Tired of pouring over screeners and individual financial statements looking for different investment vehicles to diversify your portfolio? Index funds are the answer.

They have become synonymous with retirement investing, but they are a quick portfolio diversification fix. In the words of Warren Buffett, “Index funds are a haven investment for those without the knack for picking individual stocks.”

What are index funds?

They can be either mutual funds or exchange-traded funds. The composition of index funds is for the sole purpose of tracking an economic-financial index. The fund manager is tasked with ensuring results that match the tracked index as closely as possible. Therefore, they ensure that investors get exposure to either the whole economy or a niche, with deficient portfolio turnover levels and meager investment costs.

Most index funds’ composition defines their associated markets, ensuring that in the long run, profits are a guarantee since the economy has to grow; the S&P 500 index has averaged annualized returns of approximately 10% since its inception in 1992.

Their resilience in the face of economic fluctuations is the reason for their popularity with retirement investment accounts.

How to be part of the index funds’ market?

Unlike exchange-traded funds, index funds, in most cases, have a minimum investment requirement. As such, to be part of this low-cost and low-risk investment niche, you have to employ the services of a broker. Available to investors are traditional call brokers and online brokerage firms.

To escape the minimum investment requirements, online brokerage firms are investors’ best bet since most of them waive the minimum capping in an attempt to attract more clientele.

Trigger happy investors become part of this market by investing through index funds’ CFD, contract for differences only since they don’t trade throughout the day like ETFs. Buy and hold investors take part through buying shares.

Once a broker has been chosen, being part of this market is a simple three-step process.

| Step 1 | Step 2 | Step 3 |

| Deposit investment capital with the chosen index fund broker | Screen the index funds provided and pick one in line with your investment objectives and risk tolerance levels | Buy the index fund |

The best index funds in the 2021 investor jittery market

Over time, the investment markets have proven that they always win, and there is no sure way of “timing” them. Investing in index funds is all about meeting and making money off the market long-term moves rather than trying to beat the market, ensuring gains over the long haul. Index fund depends on individual investment goals, acceptable risk levels, and available investment capital.

However, the three funds with the best performance track record historically coupled with a low investment cost to help you weather the current uncertain market conditions are as follows. Just remember, historical performance is not a guarantee of future profits.

№ 1. Vanguard 500 Index Fund (VFIAX)

Price: $431.04

Expense ratio: 0.14%

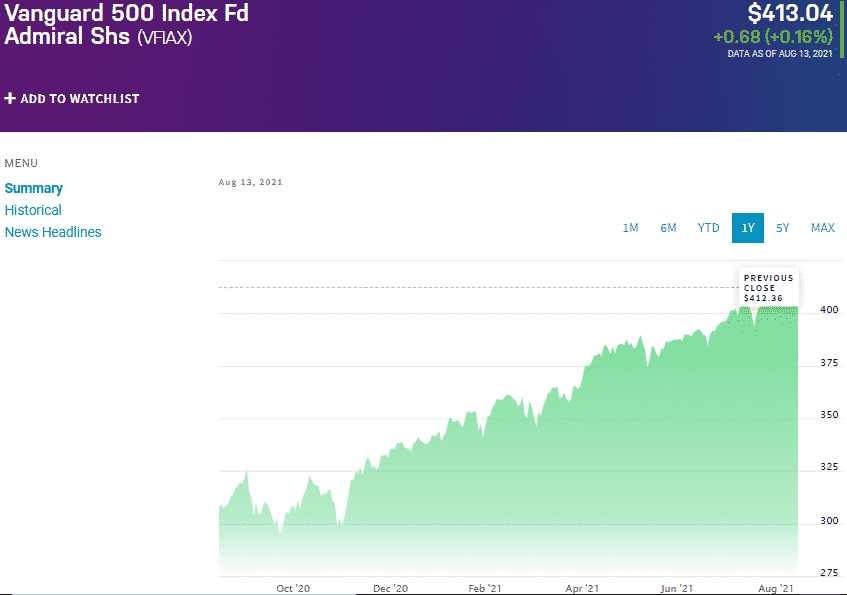

Vanguard 500 Index Fund (VFIAX) chart

The VFIAX is the flagship index fund by Vanguard, and with the launch year of 1976, the oldest index fund available to investors. It tracks the S&P 500 index giving investors exposure to the overall US economy by investing in the largest 500 US equities.

The top holdings for this fund are:

- Apple

- Johnson & Johnson

- Microsoft

- Amazon

With such industry bigwigs in their respective market niches, it is no surprise that this fund has managed approximately 17.5% returns over the last five years and 15% in the previous decade.

In a pandemic year when almost everything was at a standstill, the VFIAX recorded 40.6% returns. It has $239.32 billion in assets under management, with an expense ratio of 0.14% and 0.04% for its admiral shares variant. The minimum one can invest $3000 for the standard index and $10,000 for the admiral variant.

№ 2. First Trust Dow Jones Internet Index Fund (FDN)

Price: $241.35

Expense ratio: 0.51%

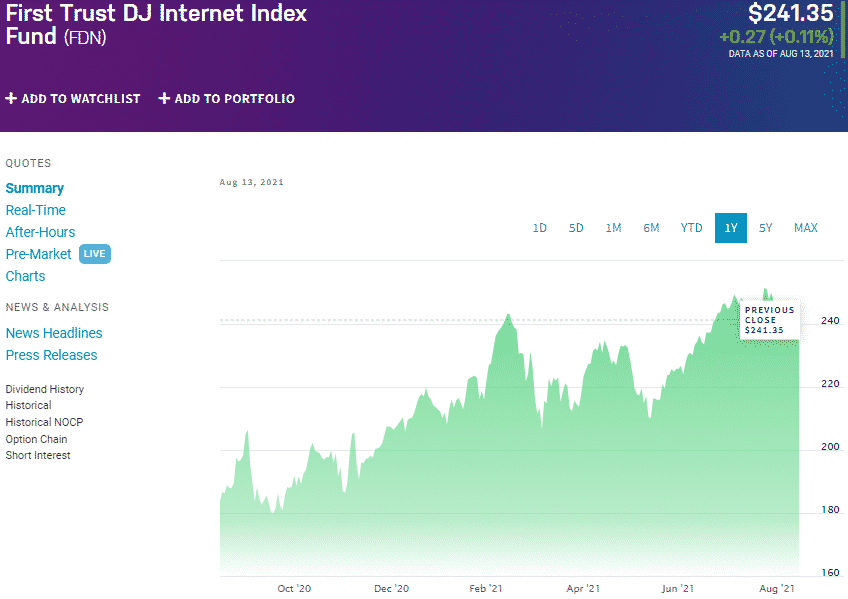

First Trust Dow Jones Internet Index Fund (FDN) chart

The FDN tracks the Dow Jones Internet Composite Index to expose investors to the most liquid internet-based organizations. Despite being a Composite Index made up of two indices, the Dow Jones Internet Commerce Index and the Dow Jones Internet Services Index, it is a non-diversified passive fund.

The top holdings for this fund are:

- Amazon Inc. — 9.18%

- Facebook Inc., Class A shares — 7.89%

- Alphabet Inc., aka Google, Class A shares — 5.48%

The holding portfolio coupled with the rate of internet adoption and changes have seen this fund record 5-year returns of 27.7% and over the last decade 21.06%; double the SPY returns.

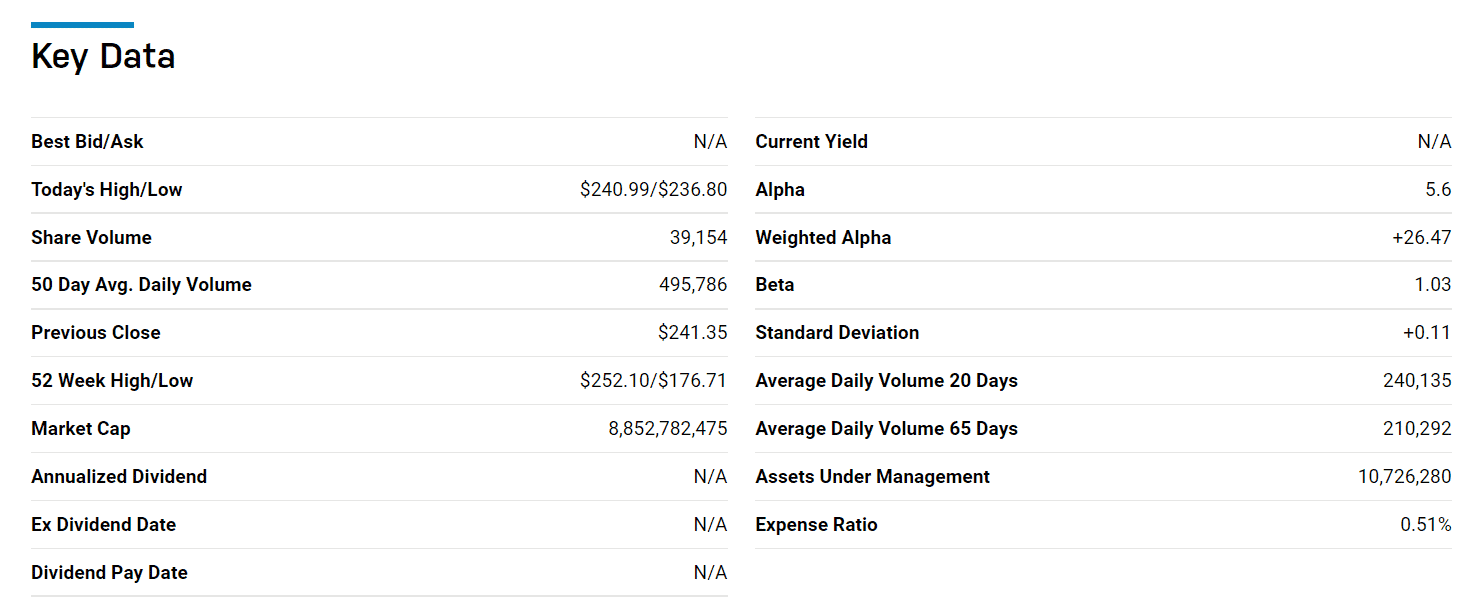

The FDN at present has $10.74 billion in assets under management, with an expense ratio of 0.51%. Things can only get better for internet-based companies, and given that this fund managed 32.07% returns in a pandemic year, it is one to hold in times of uncertainty.

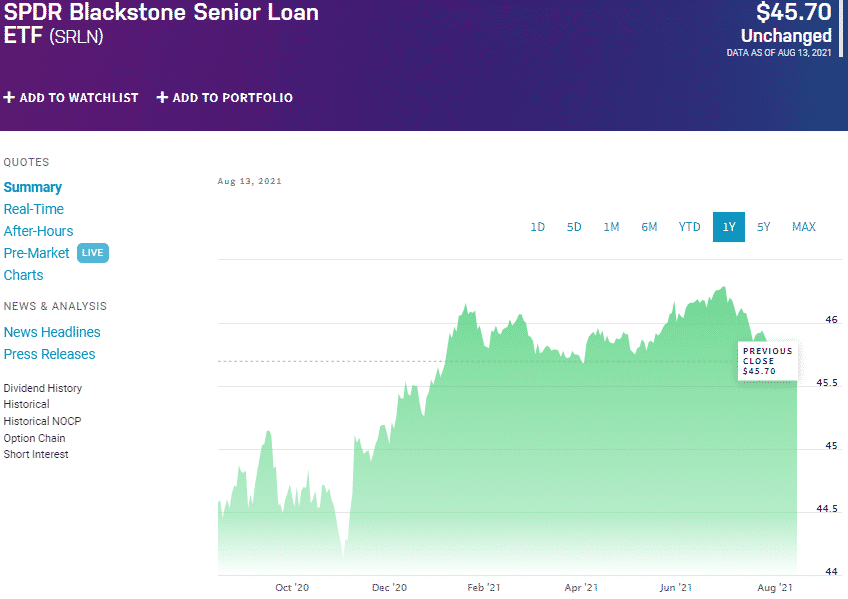

№ 3. SPDR Blackstone Senior Loan Fund (SRLN)

Price: $45.70

Expense ratio: 0.7%

SPDR Blackstone Senior Loan Fund (SRLN) chart

The SRLN is an actively managed fund that tracks two composite indices, the Markit iBoxx USD Liquid Leveraged Loan Index and the S&P/LSTA US Leveraged Loan 100 Index, with a view of outperforming it. This fund invests in short-term floating-rate bonds and secured senior loans to hedge against rising interest rates and inflation rates.

The top holdings for this fund are:

- State Street Institutional Investment Trust US Government Money Market Fund — 14.93%

- Change Healthcare Holdings Llc. — 2.05%

- Lower Cadence Holdings Llc. — 1.61%

- Alphabet Holding Co Inc. — 1.48%

This fund has $6.82 billion in assets under management, with an expense ratio of 0.7%. With the Fed not likely to check the rising rates to spur economic recovery, this is a fund worth having on the crosshairs.

Comments