.42 billion in assets under management, with investors having to part with $75 for every investment worth $10000 annually. The lithium-ion battery is the technology powering transport sector migration from fossil fuels into the green technology era.

With the world’s appetite for green technologies reaching insatiable levels and governments giving tax breaks to accelerate EV adoption, this fund, which provides exposure to the entire lithium value chain, is on the brink of explosion. Historical returns reveal that lithium and associated technologies have been powering the recent electronics and power storage evolution and can be relied upon to provide significant returns consistently; 5-year returns of 183.39%, 3-year returns of 144.46%, and 1-year returns of 22.41%.

Final thoughts

The global appetite for carbon-conscious products is rising, setting up a platform for flourishing green metals. Nickel is at the forefront of this revolution both as a primary lithium battery ingredient and a decarbonization agent. In addition, the global appetite for stainless steel is also on the rise, and nickel is a significant component, with China’s insatiable appetite leading to demand for this green metal. The ETFs above are not pure-play nickel funds but have substantial exposure to nickel industries, hence an excellent starting point to benefit from increasing prices.

Comments