ETF full name: Defiance Next Gen Altered Experience ETF

Segment: Healthcare Sector

ETF provider: Defiance ETFs

| PSY key details | ||

| Issuer | Defiance ETFs | |

| Inception date | May 27, 2021 | |

| Expense ratio | 0.75% | |

| Average daily $ volume | $119.71K | |

| Investment objective | Replication strategy | |

| Investment geography | US Pharma, Biotech, and Life Sciences | |

| Benchmark | BITA Medical Psychedelics, Cannabis, and Ketamine Index | |

| Net assets under management | $4.9M | |

About the PSY ETF

The pandemic has been a reflection and disruption on several fronts, both negative and positive. One of these revelations was the rise in mental depression and anxiety illnesses and episodes. The result was the growth of the off-label drugs market, accelerating the need for authorities the globe over to put in place a robust framework for the legal psychedelic market.

This corner of the pharmaceutical industry is expected to grow at a CAGR of 13.3% between now and 2027. As global acceptance of psychedelics and cannabis as the go-to drug for treating anxieties, addictions, and mental disorders gains global acceptance, the CAGR is expected to expand. Couple this with the continued legalization of cannabis across the globe for personal and medicinal use as a psychedelic and the resulting annual CAGR of 32%, and these two infant markets have a lot of upside potential.

How then can one invest prudently in these two niches? The Defiance Next Gen Altered Experience ETF is an excellent starting point.

PSY fact-set analytics insight

As closely as possible, this ETF tracks the total return performance of the BITA Medical Psychedelics, Cannabis, and Ketamine Index, net of expenses and fees. To meet its investment objective, it invests all of its assets in the holdings of its tracked index by utilizing a replication strategy that achieves the same weighting as its composite index. The result is a fund that exposes investors to global equities involved in the legal research, development, selling, marketing, and distribution of psychedelics, medical marijuana, ketamine, cannabidiol derivatives, and cannabis pharmaceuticals. All equities making up the index must derive at least 50% of their revenues from legal psychedelics or marijuana.

PSY annual performance analysis

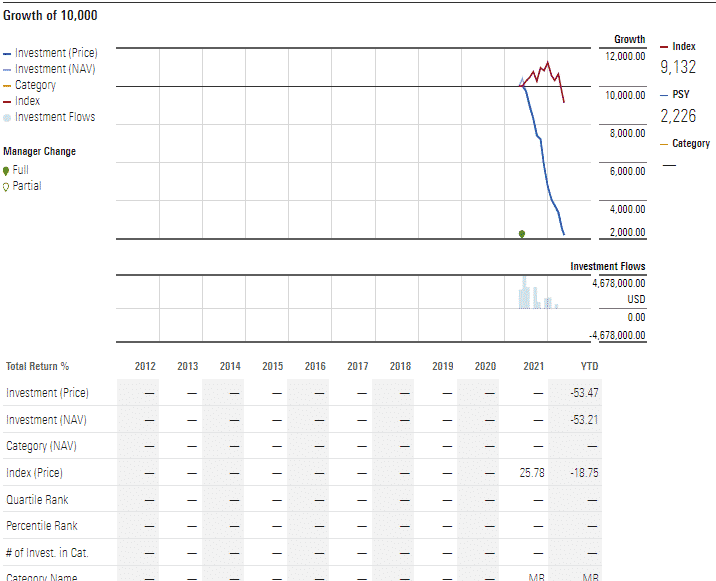

PSY growth chart

With less than 12 months under its belt, this legal psychedelic and marijuana-focused fund are yet to post positive returns. However, given positive results for its index in the first 12 months after launch, there is significant upside potential for the PSY ETF as more countries legalize marijuana and psychedelics for recreational and medicinal use.

PSY ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.COM | MARKETWATCH | Morningstar.com | Money.usnews.com |

| IPO Rating | N/A | D | N/A | N/A | N/A |

| IPO ESG Rating | N/A | N/A | N/A | N/A | N/A |

PSY key holdings

Defiance Next Gen Altered Experience ETF is a reasonably new fund exposed to highly volatile infant industries. As such, its cap weighting mitigates against concentration risk and high volatility. Semi-annual rebalancing and reconstitutions ensure the fund stays true to its investment objective.

The top ten holdings of this fund.

| Ticker | Holding | % Assets |

| CRON | Cronos Group Inc | 10.64% |

| ACB | Aurora Cannabis Inc. | 8.81% |

| ATAI | ATAI Life Sciences N.V. | 7.60% |

| GRWG | GrowGeneration Corp. | 7.30% |

| IIPR | Innovative Industrial Properties Inc | 7.04% |

| MMED | Mind Medicine (MindMed), Inc. | 6.97% |

| XXII | 22nd Century Group, Inc. | 6.11% |

| CMPS | COMPASS Pathways Plc Sponsored ADR | 4.87% |

| CRDL | Cardiol Therapeutics Inc. Class A | 4.87% |

| GHRS | GH Research Plc | 4.84% |

Industry outlook

The growth of thematic ETFs is primarily due to compelling narratives driving the growth of their respective industries. Research into psychedelics and cannabis for medicinal use, especially for depression, mental disorders, and pain relief, has proven they are more effective than conventional medicine.

The result is a fast-paced industry that is highly volatile, like all infant industries. As more of the globe comes to terms with this new routine and growth of the psychedelics and marijuana industries accelerates, the PSY ETF offers a chance to buy the dip at the current price and a profit ride on the resulting upside potential.

Comments