The word retail, for some reason, brings into mind the hypermarkets and supermarkets. These retail niches account for only 35% of the global retail sales value. Globally, the retail sector accounts for 31% of the world’s GDP. Before the pandemic, this economic sector was valued at approximately 25 trillion dollars, growing at a CAGR of 2.4% from 2015.

However, unlike other sectors that dipped with the coronavirus pandemic, the retail sector has shown tremendous resilience and growth, with experts now estimating a 7.7% CAGR growth up to 2025. The shift has been due to increased consumer spending and improving employment terms, despite the rising inflation and subsequent increase in the cost of goods.

It might also have something to do with the traditional retail business taking advantage of the internet of things to expand their operations and follow in the footsteps of Amazon to take advantage of the global consumer market. It is not a sector that traditionally has been one for significant returns. Still, with all these factors feeding a change in fortunes, the retail funds below give you exposure and a chance at more than average profits.

Retail ETFs for profits in 2022: how do they work?

Retail exchange-traded funds comprise equities involved in providing consumer products and all associated ancillary services; warehouse clubs, apparel and electronics stores, general merchandise stores, specialty stores, footwear stores, accessories stores, department stores, and discount stores.

The best retail ETFs for profit in 2022

The economy is yet to get to pre-pandemic levels, and with rising inflation, usually, expectations would be for consumer expenditure to decline. However, full employment and increasing wage rates coupled with a recovering economy mean more purchasing power to the population, which has resulted in higher consumer spending. The three ETFs below offer diversified exposure to the retail industry and a way to benefit from increased consumer spending.

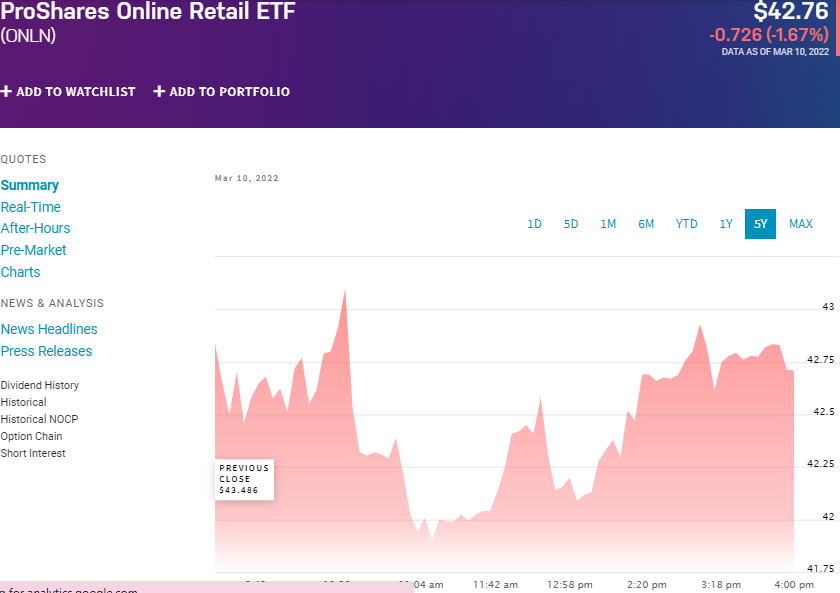

№ 1. SPDR S&P Retail ETF (XRT)

Price: $75.24

Expense ratio: 0.35%

Dividend yield: 0.71%

XRT chart

SPDR S&P Retail ETF tracks the performance of the S&P Retail Select Industry Index, net of expenses and fees. It invests at least 80% of its total assets in the underlying holdings of the tracked index, offering exposure to the largest retail equities publicly traded in the US.

Among 36 cyclical consumer funds, the XRT is ranked №5 by USNews.

The top three holdings of this retail ETF are:

- Kroger Co. – 1.53%

- Sprouts Farmers Markets, Inc. – 1.43%

- Nordstrom, Inc. – 1.43%

The XRT ETF has $369 million in assets under management, with an expense ratio of 0.35%. This ETF uses an equal weighting methodology to ensure a balanced retail fund free of concentration risk. It also diversifies across the retail sector, ensuring that it can weather market downturns; supermarkets, specialty stores, drug stores, automotive dealerships, apparel, and footwear.

Except for the last year, XRT has been a consistent source of returns for investors; 5-year returns of 91.73%, 3-year returns of 77.98%, and 1-year returns of -15.25%.

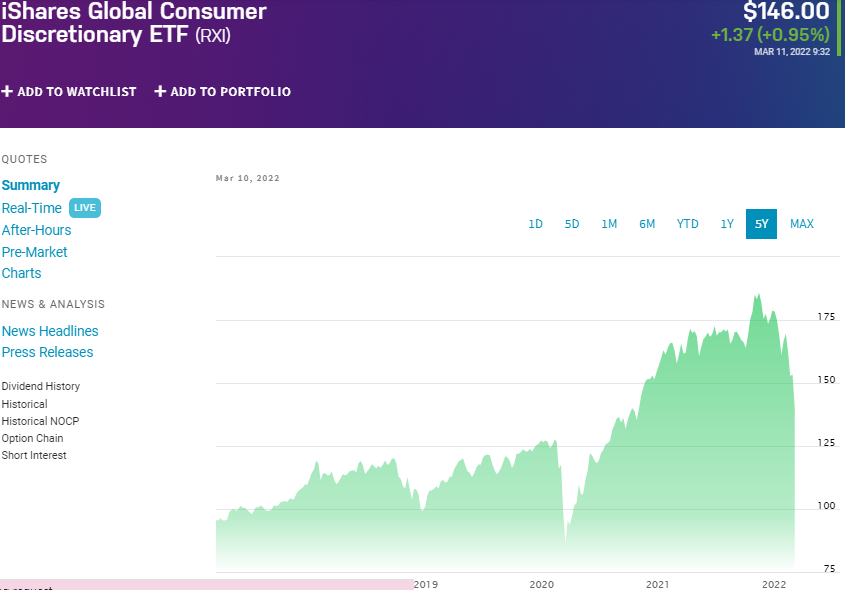

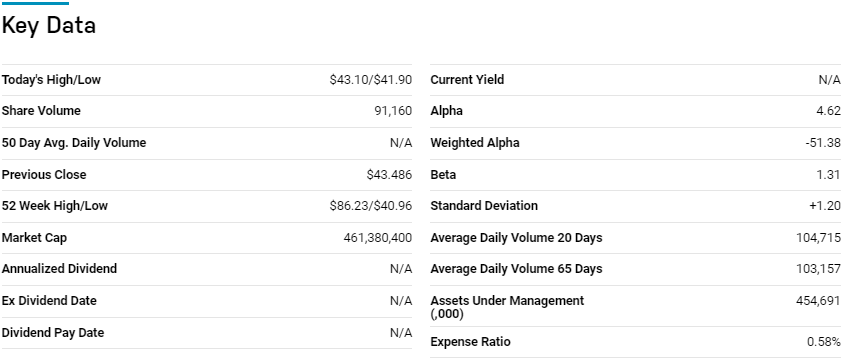

№ 2. ProShares Online Retail ETF (ONLN)

Price: $42.76

Expense ratio: 0.45%

Dividend yield: N/A

ONLN chart

ProShares Online Retail ETF tracks the performance of the ProShares Online Retail Index, net of expenses, and fees. It invests a minimum of 80% of its total assets in its composite index in the same weight distribution. ONLN ETF exposes investors to publicly traded retail equities selling off brick and mortar, non-store sales channels, and mobile and app purchases.

The top three holdings of this ETF are:

- Amazon.com, Inc. – 23.48%

- Alibaba Group Holding Ltd. 3.125% 28-NOV-2021 – 11.08%

- eBay Inc. – 4.93%

ONLN ETF has $454.7 million in assets under management, with investors’ parting with $58 annually for every $10000 invested, a relatively more expensive option than the XRT. Despite the top three holdings accounting for close to 40% of the total fund weight, it uses a modified cap weight, with the largest equities having preferential treatment.

Still, no single equity should account for more than 25% of the total fund weight. Global exposure to equities disrupts the retail segment, especially non-store selling, which means taking advantage of all opportunities riding the consumer expenditure digitization tailwind.

Launched in mid-2018, ONLN has yet to outperform the market, but with the accelerations of off-store selling during the pandemic, which is expected to continue, it is an ETF worth watching closely; 3-year returns of 19.65% and 1-year returns of -45.64%.

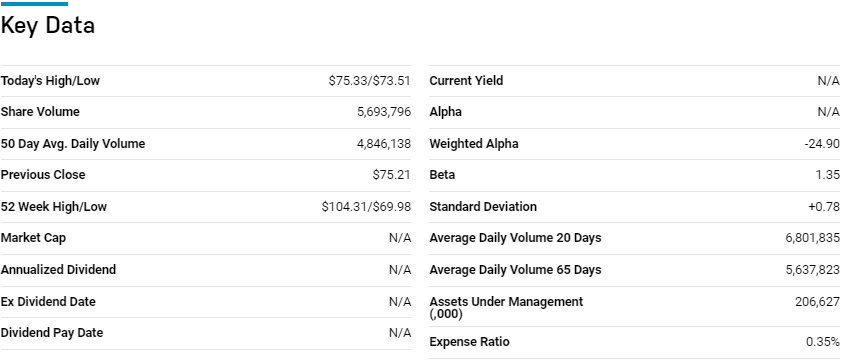

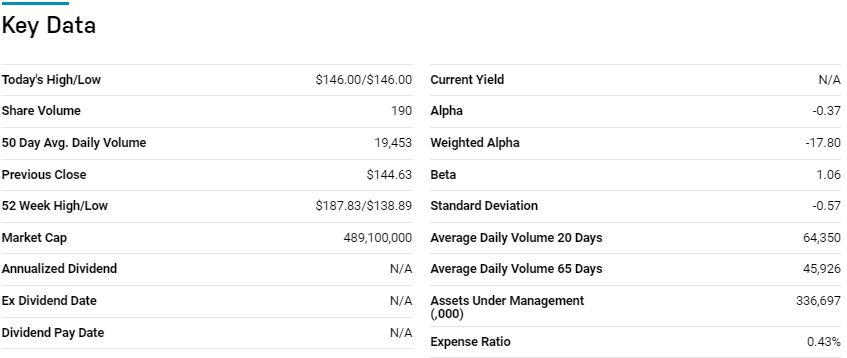

№ 3. iShares Global Consumer Discretionary ETF (RXI)

Price: $146.00

Expense ratio: 0.43%

Dividend yield: 0.64%

RXI chart

The iShares Global Consumer Discretionary ETF tracks the performance of the S&P Global 1200 Consumer Discretionary (Sector) Capped Index, net of fees, and expenses. It invests at least 80% of its total assets in the holdings of its composite index and other securities exhibiting similar economic characteristics to the composite index’s securities. It exposes investors to global consumer discretionary equities; splits holdings evenly between the US and international markets.

The top three holdings of this diversified ETF are:

- Tesla Inc. — 9.89%

- Amazon.com, Inc. — 9.73%

- Home Depot, Inc. — 4.27%

The RXI ETF has $336.7 million in assets under management, with investors having to part with $43 for every investment worth $10000 annually. This fund is not a pure-play retail ETF but has significant exposure to the industry, providing diversified exposure to the retail sector. It also caps single equity weighting to 10%, providing a pretty evenly weighted fund.

Holdings are also screened to ensure the fund maintains a high beta that outperforms bullish markets. The result is a globally diversified fund providing consistent profits to its investors; 5-year returns of 62.36%, 3-year returns of 36.97%, and 1-year returns of -9.00%.

Final thoughts

The retail industry is undergoing evolution and stepping into the digital space. The result of its digitization is the opening up of the global consumer markets for those with an online presence and, for consumers, convenient shopping. As the economy continues to recover from the coronavirus and consumer spending increases, the ETFs above provide a way to invest in the retail sector for portfolio profits.

Comments