ETF full name: WisdomTree Emerging Currency Strategy Fund

Segment: Currencies

ETF provider: WisdomTree

| CEW key details | |

| Issuer | WisdomTree |

| Dividend | $0.12 |

| Inception date | May 6, 2009 |

| Expense ratio | 0.55% |

| Management company | WisdomTree |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 4.49% |

| Investment objective | Non-fundamental investment policy |

| Investment geography | Currencies |

| Benchmark | Active-no index |

| Leveraged | N/A |

| Median market capitalization | $16.2 million (assets under management) |

| ESG rating | MSCI 6.1/10 |

| Number of holdings | 4 |

| Weighting methodology | Weighted Market capitalization |

About the CEW ETF

WisdomTree Emerging Currency Strategy Fund was founded in May 2006 and provided exposure to currencies in the emerging markets. Its market capitalization amounts to $16.2 million in assets under management, with an average yearly return of 4.49%.

CEW Fact-set analytics insight

The CEW consists of only four holdings, with two of them being the United States Treasury bills, the US dollar, and the WisdomTree Floating Rate Treasury Fund making up for the remainder.

The CEW ETF uses weighted market capitalization for its methodology.

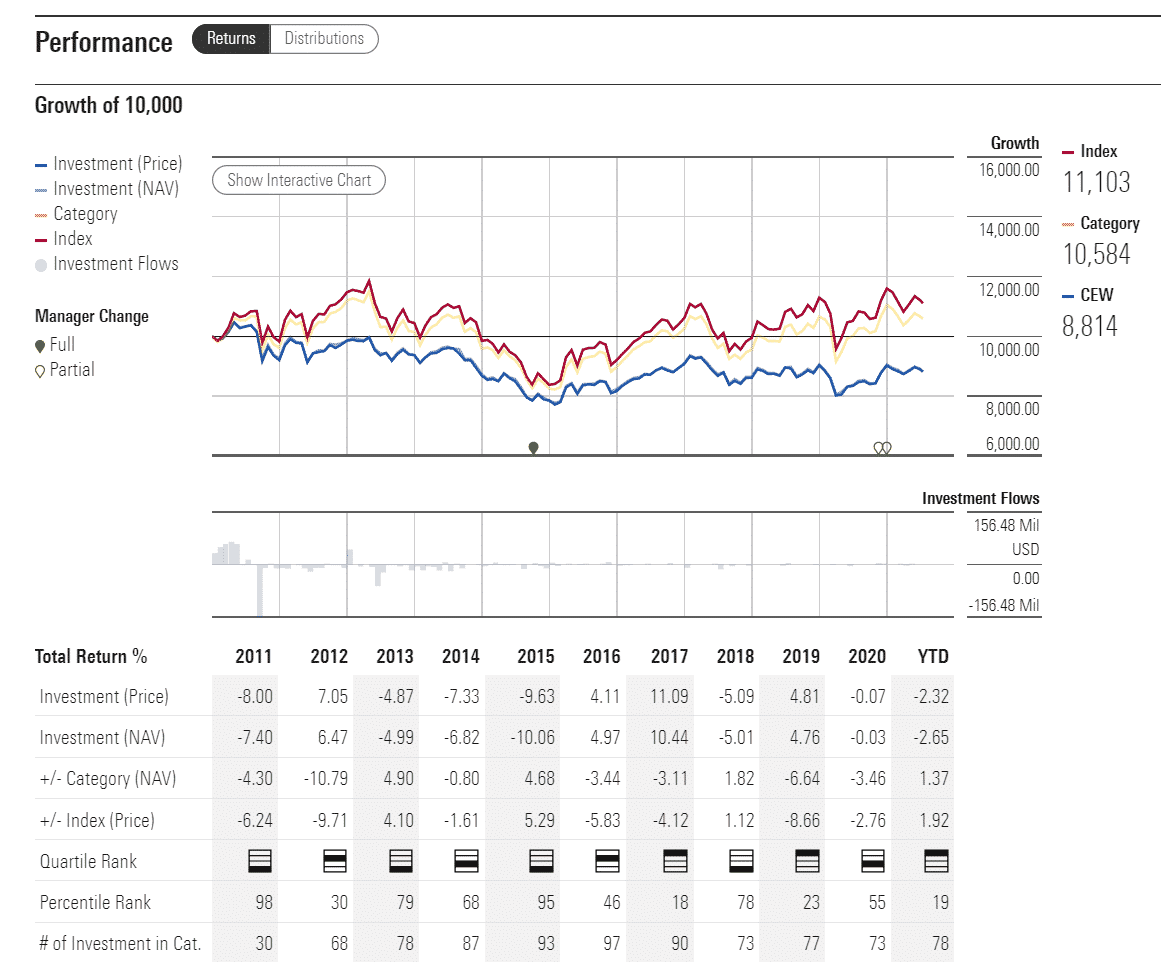

CEW performance analysis

Like most ETFs out there, the fund experienced a sharp downward trend at the emergence of the Covid-19 pandemic and the subsequent closing up of the economies worldwide.

With the emerging markets, along with their currencies, being followed with more volatility, you can see that the rise wasn’t as smooth after discovering the vaccine and the pick-up in the pace of the inoculation process.

Regardless of the hiccups, the fund has managed to recover from the shocks largely, while it still remained below its pre-outbreak levels.

The CEW ETF pays dividends quarterly. The last disclosed dividend amounted to $0.12 on the share at an expense ratio of 0.55%. On the MSCI ESG scale, CEW ETF has a 6.1/10 A rating. The fund was declared to be of higher-than-average resilience in terms of environmental, governmental, and social changes.

CEW ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| CEW Rating | A | A | N/A | ** | N/A |

| CEW ESG Rating | 6.1/10 | A | N/A | N/A | N/A |

CEW key holdings

The CEW ETF looks to secure returns by investing in emerging market countries’ currencies and relative changes in these currencies compared to the US dollar. In normal circumstances, the fund will invest around four-fifths of its resources in assets, which correlates with the performance of the selected developing markets.

The fund itself is non-diversified, and it will usually maintain a weighted average maturity of the portfolio over 90-day periods.

Here are the four holdings making up the CEW ETF.

| Holding name | % of assets |

| United States Treasury Bills 0.0% 15-JUL-2021 | 39.9% |

| United States Treasury Bills 0.0% 29-JUL-2021 | 30.4% |

| US Dollar | 26.23% |

| WisdomTree Floating Rate Treasury Fund | 3.47% |

Industry outlook

Since the fund looks to invest in currencies tied to markets in Latin America, Europe, Middle East, Africa, and Asia, you will have to know the geopolitical situation in the regions mentioned. The ETF doesn’t rely on giants from the region, either, so more in-depth knowledge about up-and-coming industries and companies from those areas would also go a long way.

An important thing to look out for is that the fund doesn’t expose investors to spot greenback prices compared to emerging market’s currencies. It instead invests in futures currency contracts and swaps. As a result, the fund may differ from the aggregate performance of the basket of currencies it seeks to follow.

The outlook for the fund is difficult to predict, not only due to the sheer number of currencies followed but also due to a precise approach to investing the fund’s issuer took. If you decide to walk down the CEW ETF path, be sure to check often the primary geopolitical movers of the fund’s participants.

Comments