What if you could invest with the outcome already well known? Borrowing from the more prominent ETF family to provide funds for every investor, Innovator capital management introduced the defined outcome of exchange-traded funds to the investor world.

These revolutionary ETFs provide their investors with a range of possible outcomes before investing. Market participants have three options to choose from.

- Accelerated ETFs

Expose investors to assets that provide accelerated upside potential without risk of accelerated losses in times of market downturn but attached to a predefined bullish cap.

- Buffer ETFs

Expose investors to assets that provide bullish potential capped at a predefined maximum but with a built-in buffer for bearish movement.

- Floor ETFs

ETFs comprise assets that provide capped market upside but a known maximum allowable percentage loss in case of a market downturn.

Relatively new, having been introduced in 2018, defined outcome ETFs have proven to outperform the market in times of downturn. With the high volatility being experienced post-pandemic, these three innovators’ ETFs have the potential to buffer a portfolio.

What is the composition of Innovator ETFs?

Defined outcome ETFs provided by Innovator comprise a pool of customized flexible exchange options featuring variable strike prices-buying or selling prices at the date of option maturity or expiry. These ETFs also feature a 12-month expiration period after which they reset. The result is an exchange-traded fund with a defined buffer level and upside leg room but capped at a predefined level.

Top 3 Innovator ETFs for investing perspective in 2022

The ultimate goal of investing is to make money while mitigating any potential risks. It then calls for having investment assets that are hedged against market downturn or with diversification to ensure such movements don’t lead to financial ruin.

2021 proved to be a record earnings season but in between was filled with a plethora of massive sell-offs and other unprecedented market movements. Given the rising inflation and a need to spur economies to pre-pandemic levels, markets are bound to experience quite a tumultuous time before that sweet spot that will ensure a balance is found. Therefore, why not limit your equity risk and diversify your portfolio to ensure returns using these three Innovator ETFs?

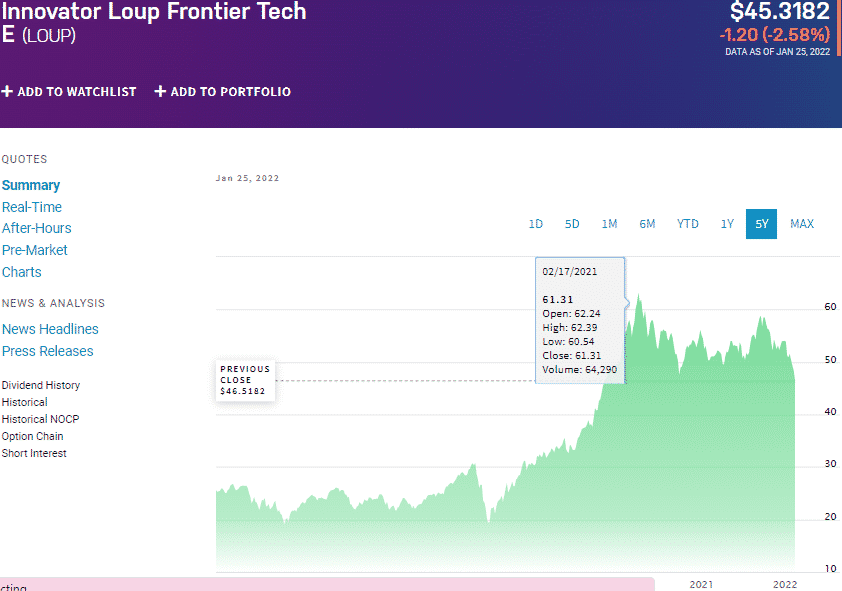

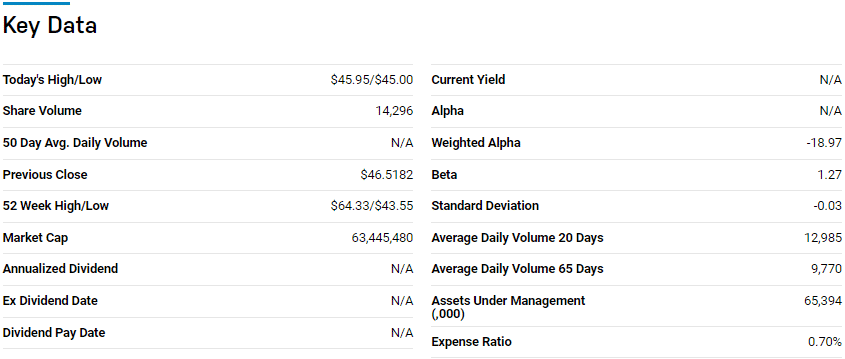

№ 1. Innovator Loup Frontier ETF (LOUP)

Price: $45.31

Expense ratio: 0.70%

Dividend yield: N/A

LOUP chart

Innovator Loup Frontier Tech ETF tracks the performance of the Loup Frontier Tech Index, investing at least 80%of its total assets, including borrowings, in the tracked index securities. This non-diversified fund exposes investors to technology equities believed to be frontiers in the niches with the potential to influence them in the future.

The top three holdings of this ETF as of now are:

- JD Logistics, Inc. — 5.79%

- Nintendo Co., Ltd. — 5.52%

- AeroVironment, Inc. — 4.97%

LOUP has $65.4 million in assets under management, with an expense ratio of 0.70%. This ETF provides investors with accelerated upside potential by concentrating on technology firms that influence our future. Scoring its holding selection pool by revenue growth, quarterly revenue acceleration, earnings per share, and free cash flow, while choosing among the highest scoring 30 in the niche ensures top dollar earnings.

Couple this to a weight cap of 250 billion on the holdings, and what you have is a fund providing both value and growth attributes as exhibited by its returns in the last 12-months of 116.22% against its category average of 30.92%.

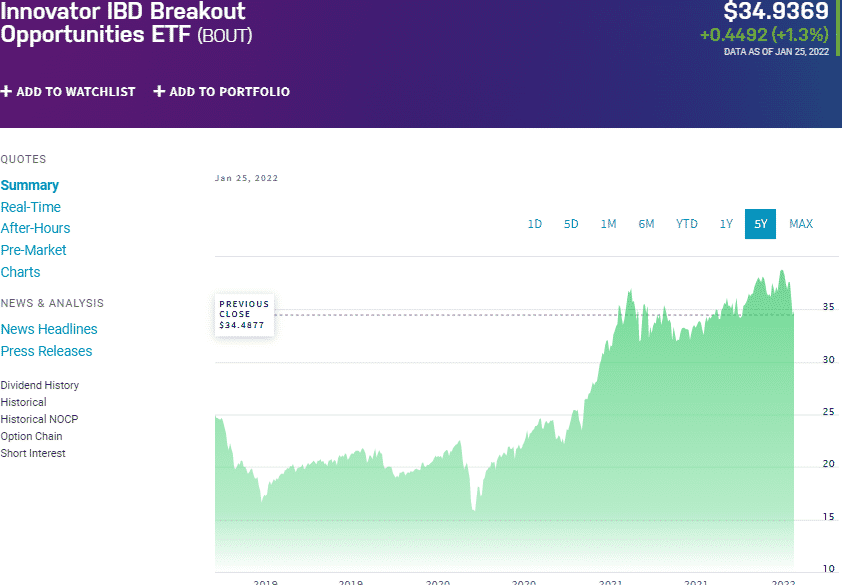

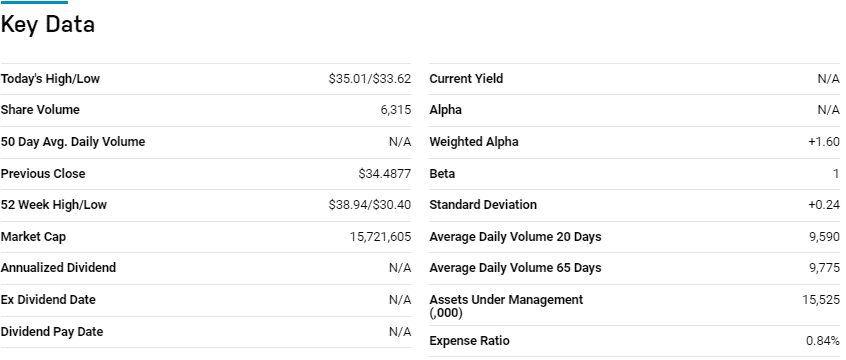

№ 2. Innovator IBD Breakout Opportunities ETF (BOUT)

Price: $34.93

Expense ratio: 0.84%

Dividend yield: N/A

BOUT chart

Innovator IBD Breakout Opportunities ETF tracks the IBD Breakout Stocks Index, exposing investors to stocks on the verge of breaking out or experiencing significant price growth in the long term. It invests at least 80% of its total assets, including capital borrowings, in the securities making up its composite index.

The top three holdings of this ETF as of now are:

- AbbVie, Inc. — 2.82%

- Royal Dutch Shell Plc Sponsored ADR Class B — 2.81%

- NortonLifeLock Inc. — 2.81%

BOUT ETF has $15.5 million in assets under management, with an expense ratio of 0.84%. Reconstituting and rebalancing weekly off fundamentals and relative strength index ensures this fund is agile enough to identify and take advantage of equities on the verge of breaking out as exhibited by its returns in the last 12 months, 84.97%. This agility is needed to navigate the uncertain markets in 2022 if money is to be made.

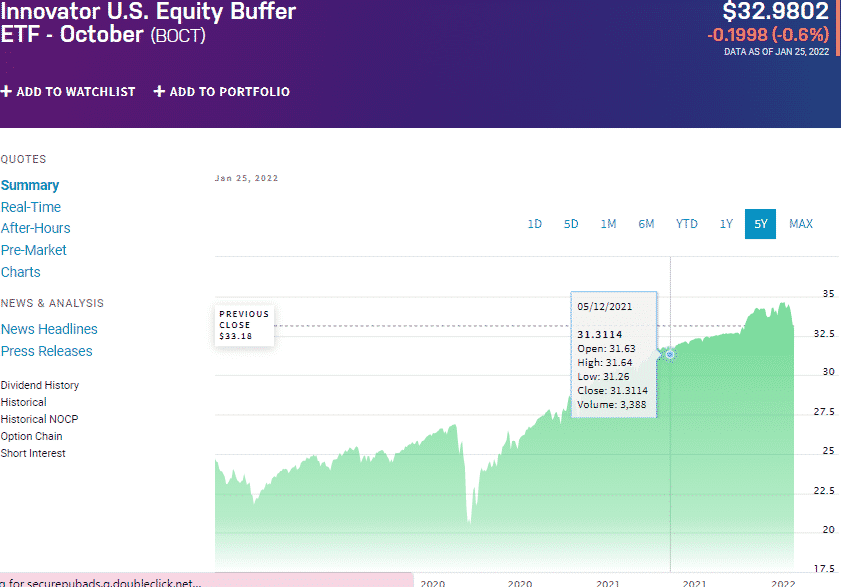

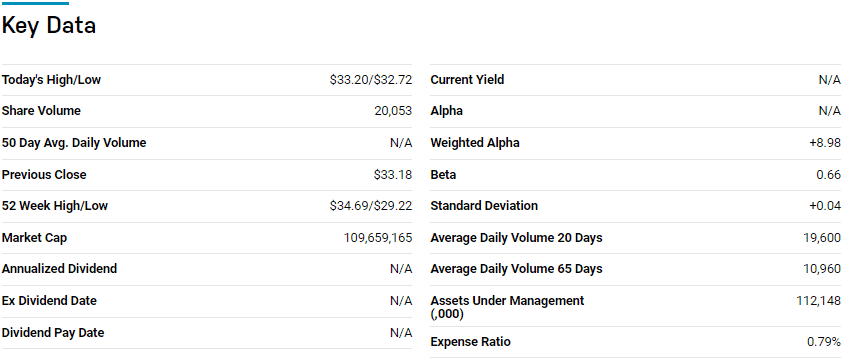

№ 3. Innovator US Equity Buffer ETF (BOCT)

Price: $32.98

Expense ratio: 0.79%

Dividend yield: N/A

BOCT chart

The Innovator US Equity Buffer ETF-October tracks the SPDR S&P 500 ETF Trust, investing at least 0% of its total assets in the Flex Options that reference its composite index. Investors get 12-month buffered exposure to the S&P 500, with the 12-months running from October.

BOCT ETF has $110.9 million in assets under management, with investors having to part with $79 for every investment worth $10000 annually. With investors buffered against the first 9% loss to the SPY, this ETF provides a different twist to play the US economy. Except for 2021, BOCT has outperformed its tracked index over the last three years to record 3-year returns of 44.07%.

Final thoughts

Buffered ETFs are not risk-free investments. However, they offer the best of both worlds in the investment world offer massive upside potential while mitigating against losses during a market downturn. If you are interested in diversifying your portfolio in the current uncertain market conditions, the funds above provide limited downside but significant upside potential.

Comments