ETF full name: Direxion Moonshot Innovators ETF (MOON)

Segment: US Broad Thematic

ETF provider: Rafferty Asset Management

| MOON key details | ||

| Issuer | Rafferty Asset Management | |

| Dividend | 0.42% | |

| Inception date | 12th November 2020 | |

| Expense ratio | 0.65% | |

| Average Daily $ Volume | $1.93 million | |

| Investment objective | Replication Strategy | |

| Investment geography | US Science and Technology | |

| Benchmark | S&P Kensho Moonshots Index | |

| Weighted Average Market Cap | $4.00 billion | |

| Net Assets under Management | $154.8 million | |

| Number of holdings | 50 | |

| Weighting methodology | a | |

About the MOON ETF

Mankind’s advancement is determined by the rate of innovation and how fast the global populace embraces and adopts these innovations. In the current world, technology and science are driving the next phase of human evolution, and they have proven to be highly dynamic, providing numerous opportunities to make money. With the Direxion Moonshot Innovators ETF, investors get a front-row seat to all disruptive innovations transforming businesses and society.

MOON Fact-set analytics insight

The Direxion Moonshot Innovators ETF tracks the S&P Kensho Moonshots Index, intending to replicate its performance as closely as possible, net of expenses and fees. MOON invests at least 80% of its net assets in the underlying holdings of its composite index, which comprise 50 top companies involved in innovations with the highest potential for disrupting existing technologies, “Moonshot innovators.”

To ensure growth, MOON ETF focuses on mid and small-cap organizations, applying modified equal weighting on the holdings; weighted equally first, then adjusted to conform to the target liquidity, diversification constraints, and industry grouping.

MOON performance analysis

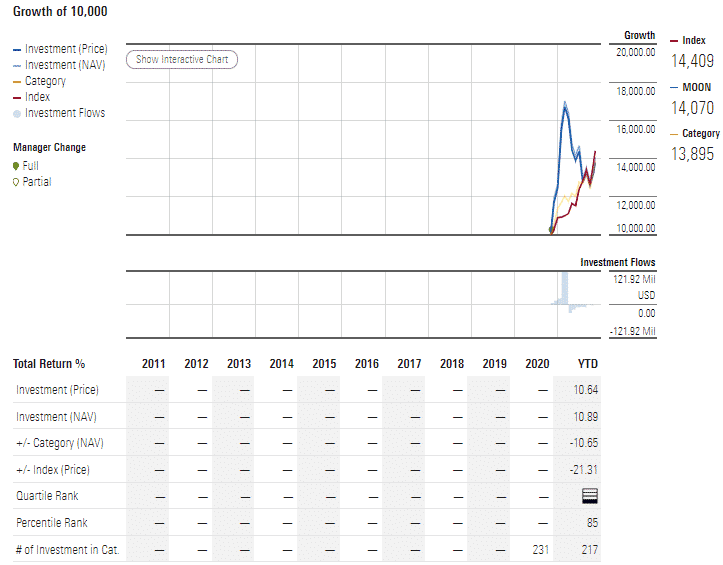

It might not be unheard of for an ETF to post positive returns on its debut year. Nevertheless, the chart below shows that despite MOON launching in late 2020 and dealing with the coronavirus pandemic, investors have enjoyed positive returns with a decent standard deviation to the category average.

At only 50 underlying holdings, MOON is a non-diversified fund. Its objective, however, means that those underlying holdings cut across six sectors at the forefront of innovation for the next evolution of humankind. The year-to-date returns of 9.47%, despite launching in a pandemic year, show that disruptive innovations are the drivers of the world today.

MOON ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A+ | N/A | N/A | N/A | N/A |

| IPO ESG Rating | 6.33/10 | 6.33/10 | N/A | 28.84 out of 50 | N/A |

MOON key holdings

Despite having a limited holding base, this ETF has companies from six different sectors, with the top ten holdings below.

| Ticker | Holding name | % of assets |

| ASAN | Asana, Inc. Class A | 6.92% |

| LC | LendingClub Corp. | 5.66% |

| AMBA | Ambarella, Inc. | 4.20% |

| MDB | MongoDB, Inc. Class A | 3.69% |

| SLAB | Silicon Laboratories Inc. | 3.19% |

| PRQR | ProQR Therapeutics N.V. | 2.72% |

| VRNS | Varonis Systems, Inc. | 2.71% |

| FFIV | F5 Networks, Inc. | 2.64% |

| SOHU | Sohu.com Limited Sponsored ADR | 2.63% |

| RDWR | Radware Ltd. | 2.48% |

MOON ETF management rebalances its holding base quarterly and reconstitutes it semi-annually to stay true to its investment objective.

Direxion Moonshot Innovators ETF might be biased towards domestic equities, but its focus on the next disruptive innovation necessitates the need for footprints globally:

- USA — 76.7%

- Asia Developed — 6.4%

- Asia Emerging — 5.6%

- Canada — 3.7%

- United Kingdom — 3.2%

- Eurozone — 2.7%

- Europe Ex Euro — 1.6%

Given that MOON focuses on the next disruptive frontier, it is no surprise that it only has representation from six economic segments.

| Industry | MOON |

| Technology | 50.98% |

| Healthcare | 16.20% |

| Industrials | 10.63% |

| Consumer cyclicals | 9.24% |

| Communication services | 7.27% |

| Financial services | 5.68% |

Industry outlook

Having mid-cap and small-cap equities as part of its 50 holding-base gives this ETF a balance between the potential for growth and reduced volatility and risk levels. As such, the ever-increasing appetite for efficiency in how every task is run fuels the never-ending race for innovation.

Combining this with increased consumer awareness of the importance of climate and environmental reclamation and innovation becomes a basic need rather than a corporate goal for offering a competitive edge. MOON is pretty crowded with already established funds, but its focus on the formative innovation phase across six different fronts gives it an edge; robotics, metaverse, internet of things, cyber security, artificial intelligence, and analytics.

With the innovation space expected to pick up pace post coronavirus pandemic, MOON ETFs focus on early innovation phase investing and places it in pole position to benefit.

Comments