Gold has been since time immemorial a store of value first in addition to the other industrial uses. The coronavirus affected a lot of industries, and gold was not spared. However, things are back on track, with experts forecasting a 3% CAGR growth for the gold mining market from now to 2026.

Despite these figures, the gold market is affected by forces of demand and supply, global inflation rates, and currency valuation due to its acceptance globally as a store of value. It is, therefore, a commodity that is highly liquid but also highly volatile. For short-term amplified returns during times of gold volatility, investors have access to the leveraged gold ETFs.

What is the composition of leveraged gold ETF?

Conventional exchange-traded funds consist of economically like investment assets that track an index to replicate its performance with minimal deviation. On the other hand, leveraged ETFs comprise derivatives future contracts of tracked index holdings and the underlying assets ensuring amplified returns compared to the composite index movement.

Leveraged gold ETFs to make a quick buck in 2022

Inflation is at an all-time high, and the economic resurgence has slowed down. The result is a market with a lot of uncertainty fueling investor jitters. In such conditions, the gold market thrives due to this precious metal attribute of a store of value, substituting the green buck and an inflation-protected commodity.

With 2022 pipped to be a year full of unprecedented market movements, the leveraged gold ETFs below provide an avenue to capitalize on this volatility and make a killing in the markets if played right.

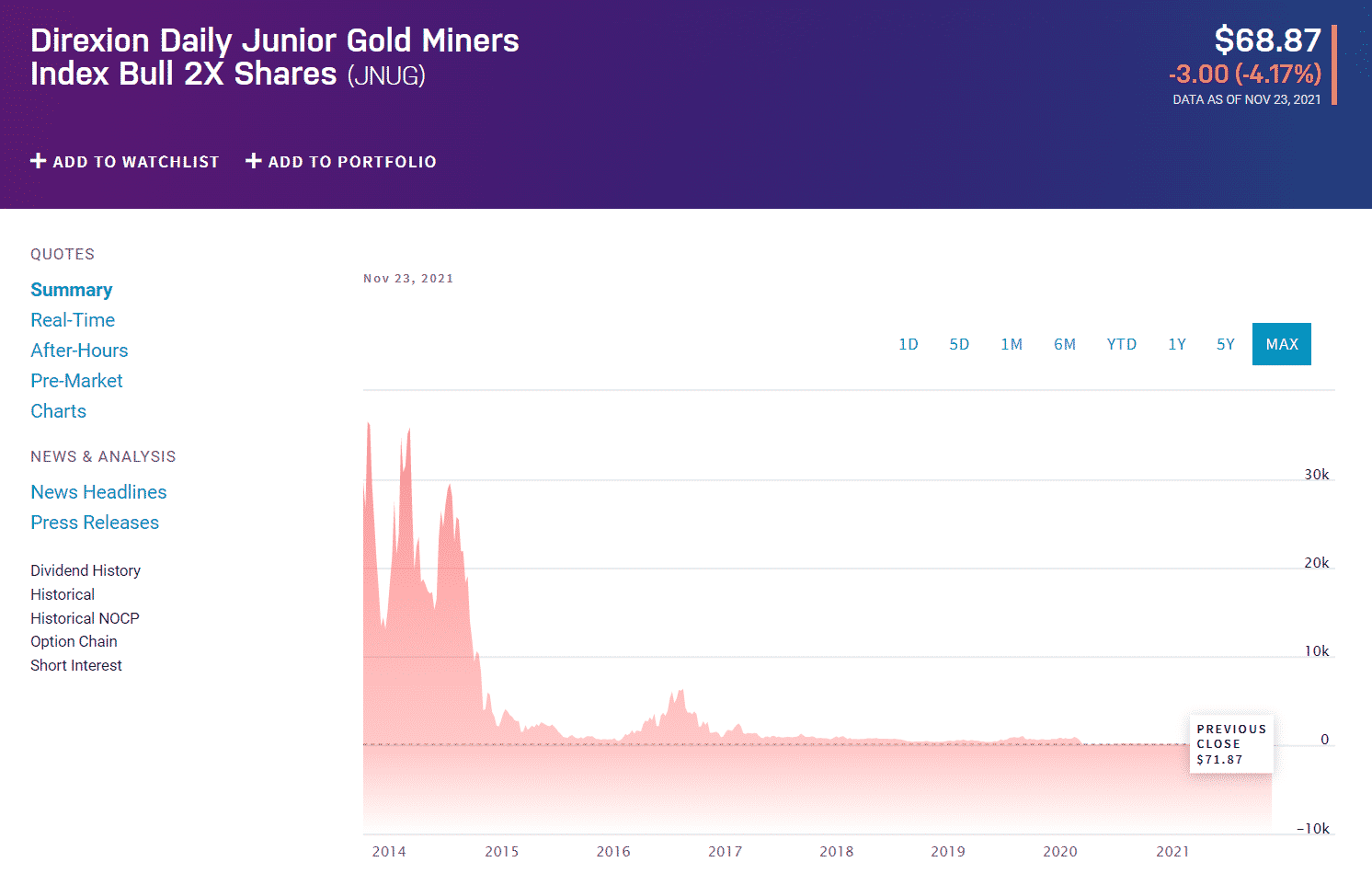

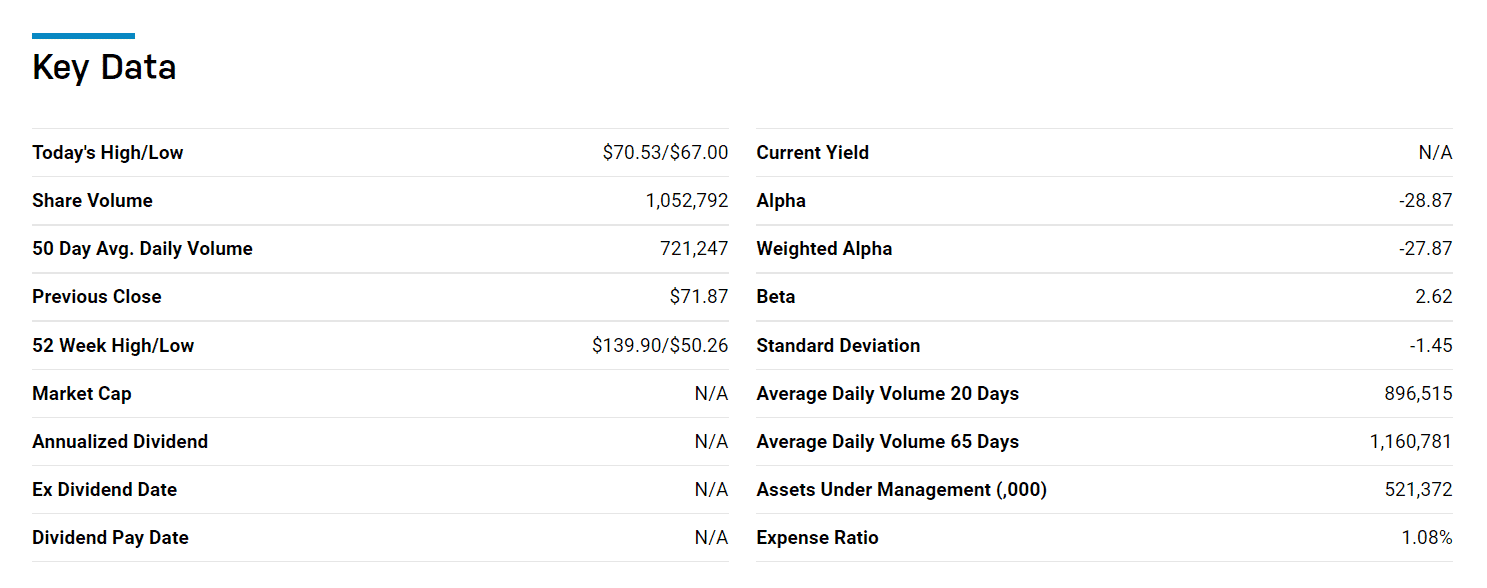

№ 1. Direxion Daily Jr Gold Miners Bull 3X ETF (JNUG)

Price: $68.87

Expense ratio: 1.08%

JNUG chart

The Direxion Junior Gold Miners Bull 2X ETF seeks the returns of the MVIS Global Junior Gold Miners Index twice daily. It invests 80% of its resources in financial instruments that track the composite index and other financial instruments and ETFs of like economic characteristics that ensure daily leveraged returns.

The top three holdings of this ETF as of now are:

- The US Dollar — 31.45%

- VanEck Junior Gold Miners ETF — 30.36%

- Goldman Sachs Trust Financial Square Treasury Instruments Fund Institutional — 20.88%

JNUG ETF boasts $582.34 million in assets under management, with an expense ratio of 1.08%. It distributes its dividends quarterly, and currently, its investors are enjoying dividends of $0.34 to the share.

As inflation continues soaring with FED insisting that it is still transitory, this leveraged gold ETF has shown to have the potential to make returns during short market volatility movements; 3-month returns of 23.26% and one-month returns of 13.11%. It is one of the most heavily traded leveraged funds globally also ensures its liquidity facilitates fast exits in times of market downturn.

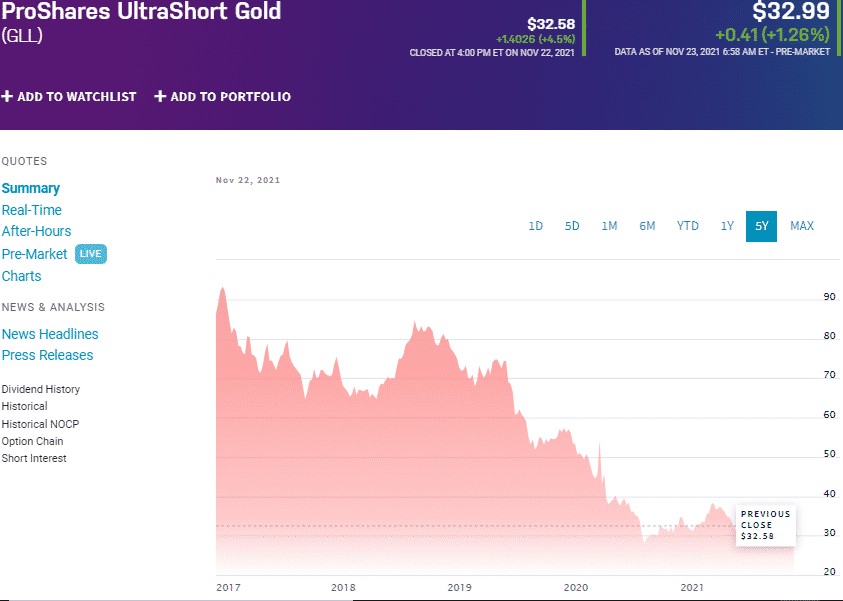

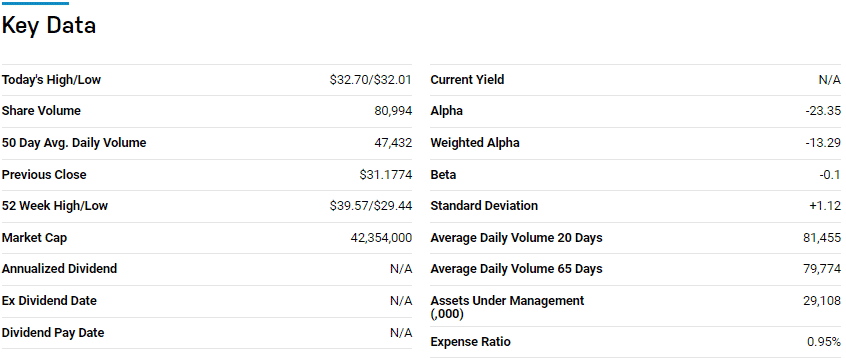

№ 2. ProShares UltraShort Gold (GLL)

Price: $32.99

Expense ratio: 0.9%

GLL chart

The ProShares Ultrashort Gold ETF seeks the returns of the Bloomberg Gold SubindexSM twice daily. It invests 95% of its resources in its composite index financial instruments; future contracts, swap agreements, and forward contracts.

The GLL ETF has $30.84 million in assets under management, with investors having to part with $95 annually for every $10000 investment. Despite the compounding effect of leveraged ETFs, the ProShares Ultrashort Gold ETF has a year-to-date return of 0.11%, putting a strong case for consideration when playing off gold volatility.

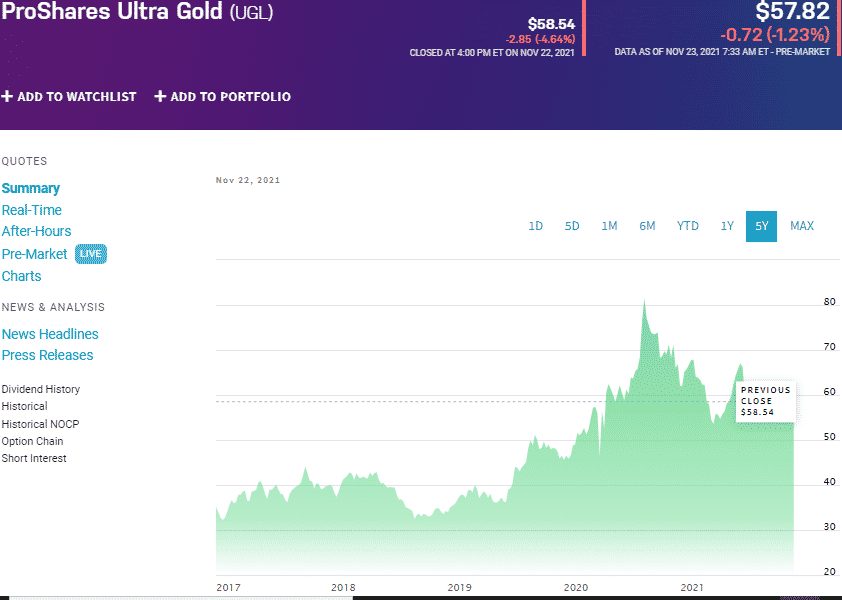

№ 3. ProShares Ultra Gold Fund (UGL)

Price: $57.82

Expense ratio: 0.95%

UGL chart

The ProShares Ultra Gold ETF seeks the returns of the Bloomberg Gold SubindexSM twice daily. Unlike its counterpart, the GLL, this leveraged gold ETF does not invest in any commodity directly. However, it invests in varying financial instruments, at the discretion of the fund advisor, that will resort to twice the returns of the tracked index daily.

The UGL has $225.52 million in assets under management, with an expense ratio of 0.95%. With a stake in the spot price of gold, the UGL provides a trading opportunity with every fundamental affecting the gold industry.

With the slide in the dollar value and rising inflation that FED insists are still within acceptable levels, the UGL, despite the compounding effect, has been posting positive returns; 3-month returns of 6.03% and one-month returns of 9.57%.

The year 2022 is bound to experience several unprecedented market movements, and the UGL’s historical performance is an indication that it can make money for investors in an uncertain market.

Final thoughts

In the short term, all fundamentals that touch on the mining sector, inflation, and currency valuation affect the price of gold. Despite cryptocurrencies providing an alternative store of value to commodities, they are yet to be accepted globally and not yet understood by the majority of the world populace.

For all of these reasons, gold remains the alternative global currency, resulting in a highly liquid market and highly volatile. The above-leveraged gold ETFs provide an excellent way to prey on gold prices and make a quick buck daily to take advantage of this volatility. The crucial aspect to remember is the compounding effect associated with leveraged ETFs calling for close monitoring of trades.

Comments