Euro Hedge was first published on the MQL5 platform on March 29, 2021 and has been updated multiple times since then. Multiple parameters within the code infrastructure can be tweaked to change the algorithm’s output. Let us go through the live and backtesting records of the EA along with its features to identify its actual performance.

Following are some of the features of Euro Hedge:

- The system is 100% automated.

- It comes with free updates and upgrades.

- The EA trades using multiple trading strategies with various trading pairs.

- It’s easy to purchase and install.

- The developer provides a demo account.

Follow the following steps to go ahead with the program:

- Purchase the robot from the MQL5 platform

- Download the robot files on your computer

- Open your hedging account on your PC

- Place the downloaded EA files into the charts section

- Enable auto-trading

Trading strategies and currency pairs

The developer of Euro Hedge recommends an initial deposit of $5000, EURUSD, XAUUSD, and GBPUSD currency pairs, 0.01 lot size, and VPS with good internet facility for better performance.

It uses a combination of multiple strategies such as martingale, anti-martingale, pyramiding, hedging, lot, and averaging to place execution for many currency pairs on various timeframes. The system can partially close trades to avoid getting trapped in unexpected market events.

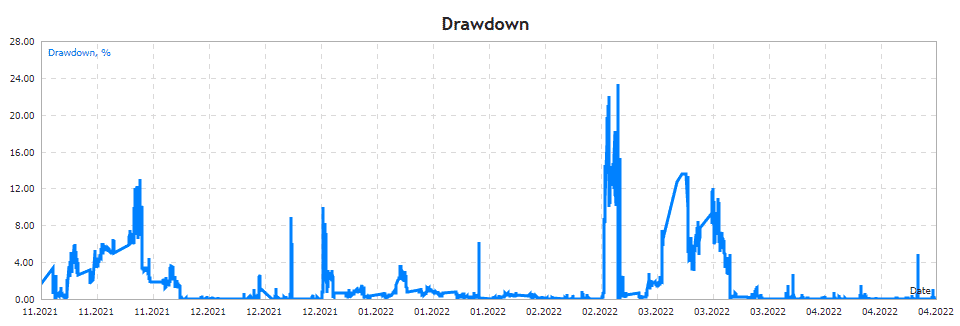

From the history on MQL5, we can observe that the increase in lot size is done automatically. It uses currency correlation to hedge out losing positions.

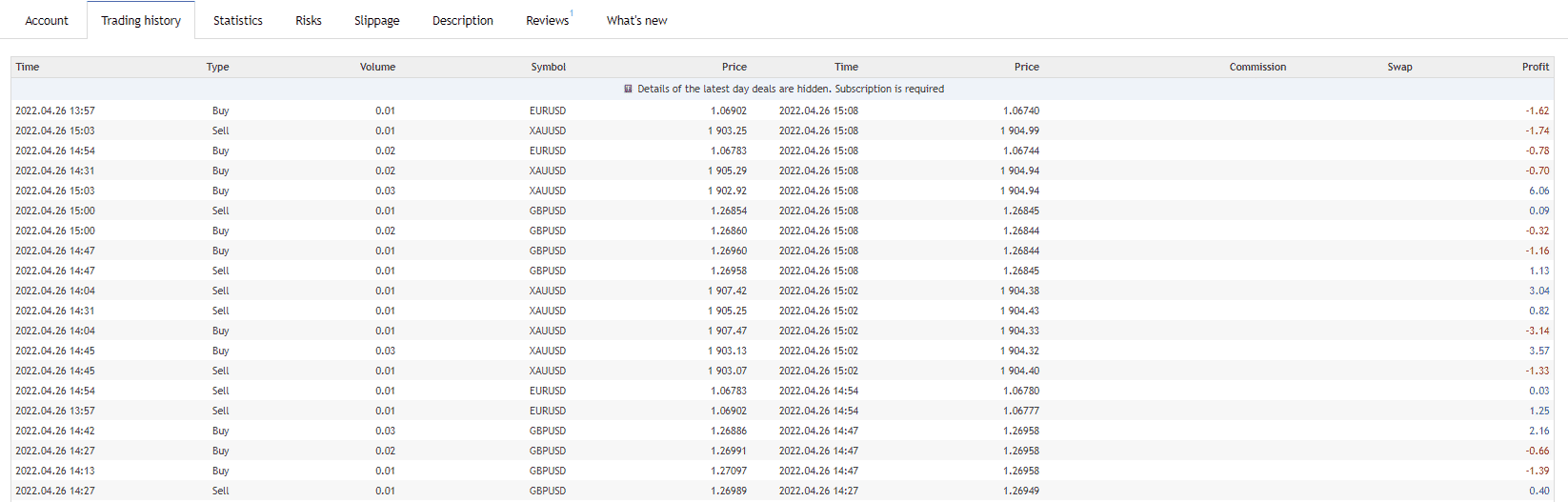

Trading history from Myfxbook

The vendor of the EA doesn’t disclose the backtesting records. No historical statistics means we cannot analyze the win ratio, profit factor, drawdown, and profitability of the EA for the past data.

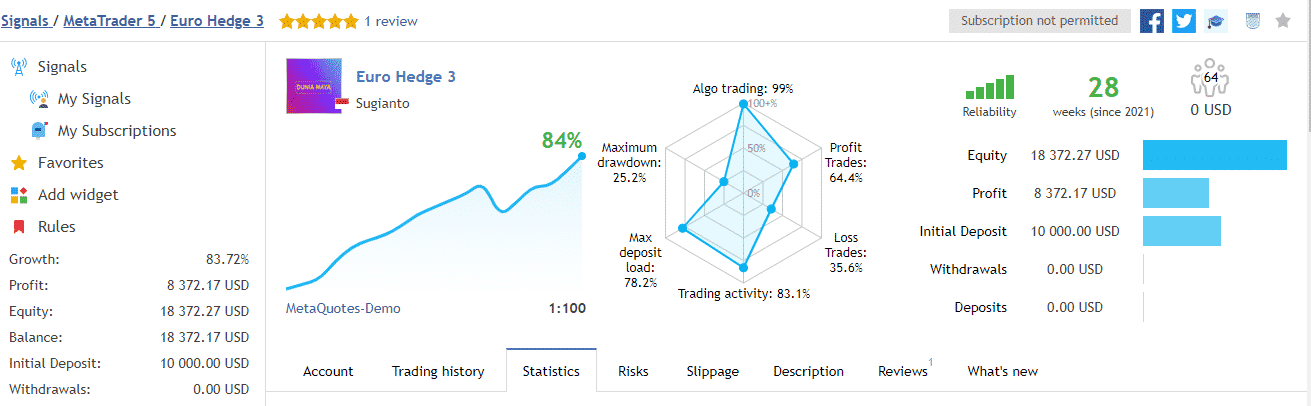

Euro Hedge trading statistics

Euro Hedge comes with a live signal available on the MQL5 platform. The vendor fails to provide third-party verified live trading results such as Myfxbook, Fxblue, etc. The initial amount of deposit was $10000 with $0 withdrawals. The profit factor is 1.21, with a total gain of 83.72%. The total profit of the robot is $8372.17, and the current balance of the account stands at $18372.17. While the overall performance may seem attractive, traders should not forget that the use of averaging and martingale can cause a high drawdown on the portfolio.

Live signal stats from MQL5

Bad winning ratio

From the live records, we can see that the EA started trading 135 days ago and participated in 26125 trades in total with a winning percentage of just 64.36%, which is a bit poor considering the risk reward ratio of 1.21.

Live signal stats from MQL5

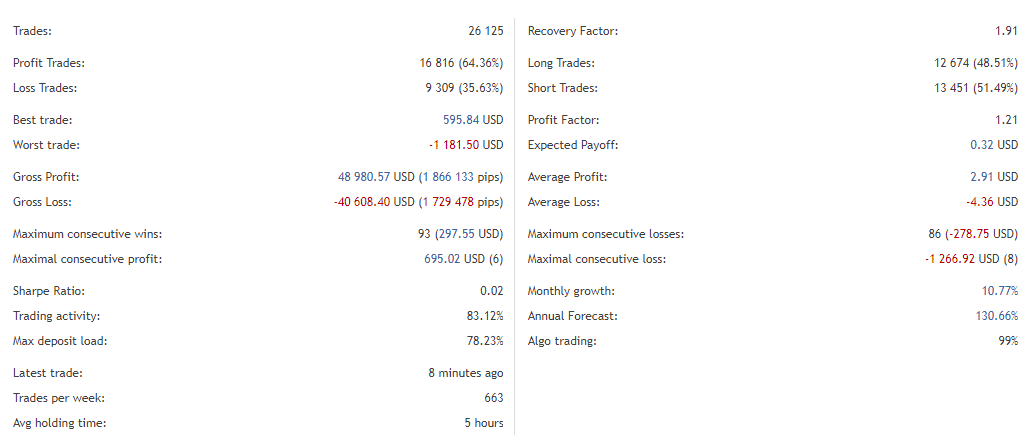

Average drawdown

The live signals of Euro Hedge are available on MQL5, showing an average drawdown value of 25.2%. The graph attached below can be analyzed to study the changes in drawdown via the bar fluctuation making it evident that the robot is using a high-risk strategy resulting in floating losses.

Drawdown graph of Euro Hedge on MQL5

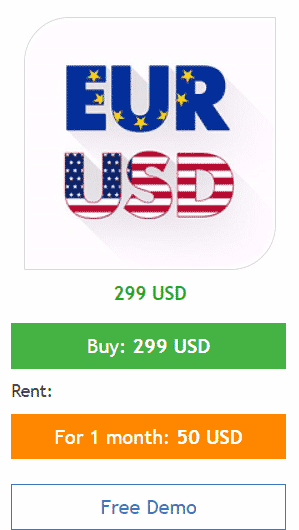

Pricing and refund

Euro Hedge is available to be purchased at a price of $299. The developer also provides a monthly rental option for an asking price of $50. Unfortunately, the vendor doesn’t promise any money-back guarantee, and there is no mention of customer support. The only way to reach the service provider is through the MQL5 platform.

Pricing of the EA on the MQL5 platform

What else you should know about Euro Hedge

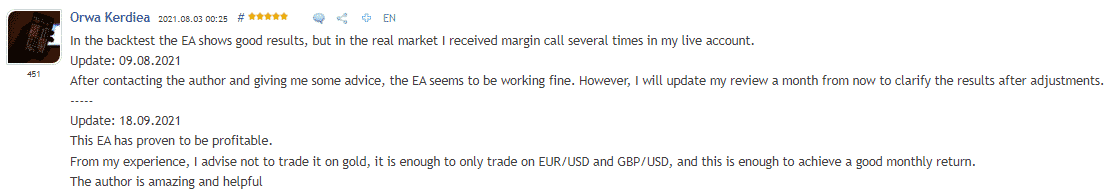

Euro Hedge doesn’t have any user testimonies on trusted platforms such as Forexpeacearmy, Trustpilot, Quora, etc. Only two feedbacks are available on the MQL5 platform, which is not enough to get a general viewpoint of traders. One of the investors comments that they have received margin calls on their portfolio several times using the robot.

User review at MQL 5

Comments