What if you could make money in the financial and banking sector? Financial services organizations and banks experience a business boom at the start of earnings season as other equities and investors look for capital for expansion and investments, respectively.

This economic sector is working on overdrive in the current post-pandemic world as everyone tries to get to pre-pandemic capacities. Investors have access to regional bank ETFs as an option to be part of this bullish corner of the economy.

Regional bank ETFs for 2022: how do they work?

Financial and banking services are an entire value chain that transcends bank deposits, withdrawals, and loans. They also provide services such as selling insurance, facilitating investment management payments, brokerage services, and retirement planning. Regional banking ETFs are made up of banks offering all these services, exposing investors to the profits made from these services in addition to the interests paid on loans.

Top 3 regional bank ETFs for effective money management in 2022

The global economy is on the road to recovery from the coronavirus pandemic. Banking and financial services are in high demand as both individuals and organizations look for a way to regain pre-pandemic levels. Couple this with the impending interest rate hikes, and this corner of the economy is up for a prolonged bullish run. The following three regional banking ETFs provide:

- Exposure to this corner of the economy.

- A chance at effective money management in 2022.

- Continued growth in the sector.

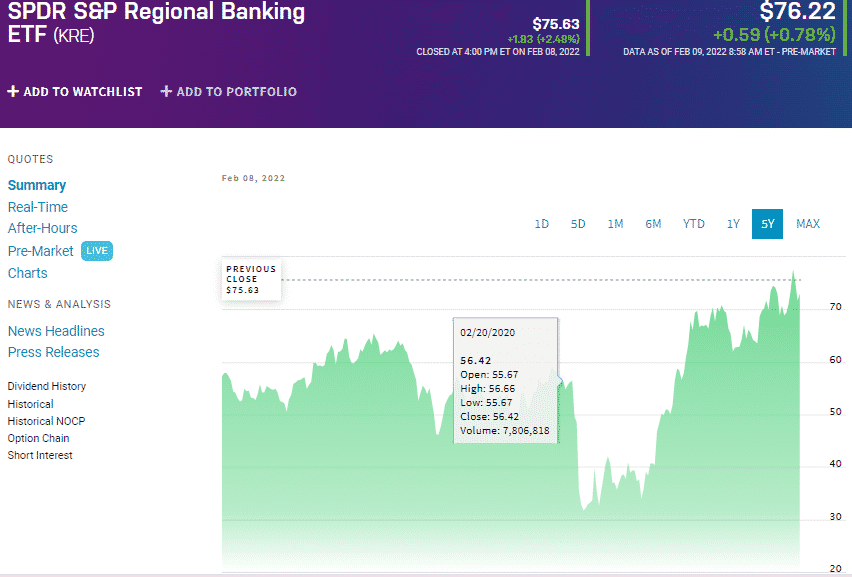

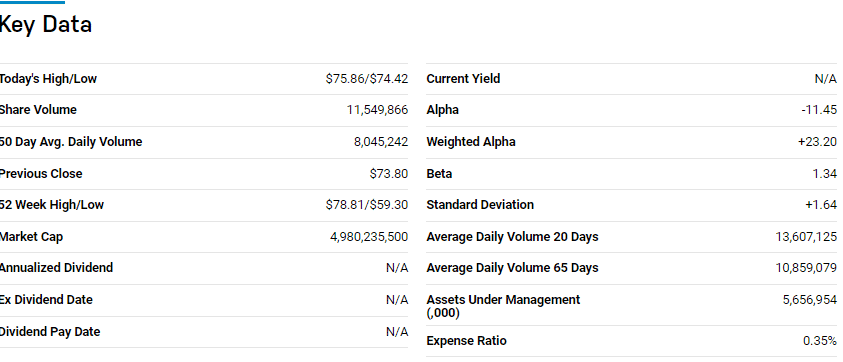

№ 1. SPDR S&P Regional Banking ETF (KRE)

Price: $76.22

Expense ratio: 0.35%

Dividend yield: 1.87%

KRE chart

The SPDR S&P Regional Banking ETF tracks the S&P Regional Banks Select Industry Index, investing at least 80% of its total assets in the tracked index securities. It exposes investors to the US total regional banking segment.

In a list of 30 financial exchange-traded funds, the KRE ETF is ranked № 25 for long-term investing, among passively managed funds.

The top three holdings of this fund are:

- M&T Bank Corporation – 2.22%

- People’s United Financial, Inc. – 2.20%

- Comerica Incorporated – 2.16%

The KRE ETF has $5.63 billion in assets under management, with an expense ratio of 0.35%. A relatively even weighting cap coupled with the incorporation of small and mid-cap stocks makes these ETFs a unique play on the financial services sector, offering value, growth, and minimal concentration risk.

Its composition, which reduces the effect of wall street banks’ volatility on this fund, has resulted in a fund minting consistent returns for its investors; 5-year returns of 53.01%, 3- year returns of 50.10%, and 1-year returns of 28.31%.

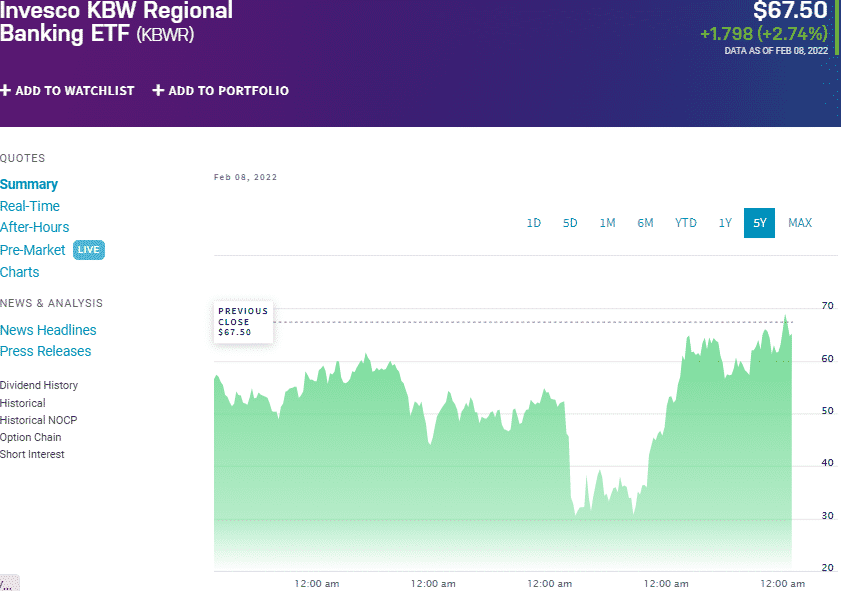

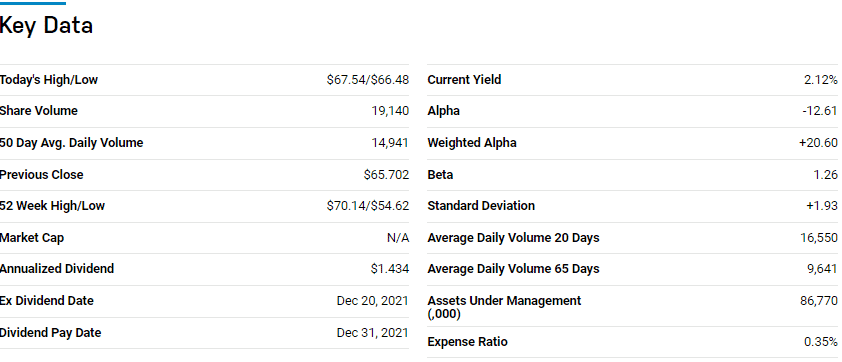

№ 2. Invesco KBW Regional Banking ETF (KBWR)

Price: $67.50

Expense ratio: 0.35%

Dividend yield: 1.93%

KBWR chart

Invesco KBW Regional Banking ETF tracks the KBW Nasdaq Regional Banking Index, investing a minimum of 90% of its total assets in the holdings of its composite index. It exposes investors to publicly traded regional banks and thrift equities in the US.

The top three holdings of this fund are:

- East West Bancorp, Inc. – 4.27%

- Cullen/Frost Bankers, Inc. – 4.02%

- Commerce Bancshares, Inc. – 3.82%

The KBWR ETF has meager assets under management compared to the KRE at $85.8 million, with investors’ parting with $35 annually for every $10.000 invested. This fund provides an indirect play on the gasoline industry by exposing investors to ancillary similar to the KRE ETF; this fund’s shunning of wall street titans to concentrate on regional banks and thrift equities results in an ETF with mitigation against financial sector volatility.

Couple this to pretty even weight distribution and a holding base of 50 holdings, and what you have is a fund that churns consistent returns for investors; 5-year returns of 38.98%, 3-year returns of 41.62%, and 1-year returns of 26.58%.

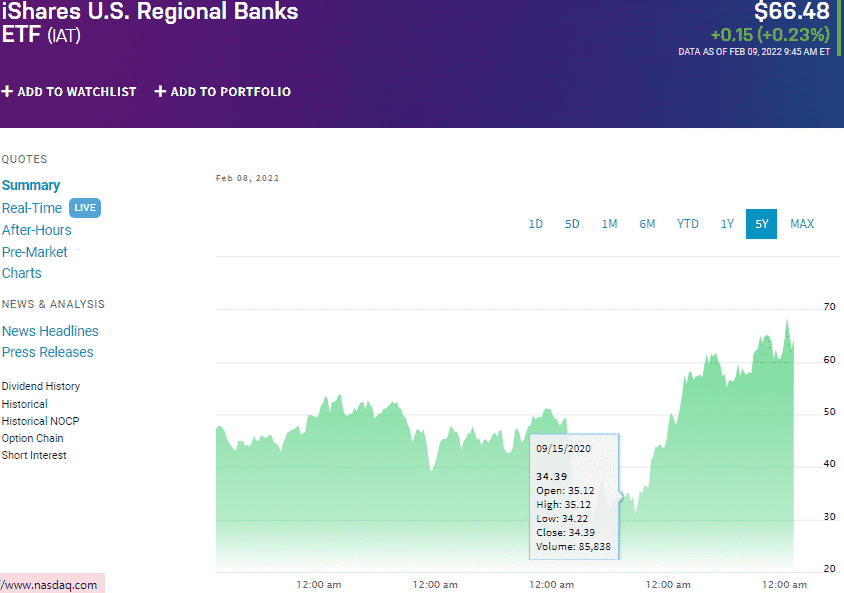

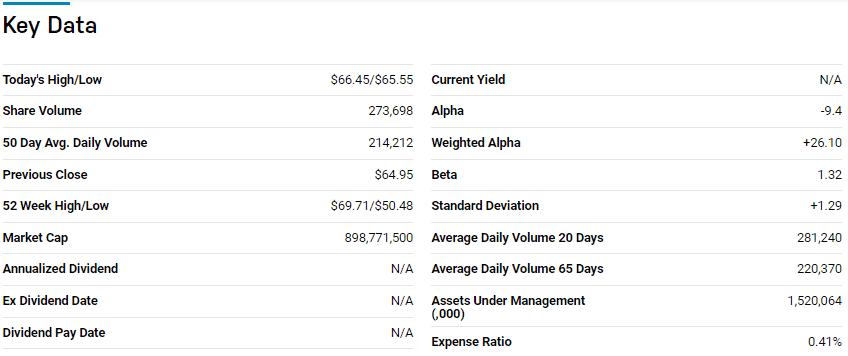

№ 3. iShares US Regional Banks ETF (IAT)

Price: $66.48

Expense ratio: 0.41%

Dividend yield: 1.75%

IAT chart

The iShares US Regional Banks ETF tracks the Dow Jones U.S. Select Regional Banks Index, investing at least 90% of its total assets in the composite index holdings. It exposes investors to mid-cap and small-cap equities specializing in the US regional banking sector.

In a list of 30 financial exchange-traded funds, the IAT ETF is ranked № 12 for long-term investing, among passively managed funds.

The top three holdings of this non-diversified ETF are:

- PNC Financial Services Group, Inc. – 12.89%

- Truist Financial Corporation – 12.47%

- US Bancorp – 11.69%

The IAT ETF has $1.51 billion in assets under management, with an expense ratio of 0.41%. This fund incorporates small and mid-cap stocks making it a unique play on the financial services sector, offering value and growth. However, unlike the other funds on this list, this fund presents some concentration risk, with the top three holdings accounting for around 35% of its total weighting.

Despite this risk, this fund has been a consistent return provider, even outperforming its category and segment averages; 5-year returns of 63.28%, 3- year returns of 56.62%, and 1-year returns of 32.84%.

Final thoughts

The FED is on the verge of interest rate hikes, and with regional banks making the bulk for their profits from net interests rates, they provide the perfect investment assets to take advantage of these measures.

2022 is also expected to result in an accelerated economic resurgence characterized by reduced fiscal policies that set the stage for loan growths and, ultimately, a bullish run for regional banks. Couple this to a steepening yield curve, and the above ETFs give you excellent exposure to a corner of the financial sector expected to outgrow its 2021 growth of 70%.

Comments