The worst of the coronavirus seems to be behind us, and the globe is slowly but steadily going back to normalcy. Among the top industries to feel the full force of the pandemic was the travel and leisure industry, dropping an unprecedented 49.5%, $2.37 trillion from $4.69 trillion, in light of the travel bans and emergency plans aimed at arresting virus spread.

Most countries have opened up their borders, and experts expect an otherwise cooped up populace to take advantage and make up for the lost time regarding travel and leisure. As such, the US travel association expects a 22.5% surge in this industry in light of increased vaccination and ease of lockdown and travel restrictions.

With even Warren Buffett shunning stock picking when it comes to the leisure and travel industry, we advocate for investing in exchange-traded funds and betting on the entire industry’s growth.

What is the composition of travel and leisure ETF?

Travel and leisure ETFs comprise organizations involved in designing, producing, and distributing all products and machinery for use in this industry. In addition, they cover all equities providing ancillary services to the travel and leisure industry and those service organizations deriving substantial revenue from leisure and travel-related activities.

Best travel and leisure ETFs in a post-pandemic era

Since the summer, they have been a steady and consistent uptick in travel and leisure-related activities. In addition, the boaster shots have reduced covid-related hospitalization and deaths by 89% resulting in the ease of restriction in international travel. To take advantage of this industry’s resurgence, the ETFs below are in pole position to benefit.

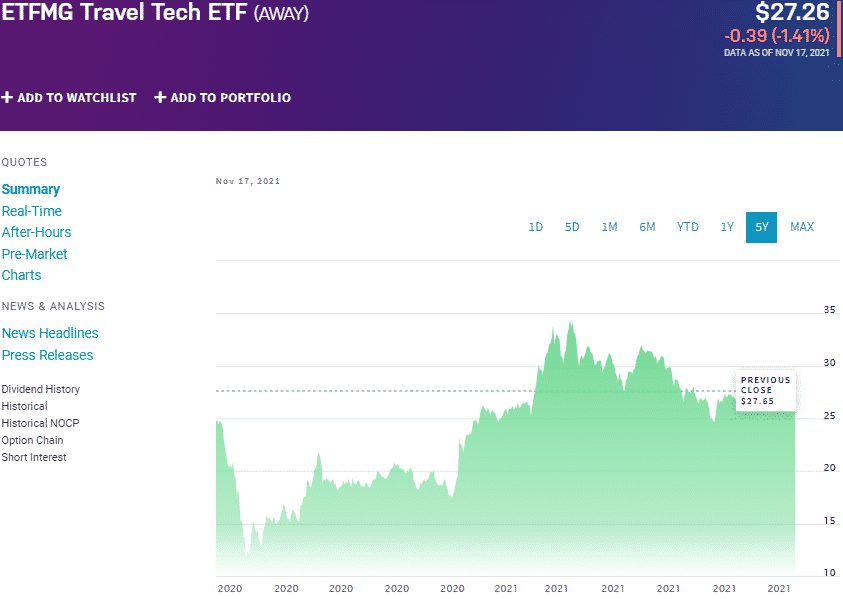

№ 1. US Global Jets ETF (JETS)

Price: $22.84

Expense ratio: 0.60%

Annual dividend yield: 0.04%

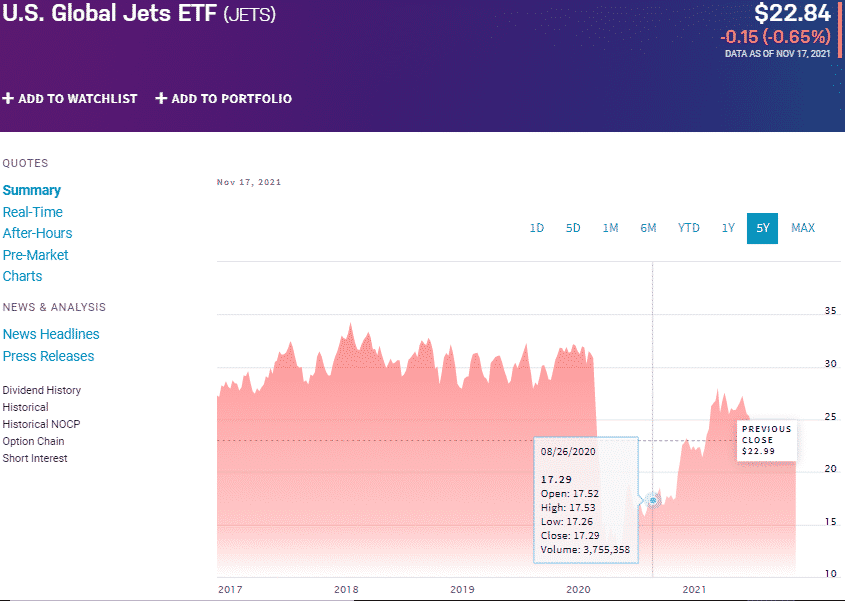

JETS chart

US Global Jets ETF uses an indexing approach to track the performance of the US Global Jets Index, exposing investors to the airline industry; aircraft manufacturers, airports, international airlines passenger services, and terminal services companies.

The top three holdings of this ETF as of now are:

- United Airlines Holdings, Inc.– 10.45%

- Delta Air Lines, Inc.– 10.10%

- American Airlines Group, Inc.– 10.03%

JETS ETF has $3.83 billion in assets under management, with an expense ratio of 0.60%. With a year-to-date return of 2.73%, this ETF is on the dip and in a great position to buy. As inflation eases and travel activities increase post covid pandemic, cost pressures will go down while revenues will increase, making it even more desirable as it sores. In addition, this is the only pure-play travel and leisure exchange-traded fund offering, making it highly liquid.

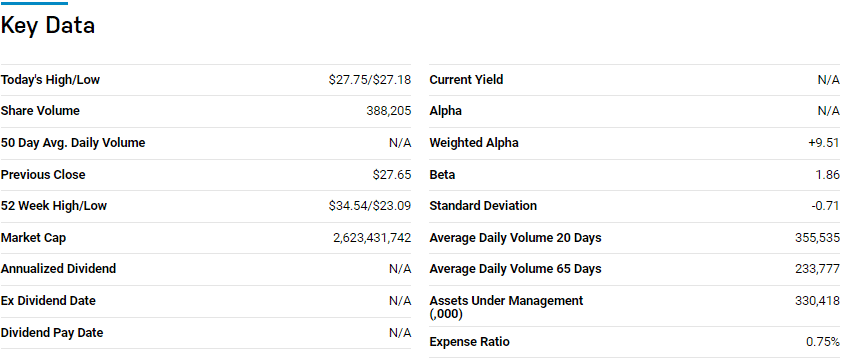

№ 2. ETFMG Travel Tech ETF (AWAY)

Price: $27.26

Expense ratio: 0.5%

Annual dividend yield: 0.04%

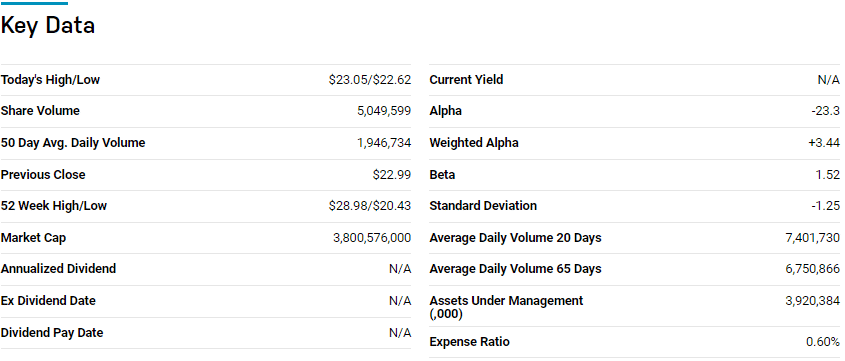

The ETFMG Travel Technology fund tracks the performance of Prime Travel Technology Index NTR, investing at least 80% of its total assets, excluding collateral, in the underlying holdings of its composite index coupled to the index’s ADRs and GDRs. This non-diversified fund exposes investors to all global technology companies’ providing technological solutions to the travel industry-both via the internet and internet-connected devices.

The top three holdings of this ETF as of now are:

- Airbnb, Inc. Class A– 5.65%

- MakeMyTrip Ltd.– 4.89%

- Expedia Group, Inc.– 4.71%

AWAY has $352.30 million in assets under management, with an expense ratio of 0.75%, which is a bit high for an index fund but within the acceptable range for niche funds. Despite operating in the travel and leisure space, its focus on technology solutions has enabled this ETF to post positive results despite launching at the start of the coronavirus pandemic. It is an ideal ETF to play the travel and leisure industry indirectly for diversification.

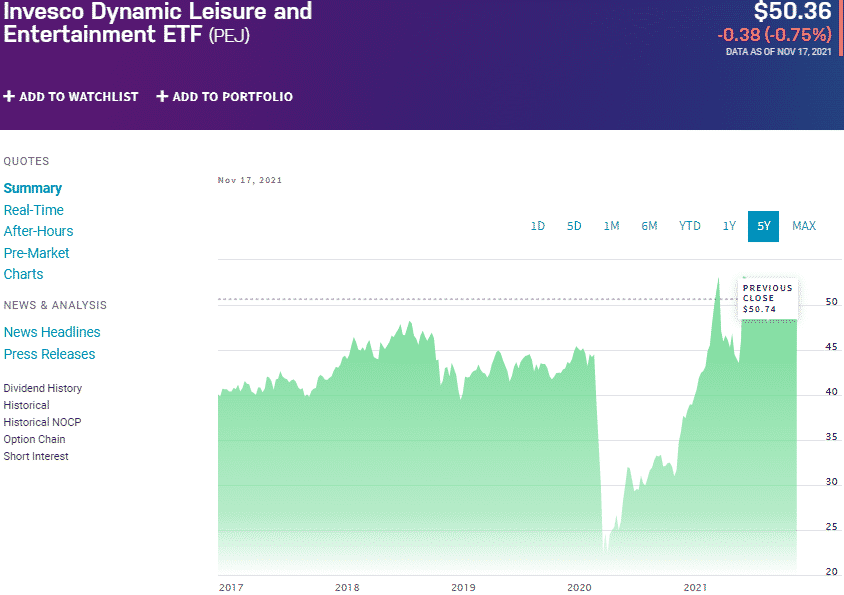

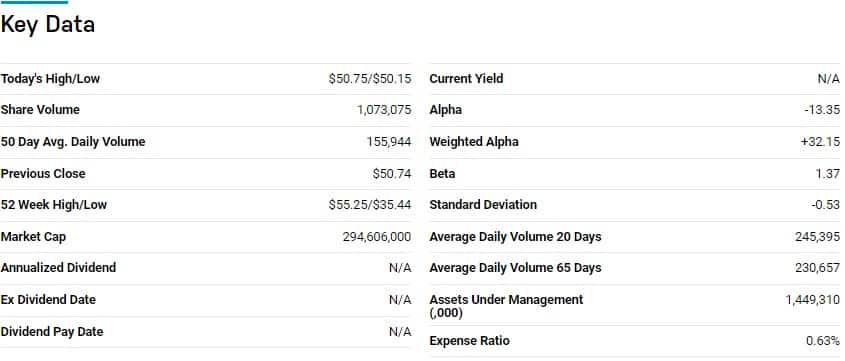

№ 3. Invesco Dynamic Leisure and Entertainment ETF (PEJ)

Price: $50.36

Expense ratio: 0.63%

Annual dividend yield: 0.73%

PEJ chart

The Invesco Dynamic Leisure and Entertainment fund mimic the performance of the Dynamic Leisure & Entertainment Intellidex Index, investing at least 90% of its total assets in the holdings of the tracked index. Investors in this ETF get exposure to the consumer discretionary segment by having a stake in an organization that designs, produce and distribute goods and services in the leisure and travel niches.

PEJ is ranked No. 13 by USNews among the 35 best long-term investment funds among cyclical consumer ETFs.

The top three holdings of this ETF as of now are:

- Booking Holdings Inc. – 5.13%

- McDonald’s Corporation – 5.09%

- Sysco Corporation – 4.69%

PEJ boasts of $1.42 billion in assets under management, with investors having to part with $63annually for every $10000 investment. With its rigorous holdings’ evaluation metrics, this fund is always on track to make money for its investors; 5-year returns of 34.75%, 3-year returns of 21.94%, pandemic year returns of 42.81%, and current year to date returns of 26.98%.

Unlike most funds with a limited holding base, 30 holdings for the PEJ, this fund has one of the most evenly distributed asset structures that lowers concentration risk significantly.

Final thoughts

The global populace has been restricted in their movement for more than a year on raising their appetites for travel, leisure, and socializing to unprecedented levels. As such, the exchange-traded funds above give you exposure and opportunities to make green bucks as the industry accelerates towards pre-pandemic levels.

Combine this with solid fundamentals for the travel and leisure industry and what you get is fuel for a bullish updraft for this niche with tons of opportunities to make money.

Comments