ETF full name: VanEck Uranium Nuclear Energy ETF (NLR)

Segment: Global Nuclear Energy

ETF provider: VanEck

| URA key details | ||

| Issuer | VanEck | |

| Dividend yield | 2.05% | |

| Inception date | 13th August 2007 | |

| Expense ratio | 0.61% | |

| Average Daily $ volume | $161.4K | |

| Investment objective | Replication Strategy | |

| Investment geography | Global Nuclear Energy Equities | |

| Benchmark | MVIS Global Uranium & Nuclear Energy Index | |

| Weighted Average Market Cap | $28.68 billion | |

| Net Assets under Management | $27.57 million | |

| ESG rating | 5.91 out of 10 | |

| Number of holdings | 25 | |

| Weighting methodology | Weighted average market cap | |

About the NLR ETF

At present, the global community has fully grasped the detriment fossil fuels have on our environment. Thus, community kicking off a race between developed countries to alternative, scalable, sustainable, and environmentally friendly energy sources.

As a result, the global nuclear power plants are increasing exponentially as developed and emerging economies seek green energy options resulting in increased demand for uranium to power nuclear energy sources.

Despite the ever-increasing appetite for renewable energy, nuclear-based energy is still far from total global acceptance. This industry comprises a few big player organizations resulting in a highly volatile energy niche. Therefore, picking individual stocks that have the legroom to make money as this market grows is problematic. It is for this reason that the VanEck Uranium + Nuclear Energy ETF exists.

NLR Fact-set analytics insight

This ETF seeks to replicate the performance of the MVIS Global Uranium & Nuclear Energy Index. Doing so exposes investors to global firms involved in the nuclear supply chain ranging from uranium exploration to ancillary nuclear-related services.

NLR invests at least 80% of its assets in the underlying holdings of its composite index. In addition, it also invests in depository receipts with economic characteristics similar to those of the tracked index.

Despite having a global reach, the NLR is overly biased to the US and Japan economies, with US stocks alone accounting for a quarter of the fund’s weight.

NLR performance analysis

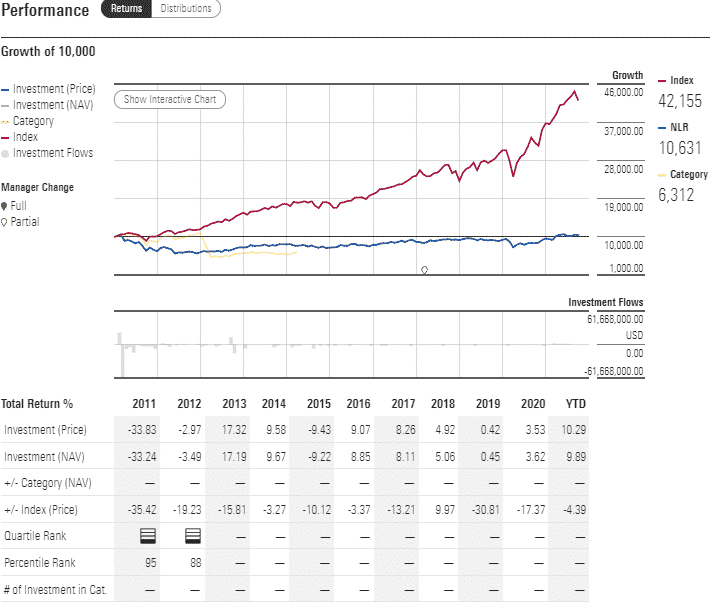

A glance at the chart below shows NLR ETF has been a consistent performer. As the global community affirms that nuclear energy is not only a destructive weapon but has the potential for sustainable clean energy, the appetite for uranium and nuclear energy is going to grow.

With tentacles in organizations across the nuclear value chain, from input material manufacture to actual nuclear power plant operation, the NLR is an excellent option for investors with a long-term bullish outlook on all thing’s nuclear energy.

A look at its historical performance reveals that it trails its nuclear counterparts, presenting the legroom necessary for wealth accumulation; 5-year returns of 33.03%, 3-year returns of 12.28%, and pandemic year returns of 22.60%.

NLR ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A+ | C | Quantile 1 | N/A | N/A |

| IPO ESG Rating | 6.55/10 | 5.91/10 | N/A | 34.37 out of 50 | N/A |

NLR key holdings

NLR asset base is not as extensive as the URA pure play ETF. This nuclear energy ETF comprises only 25 underlying holdings with a maximum weight capping of 8% on any individual organization.

As a result, it has fewer holdings than URA but does not have the concentration bias of the latter. Despite the US not being the largest producer or consumer of nuclear energy, this ETF is geographically skewed towards US uranium and nuclear energy equities, 49.7%.

The top ten holdings of the NLR are as below.

| Ticker | Holding name | % of assets |

| D | Dominion Energy Inc. | 7.78% |

| DUK | Duke Energy Corp. | 7.68% |

| EXC | Exelon Corp. | 6.96% |

| PEG | Public Service Enterprise Group Inc. | 6.40% |

| FORTUM | Fortum Oyj | 5.55% |

| ETR | Entergy Corp. | 5.38% |

| PCG | PG&E Corp. | 5.34% |

| CEZ | CEZ Group | 4.76% |

| TYO:9503 | Kansai Electric Power Company, Inc. | 4.68% |

| EDF | Electricite de France SA | 4.59% |

NLR reconstitutes its holding base quarterly to ensure it stays true to its investment objectives-underlying holdings must derive at least 50% of their total revenues from nuclear-related activities.

Industry outlook

Estimates show that the world nuclear energy supply will double in the next three decades, showing an increasing appetite for clean, renewable, and scalable energy. Under the right circumstances, scientists reveal that nuclear energy is the most efficient and cost-friendly alternative energy source.

According to Zack’s analysts, the increasing demand for nuclear energy from China and India, among other emerging markets, is attributable to the appreciating value of uranium and nuclear-related equities.

Having already recorded a year-to-date return of 10.29%, the NLR has the potential to mint money as this energy niche market grows.

Comments