ETF full name: SPDR® S&P Kensho Smart Mobility ETF (HAIL)

Segment: US Equity Mobility

ETF provider: State Street Global

| HAIL Key Details | ||

| Manager | Morgan, Krivitsky, and Feehily | |

| Dividend | 0.93% | |

| Inception date | 26th December 2017 | |

| Expense ratio | 0.45% | |

| Average Daily $ Volume | $1.81M | |

| Investment objective | Replication Strategy | |

| Investment geography | Global Transportation Innovative Equities | |

| Benchmark | S&P Kensho Smart Transportation Index | |

| Weighted Average Market Cap | $71.69B | |

| Net Assets under Management | $168.9 Million | |

| Number of holdings | 85 | |

| Weighting methodology | Market Capitalization | |

About the HAIL ETF

The transport sector is on the brink of significant evolution. Electric vehicles, intelligent supply chain and logistics systems, drone technology, and autonomous transport optimized systems are driving factors. The truth is that all these technologies are the next big thing in their respective fields but knowing which stock will thrive and which will struggle continues to be next to impossible.

For this reason, State Global has availed to investors the SPDR S&P Kensho Smart Mobility ETF. This exchange-traded fund cuts the need for identifying individual stocks in all of the stated fields by providing exposure across these innovative transportation sectors.

HAIL Fact-set analytics insight

SPDR S&P Kensho Smart Mobility ETF tracks the S&P Kensho Smart Transportation Index, intending to replicate its performance as closely as possible, net of expenses and fees. It invests at least 80% of its total assets in the securities of the tracked index, coupled with its ADRs and GDRs.

HAIL investors get exposure to the US publicly traded companies, domiciled either in the United States, developed economies, and emerging markets, with tentacles in the intelligent transportation sector. The underlying sector constituent holdings are screened via natural language processing, NLP, to ensure filings are consistent with its objective, in addition to other liquidity and size considerations.

HAIL performance analysis

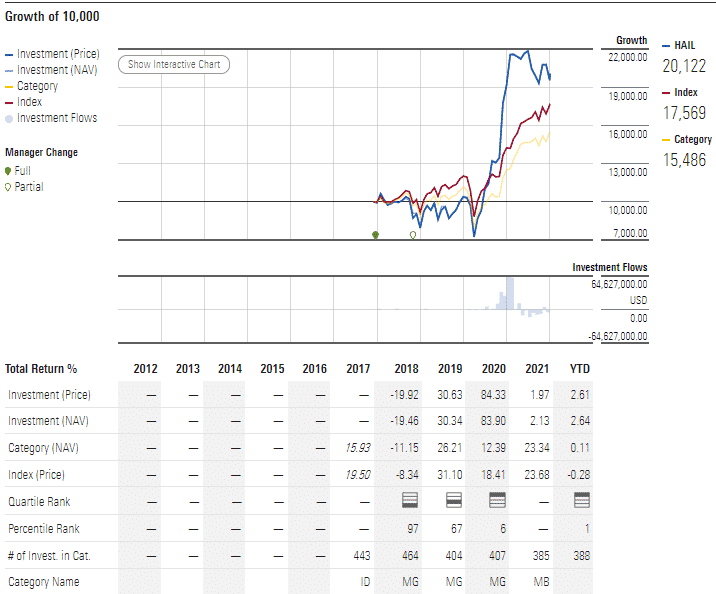

A look at the chart below shows that an investment of $10.000 on HAIL at launch would right now be worth $20122, an investment price increment of over 100%. A couple with positive returns since its inception year puts this ETF among an exclusive group of ETFs that have posted positive returns since the inaugural year; 3-year returns of 144.49% and pandemic year returns of 1.94%.

HAIL ETF performance chart

With such numbers, it comes as no surprise that this ETF is in the mouth of many technologies and transport investors and those interested in disruptive technology.

HAIL ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A | A | N/A | ***** | N/A |

| IPO ESG Rating | 7.08 out of 10 | 6.37 out of 10 | 1st Quantile | 25.60 out of 50 | N/A |

HAIL key holdings

In addition to the NPL screening, HAIL ETF reconstitutes semi-annually. To stay true to its investment objective, the underholding’s are classified into “core” and “non-core” innovative transportation firms. Initial listing has all holdings weighted equally, and then 20% of the non-core holdings’ weight is assigned to the core holdings.

| Ticker | Holding | % Assets Weighting |

| UBER | Uber Technologies, Inc. | 1.61% |

| LAZR | Luminar Technologies, Inc. Class A | 1.56% |

| ALGM | Allegro MicroSystems, Inc. | 1.51% |

| F | Ford Motor Company | 1.51% |

| TXT | Textron Inc. | 1.50% |

| LYFT | Lyft, Inc. Class A | 1.50% |

| XPEV | XPeng, Inc. ADR Sponsored Class A | 1.49% |

| BLDE | Blade Air Mobility, Inc. Class A | 1.49% |

| LI | Li Auto, Inc. Sponsored ADR Class A | 1.48% |

| THRM | Gentherm Incorporated | 1.48% |

Industry outlook

One of the significant challenges of disruptive innovation funds, especially electric vehicles, is high concentration risk. HAIL ETF navigates these muddy waters by first having a reasonably sizeable holding base, 85, and a fairly even weight distribution. In addition, it cuts across the intelligent transportation sector, providing the diversification needed to weather storms in the EV space.

In addition, investors are more aware of the ramifications of their investments to the environment and climate, resulting in more appetite for green investing or ESG investing. The SPDR S&P Kensho Smart Mobility ETF can only get more inflows as the global appetite for green technology and investing grows.

Comments