The global populace, especially in the face of the pandemic and other recent calamities, has grown financially conscious and has acknowledged the need for caution not only for their health but their investments and property. The result is the insurance industry’s growth to a trillion niche of the financial sector, with 2021 premiums valued at upwards of $5.03 trillion.

Being a part of this industry provides portfolio diversification and the potential for significant gains- historically, insurance stocks are the best performing equities in the financial sector. If not yet convinced, investment experts project insurance sector growth between 2021 and 2025 to be upwards of 13% annually. To kill off this growing industry, the following three insurance ETFs are a great starting point.

What is the composition of insurance ETFs?

Insurance industries comprise equities operating within the insurance space and provide the following policies; personal policies, commercial policies, financial guarantee, reinsurance, insurance brokerage, life insurance, and property/casualty policies.

The top 3 insurance ETFs for blooming returns in 2022

Insurance companies charge premiums to clients to cover them against certain eventualities. In most cases, these companies can settle several high-value claims in a year, but in most cases, this is a grain of sand compared to the premiums collected.

The extra income collected as premiums is invested in other income and interest-generating assets resulting in compounded earnings. With the Ukraine-Russia conflict, interest rate hikes, and unchecked inflation, these three insurance ETFs provide portfolio stability and a chance at solid gains in 2022.

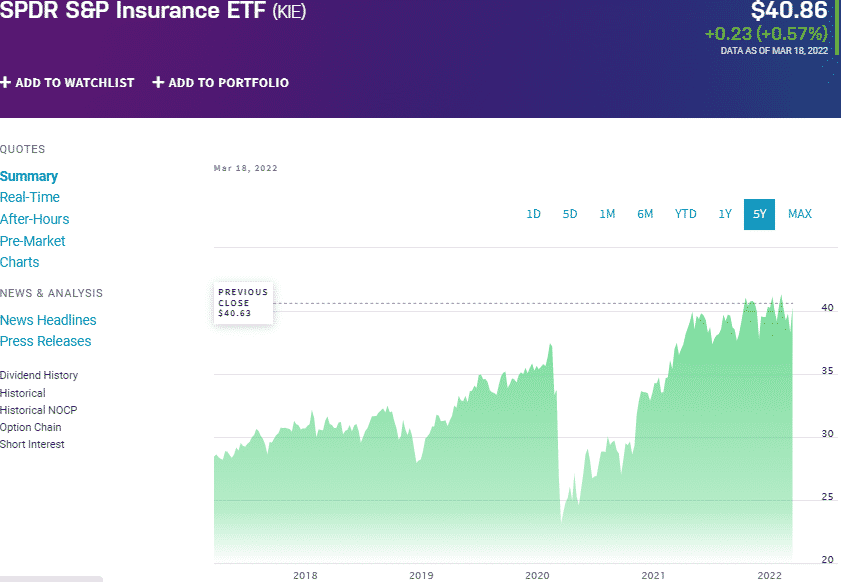

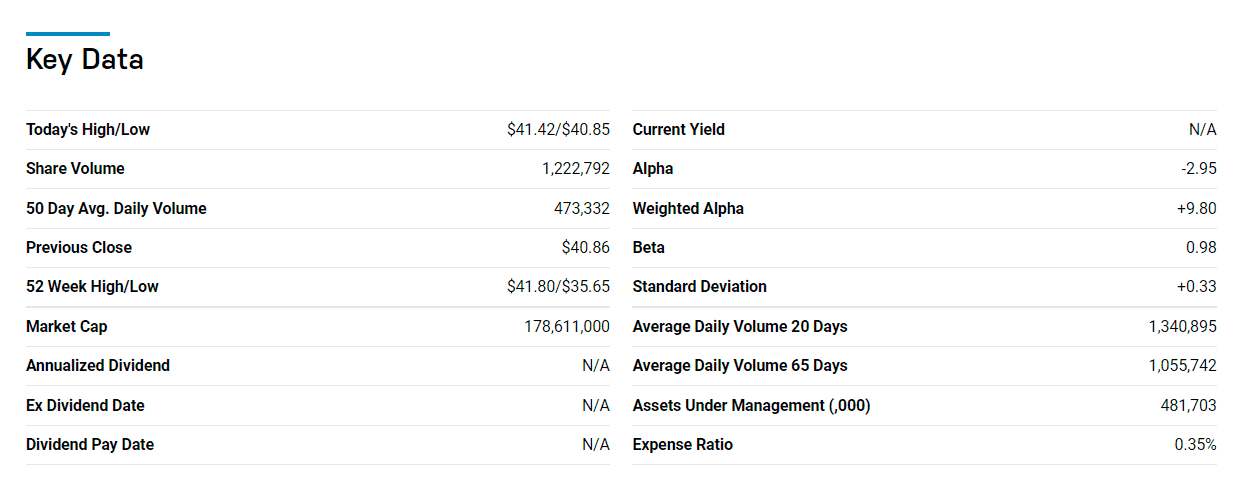

№ 1. SPDR S&P Insurance ETF (KIE)

Price: $40.86

Expense ratio: 0.35%

Dividend yield: 1.88%

KIE chart

This ETF tracks the performance of the S&P Insurance Select Industry Index, net of expenses, and fees. It invests at least 80% of its total assets in the equities making up its composite index, exposing investors to the large and mid-cap publicly-traded insurance equities.

Among financial funds, KIE ETF is ranked No. 2 by USNews in 31 of the best funds for long-term investing.

The top three holdings of this hospitality ETF are:

- Assured Guaranty Ltd. – 2.65%

- Unum Group – 2.56%

- Allstate Corporation – 2.46%

KIE ETF has $476.2 million in assets under management, with investors spending $35 annually for a $10000 investment. Combining large-cap and mid-cap equities coupled with a pretty consistent weight distribution results in a fund that provides both value and growth and mitigation against concentration risk. The conservative nature of the equities making up this ETF provides for a stable fund and consistent returns; 5-year returns of 53.02%, 3-year returns of 36.5%, and 1-year returns of 10.65%.

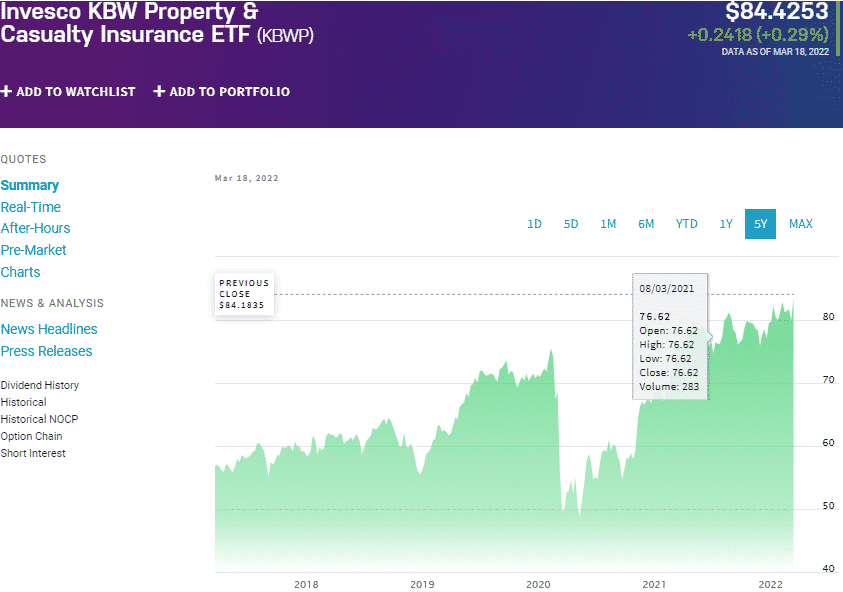

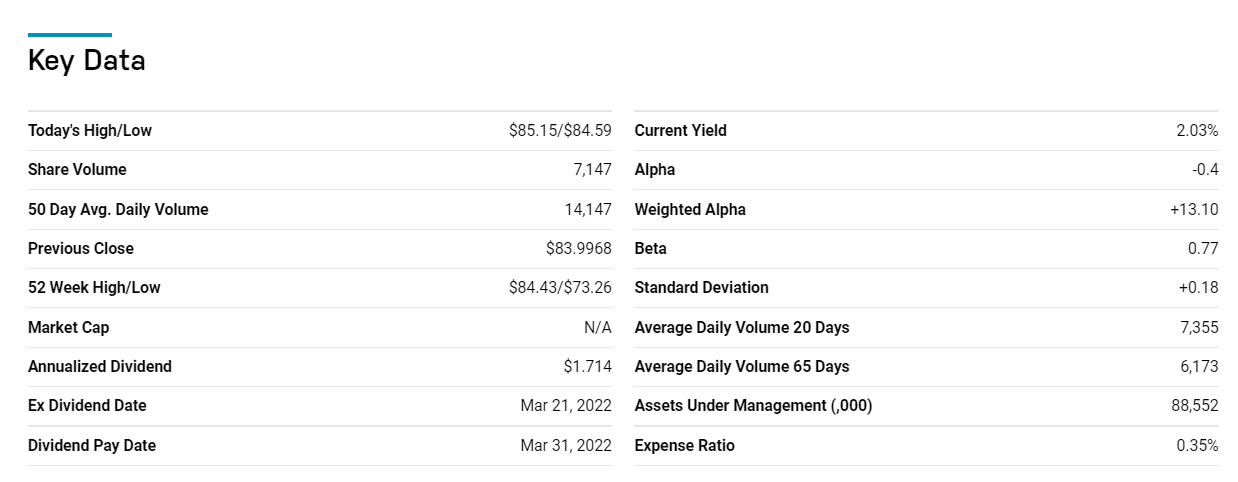

№ 2. Invesco KBW Property and Casualty Insurance ETF (KBWP)

Price: $84.42

Expense ratio: 0.35%

Annual dividend yield: 2.35%

KBWP chart

This ETF tracks the performance of the KBW Nasdaq Property & Casualty Index, net of expenses, and fees. It invests at least 90% of its total assets in the tracked index holdings, exposing investors to the best publicly traded companies operating in the US casualty and property insurance niche.

The top three holdings of this ETF are:

- Travelers Companies, Inc. – 8.70%

- Allstate Corporation – 8.50%

- Progressive Corporation – 8.32%

This fund has $84.9 million in assets under management, with an expense ratio of 0.35%. This fund is more concentrated than the KIE, but given its targeted exposure to a specific niche of the insurance sector, it comes as no surprise.

The top five holdings account for upwards of 41% of the total fund weight, but with the stability of the insurance industry, this insurance ETF has still managed to provide consistent returns for its investors; 5-year returns of 62.71%, 3-year returns of 44.23%, and 1-year returns of 13.79%. Investors also get to enjoy regular income as this fund features a dividend yield of 2.35%

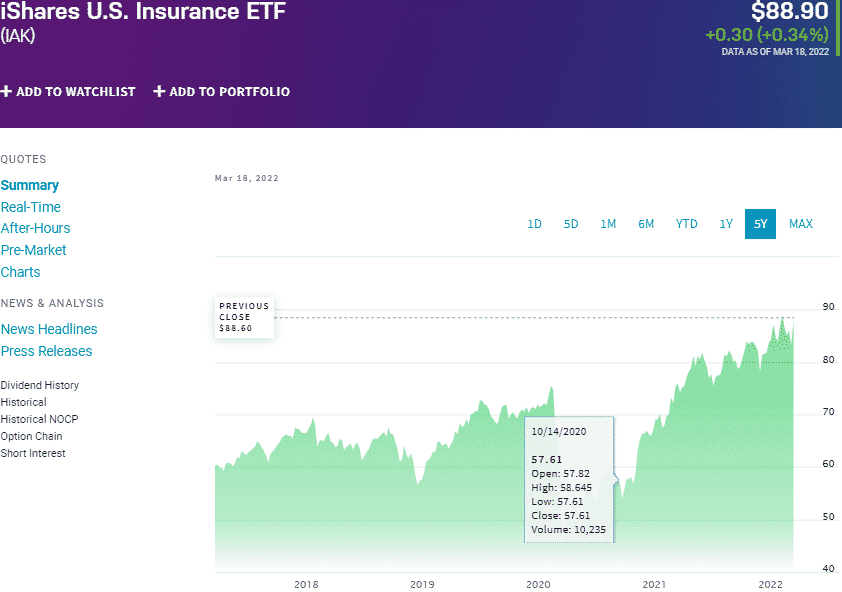

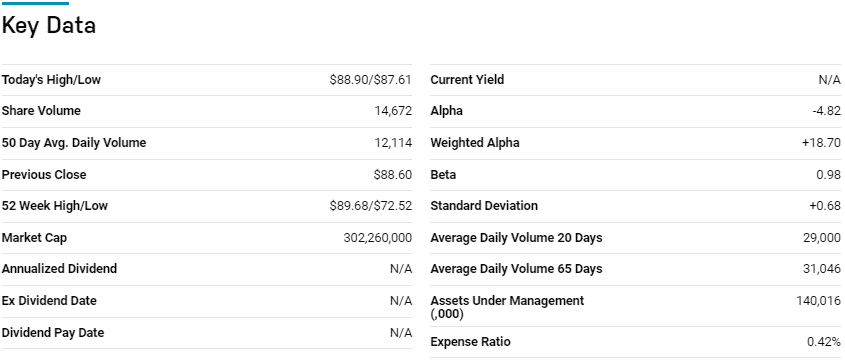

№ 3. iShares US Insurance ETF (IAK)

Price: $88.90

Expense ratio: 0.42%

Annual dividend yield: 2.01%

IAK chart

This fund tracks the performance of the Dow Jones U.S. Select Insurance Index, net of expenses, and fees. It invests at least 80% of its total assets in the holdings of its composite index and other investment securities believed to exhibit similar economic characteristics to the tracked index holdings. The fund management can also invest the remaining 20% in futures, swap contracts, options, and cash equivalents that can help the fund tracks its composite index. It exposes investors to the US publicly traded organizations in the insurance sector.

Among financial funds, the IAK ETF is ranked No. 13 by USNews in a list of the best 31 funds for long-term investing.

The top three holdings of this ETF as of now are:

- Chubb Limited – 12.27%

- Progressive Corporation – 8.38%

- American International Group, Inc. – 6.70%

The IAK ETF has $140 million in assets under management, with investors having to part with $42 annually for every $10000 investment, making it the most expensive fund on this list.

Despite significant concentration, the IAK ETF offers more diversification with 60 under holdings than 25 for the KBWP, resilience in a market downturn; 5-year returns of 59.54%, 3-year returns of 46.39%, and 1-year returns of 19.53%.

Final thoughts

The markets at present are very unpredictable, and with the historically high inflation rates, Ukraine-Russia war, and rising interest rates, insurance is a must-have to protect against financial ruin. Couple this with the fact that the insurance sector is a defensive sector due to its stability. You have a sector that can result in a diversified solid portfolio with the ability to protect your money in the unpredictable 2022 investment markets.

Comments