ETF full name: AAM S&P 500 High Dividend Value ETF

Segment: equity: US large-cap value

ETF provider: Advisors Asset Management (AAM)

| GLD key details | |

| Issuer | Advisors Asset Management |

| Dividend | $0.02 |

| Inception date | 28 November 2017 |

| Expense ratio | 0.29% |

| Management company | Advisors Asset Management |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 42.11% |

| Investment objective | Tracks an index of US large caps |

| Investment geography | North America |

| Benchmark | MSCI USA Large Cap Index |

| Leveraged | N/A |

| Median market capitalization | $44.24 billion |

| ESG rating | AA (7.32 / 10) |

| Number of holdings | 58 |

| Weighting methodology | Equal |

About the SPDV ETF

The AAM S&P 500 High Dividend Value ETF had its inception on 28 November 2017. The fund tracks the MSCI USA Large Cap Index of US equity stocks.

The fund selects S&P 500 companies with high, positive dividend free-cash-flow yields. A statistical model scores each security on its dividend and free-cash-flow yield; furthermore, the model removes outliers from the pool. Due to this modeling strategy, the index undergoes rebalancing semi-annually.

The fund invests at least 80% of its total assets in the Index securities, consisting of approximately 500 leading US-listed companies. These companies represent about 80% of the US equity market capitalization.

SPDV Fact-set analytics insight

AAM S&P 500 High Dividend Value ETF has a median market cap of $44.24 billion. The fund has total assets under management of $45.16 million. It has a price-per-earnings ratio of 21.17%. Furthermore, the fund follows an equal index weighting methodology.

The AAM S&P 500 High Dividend Value ETF has a net expense ratio of 0.29%.

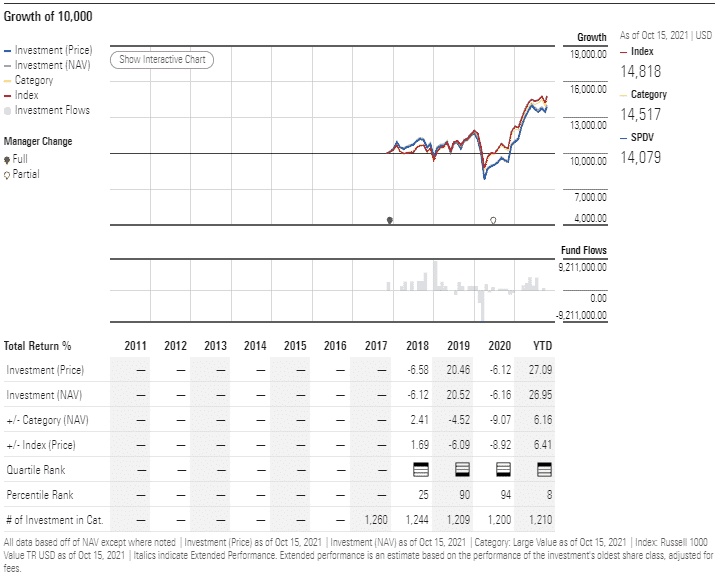

SPDV performance analysis

The SPDV fund has an annualized return of 42.11% and paid dividends on 28 September 2020 of $0.02. The fund’s annual dividend yield is 2.86%.

The fund’s ESG rating is a AA or a score of 7.32 out of 10.

SPDV ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| SPDV Rating | A+ | B / 49 | Quintile 1

(14th percentile) |

* | N/A |

| SPDV ESG Rating | 7.32 / 10 | AA

(7.32 / 10) |

N/A | N/A | N/A |

SPDV key holdings

The SPDV has 58 holdings, of which 99% are investing in US companies. 97.45% of the companies are US based and 1.84% in the UK.

SPDVS top five holdings by sector are: financials (18.79%), consumer cyclicals (14.36%), consumer non-cyclicals (10.69%), industrials (10.50%), and utilities (9.36%).

The top 10 companies make up 21.15% of the SPDV fund’s holdings.

| Ticker | Holding name | % of assets |

| BKR | Barker Hughes Company Class A | 2.33% |

| CTRA | Coterra Energy Inc. | 2.31% |

| CF | CF Industries Holdings, Inc. | 2.25% |

| MPC | Marathon Petroleum Corporation | 2.19% |

| WMB | Williams Petroleum Corporation, Inc. | 2.05% |

| PBCT | People’s United Financials, Inc. | 2.04% |

| RF | Regions Financial Corporation | 2.03% |

| MET | MetLife, Inc. | 2.00% |

| SPG | Simon Property Group, Inc. | 1.97% |

| TSN | Tyson Foods, Inc. Class A | 1.96% |

Industry outlook

Since April 2020, the SPDV fund has been on a bullish run and has gained over 100% value. This growth is due to the positive performance of the top ten holding companies. Furthermore, it has a low expense ratio of 0.29%, making it an affordable fund for management fees. The SPDV fund is an appealing option for investors looking for high-yield dividend-paying returns.

Comments