It is rare to have low-risk and high value in the same sentence when referring to commodity trading. However, it checks both boxes and more when it comes to copper. Copper is one of the go-to commodity assets for investors in any given season but more so in a time of economic turmoil.

In addition to being a metal heavily in use across multiple industries, copper is a green metal acting as one of the critical drivers for green energy-the appetite for this globally is at an all-time high. The result of all these factors is a metal market worth upwards of $220 billion and is expected to grow at a CAGR of 5.1% for the period ending 2026.

In addition, global recovery from the ravages of Covid-19 and the Biden infrastructure bill will act as a fan to drive demand in the short term, increasing the opportunity to make a ton of money. Rather than fumble about picking the winning stocks, why not bet on the copper industry with the ETFs below.

Copper ETFs to keep an eye on: how do they work?

Copper is an industrial metal utilized in the energy sector, manufacturing sector, and construction industry. This metal is considered a cyclical commodity that reflects the prevailing economic conditions. Therefore, copper ETFs comprise assets depicting the spot price of copper or organizations along the copper value chain; exploration and mining, refinement, copper utilization in the different sectors of the economy, and all copper-related ancillary services.

Copper ETFs worthy keeping on the crosshairs

Due to its numerous industrial uses, copper plays a significant indirect play in a healthy global economy. Demand for copper goes up when economies are doing well as the globe recovers from the coronavirus. The three copper ETFs below provide a great play on global economic resurgence.

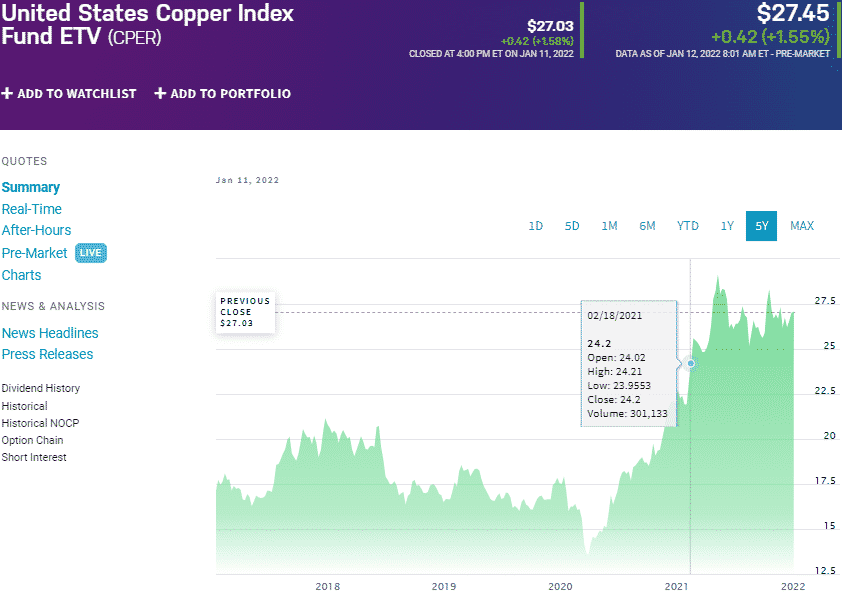

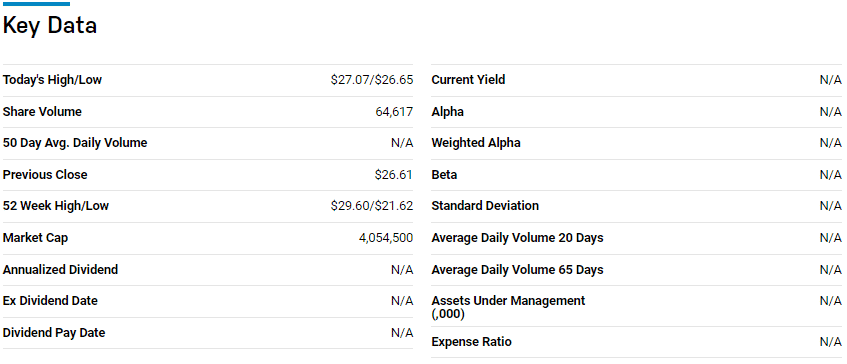

№ 1. United States Copper Index (CPER)

Price: $27.45

Expense ratio: 0.80%

Dividend yield: N/A

CPER chart

The United States Copper Index fund is a passively managed fund seeking to reflect the performance of copper as a commodity, net of liabilities, and fund’s operational cost, by tracking the performance of the SummerHaven Copper Index Total returns. It exposes investors to a copper futures contract on the commodity exchange.

The CPER ETF currently has $228.7 million in assets under management, with an expense ratio of 0.80%. Unlike most precious metals, industrial uses of copper ensure it weathers market downturns in the commodity market. Its emergence as a green metal has ensured that copper and this copper spot ETF continue minting money for its investors; 5-year returns of 58.63%, 3-year returns of 39.54%, and 1-year returns 22.98%.

The economic resurgence will increase demand for copper across its use industries. As the only pureplay copper fund, the CPER is in a great position to cash in on the increasing price of copper on the back of this increased demand.

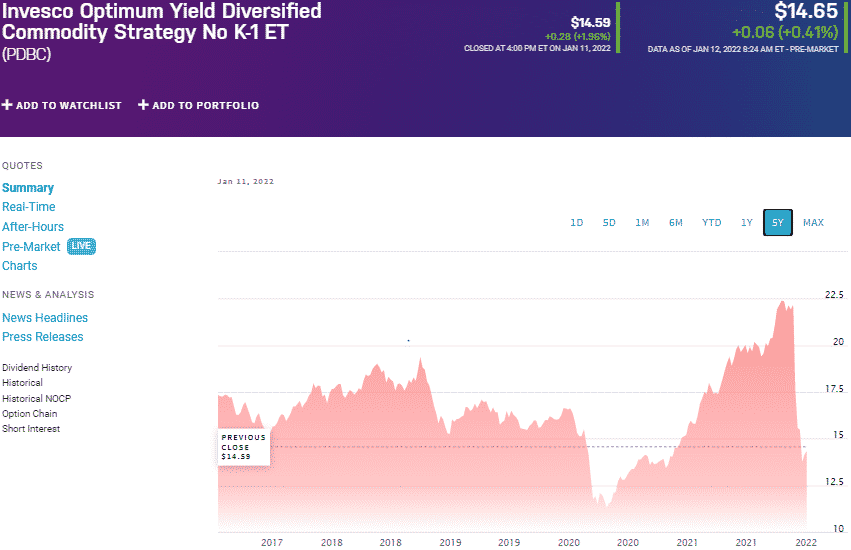

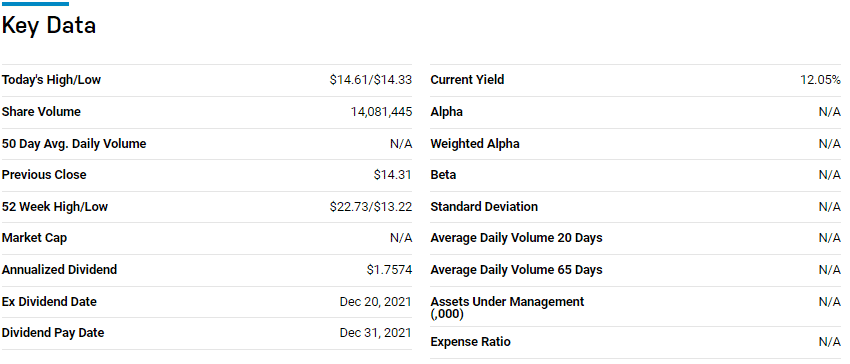

№ 2. Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

Price: $14.65

Expense ratio: 0.59%

Dividend yield: 0.01%

PDBC chart

The Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF is an actively managed fund that exposes investors to the most heavily traded commodities and investment assets of like economic characteristics.

PDBC ETF has $4.84 billion in assets under management, with investors’ parting with $59 annually for every $10000 invested. This fund has a knack of outperforming its category and segment averages and posting more than average returns for investors; 5-year returns of 41.39%, 3-year returns of 42.13%, and 1-year returns of 42.54%. The problem of commodity ETFs is negative roll yield which eats away on returns, but the PDBC solves this by being actively managed.

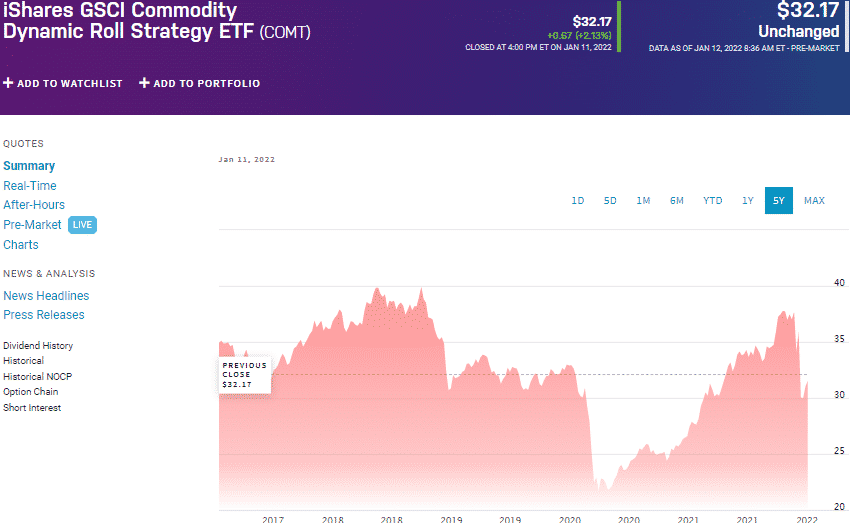

№ 3. iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT)

Price: $32.17

Expense ratio: 0.48%

Dividend yield: 0.26%

COMT chart

The iShares GSCI Commodity Dynamic Roll Strategy ETF tracks the S&P GSCI Dynamic Roll (USD) Total Return Index, investing its assets in a combination of financial instruments to achieve enhanced roll on the total returns; commodity futures contracts, swaps, swap options, and commodity-related futures contracts.

COMT ETF has $2.59 billion in assets under management, with an expense ratio of 0.48%. A problem of investing in commodity ETFs is that most have a specific day futures contract, maturing within a specific time.

To ensure enhanced returns for its investors, the COMT ETF employs a dynamic role that allows the rolling of short-term futures contracts into related long-term contracts hence different price points and returns potential. As a result, it results in better returns, tax advantages, and relatively lower costs.

Concentration on fixed investment-grade assets results in both capital appreciation and interest income, and ultimately better returns5-year returns of 34.46%, 3-year returns of 22.42%, and 1-year returns of 38.59%.

Final thoughts

Copper might be one of the first metals discovered by man, but it has proven to be a gift basket with a bottomless pit. While some metals are expected to take a backseat in the age of green technology, energy, and way of life, copper has yet again proven to be malleable enough to adapt to the change and be at the forefront of this revolution.

The exchange-traded funds above give investors short-term and long-term exposure to the rising prices of copper and a way to cash in on its ever-increasing demand.

Comments