Not all positive climate change and environmental reclamation efforts are tech-based. Global water catchment areas receive their fair share of beef-up through forest repopulation and afforestation efforts.

Aggressive tree planting ensures that the increasing appetite for lumber and timber does not overtake climate change efforts, making it one of the most sustainable natural resources. As this tailwind starts a bullish run in this corner of the commodity market, the ETFs below give you a chance to infuse some hope for portfolio growth and value in 2022.

Wood, Forest, and Lumber ETFs: how do they work?

Market uncertainty, rising inflation rates, and unprecedented market volatility call for investment assets that provide a hedge. Unfortunately, precious metal is the default commodity investment option to many. Forest, lumber, and wood niches of the commodity market provide a durable option to hedge against the same indicators.

How do you invest in this hedge sector?

Investors can gain exposure to this industry via either equities or exchange-traded funds. However, ETFs offer exposure to the entire sector, making them the ideal investment vehicle for this niche of the commodity market. These wood, forest, and lumber ETFs comprise; organizations involved in forested leasing land, timber harvesting, afforestation and forest repopulation activities, and lumber processing, distribution, and sale. Some may even diversify to sectors benefiting from this resource; real estate, cyclical consumer sectors, industrial sector, among others.

The best three lumber ETFs for 2022 to take advantage of soaring prices

Timber, forest, and lumber transcend over several sectors, providing an indirect into them and a way to check the pulse of the investment market. In addition, they proved over the last +40 years to be an almost perfect complement to equity investing. The ETFs below are a great starting point to be a part of this sustainable demand market and its stability.

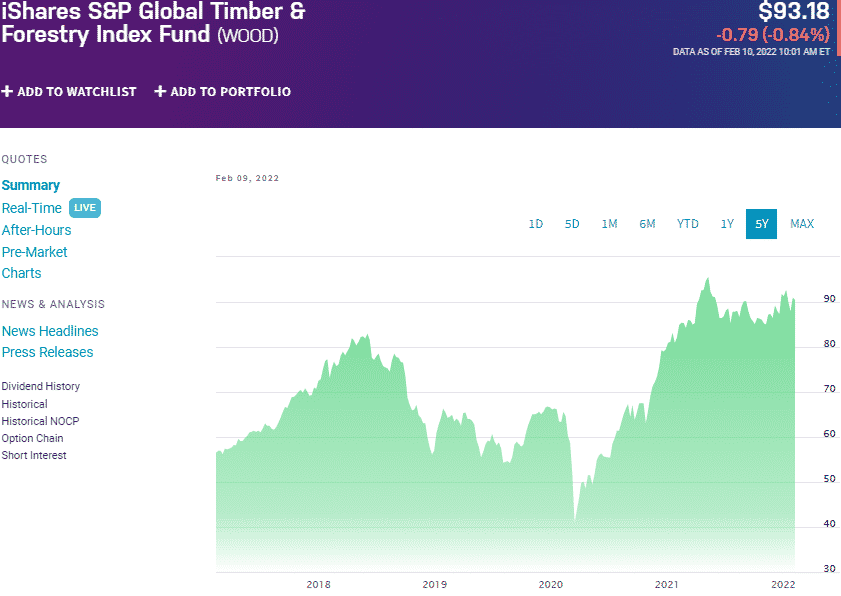

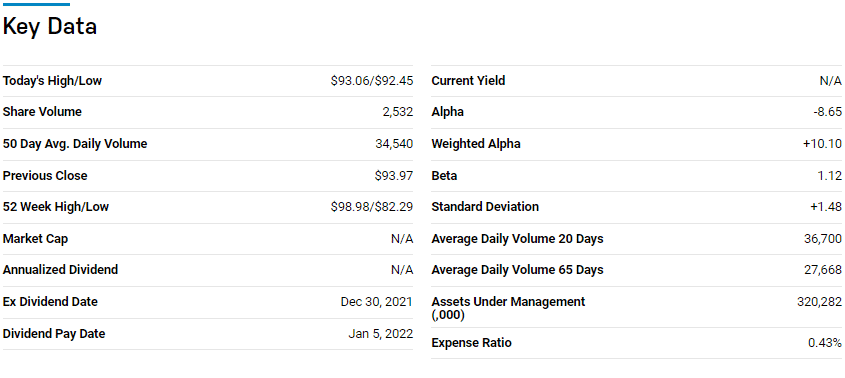

№ 1. iShares Global Timber and Forestry Fund (WOOD)

Price: $93.23

Expense ratio: 0.43%

Annual dividend yield: 1.36%

WOOD chart

The iShares Global Timber and Forestry Fund tracks seek to replicate the performance of the S&P Global Timber & Forestry Index, net of expenses, and fees. To achieve its objective, it invests at any given time a minimum of 80% of total assets to the securities included in its composite index, including futures, swap contracts, cash, options, and cash equivalents.

In a list of 38 natural resources exchange-traded funds, USNews ranks the WOOD ETF at №15 for long-term investing.

The top three holdings of this ETF are:

- West Fraser Timber Co. Ltd. – 9.47%

- Weyerhaeuser Company – 9.03%

- Svenska Cellulosa AB Class B – 8.48%

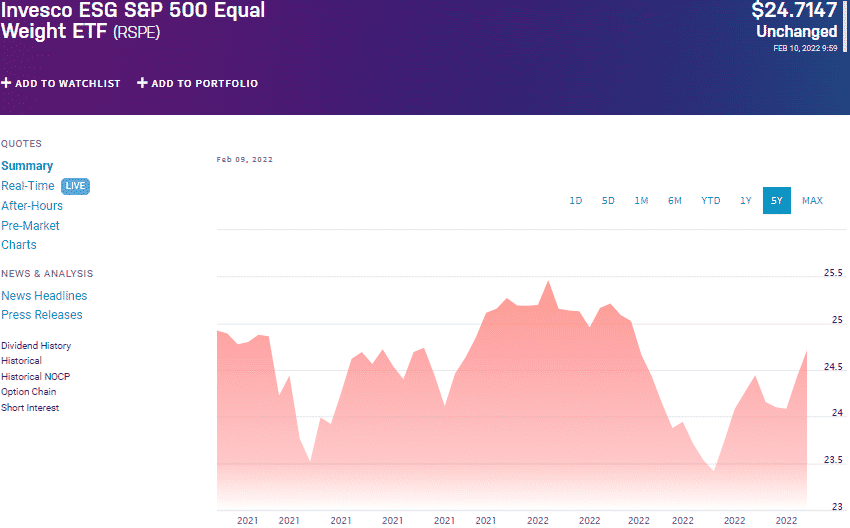

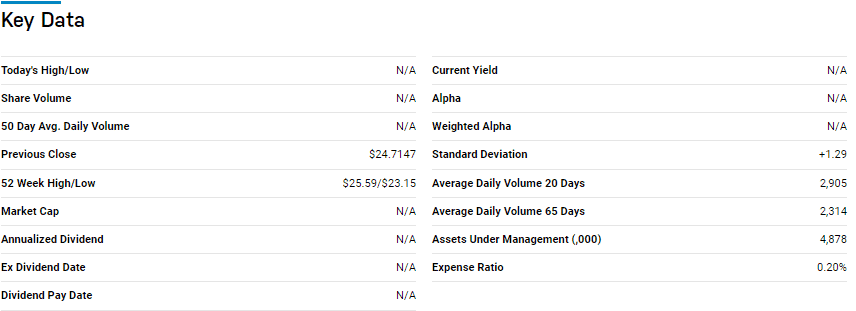

№ 2. Invesco ESG S&P 500 Equal Weight ETF (RSPE)

Price: $24.71

Expense ratio: 0.20%

Annual dividend yield: N/A

RSPE chart

Invesco ESG S&P 500 Equal Weight ETF tracks the performance of the S&P 500 Equal-Weight ESG Leaders Select Index, investing at least 90% of its total assets in the securities of its underlying holdings via an equally weighted sampling strategy. It exposes investors to the top-rated S&P 500 equities with the best ESG score; environmental, social, and governance.

The top three holdings of this ETF are:

- Activision Blizzard, Inc. – 0.75%

- DXC Technology Co. – 0.69%

- Mosaic Company – 0.69%

The RSPE ETF is a fairly new exchange-traded fund in this corner of the commodity market. It has just $4.9 million in assets under management, with a relatively low expense ratio of 0.35%, for a new fund. An equally weighted holdings’ selection methodology ensures no concentration risk while their blue-chip attribute provides stability. These ETFs provide timer, lumber, and wood exposure through an $8 trillion valued market, sustainable investing.

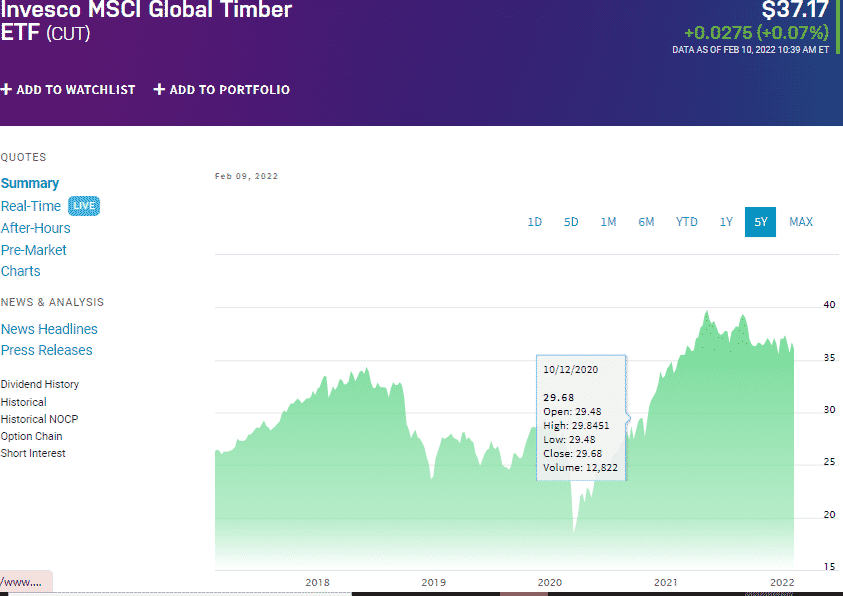

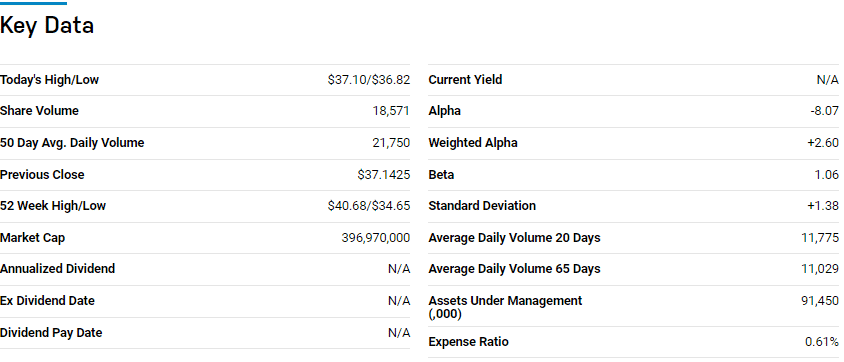

№ 3. Invesco MSCI Global Timber ETF (CUT)

Price: $37.17

Expense ratio: 0.61%

Dividend yield: 1.49%

CUT chart

The Invesco MSCI Global Timber Fund tracks seek to replicate the performance of the MSCI ACWI IMI Timber Select Capped Index, net of expenses, and fees. To achieve its objective, it invests at any given time a minimum of 90% total assets to the securities included in its composite index, including their associated ADRs and GDRs.

The top three holdings of this ETF are:

- West Fraser Timber Co. Ltd. – 5.61%

- Packaging Corporation of America – 5.20%

- UPM-Kymmene Oyj – 5.17%

CUT ETF has $91.5 million in assets under management, with investors having to part with $61 annually for every $10000 investment. CUT, therefore, exposes investors to equities of organizations that own and operate forests and timberyards, harvest the timber for commercial use and sale of wood-based products, and those that produce timber-based end products.

With a holding base of upwards of 200 holdings, this ETF provides more diversification in the timber industry than the other ETFs on this list. Free of concentration risk, this ETF has been a consistent return provider for investors; 5-year returns of 58.89%, 3-year returns of 45.13%, and 1-year returns of 8.36%.

Final thoughts

Forest land, timber, and lumber are among the oldest assets man ever to make an investment asset. With this corner of the market providing sustainable natural resource inputs and being a part of the sustainable investment docket, the ETFs on this list are in pole position to benefit and exhibit serious returns.

Comments