ETF full name: Invesco California AMT-Free Municipal Bond ETF (PWZ)

Segment: California Municipal Bond

ETF provider: Invesco

| PWZ key details | ||

| Manager | Team Managed | |

| Dividend | 2.33% | |

| Inception date | 1st October 2007 | |

| Expense ratio | 0.28% | |

| Average Daily $ Volume | $1.84M | |

| Investment objective | Replication Strategy | |

| Investment geography | California Municipal Council | |

| Benchmark | CE BofAML California Long-Term Core Plus Municipal Securities Index FTSE | |

| Weighted Average Market Cap | N/A | |

| Net Assets under Management | $565.2 Million | |

| Number of holdings | 212 | |

| Weighting methodology | Market Capitalization | |

About the PWZ ETF

In economic turmoil, investors turn to hedge assets such as bonds. However, not all bonds were created equal. Historically, municipal bond returns have consistently outperformed their government-based counterparts.

Therefore, with the current economic turmoil in the post-pandemic error, portfolios need diversification to result in consistent income to offset the losses due to market volatility. In addition, they have tax incentives that will result in more money in the pocket for investors. One of the best options to achieve this is the Invesco California AMT-Free Municipal Bond ETF.

PWZ Fact-set analytics insight

The Invesco California AMT-Free Municipal bond fund tracks the CE BofAML California Long-Term Core Plus Municipal Securities Index FTSE Index intending to replicate its performance as closely as possible, net of expenses and fees.

It invests at least 80% of its total assets in the securities of the composite index and the remaining 20% in financial instruments with similar economic characteristics; future contracts, cash equivalents, swap contacts, cash, and options. It gives investors exposure to California-issued US dollar denominated tax-exempt municipal debts. In addition, it includes Muni-debts issued by US territories that have the same tax benefits.

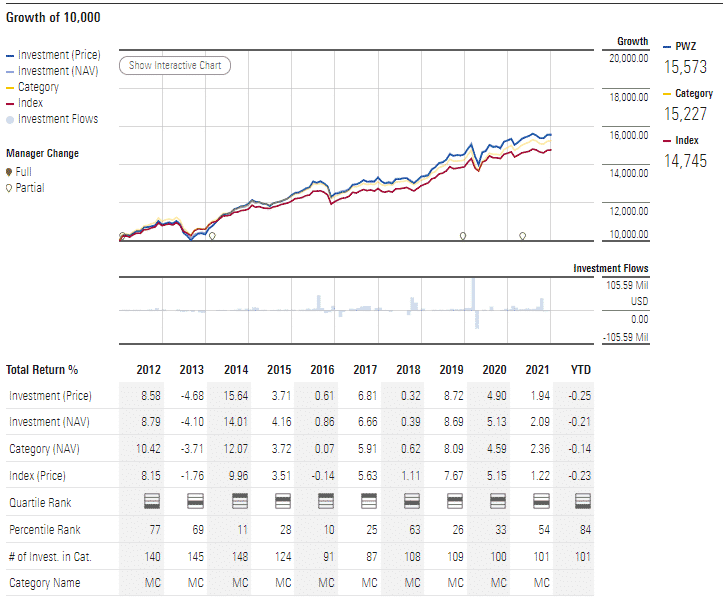

PWZ performance analysis

Municipal bond funds are fixed-income debt instruments issued to raise funds by municipal agencies. As such, investors look to them for their consistent income generation rather than returns. However, a look at the historical performance of the PWZ shows that it has been a consistent return generator for its investors in addition to income generation; 5-year of 24.40%, 3-year returns of 16.05%, and pandemic year returns of 1.46%.

Despite its negative returns, this bond ETF has consistently yielded to its investors more than average income to the tune of $1.43 dividend to the share, monthly.

PWZ ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A- | B | N/A | *** | N/A |

| IPO ESG Rating | N/A | N/A | 4th Quantile | N/A | N/A |

PWZ key holdings

The PWZ holding base comprises high-quality municipal tax-exempt bonds from California and some US territories with the same tax incentives. However, it has a concentration bias towards bonds with a longer maturity, which increases interest rate risk. However, the trade-off is attractive to the high-risk-high return investors since it results in better yields.

| Holding | % Assets |

| California Health Facs Fing Auth Rev 4.0% 15-AUG-2050 | 4.57% |

| San Diego Calif Uni Sch Dist 5.0% 01-JUL-2041 | 2.93% |

| Los Angeles Cnty Calif Pub Wks Fing Auth Lease Rev 5.0% 01-DEC-2049 | 2.40% |

| San Francisco Calif Bay Area Rapid Tran Dist 3.0% 01-AUG-2050 | 2.00% |

| San Francisco Calif City & Cnty Arpts Commn Intlarpt Rev 5.0% 01-MAY-2048 | 1.53% |

| San Mateo Foster City Calif Pub Fing Auth Wastewater Rev 5.0% 01-AUG-2049 | 1.47% |

| Los Angeles Cnty Calif Met Transn Auth Sales Taxrev 5.0% 01-JUL-2042 | 1.40% |

| University Calif Revs 4.0% 15-MAY-2046 | 1.28% |

| University Calif Revs 5.0% 15-MAY-2046 | 1.16% |

| Chino Vy Uni Sch Dist Calif 5.0% 01-AUG-2055 | 1.12% |

Industry outlook

Having a bond fund provides diversification and enhanced portfolio returns. A municipal bond fund results in higher yields for the portfolio, consistent income and a buffer in times of market volatility and downturn. With the unchecked inflation rates currently, PWZ ETF provides a great starting point for putting money in investor pockets and taking care of rising prices. In addition, the Biden trillion-dollar infrastructure bill and higher taxes in the coming months call for an asset that can take advantage of the projects while reducing the tax burden.

Comments