ETF full name: Simplify US Equity PLUS Convexity ETF

Segment: Equity US large-cap

ETF provider: Simplify

| GLD key details | |

| Issuer | Simplify Asset Management |

| Dividend | $0.13 |

| Inception date | 3 September 2020 |

| Expense ratio | 0.28% |

| Management company | Simplify |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 19.88% |

| Investment objective | Track large-cap US equities |

| Investment geography | North America |

| Benchmark | MSCI USA Large Cap Index |

| Leveraged | N/A |

| Median market capitalization | $604.28 billion |

| ESG rating | A (6.15/10) |

| Number of holdings | 3 |

| Weighting methodology | Proprietary |

About the SPYC ETF

The Simplify US Equity PLUS Convexity ETF (SPYC) had its inception on 3 September 2020. The fund is, therefore, reasonably new. The SPYC ETF tracks large US equity stocks. The SPYC fund benchmarks the MSCI USA Large Cap Index; however, it does not follow any underlying index.

An actively managed ETF, the fund exposes investors to the S&P 500 with a systematic options overlay strategy. The overlay strategy seeks to enhance upside potential and hedge downside risk.

The fund allocates up to 20% of its holdings to the option overlay strategy. Frequent trading occurs for actively managed funds. Therefore, the fund purchases both exchange-traded and OTC put and call options on the S&P 500 index.

SPYC Fact-set analytics insight

The SPYC ETF has $98.87 million assets under management, and the fund has a weighted market cap of $604.28 billion. The fund’s net expense ratio is 0.28%. The US Equity PLUS Convexity ETF has a total of 3.2 million shares outstanding.

SPYC performance analysis

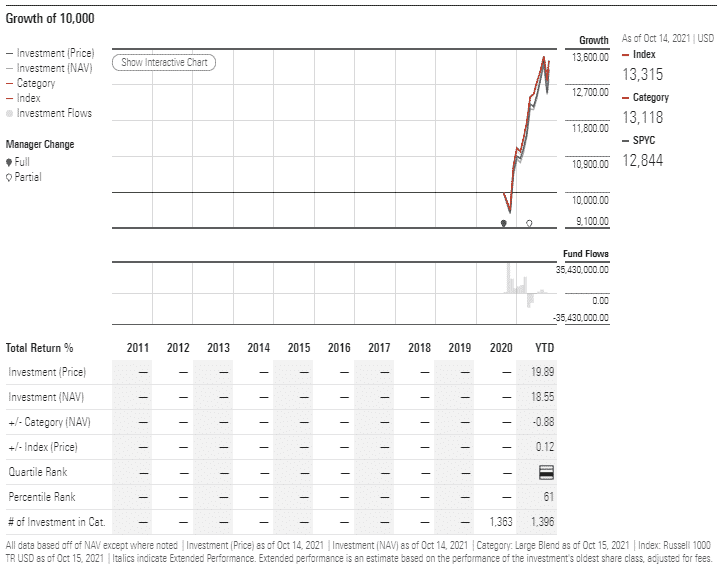

The SPYC has achieved an annual return of 19.88%. The last dividend payment was on 27 September 2021 and amounted to $0.31 with a yearly dividend yield of 1.26%.

The fund has an MSCI ESG of A or a score of 6.15 out of 10.

SPYC ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| SPYC Rating | A+ | -/ 92 | Quintile 1

(2nd percentile) |

N/A | N/A |

| SPYC ESG Rating | 6.15 / 10 | A

6.15/10 |

N/A | N/A | N/A |

SPYC key holdings

The Simplify US Equity PLUS Convexity ETF (SPYC) has three holdings. Its assets are in the iShares Core S&P 500 ETF, options, and the US Dollar.

The fund has 98.51% of its assets invested in large-cap equities. In terms of geography, the fund invests over 98% of its assets in North American companies.

If we look at sector breakdown, the top five are technology (35.47%), consumer cyclical (14.79%), financials (13.44%), healthcare 13.14%, and industrials (8.77%).

Industry outlook

The Simplify US Equity PLUS Convexity ETF has been trading for just over a year. However, the fund has gained over 19% in returns.

According to a report from CNBC, Simplify ETFs that trade options like SPYC have gained roughly $5 billion in the last year.

Simplify’s ETF strategies to use option overlays to hedge against the downside are becoming an attractive strategy for investors. This type of strategy serves as insurance against extreme market volatility.

Comments