There is no debate about the importance of agriculture and its role in the global economy. Produce such as corn, soybeans, wheat, beef, and fish, among others, provides the food basket the global populace survives on. It employs more than a billion people, and when you consider the considerable annual revenue generation of upwards of $1.3 trillion, it is a sector that provides numerous investment opportunities.

However, the agricultural industry is susceptible to global population numbers, global weather patterns, seasons, and geopolitical risks making them highly volatile. For these reasons, investing in agricultural ETFs rather than stocks is a prudent investment strategy.

What is the composition of agriculture ETFs?

Food ETFs comprise equities in producing grains, vegetables, flowers, dairy products, and livestock. In addition to these primary agricultural product and service equities, they include equities providing ancillary services to this industry, manufacturing of farming machines and farming inputs, and agriculture-based REITs.

The best 3 food ETFs that offer more upside than meets the eye

Agricultural ETFs have outperformed the broader market in the past year. In the same breath, the global populace is on the rise, creating even more demand for food, making demand for agricultural products since they are responsible for all the food variation around the globe. Feeding the world is big business and will continue to provide investment opportunities as long as the global population increases. These three agriculture ETFs offer the opportunity to grow your profits and a smart way to play one of the essential segments of the worldwide economy.

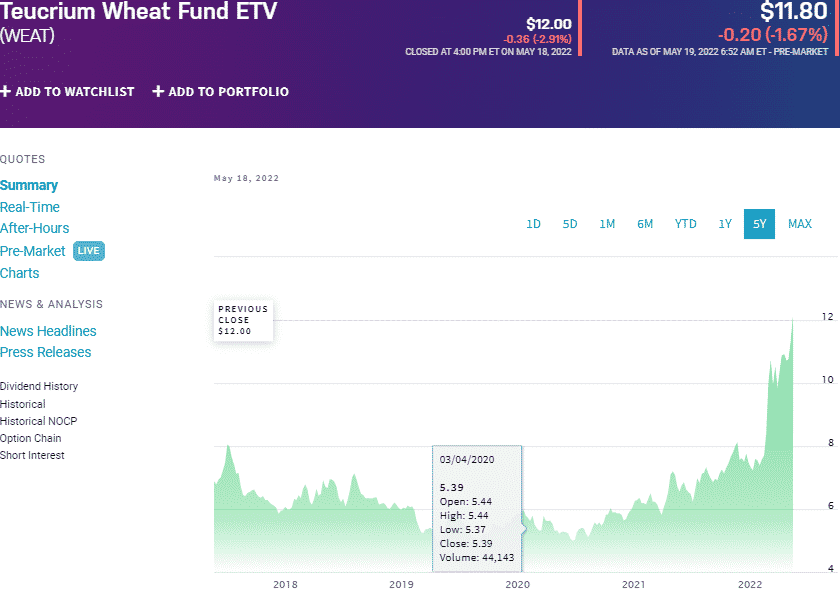

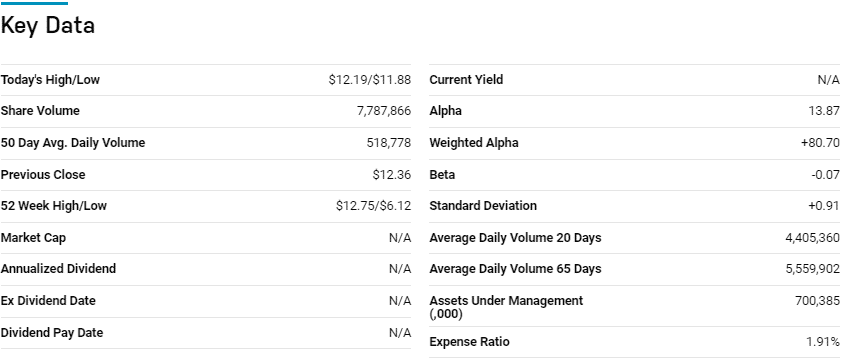

№ 1. Teucrium Wheat Fund (WEAT)

Price: $11.80

Expense ratio: 1.91%

Dividend yield: N/A

WEAT chart

The Teucrium Wheat Fund tracks the spot price of future wheat deliveries, measured by the Teucrium Wheat Index. It invests all of its assets in benchmark component futures contracts and financial instruments that help track the future price of wheat, swap contracts, futures, cash and cash equivalents, and options.

The WEAT ETF has only $700.4 million in assets under management, with investors having to cough up a hefty $191 annually for a $10000 investment. With wheat as one of the most utilized agricultural products globally and Russia being among its top global producers, the current global geopolitical issues resulting from the Ukraine war provide tactical tilt that can result in serious gains.

Inclusion of future contacts with different maturities ensures minimal contango effect and a fund capable of delivering profits and returns in a market downturn; 5-year returns of 86.66%, 3-year returns of 134.09%, and 1-year returns of 81.76%.

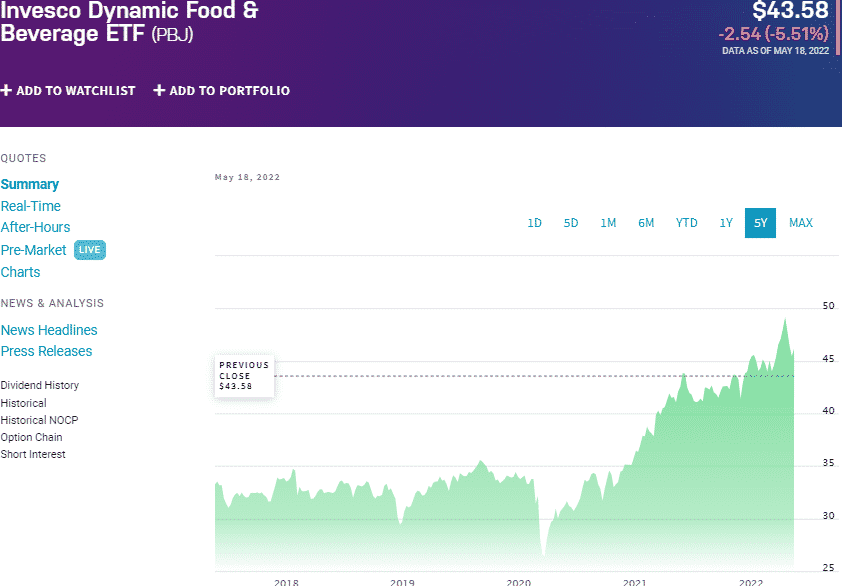

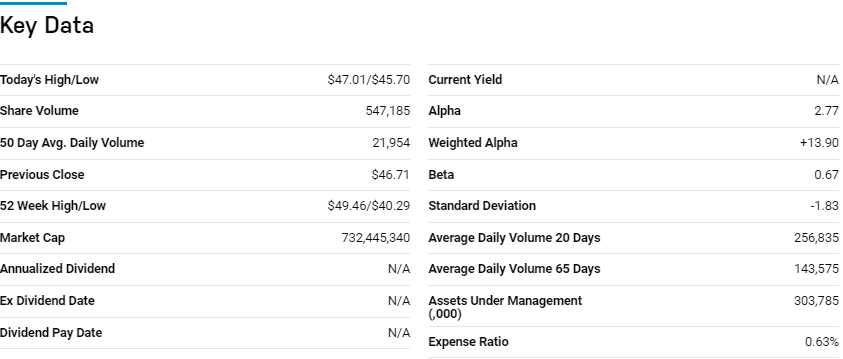

№ 2. Invesco Dynamic Food and Beverage ETF (PBJ)

Price: $43.58

Expense ratio: 0.63%

Annual dividend yield: 1.04%

PBJ chart

There are not very many pure-play agricultural ETFs to choose from, but when it comes to indirect but significant exposure to this industry, the Invesco Dynamic Food and Beverage Fund might as well be named among the earlier category.

It tracks the yield and price performance of the Dynamic Food & Beverage IntellidexSM Index, investing at least 90% of its assets in the tracked index holdings. Investing in the PBJ ETF exposes investors to equities involved in manufacturing, selling, marketing, and distributing food and beverage products, products related to the development of new food technologies, and agricultural products.

Among 15 of the best consumer defensive ETFs, PBJ is ranked No. 8 for long-term investing by USNews.

The top 3 holdings of this food ETF as of now are:

- Constellation Brands, Inc. Class A – 5.55%

- Archer-Daniels-Midland Company – 5.54%

- Hershey Company – 5.35%

The PBJ has $314.5 million in assets under management, with investors having to part with $63 annually for every $10000 investment. This fund is an indirect play on the agriculture industry by coupling consumer staples equities operating within the food and beverage segment with cyclical equities in the same segment.

A rigorous quantitative-based equity screening methodology geared towards more than average positive alpha-generating equities results in a resilient fund during the market downturn; 5-year returns of 46.70%, 5-year returns of 48.59%, 3-year returns of 41.55%, 1-year returns of 10.09%, and a dividend yield of 1.04%.

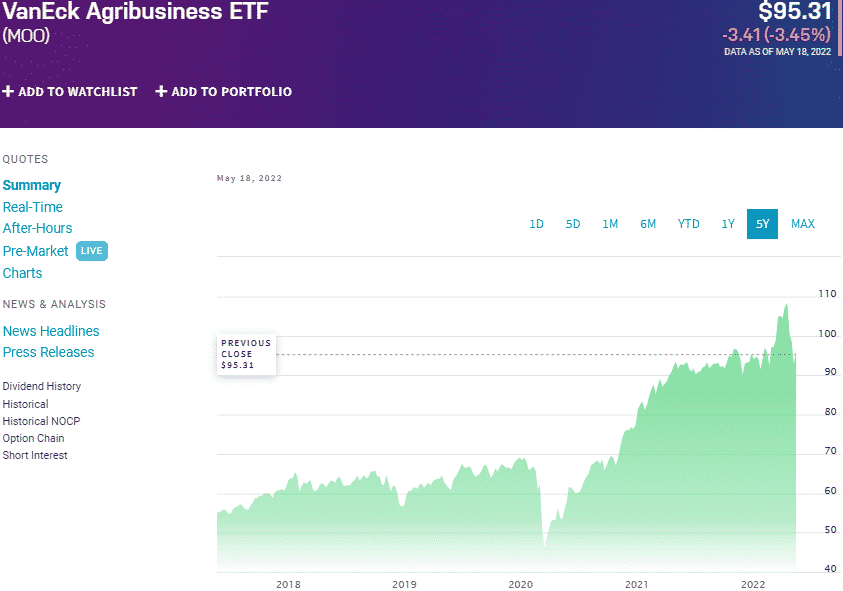

№ 3. VanEck Agribusiness ETF (MOO)

Price: $95.31

Expense ratio: 0.55%

Dividend yield: 0.89%

MOO chart

The VanEck Agribusiness ETF seeks to replicate the price and yield performance of the MVIS® Global Agribusiness Index, net of fees and expenses. It invests at least 80% of its net assets in equities to ensure minimal deviation, making up the tracked index. It exposes investors to global equities deriving 50% of their revenues from agriculture business; farm irrigation equipment, aquaculture and fishing, agri-chemicals, cultivation and plantations, agricultural products futures, animal health and fertilizers, and farm input equipment and machinery.

Among 40 natural resources funds, the MOO ETF is ranked No. 19 for long-term investing by USNews.

The top three holdings of this agriculture ETF are:

- Bayer AG – 8.65%

- Deere & Company – 8.15%

- Zoetis, Inc. Class A – 7.01%

The MOO ETF has $1.95 billion in assets under management, with an expense ratio of 0.55%. It uses data science and text analysis to group equities into the evolved consumer segment. Combining equities of developed, quasi-developed, and emerging markets operating in the agriculture value chain provides diversification and growth and value; 5-year returns of 94.70%, 3-year returns of 63.71%, and 1-year returns of 6.76%, and a dividend yield of 0.89%.

Final thoughts

As the demand for food grows worldwide, the agricultural sector will be looked upon to quench this hunger resulting in numerous investment opportunities. Investing in agriculture can be via equities operating in the agriculture sector or agricultural commodities themselves. The three ETFs above provide diversification in this sector with an ever-expanding demand and a chance at phenomenal profits.

Comments