The advent of Bitcoin in the economic space in 2008 brought about a paradigm shift in global financial transactions & investing principles. Following the main digital cryptocurrency, others began to appear: Ethereum, Zcash, Litecoin, Dash, EOS, etc. The pool of crypto assets is growing every day, and its profitability is no longer in doubt, even among skeptics.

However, there is one complication. What is the best asset for investing when we talk about cryptocurrency? This is where Exchange Traded Funds come to the rescue. ETFs are allowing the owner not to choose the best cryptocurrencies but to purchase several.

Let’s look at the concept of an ETF, how it works, the reasons to invest in a crypto ETF, and finally, the best ETFs to invest in.

What are crypto ETFs?

Cryptocurrency ETFs are essentially the same as any other. However, most ETFs track an index or a basket of assets, tokens, crypto, or companies with bitcoin or blockchain technology exposure. ETFs with digital tokens will be traded on the exchange like regular stocks, and they will be subject to price changes throughout the day as investors buy and sell.

Why crypto ETFs?

An ETF tracks assets you can invest in, but it is not so different for a Bitcoin ETF. Here, the price of one exchange-traded fund will move or fluctuate with the Bitcoin price. If the price of Bitcoin goes up, the ETF goes up, and vice versa. The only difference is that the ETF is not traded on a cryptocurrency exchange, but rather it is traded on a market exchange such as TSX and NYSE.

How a crypto ETF works?

For a crypto ETF to function correctly, the organization that manages the fund must own the underlying assets that it is tracking. The ETF must hold a proportional share of companies with exposure to digital tokens or blockchain technology. The ownership is represented in the form of shares, and by purchasing, investors in the ETF will indirectly own a piece of each company or digital asset.

What is the essence of a crypto ETF?

They track a basket of assets, crypto, tokens, or companies with bitcoin or blockchain technology exposure. Then trade them as regular stocks on a trusted trading marketplace. The concept of a crypto ETF may be new to some investors, but the benefits of this type of investment are undeniable.

What are the main reasons for investing in crypto ETFs?

- More room for diversification of assets.

- No worry about the security procedures.

- No crypto wallet to lose.

- Possibility to invest in crypto ETFs without knowing the underlying crypto asset.

- Ability to short sell shares of the ETF if any suspicion arises concerning the price of Bitcoin.

- Tax-efficiency, well regulated and listed on major stock exchanges.

Crypto ETF gainers

Let’s take a look at five of the best crypto ETFs you can invest in today. We selected based on several factors, including AUM (assets under management), market capitalization, expense ratio, annual dividend yield, and other important factors for investors.

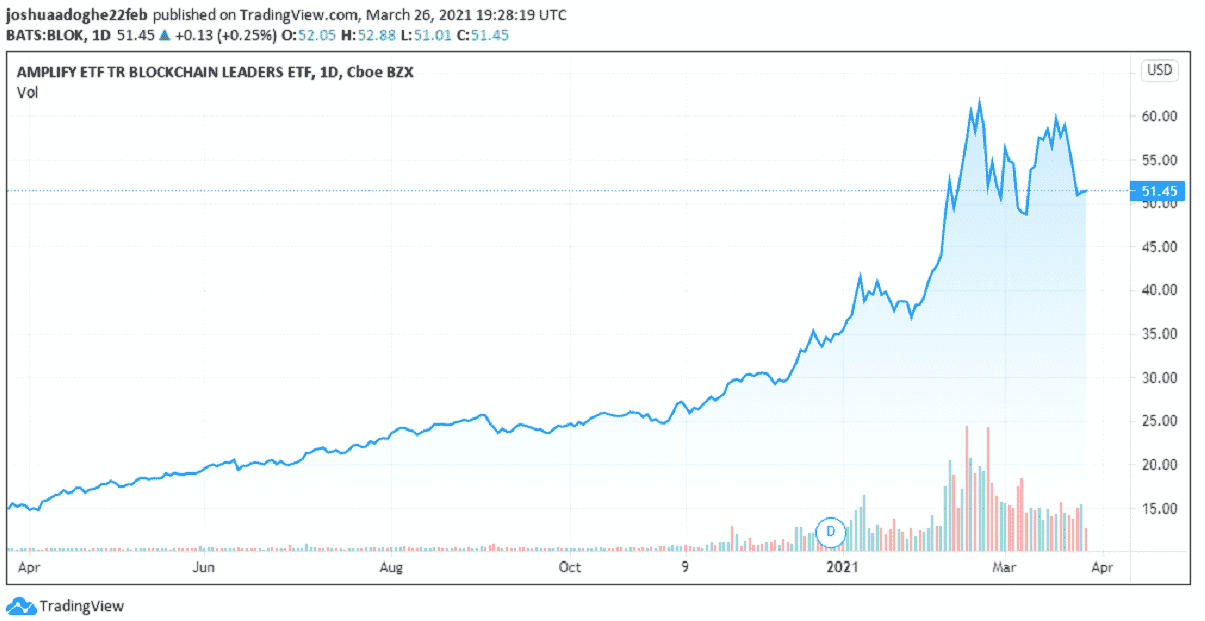

Amplify Transformational Data Sharing ETF (NYSEARCA: BLOK)

Foundation date

Since 2018, Amplify Transformational Data Sharing ETF has been on the trading floor. It stands as the first and original crypto ETF since the inception of crypto ETFs. The ETF owns shares in 56 companies.

Top companies include:

Galaxy Digital Holdings Ltd. (GLXY), Voyage Digital Ltd. (VYGR), Bitfarms Ltd. (BITF), Silvergate Capital Corp (SI), and MicroStrategy Incorporated (MSTR).

The expense ratio, a daily trading share, asset management scale

BLOK is the only actively managed ETF amongst other ETFs and has an expense ratio of 0.71%, a daily trading share of 270,526 shares, and an asset management scale of US$365 million, so it has high liquidity.

The return rate: 92.11%

One reason BLOK is on top of the list, apart from the fact that it is actively managed, is that it has a 3% stake in the Grayscale Bitcoin Trust, making it the first ETFs clear-cut exposure to the Bitcoin blockchain.

Annual dividend yield

It is also worthy of note that BLOK has an annual dividend yield of 1.72%, which is an excellent yield for many crypto investors.

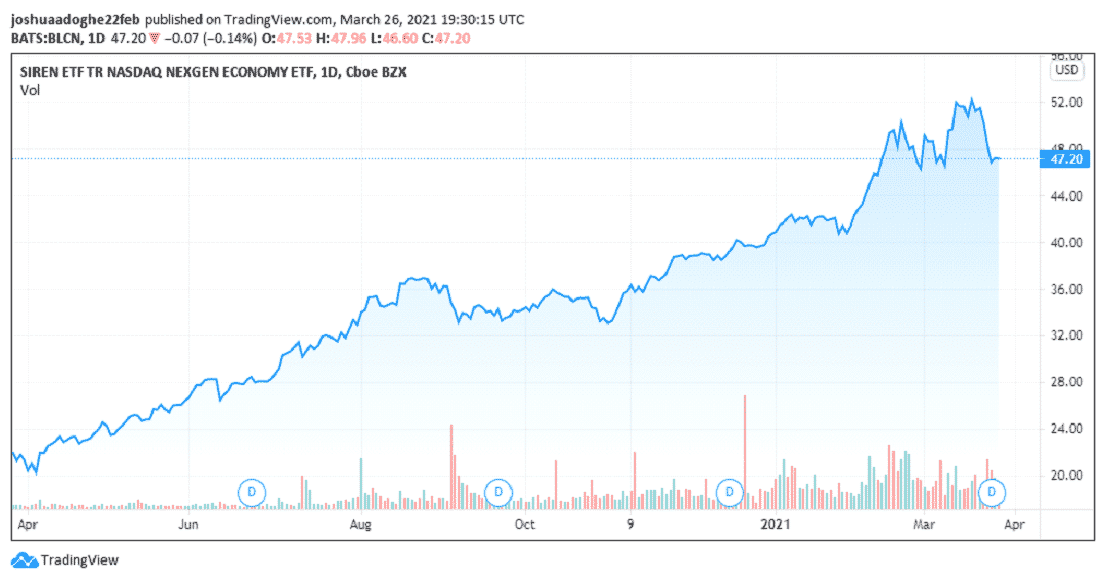

Reality Shares Nasdaq NexGen Economy ETF (NASDAQ: BLCN)

Foundation date

Reality Shares Nasdaq NexGen Economic ETF (NASDAQ: BLCN) is our second-ranked ETF and has been trading since 2018. The ETF asset tracks the Reality Shares NASDAQ NexGen Economy index and owns company shares in 72 companies. The top companies gauged by BLCN are mainly in the fields of research, development, support, and innovations in blockchain technology.

Top companies include:

Canaan Corporation (CAN), Galaxy Digital Holdings Limited (GLXY), Signature Bank (SBNY), Daimler Corporation (DAI), Square Inc. (SQ), Micron Technology (MU), and Baidu.

The expense ratio, a daily trading share, asset management scale

The expense ratio of BLCN ETF is 0.68%, and the scale of asset management is US$188 million. It trades more than 69,473 shares per day, and ADY is $0.31 per share.

The return rate: 58.66%

Annual dividend yield

BLCN has an annual dividend yield of 0.56% and is an excellent investment. One unique characteristic of BLCN is that it assigns a Blockchain score to every fund component. This is a ranking system that helps identify companies that would be of more benefit from blockchain technology.

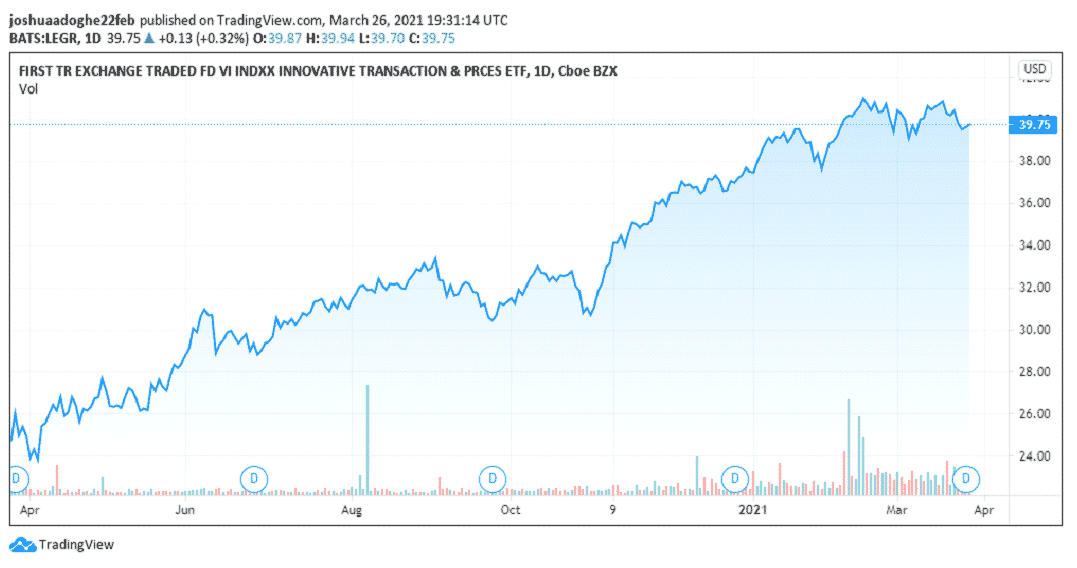

First Trust Indxx Innovative Transaction & Process ETF (NASDAQ: LEGR)

Foundation date

First Trust Indxx Innovative Transaction & Process ETF is the third ETF on our top ETF list and has been on stock exchanges since 2018. LEGR tracks over 100 company holdings.

Top companies include:

Advanced Micro Devices (AMD), International Business Machines Corporation (IBM), Swisscom AG (SCMN), Oracle Corporation (ORCL), Honeywell International Inc. (HON), Texas Instruments Incorporated (TXN), and Baidu Inc (BIDU).

The expense ratio, a daily trading share, asset management scale

LEGR has an expense ratio of 0.65 percent, with an AUM of around 54.4 million US dollars. It trades over 3,527 shares per day with an ADY of $0.36 /share.

The return rate: 17.90%

Annual dividend yield

With an annual dividend yield of 0.95%, LEGR is a top investment. LEGR uses a tier system for eligible securities within its portfolio.

There are three tiers:

- Tier one for active enablers

- Tier two for active users

- Tier three for active explorers

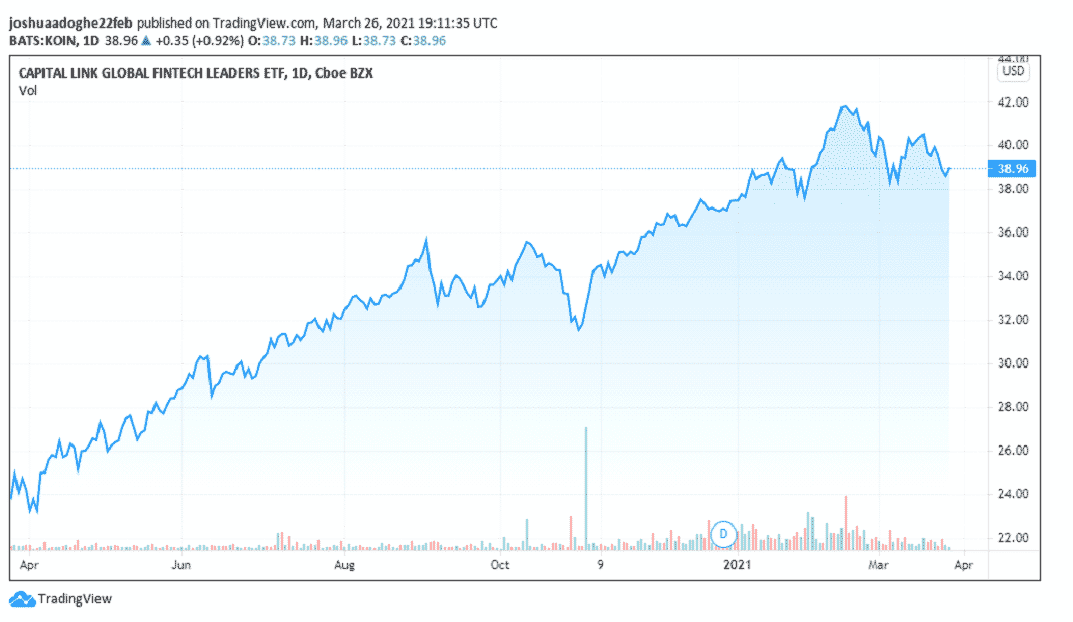

Innovation Shares NextGen Protocol ETF (NYSEARCA: KOIN)

Foundation date

Innovation Shares NextGen Protocol ETF is the fourth-ranking ETF on our list and has been trading since 2018. It tracks the index of over 45 company holdings.

Top companies include:

PayPal Holdings Inc. (PYPL), Taiwan Semiconductor Manufacturing Co., Ltd. (TSM), Microsoft Corporation (MSFT), Cisco Systems, Inc. (CSCO), Intel Corporation (INTC), Mastercard Incorporated (MA), NVIDIA Corporation (NVDA), and Amazon.com, Inc. (AMZN).

The expense ratio, a daily trading share, asset management scale

The expense ratio of KOIN ETF is about 0.95%, with an AUM of 20.6 million US dollars. It trades over 19,404 shares per day with an ADY of $0.15/share.

The return rate: 30.85%

Annual dividend yield

KOIN has an Annual Dividend Yield of 0.4%. KOIN also leverages a categorization of companies into enablers, providers, and users.

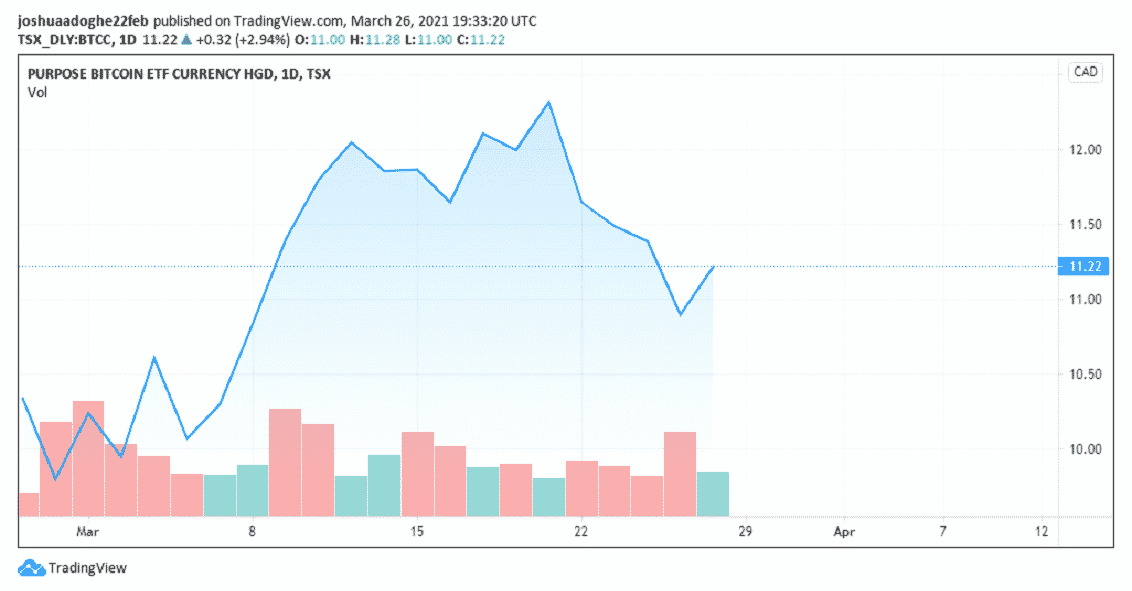

Purpose Bitcoin ETF (TSX: BTCC)

Foundation date

Purpose Bitcoin ETF is the fifth ETF on our top ETF list and came on board in February 2020. It is the first Bitcoin ETF globally and has an AUM of over 590 million US dollars.

Management fees

The management fee of the BTCC ETF is 1%. This ETF holds BTC in cold storage while avoiding high costs.

Average trading volume

BTCC has a 10-day average trading volume of about 1.45 million.

Best Online Brokers for Crypto ETFs

Buying and selling of Crypto ETF shares can be done online using online brokers. Online brokers allow you to trade ETFs commission-free. However, they require you to maintain a minimum balance in your account before making a trade. The top best online brokers for Crypto ETF trades include Ameritrade, Webull, eToro, and Robinhood. There are many reasons why we chose these crypto platforms amongst many great platforms.

Top of the reasons include:

- Overall service as a broker is excellent

- Comprehensive and user-friendly platform

- Number of assets supported by the platform

Conclusion

Since the inception of Bitcoin and other crypto assets, the cryptocurrency market has always faced regulations. On the other hand, Crypto ETFs are a safer way to invest in cryptocurrency assets like Bitcoin without worrying about the regulatory barriers faced by direct crypto investors. Furthermore, the volatility of many crypto assets can be a scare for a lot of investors. This fact makes crypto ETF a safe haven for many investors looking to get into the digital asset space.

We have successfully outlined the top five cryptos ETFs that you can get started with right away. They are best for their track records in the crypto space, their return rate, annual dividend yield, and the companies’ quality in their portfolio. If you are looking to get started in the ETF space, these five crypto ETFs are a great place to start.

Comments