ETF full name: Collaborative Investment Series Trust (FOMO)

Segment: Asset Allocation: Global Target Outcome

ETF provider: Tuttle Tactical Management LLC

| FOMO details | |

| Issuer | Tuttle Tactical Management LLC |

| Dividend | N/A |

| Inception date | 25 May 2021 |

| Expense ratio | 0.90% |

| Management company | Tuttle Tactical Management LLC |

| Average 3-5 EPS | N/A |

| Average Annualized Return | N/A |

| Investment objective | FOMO is an actively-managed fund that seeks long-term capital appreciation by holding all-cap equities, SPACs, fixed income ETFs, volatility and inverse volatility ETFs and ETNs, and leveraged and inverse products. |

| Investment geography | Global |

| Benchmark | No benchmark |

| Leveraged | N/A |

| Median market capitalization | N/A |

| ESG rating | A (5.76 / 10) |

| Number of holdings | N/A |

| Weighting methodology | Proprietary |

About the FOMO ETF

FOMO ETF’s inception was on 25 May 2021. The fund focuses on long-term capital gains from investments in all-cap equities, SPACs, fixed income ETFs, volatility and inverse volatility ETFs and ETNs, and leveraged and inverse products.

The fund has no benchmark and no underlying index. Tuttle Tactical Management LLC is the fund issuer and manages the fund.

FOMO Fact-set analytics insight

Since the fund is relatively new, the market cap data is not available. FOMO has $5.13 million assets under management and an average daily volume of $53.94K. The fund follows a proprietary weighting methodology.

FOMO performance analysis

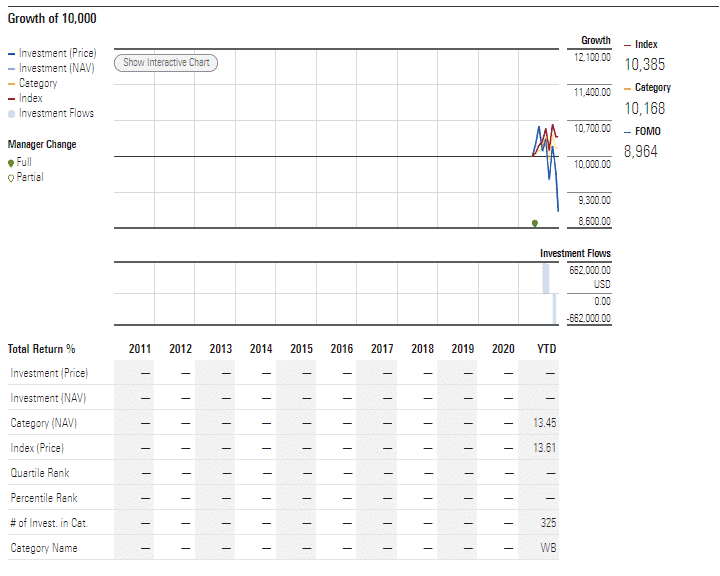

FOMO ETF performance chart

The FOMO ETF has not been active for a full year. Therefore, annualized performance will only be available by May next year. However, the fund’s year-to-date return is 13.45% in terms of Net Asset Value (NAV).

The fund has also not paid any dividends to date.

FOMO ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| FOMO Rating | N/A | N/A | Quintile N/A (N/A percentile) | N/A | N/A |

| FOMO ESG Rating | N/A | A

(5.76 / 10) |

N/A | N/A | N/A |

FOMO key holdings

The number of holdings is not readily available; however, the sector allocation is as follows.

| Non-Classified Equity | 17.96% |

| Financials | 16.12% |

| Technology | 11.50% |

| Consumer Goods | 10.40% |

| Consumer Services | 8.97% |

| Basic Metals | 5.41% |

| Oil & Gas | 5.05% |

| Industrials | 4.71% |

| Healthcare | 2.10% |

| Utilities | 0.88% |

The Collaborative Investment Series Trust invests 83.11% in stocks and 16.89% in other assets.

Below is a list of the fund’s top ten holdings.

| Ticker | Holding name | % of assets |

| GS | Goldman Sachs Group Inc. | 2.37% |

| AGCUU | Altimeter Growth Group | 2.12% |

| MAT | Mattel Inc. | 2.08% |

| GBTC | Grayscale Bitcoin Trust | 2.03% |

| RBLX | Roblox Corp. | 1.97% |

| FB | Meta Platforms Inc. | 1.90% |

| UPST | Upstart Holdings Inc. | 1.89% |

| SEAH | Sports Entertainment Acquisition Corp. Cl A | 1.53% |

| SNOW | Snowflake Inc. | 1.51% |

| TSLA | Tesla Inc. | 1.48% |

Industry outlook

FOMO is an acronym used on social media, and it stands for ‘Fear of missing out.’ The FOMO ETF focuses on meme stocks. Therefore, it can move its assets to whatever is trending at the time. For this reason, the fund rebalances weekly to stay up to date with the latest market trends and, at this moment, adjusts its holdings weighting accordingly.

The FOMO fund has an expense ratio of 0.90%, a little higher than others in its category; for example, BUZZ, the VanEck social-sentiment ETF, has an expense ratio of 0.75%. However, BUZZ’s returns have not been favorable since its inception in March 2021.

Investors should watch FOMO and perhaps wait for the fund to reach its first anniversary to judge its performance accurately.

Comments