ETF full name: Fidelity MSCI Financials Index ETF (FNCL)

Segment: US Financials Equity Market

ETF provider: Fidelity Research and Management Company

| FNCL key details | ||

| Manager | Hsui, Mason and Whitelaw | |

| Dividend | 1.60% | |

| Inception date | 1st October 2013 | |

| Expense ratio | 0.08% | |

| Average Daily $ Volume | $12.72M | |

| Investment objective | Vanilla Strategy | |

| Investment geography | US Financials Market | |

| Benchmark | MSCI USA IMI Financials 25/50 Index | |

| Weighted Average Market Cap | $165.21B | |

| Net Assets under Management | $1.91 Billion | |

| Number of holdings | 396 | |

| Weighting methodology | Market capitalization | |

About the FNCL ETF

The financial services sector is the most significant economic niche industry globally, a feature attributed to it being the oldest formal industry. It translates to the US economy to make it the most liquid and volatile sector of the US economy.

It comprises banking, insurance, and financial services. In 2020 alone, a pandemic year, estimated revenues from the financial services sector were $4.74 trillion. How does one gain exposure to this leading industry with all these in mind? The Fidelity MSCI Financials Index ETF is the answer.

FNCL Fact-set analytics insight

The Fidelity MSCI Financials Index Fund tracks the MSCI USA IMI Financials 25/50 Index, intending to replicate its performance as closely as possible, net of expenses and fees. Before 2020, FNCL tracked the unrestricted MSCI USA IMI Financials Index. The change was to reflect its current holdings after restructuring in 2016 to comply with the GICS classification; it did away with its REITs. As a result, FNCL investors gain exposure to the US financials equity market, skewing towards large-cap equities.

To meet its investment objective and mitigate against concentration risk, this fund utilizes capping; no group entity should exceed 25% of the fund’s weight. Holdings with more than 5% weighting should not exceed 50% of the total fund’s weight.

FNCL performance analysis

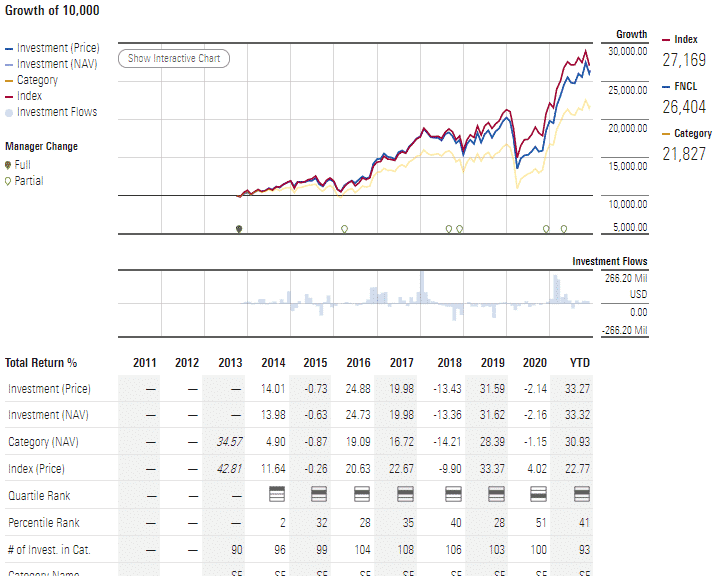

A look at the chart below reveals that an initial investment of $10000 on the FNCL at inception would now be worth $26404 without accounting for dividend payouts at an average annual yield of 1.60%, making it the go-to fund for financial exposure.

FNCL ETF performance chart

The FNCL returns over the years have made it a popular option for those seeking exposure to the financial industry. To put this into perspective, the FNLC ETF has always outperformed its category and segment averages; 5-year returns of 81.78%, 3-year returns of 50.07%, pandemic year returns of 36.47%, and year to date returns of 31.34%.

FNCL ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | A+ | A/92 | N/A | **** | Rank No 1 in Financials |

| IPO ESG Rating | 7.96 out of 10 | 7.83 out of 10 | 2nd Quantile | 23.53 out of 50 | 6.7 out of 10 |

FNCL key holdings

The FNCL has close to 400 holdings, consisting of large-cap, mid-cap, and small-cap equities. Therefore, it offers broader exposure to the financial industry than even the Financial Select Sector SPDR Fund

The top ten holdings of the FNCL account for 40.74% of the total fund weighting and are as below.

| Ticker | Holding | % Assets |

| JPM | JPMorgan Chase & Co. | 9.11% |

| BRK.B | Berkshire Hathaway Inc. Class B | 6.99% |

| BAC | Bank of America Corp. | 6.43% |

| WFC | Wells Fargo & Company | 3.80% |

| BLK | BlackRock, Inc. | 2.64% |

| MS | Morgan Stanley | 2.56% |

| GS | Goldman Sachs Group, Inc. | 2.47% |

| C | Citigroup Inc. | 2.45% |

| SCHW | Charles Schwab Corp. | 2.19% |

| SPGI | S&P Global, Inc. | 2.10% |

Industry outlook

Higher capital requirements, capping on interest rates due to the coronavirus pandemic, and greater regulation have slowed down resurgence to the financials industry pre-pandemic levels. The economic resurgence is expected to pick up pace in 2022 and for interest rate hikes to happen as early as the first quarter.

It will be the beginning of the earning season for this economic niche. Firms will be looking for finances to ramp up capacity to 100%, combined with the resulting interest rate hikes. However, higher rates’ effects on earnings are long-term as net interest margins drive them.

Fortunately, the FNCL asset under management of $1.91 billion and broad holding base allows it to weather the tailwinds in the financial sector hence its continued popularity.

Comments