ETF full name: Invesco CurrencyShares Euro Trust Fund (FXE)

Segment: Currency

ETF provider: Invesco

| HYEM key details | |

| Issuer | Invesco |

| Dividend | $0.01 |

| Inception date | December 9, 2005 |

| Expense ratio | 0.40% |

| Management company | Invesco |

| Average 3-5 EPS | N/A |

| Average Annualized Return | -1.25% |

| Investment objective | Replication |

| Investment geography | Developed Europe |

| Benchmark | WM/Reuters Euro Closing Spot Rate |

| Leveraged | N/A |

| Median market capitalization | $286.4 million |

| ESG rating | N/A |

| Number of holdings | 1 |

| Weighting methodology | Single asset |

About the FXE ETF

Invesco issued the FXE ETF, and its inception date was December 2009. The fund tracks the euro price and trades on the New York Stock Exchange Arca under the ticker symbol FXE.

The FXE fund benchmarks the WM/Reuters Euro Closing Spot Rate, representing the euro’s performance. It allows investors to access the euro with holdings of the physical currency in a deposit account. Investors should note that the fund’s physical deposits of euros are uninsured, so it carries the default risk of its depository, JPMorgan.

FXE Fact-set analytics insight

Invesco CurrencyShares Euro Trust Fund has dividend payouts of $0.01 and a current annualized return of -1.25%. The expense ratio is 0.40%. The FXE fund does not have a P/E ratio compared to peers in its sector. The FXE fund has total assets under management of $286.4 million.

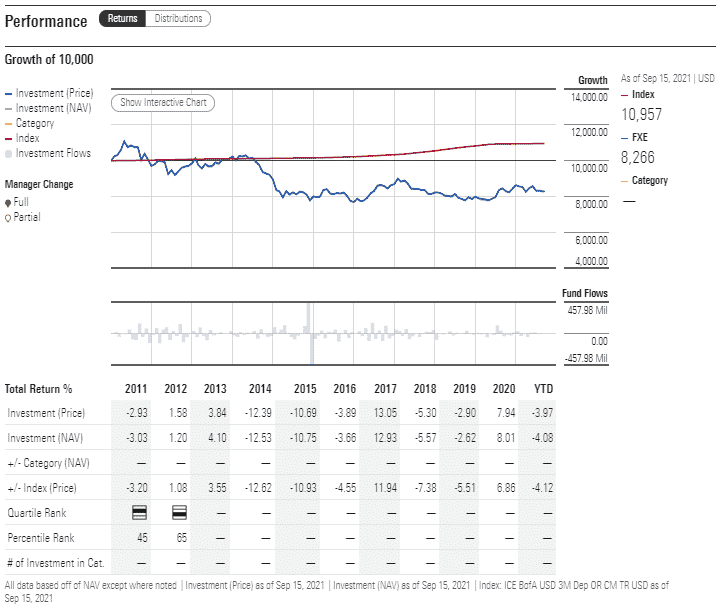

FXE performance analysis

The fund has been declining from its high of $159 in 2008 and has lagged its benchmark index since 2013. The historical drive of the EUR/USD exchange rate is mainly 10-year bond yield differences between the US and Germany.

In May 2020, the euro rallied due to the declining difference in the bond yields. The narrower the gap, the stronger the euro becomes. In addition, the US dollar suffered due to the Covid-19 pandemic last year. However, the strength in the euro was short-term as many economic and political factors influenced it.

Furthermore, the fund does not have an MSCI ESG rating.

FXE ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| FXE Rating | A+ | B | Quintile 4 (78th percentile) | N/A | N/A |

| FXE ESG Rating | N/A | N/A | N/A | N/A | N/A |

FXE key holdings

The FXE is a singular asset fund; as we mentioned, it gives investors exposure to the performance of the euro currency.

Industry outlook

If we look at the FXE fund’s historical performance, it does not seem very promising since it’s been in a downtrend since 2008. The annualized return is down by 1.25%, and the fund has a year-to-date return of -4.21%.

Furthermore, the fund holds physical currency in euro with JPMorgan, which is not insured and exposes investors to default risk. Considering the fund’s expense ratio of 0.40%, those investors who are holding longer might be on the losing end, especially since the fund is in a bearish trend.

However, funds that track currencies are considered short-term investors. Furthermore, they make for a good hedging strategy when one currency is dominating another. Analysts’ sentiments are currently not bullish for the FXE fund, and they forecast that the euro’s recovery since 2020 seems to be coming to a halt.

Comments