Clean energy is the one that we get from renewable resources. That means that the assets we tap for energy can replenish themselves. They include the sun, wind, rain, waves, or geothermal heat.

The technology is ever-growing, and ever-developing and the demand for energy that would facilitate the process are also rising. More to the point, the global population is increasing, which can also mean more energy is needed for daily life to function normally.

Clean energy: why should you care?

As measured by the S&P 500 Energy Sector Index, the energy niche has even outperformed the global market, with a 52.3% annual return. As we speak, there are 42 exchange-traded funds with more than 50 million dollars in assets in the United States alone.

While some claim that the energy in the future will also come from coal, oil, and gas, with the green initiatives growing in popularity worldwide, you can bet that renewable energy sources will take the wheel in the years to come.

What is an ETF

ETF stands for exchange-traded fund. To put it bluntly, an ETF is a group of stocks, or bonds, that you can buy at an exchange. The difference between single securities and ETFs is that the latter serves as a tiny portfolio in itself, allowing you to invest in multiple companies with just one investment. People created them to make investing more effortless, more intuitive, and, to be honest, cheaper.

Today, we will answer a dilemma: what ETFs could you buy if you want to put your money on clean energy?

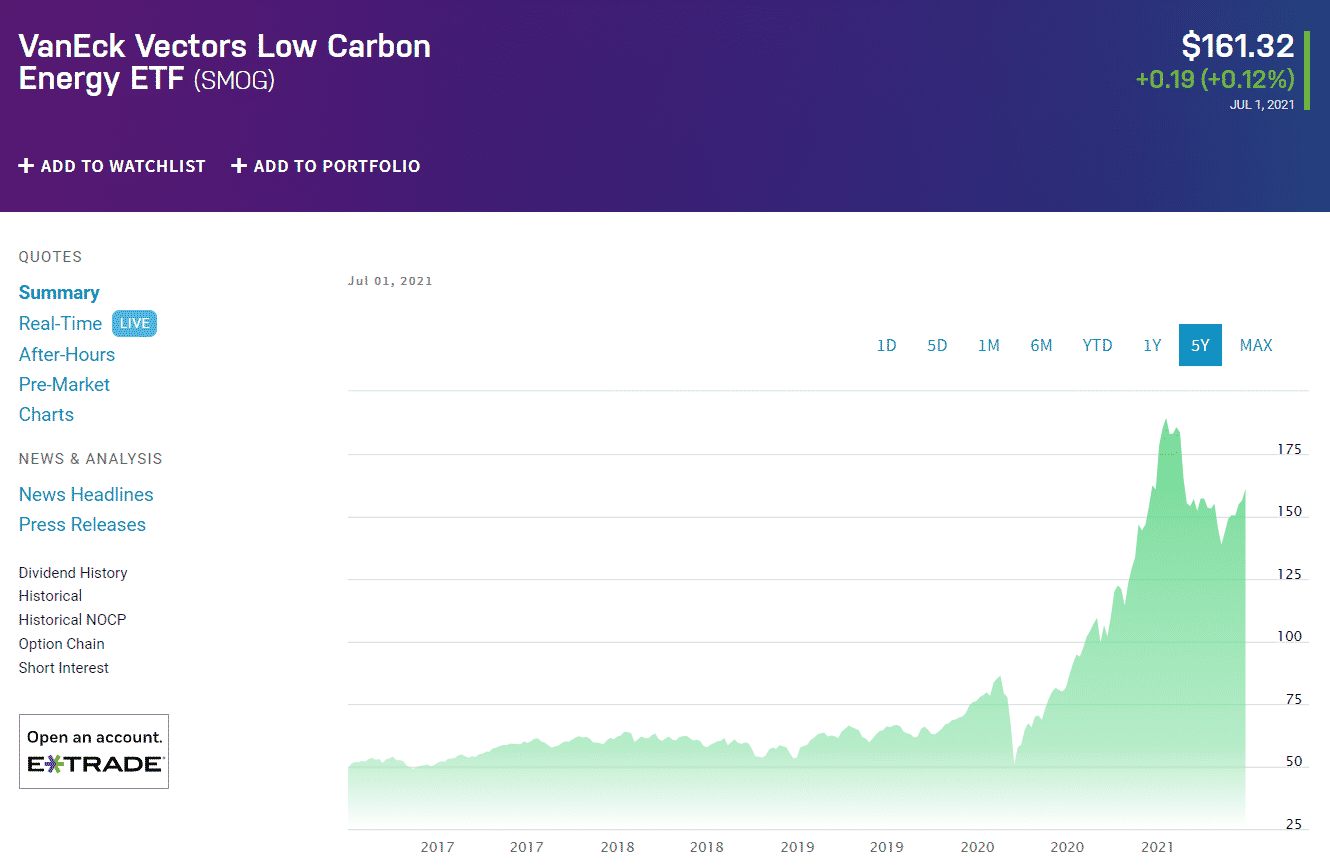

1. VanEck Vectors Low Carbon Energy ETF (SMOG)

Price: $157.52

Expense ratio: 0.62%

The SMOG ETF came to be in 2007, and it aims to track the SMOG-US – MVIS Global Low Carbon Energy Index. To be included in the benchmark, a company must obtain at least half of its revenues from wind, solar energy, hydrogen sources, waste, biofuels, and other bio-friendly energy assets. On the MSCI scale, the fund has an A rating with a 6.45/10 grade.

Holdings

Out of its 71 holdings, most in the United States, the units are located in China and Spain.

Tesla Inc., the US electric vehicle behemoth, is the fund’s most prominent holding with an 8.41% share, while another US-based company, NextEra Energy, follows it with 7.76%. The ETF’s third-largest holding is Iberdrola, a Spanish multinational electric utility company based in Bilbao, with more than 34,000 employees and 3.4 million users.

The ETF pays out a quarterly dividend of $0.09, while its annualized average return came in at 98.27%.

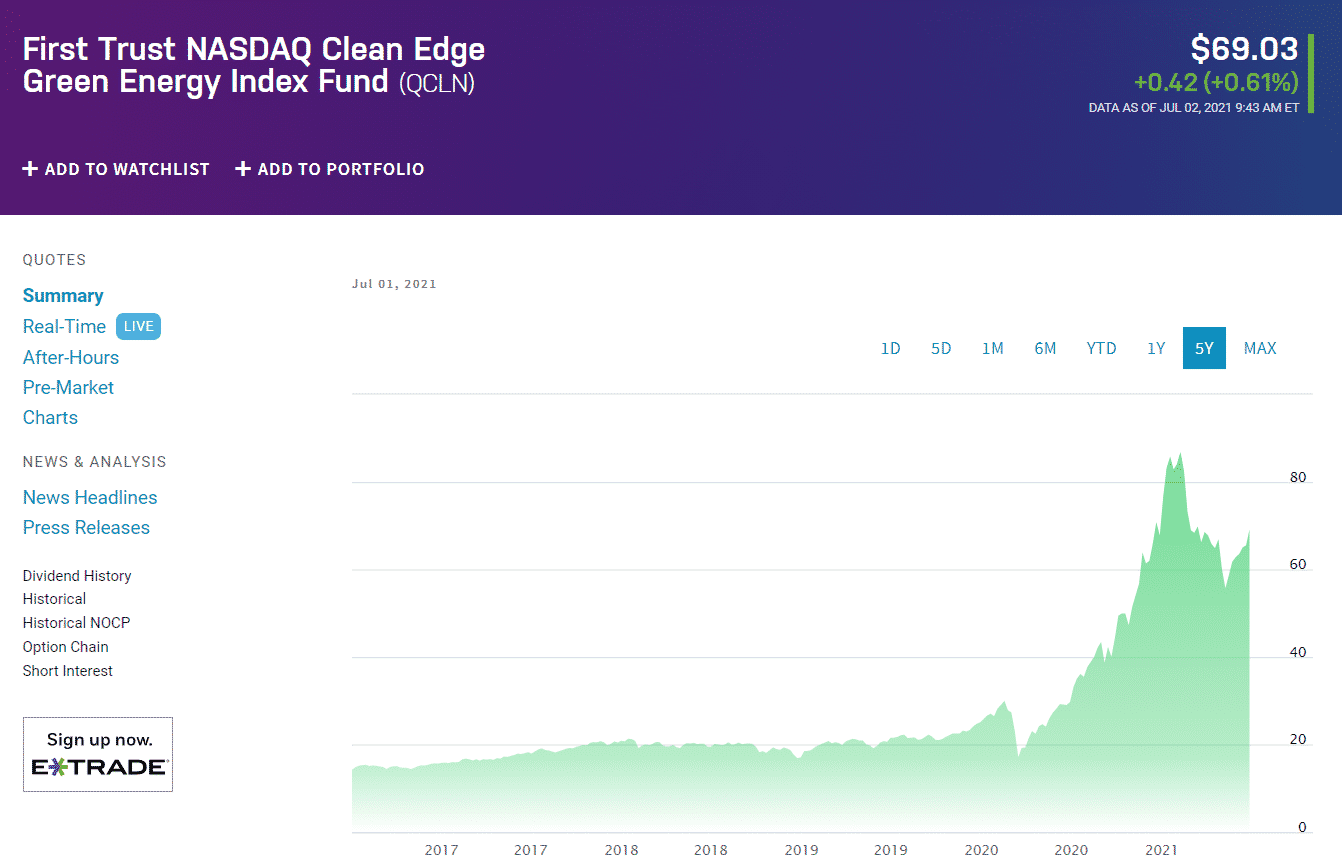

2. First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Price: $66.53

Expense ratio: 0.60%

The QCLN differs slightly from SMOG, most dominantly in terms of depth and width. With businesses focused on biofuels, solar energy, and batteries as its holdings, QCLN offers exposure wider than most of its rivals. With a relatively high number of holdings, it makes a solid choice for an investor looking to spread resources across various sub-sectors.

Holdings

More than four-fifths of the fund’s 54 holdings are located in the United States, while over 12% of its units are China-based. Electric vehicle giant Tesla Inc. and its Chinese counterpart NIO are the ETF’s top two holdings, with a combined pull of more than 16%. The third top holding is the United States-based and NASDAQ-listed Energy Enphase, which deals in-home energy solutions for the solar photovoltaic industry.

The QCLN ETF pays out a quarterly dividend of $0.01, while its yearly average return stood at 123.96%.

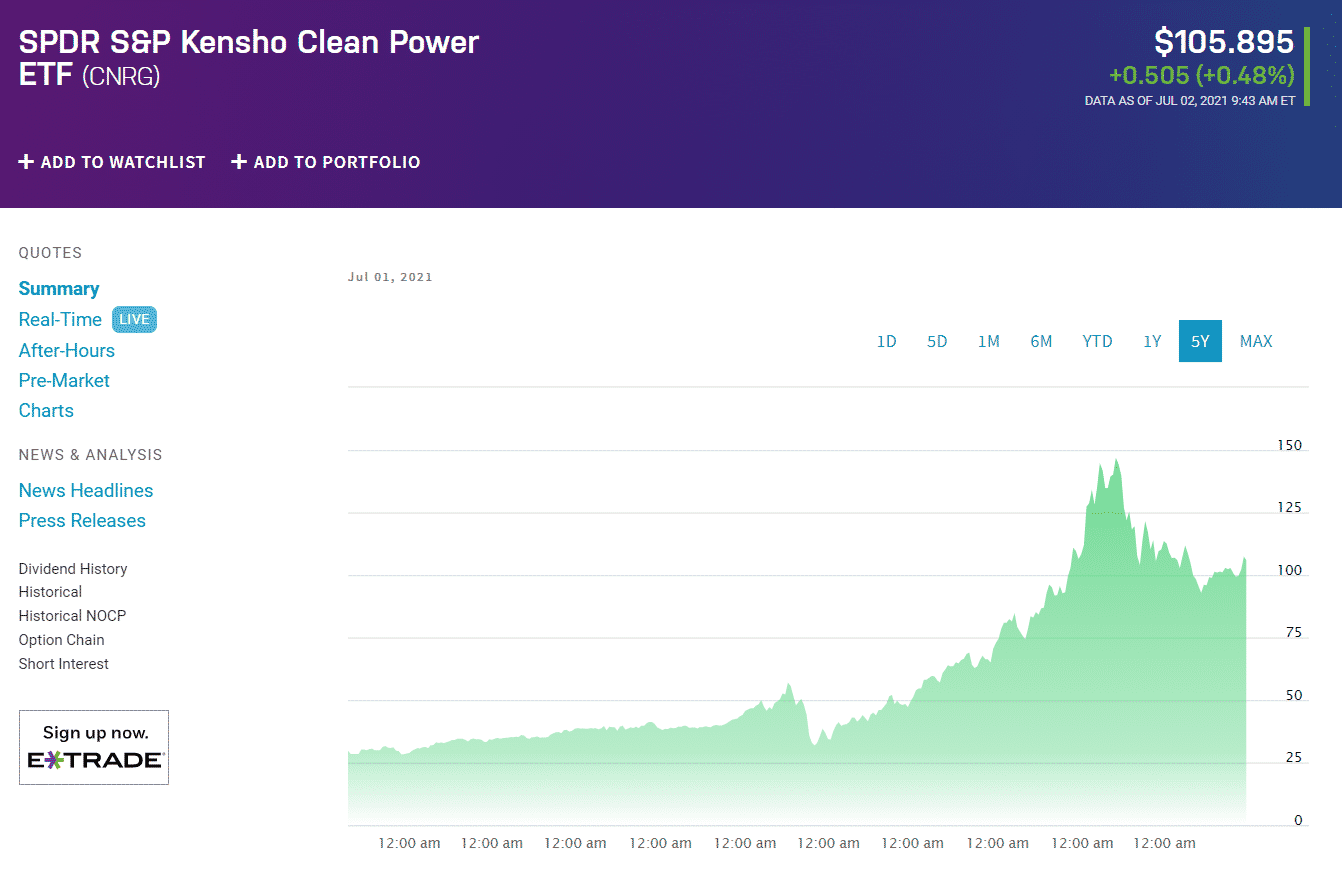

3. SPDR S&P Kensho Clean Power ETF (CNRG)

Price: $102.47

Expense ratio: 0.45%

Initiated in 2018, the CNRG ETF tracks the S&P Kensho Clean Power Index. The benchmark itself is a mixture of two sub-indexes, allowing it to simultaneously follow the manufacture of technology utilized in the renewable energy sector and companies that offer goods and services within the same niche.

Holdings

All 44 of the ETF’s holdings have headquarters in the United States, and none of them has a predominant pull, to be exact. The fund’s top three holdings all hover just above the 3% mark.

We already mentioned Enphase Energy while talking about the previous ETF, so you can get a pretty clear picture of what kind of a fund it is. Apart from it, CNRG also includes Sunrun Inc, which is a San Francisco-headquartered provider of residential solar panels and home batteries. The third top holding of the fund is Sunnova Energy International Inc., an American solar and energy storage service provider.

The fund cashes out a quarterly dividend of $0.34, with an average annual return of 109.97%.

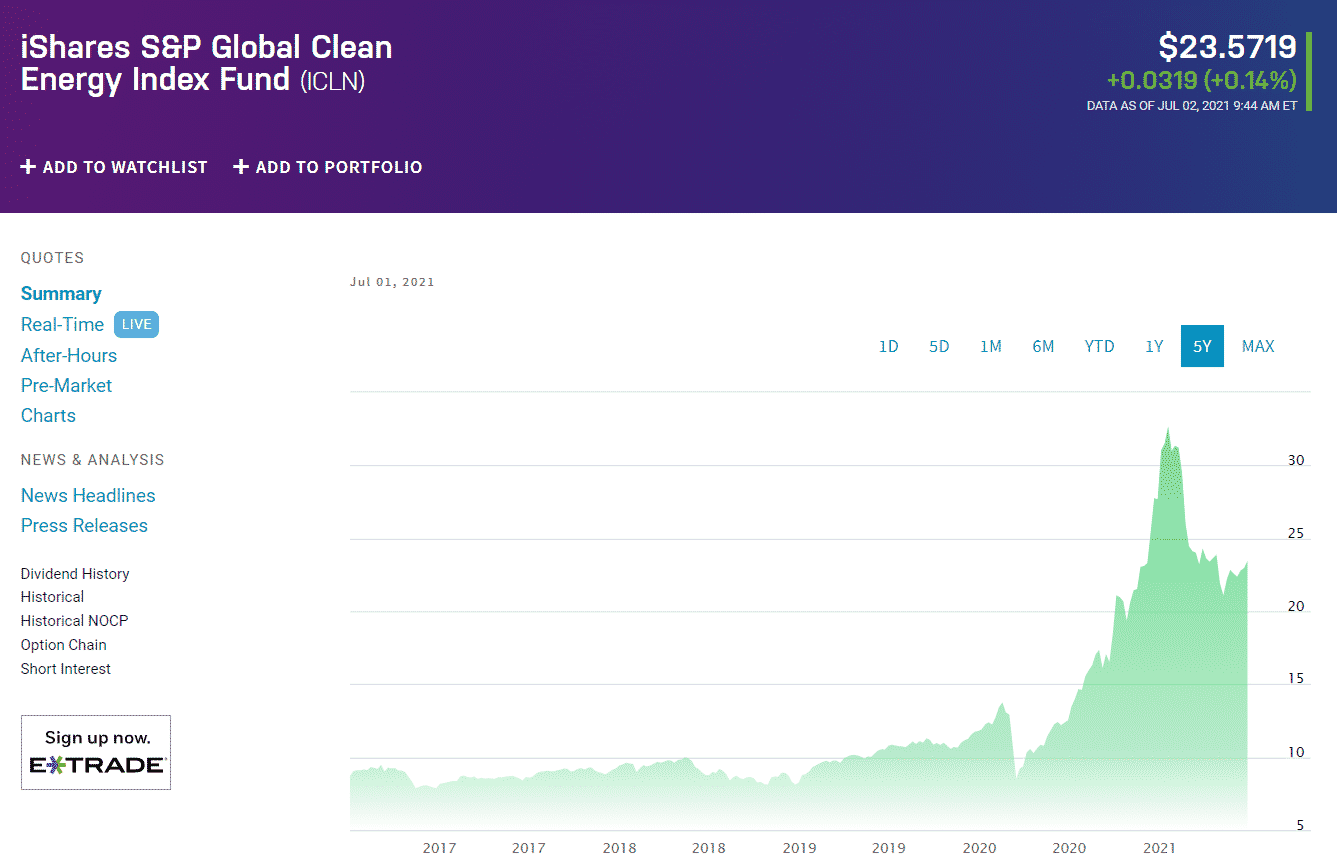

4.iShares Global Clean Energy ETF (ICLN)

Price: $23.05

Expense ratio: 0.46%

The iShares Global Clean Energy ETF came to be in 2008, and it tracks the S&P Global Clean Energy index. Much like with other clean-energy ETFs, a company must rely on renewable energy sources and products for at least 50% of its revenue to be listed. The fund holds a relatively narrow portfolio in terms of businesses but a wide one concerning the market capitalizations of its constituents.

Holdings

The ETF consists of 82 holdings with $5.98 billion in assets under management. Less than 50% of its holdings are based in the United States, while the remaining part is across the globe.

The ETF’s three most significant holdings are Vestas Wind Systems, a Danish manufacturer, seller, installer, and servicer of wind turbines, as well as NASDAQ-listed Enphase Energy, and Denmark’s largest energy company Orsted. They participate in the fund with 7.62%, 6.33%, and 5.87%, respectively. Other holdings include companies dealing in biofuels, ethanol, geothermal, hydroelectric, solar, and wind industries.

The ICLN ETF pays out a quarterly dividend of $0.12, with an average yearly return of 88.13%.

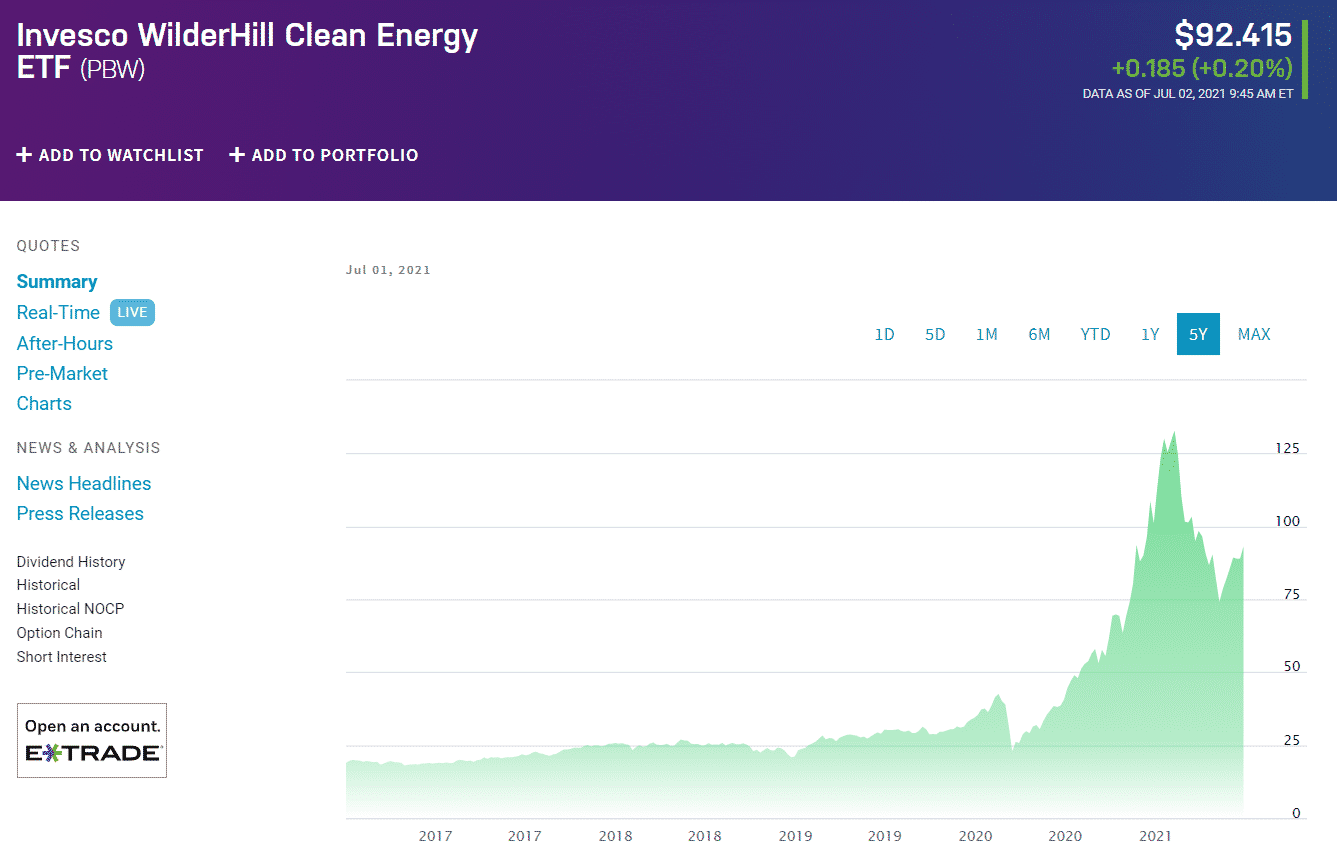

5.Invesco WilderHill Clean Energy ETF (PBW)

Price: $90.58

Expense ratio: 0.70%

Holdings

Out of 68 holdings in total, some 85% have operations in the United States. China and Canada make up for the rest, in that order, with one company headquartered in Chile. No company has an overwhelming majority share in the ETF, with the top holding amounting to as little as 2.28%.

The three units with the most significant pull are Ameresco, Inc., ChargePoint Holdings, and Xpeng, Inc. The three firms have headquarters in Framingham, Massachusetts, Campbell, California, and Guangzhou, China, and participate in the fund with 2.28%, 2.24%, and 2.02%.

The PBW ETF cashes out a quarterly dividend of $0.26, with an average yearly return of 136.38%.

Comments