Robinhood FX EA is an MT4 tool that claims to be a profitable system. This FX robot uses a special trading algorithm that enables it to minimize losses and increase profits. As per the vendor, the FX EA conducts an hourly market analysis.

We could not find info related to the company, its founding year, developer team, location, and other relevant details. For customer support, an email address and a phone number are provided. The lack of vendor transparency raises our doubts regarding the reliability of the FX robot.

Features of Robinhood FX EA

This ATS system functions automatically without any input from the user. As per the vendor, the FX robot can enter and exit trades automatically 24/7. It uses trade management and does not use high-risk approaches that can harm your capital. The vendor suggests the use of small lots to reduce risks. As important features of this EA, the vendor mentions the use of proper capital management and using proper calculated opening and closing of orders. As per the info on the site, this EA uses an advanced SL technology where the SL positions are very tight and move within a tiny frame ensuring profits. This FX robot uses a flexible configuration and parameters with an inbuilt magic number. The risk management is determined by your existing balance based on which the lot size is chosen.

Trading strategies and currency pairs

Recommendations for Robinhood FX EA

The H1 timeframe is used for this EA and it works mainly on the EURUSD pair. A lot size of 0.01 per $200 is recommended by the vendor. You can use any broker for this EA as it supports all brokers and account types. The default settings are recommended for this MT4 tool. For the trading approach, the vendor states that this EA uses a profitable strategy that does not involve high risk. It does not use dangerous approaches like the Martingale method.

While the vendor claims that the robot makes trades during the range and trend phases of the market, there is no mention of the approach used. The vague strategy explanation raises a red flag for this EA. Furthermore, there are no backtests for this EA which shows the unreliability of the system.

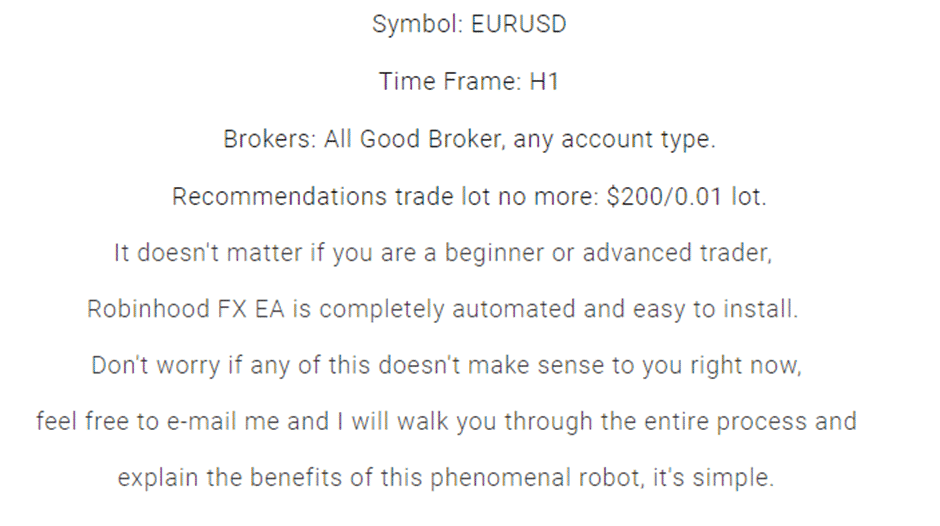

Robinhood FX EA trading statistics

A real CNH account verified by the FXBlue site is present on the official site. Here is a screenshot of the trading statement for this EA.

Verified performance of Robinhood FX EA

From the above screenshot, we can see that the account has generated a total return of 70.8% with a history of 82 days. The monthly and weekly returns for the account are 32.1% and 6.9%. For a trading history of 82 days, the profit factor is 6.47 and the profitability is 82.4%. The risk to reward ratio is 2.37. For a deposit of CNH 752.94, the balance is CNH 1,099.70. From the results, the profits are high but the risk to reward ratio indicates the risk used is high which makes the claims of low risk by the vendor false. Further, the sample size is small so the performance may not turn out to be good in the long term.

Pricing and refund

Pricing plans for Robinhood FX EA

For purchasing this FX robot, you need to choose from the three packages available that range from $127 up to $167. Features provided with the packages include real and demo accounts, a lifelong license, fully automated trading, and 24/5 support. The vendor offers a 30-day money-back guarantee for the product. Compared to the price of competitor systems in the market, the price of this FX EA is not expensive.

What else you should know about Robinhood FX EA

We found one user review for this MT4 tool on forexpeacearmy.com. Here is a screenshot of the feedback.

User review for Robinhood FX EA

From the review, we can see that the user is happy with the product but the last comment about ‘a real scammer loser’ makes us suspect the review is trustworthy. Furthermore, the minimal reviews suggest that this is not a popular EA in the market.

Comments